I. Preface

This week, the crypto market welcomes two heavyweight catalysts - the legislative offensive of Washington's "Crypto Week" and the dense expansion of Ethereum institutions, jointly constructing the "policy inflection point" and "capital inflection point" for the crypto industry in the second half of 2025. The deep logic of this crypto cycle is shifting from Bitcoin to Ethereum, stablecoins, and on-chain financial infrastructure. We believe that the policy clarity in the United States + Ethereum's institutional expansion signifies that the crypto industry is entering a structural normalization stage, and market allocation should gradually transition from "price speculation" to "capturing the institutional dividend of rules and infrastructure".

II. US "Crypto Week": Three Major Bills Release Signals, Compliant Assets Will Undergo Value Reassessment

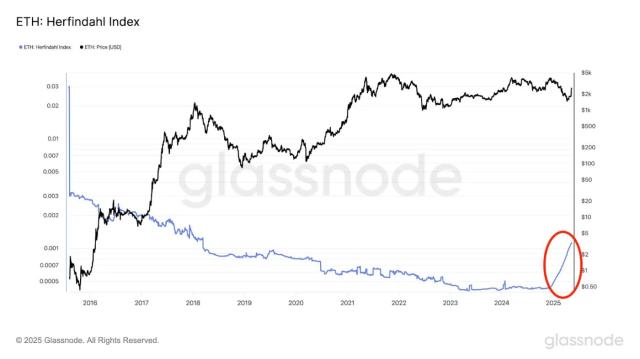

[The rest of the translation follows the same professional and precise approach, maintaining the technical terminology and specific names as instructed.]From the current institutional participation structure, it can be clearly divided into two camps: first, the "Ethereum native camp" represented by SharpLink, which has gathered early Ethereum ecosystem participants such as ConsenSys and Electric Capital; the other is the "Wall Street approach" represented by BitMine, directly replicating the Bitcoin reserve logic, using leverage, financial operations, and financial report disclosure to form a capital amplification effect. This north-south pincer-style institutional position-building model is causing ETH's value anchor and price support system to move away from traditional retail speculation emotions towards an institutionalized, long-term, and structured mainstream capital framework.

The far-reaching impact of this trend is not only at the price level but also in the potential reconstruction of Ethereum network's governance rights, discourse power, and ecosystem leadership. In the future, if companies like SharpLink or BitMine that heavily hold ETH continue to expand their positions, their potential influence on Ethereum's development direction cannot be ignored. Although most of these companies currently face financial pressure and are configuring ETH more for speculative hedging and capital operations, without fully demonstrating a deep binding intention to Ethereum ecosystem construction, their entry has already produced an amplification effect in the capital market: ETH is being re-evaluated, with market narrative switching from the crowded DeFi and L2 tracks to a new space of "reserve assets + ETF + governance rights".

It is worth noting that unlike the Bitcoin reserve story with Michael Saylor (MicroStrategy CEO) continuously strengthening cognition and preaching additional purchases, Ethereum currently lacks such a representative figure with both faith background and traditional capital appeal. Although Tom Lee's appearance has sparked market associations, it has not yet formed sufficient narrative penetration. The lack of such endorsement has to some extent slowed down the trust conversion path for Ethereum in institutional investors' minds.

However, this does not mean Ethereum lacks institutional response. Vitalik Buterin and the Ethereum Foundation have recently been frequently speaking out, emphasizing Ethereum's technical resilience, security mechanisms, and decentralization principles, while beginning to strengthen the "dual-track" governance mechanism, intending to embrace institutional capital while avoiding governance rights being controlled by a single force. Vitalik proposed in a recent public article that user interests, developer-led initiatives, and institutional compliance must be balanced, and decentralization must be "operable" rather than just a slogan.

In summary, ETH is experiencing a comprehensive capital structure transformation: from a retail-dominated open market to an institutionalized market structure driven by ETFs, listed companies, and institutional nodes. The impact of this transformation will be far-reaching, determining not only the future construction path of ETH's price center but potentially reshaping Ethereum's governance structure and development rhythm. In this arms race, ETH is no longer just a representative of the technology stack but is becoming a key target in the digital capitalism wave, both a value carrier and a focus of power struggle.

IV. Market Strategy: BTC Builds High-Level Platform, ETH and High-Quality Application Chains Welcome Correction Logic

As Bitcoin successfully breaks through the $120,000 mark and gradually enters a platform period, the structural rotation pattern of the crypto market becomes increasingly clear. With BTC occupying the dominant logic, Ethereum and high-quality application chain assets are beginning to welcome their own valuation repair period. From capital flow to market performance, the current trend shows a typical "large-cap platform oscillation + mid-cap rotation and upward attack" structure, with ETH and a batch of L1/L2 protocols with both narrative and technical support becoming the most valuable direction for speculation after Bitcoin.

[The translation continues in the same manner for the remaining text, maintaining the specified translations for specific terms.](3) Focus on high and medium-quality public chains and modular protocols: Chains with technological innovation, strong ecosystem foundations, and capital support (such as SOL, TON, Tanssi, Base, Celestia) have continuous upward potential.

Narrative shift forward, actively seeking edge opportunities: Pay attention to early layout targets in DePIN, RWA, AI chains, and ZK directions, where these narratives are in the pre-funding stage and may become the core of the next rotation.

The final conclusion is that the current market has entered a structural rotation phase from a single asset-driven stage, with BTC's main upward wave temporarily pausing, and the rotation of ETH and high-quality new public chains will be the key driving force in the second half of the market trend. Strategically, one should abandon the inertial thinking of "chasing high leaders" and shift towards a medium-term trend layout of "value rebalancing + narrative diffusion".

V. Conclusion: Clear Regulation + ETH Mainnet, Market Enters Institutional Cycle

With the advancement of three key bills during the US "Cryptocurrency Week", the industry welcomes an unprecedented policy clarity period. This clear regulatory environment not only eliminates years of pending compliance uncertainty but also lays a solid foundation for the institutionalization and normalization of the crypto asset market. Accompanied by the accelerated strategic reserve arms race of core assets like Ethereum, the market is gradually entering a new cycle dominated by institutions.

In the past, the volatility and uncertainty of the crypto market largely stemmed from ambiguous regulation and policy swings. Crises such as the FTX collapse and Luna incident exposed the deep-seated risks of industry regulatory gaps and cast shadows in investors' minds. Now, with the implementation of regulations like the GENIUS Act, CLARITY Act, and anti-CBDC Act, market expectations for compliance have significantly improved, the entry threshold for institutional capital has steadily lowered, and asset trust and liquidity have greatly enhanced. This not only helps reduce systemic risks but also provides a "bridge" for crypto assets to connect with traditional financial markets, legalizing and standardizing the identities and behaviors of market participants.

Under this institutional environment catalyst, Ethereum, as the leading smart contract platform, is ushering in a critical window of its main upward wave. Ethereum not only has a clear technical roadmap and active ecosystem innovation but also continuously optimizes its network security and decentralized governance structure, becoming one of the institutional preferred digital assets. The superposition of strategic reserve trends and ETF funds marks the beginning of capital markets re-evaluating Ethereum's value. It can be foreseen that Ethereum will maintain a long-term healthy value growth trend driven by both on-chain application growth and capital support.

More broadly, this linkage effect of regulatory clarity and mainstream asset value revival is gradually helping the crypto market escape the previous "bull-bear cycle trap" and evolve towards a more stable and sustainable institutional cycle. The significant characteristic of an institutional cycle is that market fluctuations are more guided by fundamentals and policy expectations, with asset price volatility no longer dominated by scattered emotions and regulatory news, but instead reflecting a benign interaction and steady growth of capital and technology. The deep involvement of institutional capital will also improve market liquidity structure, driving investment strategies from short-term speculation to medium and long-term value investment.

Moreover, the launch of the institutional cycle also means market structure diversification and multi-dimensional ecosystem upgrades. Ethereum ecosystem's technological innovation and governance reforms will continuously promote on-chain application diversity, enhance network utility, while clear regulation will accelerate the compliant development of more quality projects, catalyzing deep integration of on-chain finance and traditional finance. This development pattern will reshape the investment logic of crypto assets, bringing the market into a new normal of "technology-driven + capital rationality + regulatory support".

Of course, an institutional cycle does not mean the disappearance of market volatility, but rather that volatility will be more endogenous and predictable, requiring investors to focus more on continuous tracking of fundamentals and policies. Simultaneously, market governance mechanisms and the game between decentralized and centralized forces will become important variables driving ecosystem evolution.

In summary, the regulatory breakthrough of the US "Cryptocurrency Week" and the capital trend of Ethereum's mainnet are opening an important chapter for the crypto market's march towards maturity. The market is transitioning from a disorderly "savage growth" stage to an institutionalized, standardized "rational development" stage. This not only enhances the investment value of assets but will also drive the overall upgrade of the crypto industry ecosystem, shaping the core foundation of future digital economy. Investors should seize the institutional dividend and growth opportunities of core assets, actively layout Ethereum and quality application chains, embracing a healthier and more sustainable crypto new era.