As geopolitical conflicts fade from view, the most notable development in the past week was not the new tariff levels set by the "Trump 2.0" revision, but how the market completely ignored this escalation.

The new government has imposed a 50% tariff on Brazil, a 35% tariff on Canada, a 25% tariff on Japan and South Korea, and promised a unified 15-20% tariff on all trading partners. This undoubtedly exceeds market expectations. So, does the market expect another "TACO-style" policy reversal soon? Or will the current strong momentum of the stock market force the president to take more aggressive action? We will know the answer soon...

Economic data aligned with the recent "Goldilocks" narrative (indicating the economy is neither too hot nor too cold), causing no waves, and the June FOMC meeting minutes did not provide additional insights. The FOMC "dot plot" remained unchanged, still expecting two rate cuts this year, despite differences among Federal Reserve members. Some notable quotes include:

"Several participants noted that tariffs would lead to a one-time price increase"

"Most participants noted the risks of [producing] more lasting effects"

"Most participants believed that lowering the federal funds rate target range this year might be appropriate"

"Several participants indicated they would be willing to consider a rate cut at the next meeting"

Weakening labor market has replaced inflation as the primary concern. Members pointed out that higher tariffs and policy uncertainty would drag down employment and acknowledged that some indicators have shown "signs of weakness".

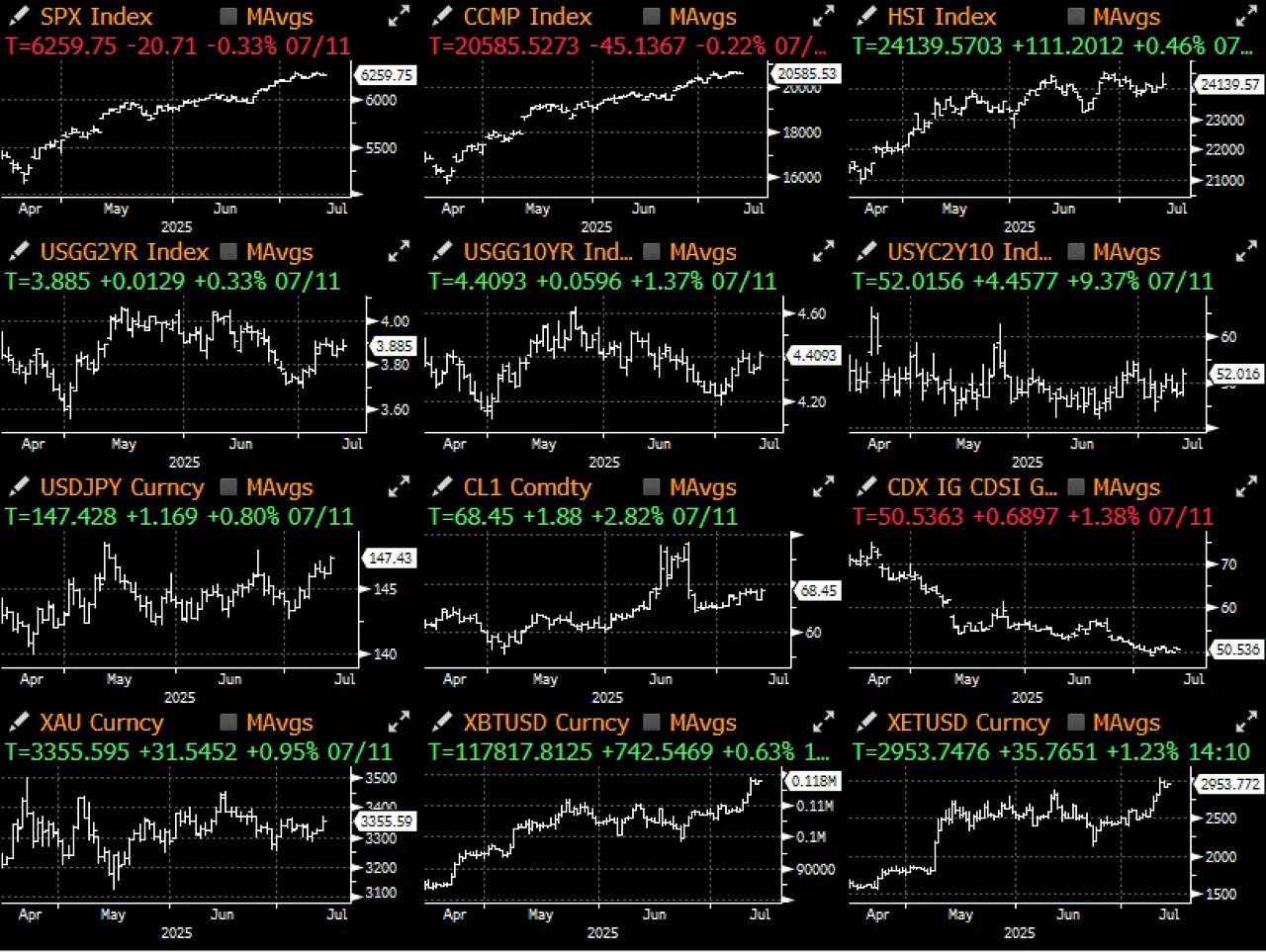

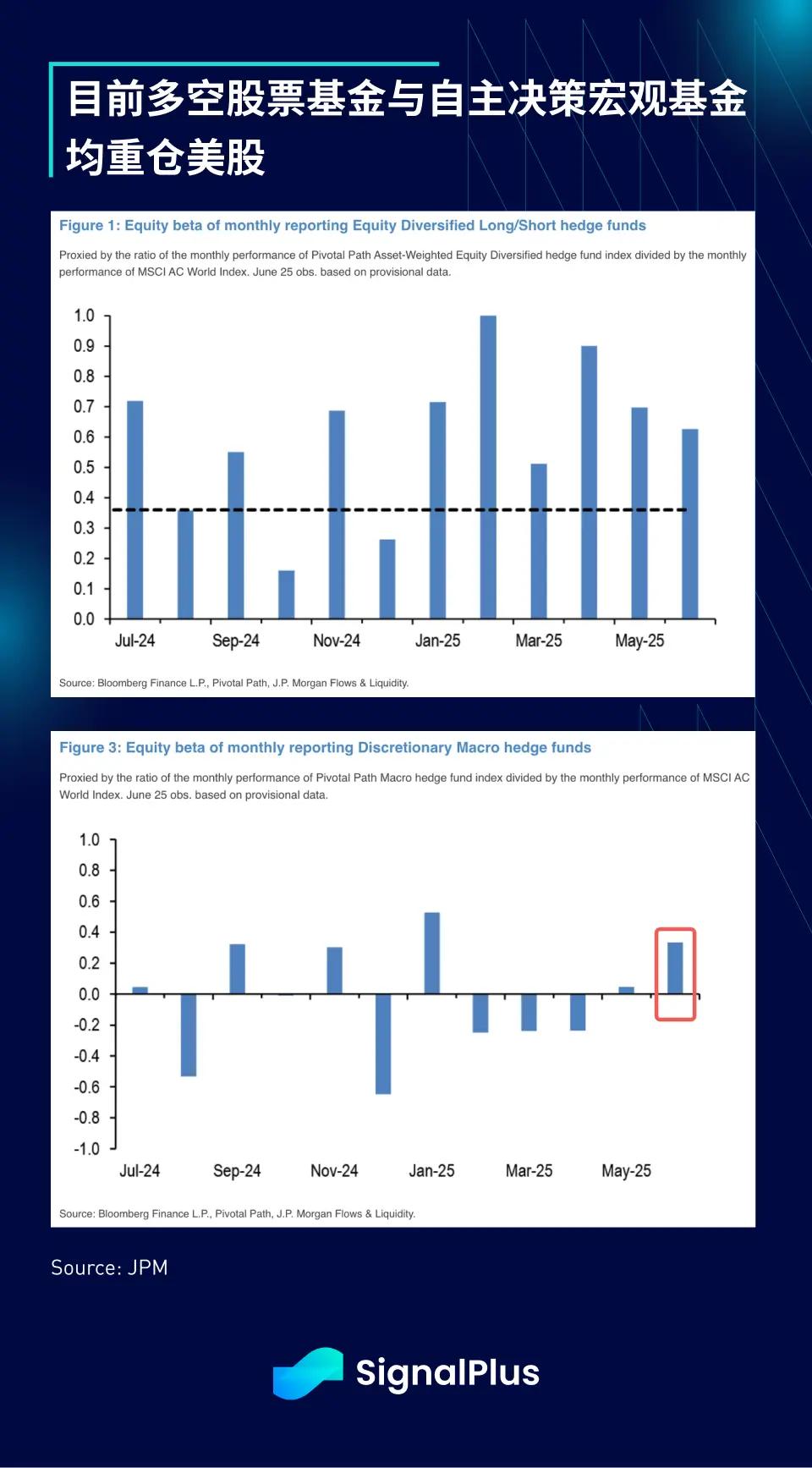

This week, both stocks and BTC surged to new highs, with all funding channels showing positive inflows. Long-short hedge funds have maintained full investment almost all year, including during the Liberation Day volatility; macro funds with independent decision-making have increased their long stock exposure for the first time this year, with the fastest increase since Trump's election.

Given the extremely positive signals from the recent market rise, momentum funds and CTAs are also likely to hold long positions, reflected in the near-historical high long positions in US stock index futures.

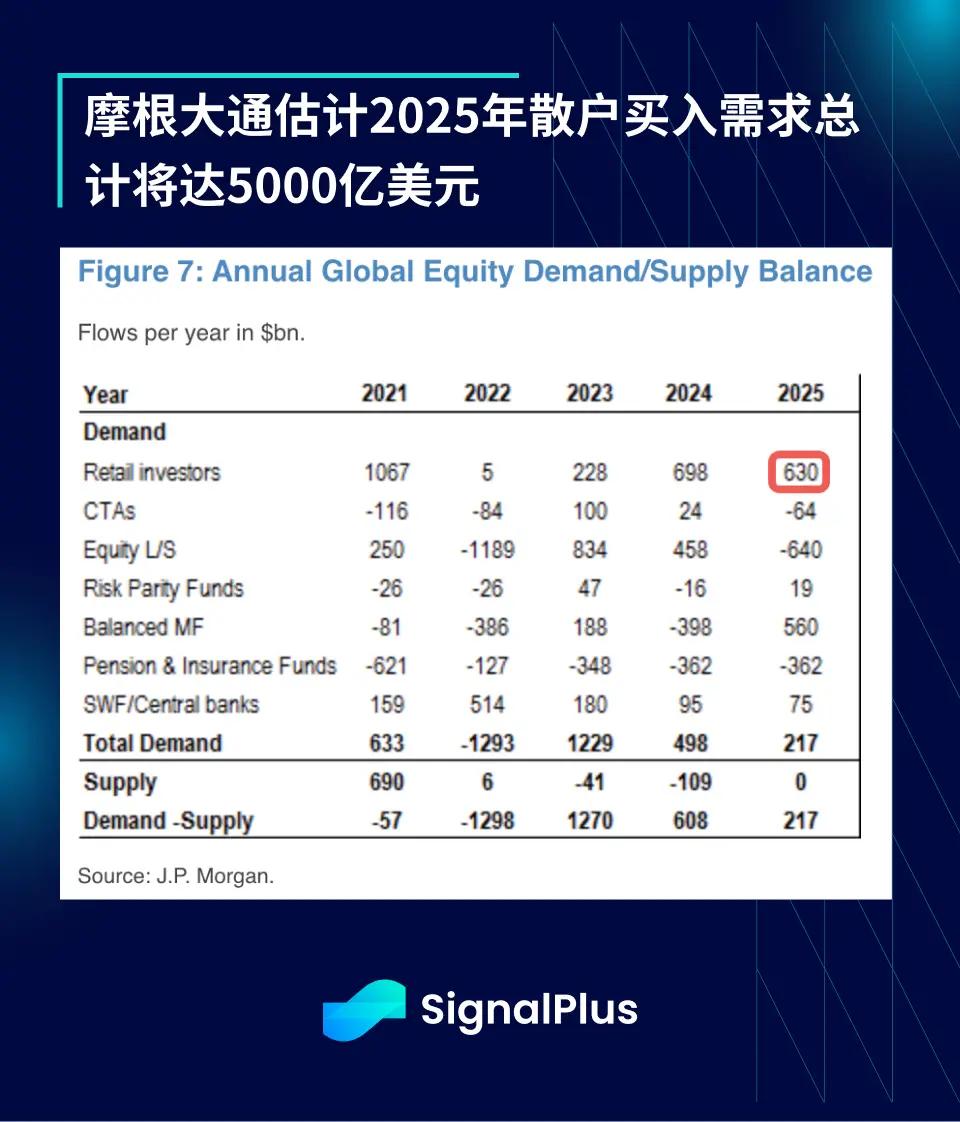

Not to be left behind, our fearless retail investors have been rushing into long stock positions this year. Vanda Research data shows that retail investors have net bought stocks and ETFs totaling $155 billion year-to-date, the fastest pace in over a decade.

That's not all. JPMorgan estimates that retail stock buying demand will total $500 billion for the full year 2025. According to their calculations, this will drive the market up by "5-10%". This would make them the largest demand source among all major investor groups - who's the "smart money" again?

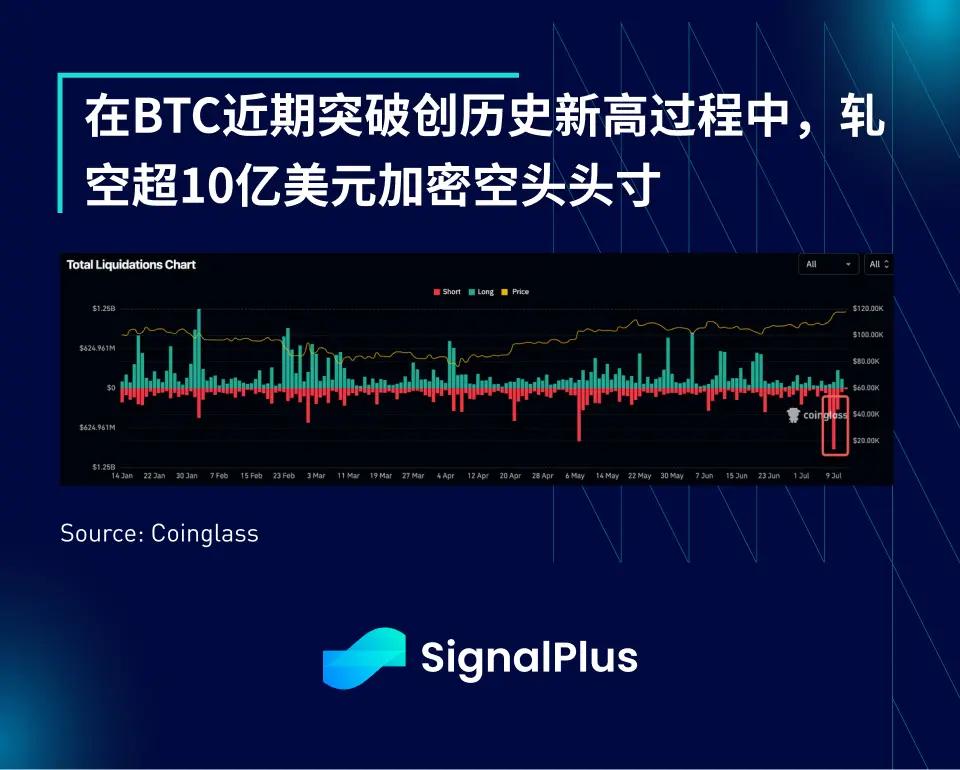

Cryptocurrency prices benefited from the overall market's euphoria, with BTC trading at around $118,000, shorting over $1 billion in crypto short positions, creating the most intense short squeeze in recent memory.

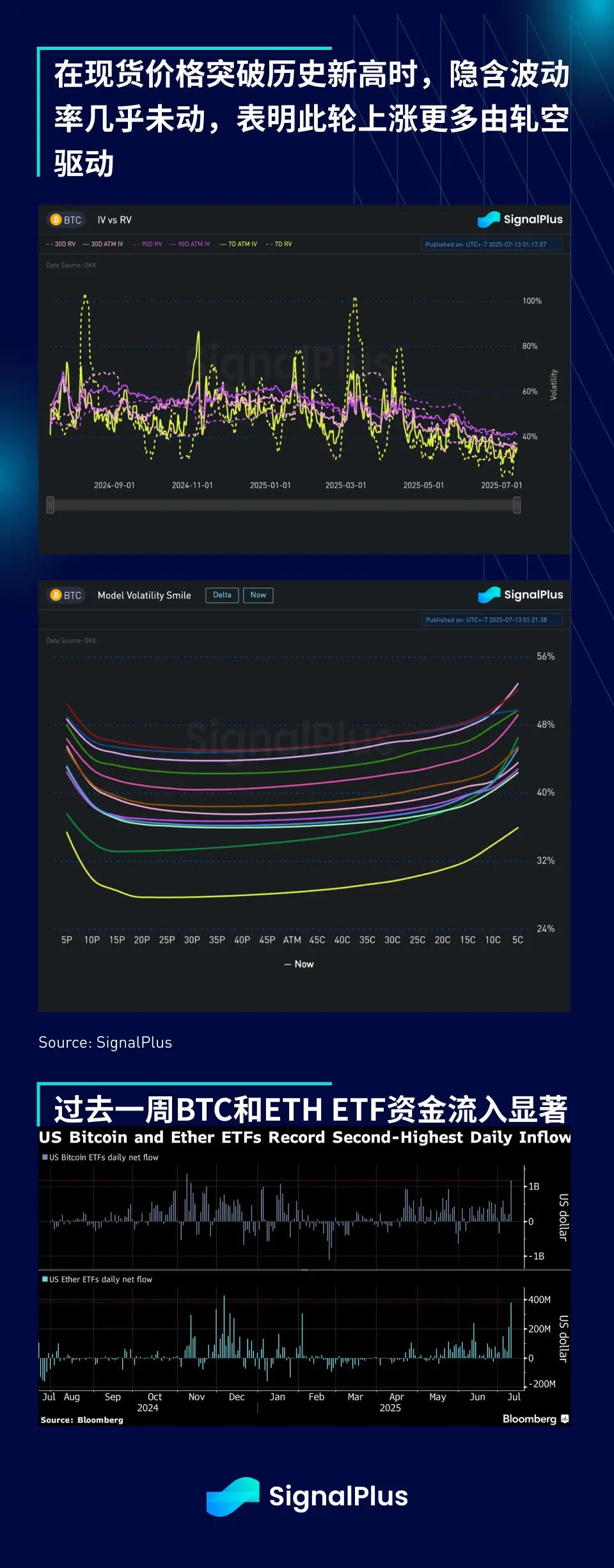

Interestingly, volatility has not significantly jumped, still hovering near cyclical lows. This suggests that there is no obvious FOMO buying, except for shorts urgently seeking protection, causing an understandable skew in volatility. The sector still feels under-positioned, with difficult position rebuilding after April's volatility; while traditional finance (TradFi) ETF buying remains endless and price-insensitive, continuously reinforcing the mainstream narrative.

Some observers point to the recent change in attitude from Chinese regulators as a catalyst for market rise, but we believe this is more of a symbolic gesture, with substantial changes still needing time. Fundamental capital control restrictions remain an unresolved issue, and the recent passage of the Hong Kong stablecoin bill suggests that pilot projects may prioritize Hong Kong.

Looking ahead, although it may sound like a cliché, market sentiment is likely to remain excited throughout the summer. The only true risk catalyst is a complete breakdown of tariff negotiations, but the ball is now in the president's court, and we'll see how aggressively he wants to play.

Meanwhile, enjoy the market, and try not to fight against it, because calm and boring markets are often the most dangerous to short! Good luck trading.