Author: Paul Veradittakit, Translation: Shan Ouba, Jinse Finance

Abstract

Crypto companies' IPOs are releasing significant value, despite initial pricing challenges.

The "Token Transparency Framework" aims to bring clarity to the token market and attract more institutional investment.

"Tokenized stocks" are revolutionizing financial markets, improving efficiency and expanding global capital access.

Crypto IPO Pricing Errors

The story since Coinbase's listing is a vivid case illustrating how public markets struggle to price innovative companies at the forefront of financial infrastructure. We watched COIN's stock price experience euphoric highs - opening 52% above the reference price, with market cap briefly touching $100 billion - followed by deep corrections, with narratives repeatedly reshaped as market sentiment and crypto cycles flip. Each market turn seemed to require a new valuation logic for Coinbase, leaving long-term value investors and builders perplexed.

Circle's IPO is another recent example: despite massive market demand for stablecoin exposure, Circle "left $1.7 billion on the table" when going public, becoming one of the most undervalued offerings in decades. This is not just a crypto industry-specific issue, but a structural deficiency in bringing next-generation financial companies to the public market.

The crypto industry needs a smarter, more flexible price discovery method that can bridge the gap between institutional demand and these platforms' true value, especially during cyclical changes.

Call for a New Valuation Framework

Tokens lack their own "S-1" document. The pricing errors in crypto IPOs prove that when underwriters cannot map token economic models to a GAAP-like list, they either overpay during hype peaks or severely underestimate during panic periods.

To address this, Pantera's Cosmo Jiang collaborated with Blockworks to launch the "Token Transparency Report" - a framework of 40 points that transforms protocol opacity into IPO-level clarity.

This framework requires founders to disclose: revenue split by entity; unlock/vesting curves with clearly marked internal wallet attributions; quarterly token holder reports including treasury balance, cash flow, and key performance indicators (KPIs); and even details of market maker or centralized exchange (CEX) collaboration agreements, allowing investors to assess liquidity risks before the first day of listing. By packaging these answers, startups can provide Wall Street with all the materials they need, thereby pricing their IPO with more confidence.

Why is this important for valuation?

Lower discount rates: Clear circulating supply and dilution information allows investment banks to price closer to intrinsic value.

Larger buyer group: Institutional investors previously excluded by "black box" protocols can participate after this framework's "endorsement".

Regulatory fast track: The US SEC's crypto issuance guidelines released in April 2025 highly align with the framework's core content, so projects can have most materials ready when submitting registration windows - accelerating approval processes and narrowing the valuation gap between private and public markets.

Viewing blockchain through a traditional enterprise lens is challenging. Ethereum's recent upgrade is typical: each new block destroys a portion of ETH (similar to automatic share buybacks), while providing 3-5% annual yield to stakers (similar to stable dividends). The correct approach is to discount "issuance minus destruction" as free cash flow, thereby obtaining a valuation that reflects the chain's characteristics, not just a balance sheet number.

But scarcity is only the first chapter of the story, the truly complete story is "speed". A chain can arbitrarily limit supply, but real value comes from flow - stablecoins transferred between wallets, cross-chain bridge activity, collateral flow in DeFi. These real-time data are the "vital signs" truly supporting token prices during market volatility. To capture a complete valuation picture, we should start from a perspective everyone trusts - the company's standard cash flow. On-chain revenue (staking yield minus burned fees) can serve as a sensitivity analysis "layer". By focusing on staking yield rates, real-time flow indicators, and simple "what-if" scenario analyses, valuation can stay current and ready to face Wall Street.

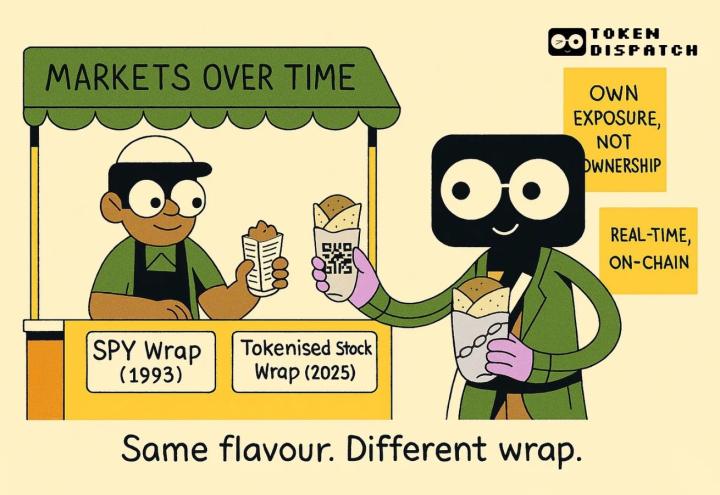

Optimizing Trading Experience through Tokenized Stocks

At Pantera Capital, we have been driving development in the RWA tokenization field by supporting Ondo Finance. Recently, we launched a $250 million fund with Ondo to further promote the RWA tokenization ecosystem. This field is gradually maturing, with Robinhood recently announcing stock tokenization.

Last week, Robinhood officially launched tokenized stocks on its platform. Robinhood's launch highlights a core paradox of this new financial technology: permissionless vs. permissioned finance, and DeFi's future role.

The vision of permissionless tokenized stocks is that anyone can trade stocks on a public blockchain at any time, achieving ultimate openness and global access to US capital markets. However, this democratization also brings a significant risk: without traditional market monitoring and regulatory control, a permissionless tokenized stock market could become a breeding ground for insider trading and market manipulation.

In contrast, permissioned tokenized stocks would follow existing KYC compliance channels, maintaining market integrity but limiting global investors' access to US capital markets - precisely the most attractive selling point of tokenized stocks.

We also believe that tokenized stocks will reshape DeFi.

DeFi's core mission is to build open, programmable financial primitives for any form of "tokenized value" - whether dollars, stocks, or commodities. So far, DeFi has primarily served crypto-native tokens, but the arrival of tokenized stocks unlocks an entirely new universe of use cases.

However, the specific structure of tokenized stocks will determine who wins the next competition for users and liquidity. In the permissioned model, access to tokenized stocks is restricted and mandatorily compliant, with existing giants like Robinhood with channels and user bases dominating user relationships, while DeFi protocols are forced to compete for liquidity in the background.

In this scenario, DeFi protocols' advantage would be leveraging blockchain-native technology to provide optimal prices and services for front-end applications. If tokenized stock issuance and trading are permissionless, the situation would completely reverse. DeFi protocols could simultaneously control user relationships and liquidity, creating a truly open, globalized capital market. Anyone, anywhere, could freely trade, lend, or develop derivatives based on tokenized stocks without intermediaries or gatekeepers.

This is the vision that the DeFi community is most excited about: unlocking new financial primitives through smart contract composability and transparency, improving capital efficiency. The most powerful evidence of this future is the rise of permissionless tokenized stock perpetual contracts, such as Hyperliquid's HIP-3 upgrade. HIP-3 allows anyone to launch a perpetual contract market for any asset by staking protocol tokens and configuring oracle, leverage, and funding rate parameters.

To build a tokenized stock perpetual contract, a protocol needs to:

Deploy a smart contract referencing a reliable tokenized stock price oracle;

Guide liquidity through on-chain incentives or protocol-native market making;

Set risk parameters (leverage, funding rates);

Open the market to global traders.

Robinhood and Coinbase have been moving in this direction, offering perpetual contracts for tokenized stocks in the EU region, but their models remain more permissioned and less composable, unable to achieve the ideal of DeFi.

The ultimate vision is very clear: With the popularization of tokenized stocks, if the infrastructure remains open, DeFi will become the default venue for programmable, borderless financial engineering.

Bitcoin Market Cap Exceeds Google

In 2025, Bitcoin's market cap has already surpassed Google, becoming the fifth-largest global asset, with a valuation of $2.128 trillion! Driven by institutional adoption, spot Bitcoin ETF approval, and clear regulation, Bitcoin's price has soared to over $106,000. This is a significant moment for Bitcoin and the crypto industry, proving that the concept of "programmable money" has a clear product-market fit.

Looking to the Future

As Dan Morehead said, investing in cryptocurrencies brings returns that traditional markets cannot obtain. This is why we see traditional public markets converging with crypto markets both financially and structurally. Digital asset vaults and crypto IPOs provide public markets with financial exposure to crypto assets; stablecoins and asset tokenization leverage crypto technology to structurally improve traditional markets. In 10 years, crypto will no longer be a niche market discussed only by tech enthusiasts, but will become the core technology supporting our daily lives.