Written by: Tyler

Have you ever traded US stocks on-chain?

Upon waking up, Kraken launched xStocks, initially supporting token trading for 60 US stocks; Bybit followed closely by launching popular stock token pairs like AAPL, TSLA, NVDA; Robinhood also announced blockchain support for US stock trading and plans to launch a self-developed public chain.

Regardless of whether the tokenization wave is old wine in new bottles, US stocks have indeed become the new "favorite" on the chain overnight.

However, upon careful consideration, this new narrative woven by USD stablecoins, US stock tokenization, and on-chain infrastructure seems to be dragging Crypto deep into financial narratives and geopolitical games, inevitably sliding towards a new role positioning.

US Stock Tokenization is Not New

US stock tokenization is actually not a new concept.

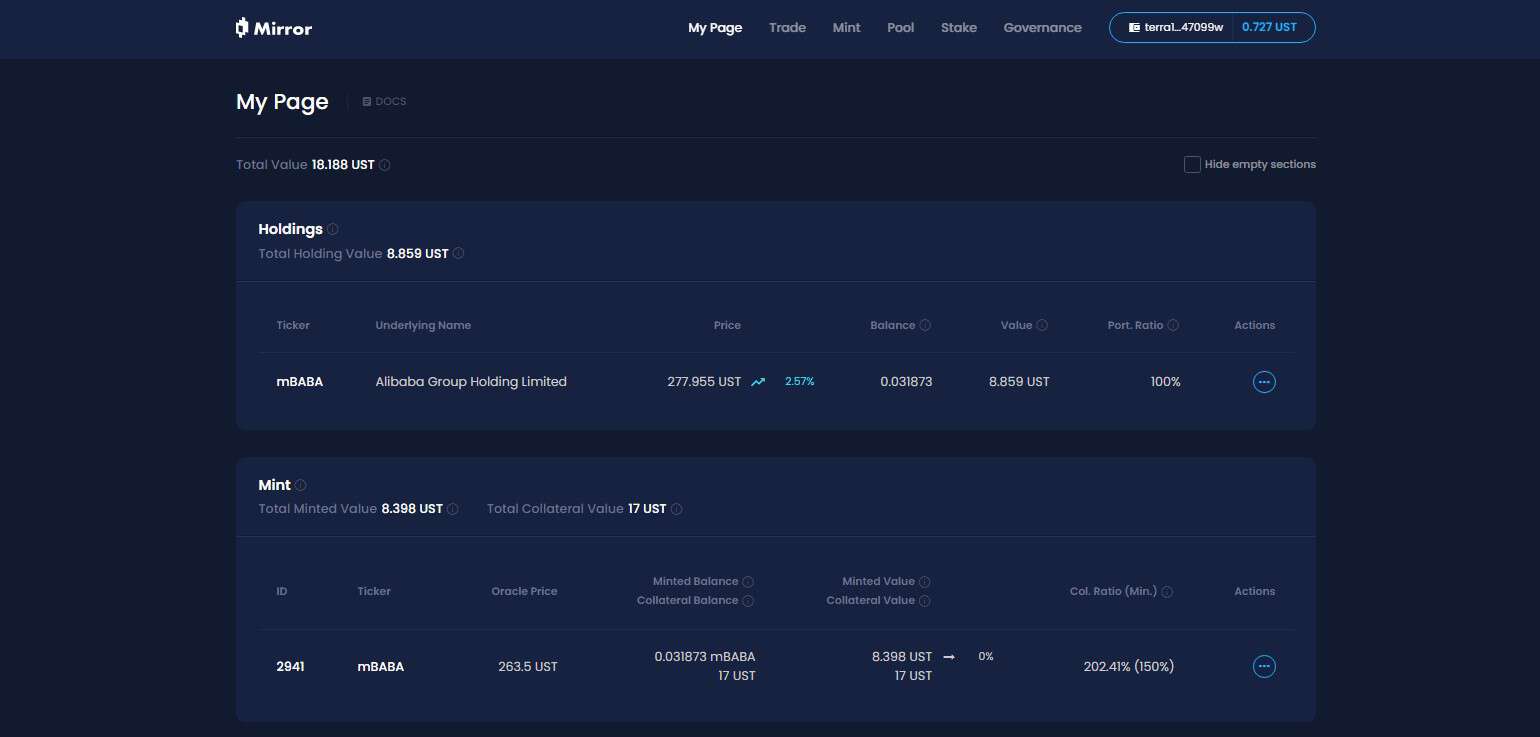

In the previous cycle, representative projects like Synthetix and Mirror had already explored a complete on-chain synthetic asset mechanism, a model that not only allows users to mint and trade "US stock tokens" like TSLA and AAPL through over-collateralization (such as SNX, UST), but even covers fiat currencies, indices, gold, and crude oil, almost encompassing all tradable assets.

The reason lies in the synthetic asset model, which tracks the underlying asset through over-collateralization: for example, with a collateralization rate of 500%, it means users can pledge $500 worth of crypto assets (like SNX, UST) into the system, thereby minting synthetic assets anchored to asset prices (like mTSLA, sAAPL) for trading.

Since the entire operating mechanism adopts oracle pricing + on-chain contract matching, with all transactions completed by internal protocol logic and no real counterparty, it theoretically possesses a core advantage: achieving infinite depth and zero-slippage liquidity experience.

So why hasn't this synthetic asset model achieved large-scale adoption?

Ultimately, price anchoring ≠ asset ownership. In the synthetic asset model, minting and trading US stocks do not represent actual ownership in reality, but merely "betting" on price. Once the oracle fails or collateral assets collapse (Mirror fell during the UST crash), the entire system faces risks of liquidation imbalance, price de-anchoring, and user confidence collapse.

Meanwhile, a easily overlooked long-term factor is that US stock tokens in Crypto are destined to be a niche market—funds only circulate within the on-chain closed loop, with no institutional or brokerage participation, meaning they remain forever at the "shadow asset" level, unable to integrate into the traditional financial system, establish true asset access and funding channels, and unlikely to attract derivative product development or incremental structural fund inflows.

So, although they were once popular, they ultimately failed to truly take off.

New Architectural US Stock Fund Diversion Structure

This time, US stock tokenization has changed its approach.

Taking the US stock token trading products launched by Kraken, Bybit, and Robinhood as examples, based on disclosed information, it's not price anchoring or on-chain simulation, but actual stock custody, with funds flowing into US stocks through brokers.

Objectively speaking, in this model of US stock tokenization, any user only needs to download a crypto wallet and hold stablecoins to easily buy US stock assets on DEX anytime, anywhere, bypassing account opening thresholds and identity verification, with no US stock account, no time zone restrictions, and no identity limitations, directly channeling funds into US stocks on-chain.

Microscopically, this allows global users to buy and sell US stocks more freely, but from a macro perspective, this is actually the US dollar and US capital market leveraging Crypto's low-cost, high-elasticity, 7x24 pipeline to attract global incremental funds—after all, in this structure, users can only long, cannot short, and lack leverage and non-linear return structures (at least so far).

Imagine this scenario: A non-Crypto user from Brazil or Argentina suddenly discovers they can buy US stock tokens on-chain or CEX, they only need to download a wallet/exchange, convert local assets to USDC, and with a few clicks, buy AAPL or NVDA.

Eloquently speaking, it simplifies user experience, but in reality, it's a "low-risk, high-certainty" US stock fund diversion structure for global funds, allowing hot money from Crypto users worldwide to flow into the US asset pool with unprecedented low friction and cross-border access, enabling people worldwide to buy US stocks anytime, anywhere.

Especially as more L2s, exchanges, and wallets connect to these "US stock trading modules", the relationship between Crypto, the US dollar, and NASDAQ will become more covert and more stable.

From this perspective, a series of "new/old" narratives around Crypto are being designed as a distributed financial infrastructure, specifically serving US finance:

US Treasury Stablecoin → Global Currency Flow Pool

US Stock Tokenization → NASDAQ Traffic Entry Point

On-chain Trading Infrastructure → US Brokerage Global Transit Station

This might be a soft global fund suction method. Without delving into conspiracy theories, at least Trump or subsequent US leadership might love this new narrative of "US stock tokenization".

How to View the Pros and Cons of "US Stock Tokenization"?

From a pure Crypto perspective, does US stock tokenization have appeal, or what potential impacts might it have on the on-chain cycle?

I believe it requires a dialectical view.

For users lacking US stock investment channels, especially Crypto natives and retail investors from third-world countries, US stock tokenization opens an unprecedented low-threshold pathway, worthy of being called "asset democratization".

After all, as a super market continuously producing star stocks like Microsoft, Apple, Tesla, and NVIDIA, US stocks' "historically long bull market" has long been celebrated in the investment world, being one of the most attractive asset classes globally. However, for most ordinary investors, participating in trading and sharing dividends has always had relatively high barriers: account opening, fund transfers, KYC, regulatory restrictions, trading time differences... various barriers have deterred countless people.

Now, with just a wallet and a few stablecoins, even in Latin America, Southeast Asia, or Africa, you can buy Apple, NVIDIA, or Tesla anytime, achieving US dollar asset universalization for global users. In other words, for underdeveloped regions where local assets can't outperform US stocks or even inflation, US stock tokenization undoubtedly provides unprecedented accessibility.

In contrast, within the Crypto circle, especially among trading-type users represented by the Chinese-speaking region, the overlap with the US stock investment circle is quite high. Most already have US stock accounts and can access the global financial system through banks and overseas brokers like Interactive Brokers (I personally use a SafePal/Fiat24 + Interactive Brokers combination).

For these users, US stock tokenization seems half-baked—only long positions are possible, with no derivative product support, lacking even basic options and stock lending, hardly trading-friendly.

As for whether US stock tokenization will further drain the crypto market, don't rush to deny it. I think this might be a window of opportunity for a new round of "asset Lego" after DeFi ecosystem asset clearance.

After all, one of the biggest current problems in on-chain DeFi is a severe lack of quality assets. Beyond BTC, ETH, and stablecoins, there are few assets with genuine value consensus, with many Altcoins of questionable quality and extreme volatility.

If these stock-backed tokens issued on-chain can gradually penetrate DEX, lending protocols, on-chain options, and derivatives systems in the future, they can completely become new base assets, supplement on-chain asset portfolios, and provide more deterministic value materials and narrative space for DeFi.

Moreover, the current stock tokenization products are essentially spot custody + price mapping, without leverage and non-linear profit structures, naturally lacking in deep financial tool accessories. It depends on who can first create a highly composable and liquid product, and who can provide an integrated on-chain experience of "spot + short + leverage + hedging".

For example, serving as high-credit collateral in lending protocols, constructing new hedging targets in options protocols, forming a composable asset basket in stablecoin protocols. From this perspective, whoever can first create an integrated on-chain trading experience of "spot + short + leverage + hedging" is expected to build the next on-chain Robinhood or on-chain Interactive Brokers.

For DeFi, this might be the real turning point.

It depends on who can benefit from this new narrative.

In Conclusion

From 2024 onwards, "Can Crypto still revolutionize TradFi" is no longer a topic worth discussing.

Especially since this year, penetrating traditional financial channels through stablecoins, bypassing sovereign barriers, tax obstacles, and identity reviews, ultimately establishing a new type of dollar channel with Crypto, has become a core storyline of recent narratives led by compliant USD stablecoins.

Crypto bless America might not just be a joke.