Author: Foxi

Translated by: TechFlow

Today, major trading platforms like Kraken and Robinhood have launched on-chain stock trading services, allowing investors to buy and sell tokens representing real stocks. This service enables investors to trade popular US stocks (such as Apple, Tesla, NVIDIA, etc.) 24 hours a day, even outside normal market trading hours.

How does this mechanism incorporate KYC considerations?

Will investors prefer crypto-based stock trading over traditional brokers?

Why do I consider this a positive case?

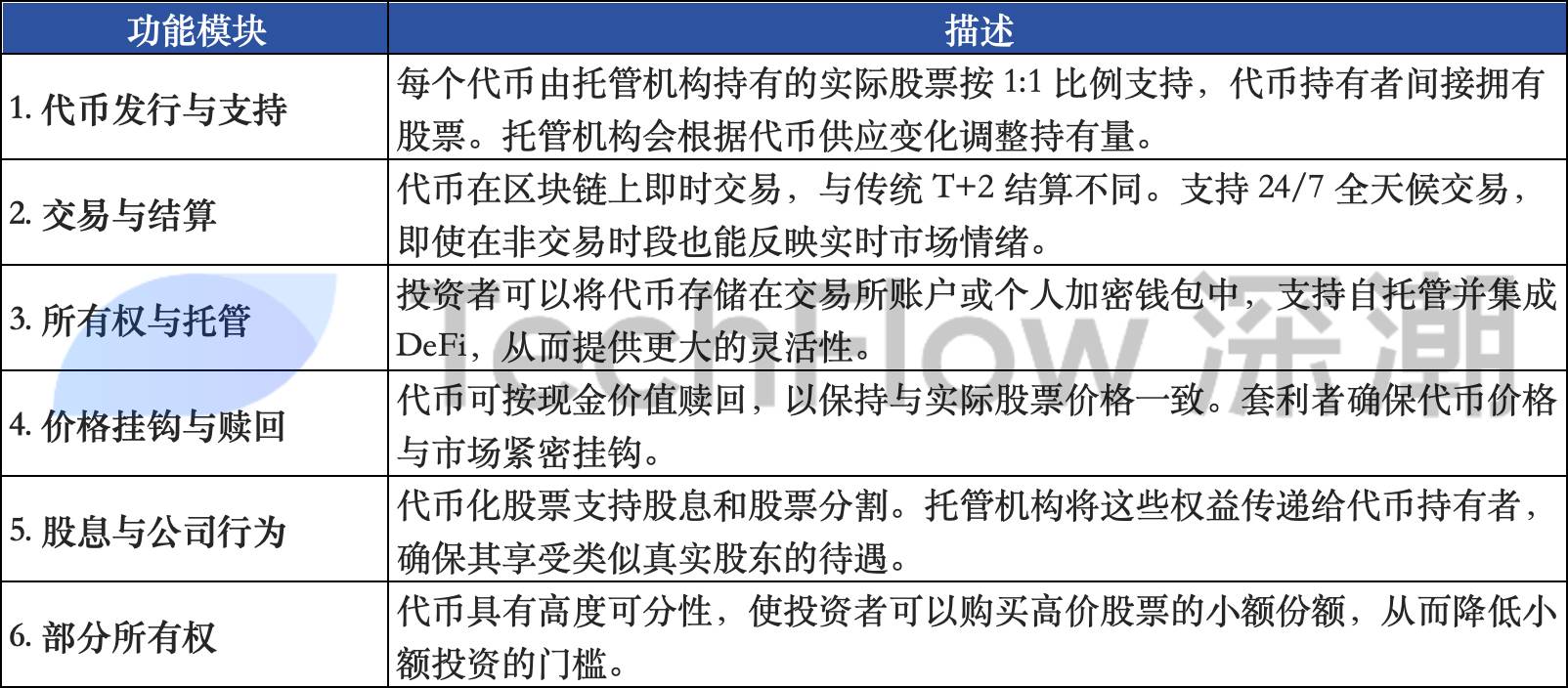

Mechanism Analysis

Step-by-step breakdown (Translated by: TechFlow)

1. When purchasing a tokenized Apple stock through Kraken's xStocks, you are not buying a derivative or futures contract. Instead, Kraken's partner Backed Finance purchases and custodies a real Apple stock, storing it in a regulated custodial institution. Subsequently, a corresponding token is issued on the Solana blockchain as a digital representation of this stock.

2. On-chain stocks ≠ Cryptocurrency. On-chain stocks introduce some interesting arbitrage opportunities. During non-trading hours when the New York Stock Exchange (NYSE) is closed but blockchain trading remains open, the token price may slightly deviate from the last stock price due to market sentiment and trading activity. Arbitrageurs can profit from these price differences by buying and selling tokens and redeeming through the issuer, thereby bringing the price back into balance. However, investors should be particularly cautious about the risks of purchasing on-chain stocks during non-trading hours.

3. It's important to emphasize that under this structure, token holders do not enjoy traditional shareholder rights (such as voting rights) - these rights are retained by the custodial institution. Investors are purchasing economic exposure to stock performance, not actual shareholder status. This trade-off enables blockchain-based trading while maintaining compliance.

24/7 Continuous Trading: The Biggest Highlight of On-Chain Stocks

The most obvious advantage of tokenized stocks is continuous trading. Unlike traditional exchanges that are open only about 6.5 hours on workdays, blockchain-based tokens can be traded around the clock. Kraken's xStocks enables 24/7 trading, while Robinhood currently offers 24/5 trading and plans to expand to continuous trading after launching its dedicated Arbitrum Layer 2.

This continuous availability creates unique market dynamics. When major news breaks outside traditional trading hours - such as financial reports, geopolitical events, or company-specific dynamics - your tokenized stocks can immediately reflect market sentiment. Token prices become real-time sentiment indicators, even providing price discovery functionality during traditional market closures, something traditional markets cannot match.

[The translation continues in the same manner for the rest of the text, maintaining the specified translation rules for specific terms.]Next Steps

From an investment perspective, the future of tokenized stocks largely depends on user adoption rates and the evolution of the regulatory environment. In an optimistic scenario, tokenized stocks could become the "killer app" of the crypto industry, expanding the user base exponentially and bringing hundreds of millions of real-world assets on-chain. This trend would be even more pronounced if a non-KYC model could meet the massive demand for US stocks.

In the long term, large-scale migration of stock trading (and even other asset trading) to the blockchain track will become a trend. This not only enhances efficiency but also further lowers entry barriers and expands market participation.

Short-term Investment Opportunities: Bullish on the Following Areas

Stablecoin

Real World Assets (RWA)

ETH/Solana as Settlement Layers

US Fintech Stocks: Such as Robinhood ($HOOD), SoFi ($SOFI), and any investment opportunities related to Kraken (such as Kraken's planned IPO in 2026)