Author: Biteye Core Contributor dddd

Introduction

In the global digital currency market, stablecoins play an increasingly important role as a bridge connecting traditional finance and the cryptocurrency world. As the second-largest stablecoin by market share, USDC (USD Coin) and its issuer Circle have recently attracted significant market attention. Circle's stock price has soared from its IPO at $31 in early June to nearly $200 (reaching a high of $298.99). This remarkable stock performance not only reflects the growth of the stablecoin industry but also reveals the opportunities and challenges facing this emerging financial instrument. This article will provide an in-depth analysis of USDC's issuance mechanism, profit model, competitive advantages, and Circle's financial status and investment value.

USDC's Issuance Mechanism and Profit Model

Fund Guarantee System

USDC employs a strict fund guarantee mechanism. For every USDC purchased, investors must deposit $1 as a reserve. To ensure investor fund safety, USDC implements a system of separation of ownership and control rights. Legally, Circle, as the issuer, holds the ownership of USDC reserves and manages these assets in a "trust form". USDC holders enjoy actual control rights of the reserves through token ownership, with Circle only able to operate the reserves according to user instructions.

In terms of custody, USDC reserves are held by the Bank of New York Mellon, stored in a dedicated account to ensure fund safety and independence. Investment management is handled by BlackRock, a globally renowned asset management company, primarily investing in its money market funds, focusing on U.S. Treasury bonds to generate returns through interest differentials.

Profit Model Risks and Limitations

[The rest of the translation follows the same professional and accurate approach, maintaining the specific translations for technical terms as requested.]

The fundamental reason for this situation is that Circle has invested a large amount of funds in government bonds, which provide stable but low returns, resulting in low asset utilization efficiency. However, as long as Circle can accumulate more funds, the total profit it brings is still considerable.

Cash Flow Situation

Circle performs excellently in cash flow management, with operating cash flow reaching $324 million, far exceeding the industry median of $11.392 million. This is mainly due to the regulatory requirements of the stablecoin business, which requires the company to maintain high cash reserves.

Growth Prospects and Concerns

Circle's revenue growth is strong, with a growth rate of 15.57%, which is 2.6 times the industry median of 5.95%. However, the company has experienced a significant deterioration in profit growth. EBITDA growth is -31.75%, EBIT growth is -32.57%, and earnings per share growth is -61.90%, forming a situation of "revenue increase without profit increase".

This situation is mainly due to the significant cost increase during the company's expansion. Distribution and trading costs have increased by 71.3% quarter-on-quarter, marketing expenses have reached $3.9 million, and the company's payroll expenses have grown by 23.7% year-on-year.

Valuation Analysis and Investment Perspective

Current Valuation Level

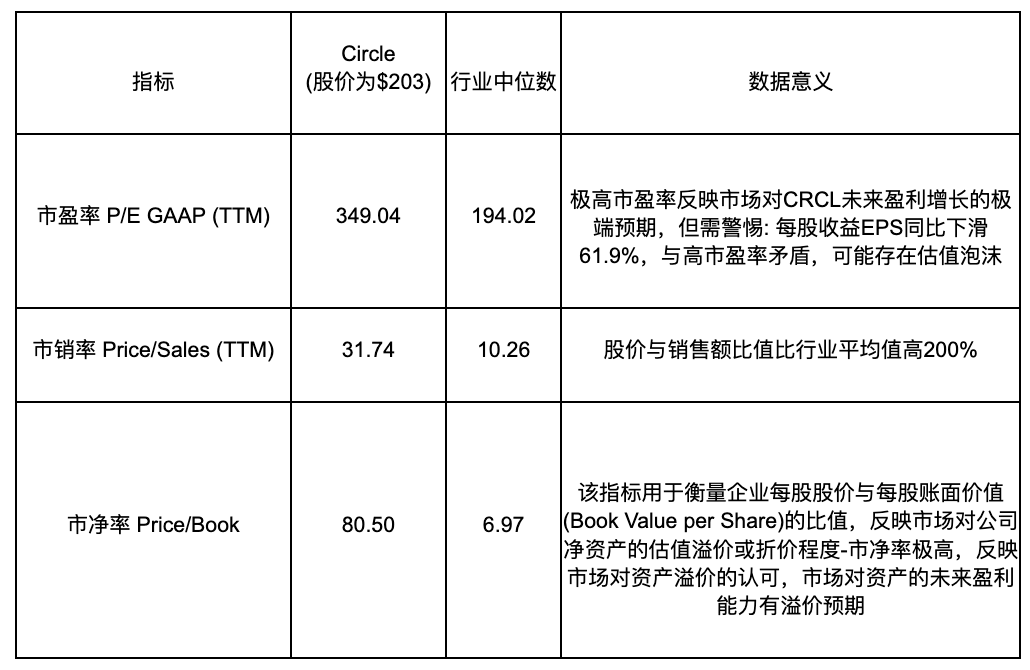

Circle's price-to-earnings ratio, price-to-sales ratio, price-to-cash flow ratio, and price-to-book ratio are all higher than the industry median, reflecting investors' extremely high expectations for the company's future performance. To support these high expectations, Circle needs to achieve strong growth in profitability, sales, and disposable cash. It is worth noting that Circle's future growth momentum may primarily come from product diversification, especially the rapid expansion of EURC Euro stablecoin in the European market, and the breakthrough of RWA tokenization product USYC in the physical asset digitization field.

Equity Structure Analysis

Circle's equity structure is not healthy. Institutional investors hold only 10%, compared to 30% for Coinbase. The company's top management holds 7.4% of shares, which is relatively low. Retail and other investors hold 37% of shares, more than institutional and management holdings. The IPO pricing range of 27-28 USD by JPMorgan, Citigroup, and Goldman Sachs reflects the institutions' lack of confidence in Circle.

Investment Logic Analysis

Bullish Logic:

Stablecoins have solved the inherent pain points of traditional fiat currency transaction systems, and the market is in an expansion period

USDC has a significant compliance first-mover advantage in the stablecoin market

Gradually reducing dependence on Coinbase's distribution, potentially gaining a larger share of investment dividends in the future

The GENIUS Act may force the main competitor USDT to exit the US market

Bearish Logic:

Valuation is disconnected from fundamentals, with continuous profit decline contradicting the high valuation

Low asset return rate, difficult to support long-term value growth

Over 60% of USDC investment income belongs to Coinbase, with Circle unable to obtain complete earnings (2024 financial data)

Low institutional investor shareholding, unhealthy equity structure

Conclusion and Outlook

Circle presents characteristics of "high market expectations, rapid growth, and high valuation". On one hand, the company's stock price has risen by over 540% since its IPO, reflecting the market's recognition of its advantages in regulatory compliance and market share expansion. USDC, as the most transparent stablecoin, enjoys a high reputation among institutional investors, establishing a solid competitive foundation for the company. On the other hand, the company faces challenges such as limited profitability, low asset utilization, and high valuation digestion.

In the short term, the significant increase in Circle's stock price has fully reflected the market's optimistic expectations, and investors need to pay attention to the matching degree between valuation and fundamentals. In the long term, whether Circle can achieve a breakthrough through product diversification will be crucial. The expansion of EURC Euro stablecoin in the European market, innovative applications of RWA tokenization product USYC, and gradually reducing dependence on Coinbase's revenue sharing may bring new growth momentum to the company.

With the advancement of regulatory policies like the GENIUS Act and the continuous development of the stablecoin market, USDC's compliance first-mover advantage may be transformed into a larger market share and profitability. When evaluating Circle, investors need to balance its innovation potential and current valuation, focusing on whether the company can prove that the high expectations given by the market are reasonable through diversification strategies and operational efficiency improvements.