Key Points

Geopolitical risks are easing, with the Israel-Iran ceasefire stabilizing the market. Concerns about tariffs are weakening, and downward inflation pressure is more likely to support the Federal Reserve's rate cut.

Polymarket's success and high valuation highlight the market's focus on consumer-centric applications, especially prediction markets, with its momentum expected to accelerate.

Market Overview

Geopolitical Risks Receding?

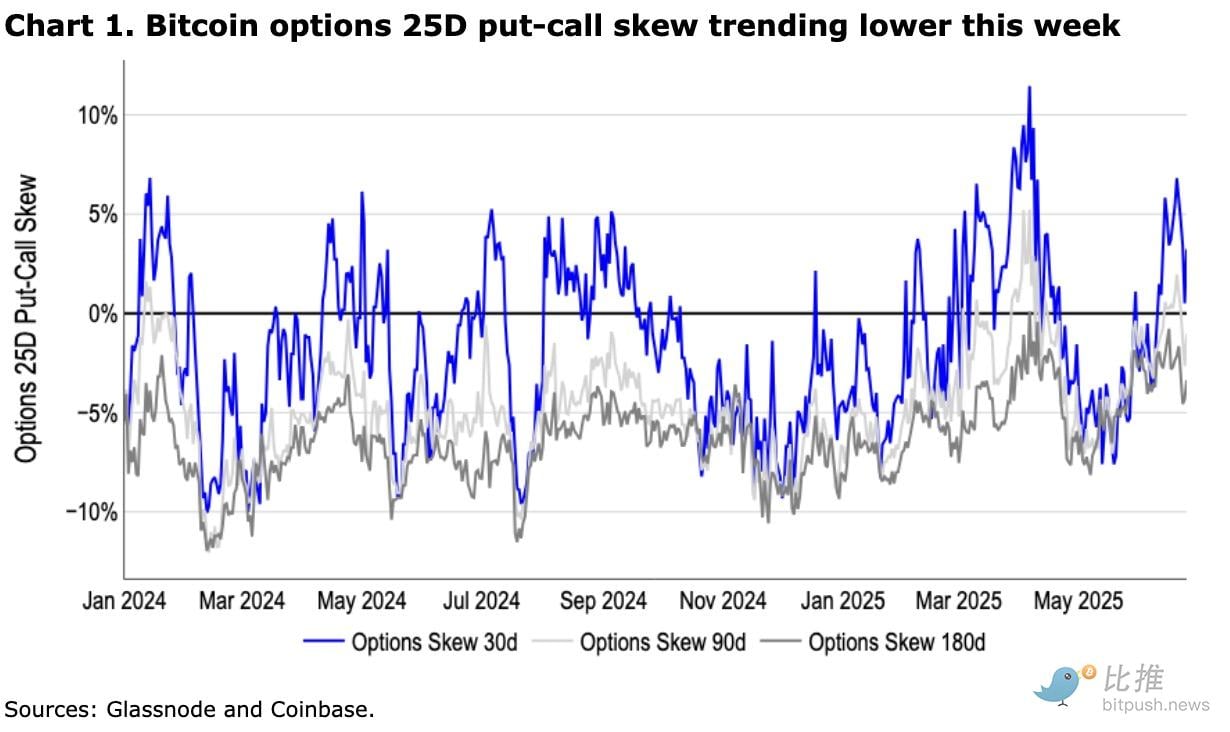

Since the ceasefire agreement between Israel and Iran on June 23, market sentiment has stabilized, with the COIN50 index and US stocks rebounding together. In fact, the 25 delta put-call skew for Bitcoin 30-day options began to decline after last week's surge, while the skew for 90-day and 180-day contracts remains in negative territory.

This indicates that the market's demand for short-term downside protection for Bitcoin options has eased. We believe that longer-term options show investors want Bitcoin exposure without paying upfront spot market costs, reflecting a slight bias towards out-of-the-money call options. The implied volatility for 1-week and 1-month contracts has significantly decreased, reducing the attractiveness of selling volatility.

Nevertheless, lingering uncertainty remains about whether tensions might reignite. Looking ahead, we believe the most likely potential scenarios include:

Maintaining the status quo, characterized by a fragile and tense balance, with Iran continuing to use its nuclear program and regional proxies to project influence, essentially buying time without crossing clear red lines.

A second, more severe scenario involves limited military escalation, given Israel's residual concerns about Iran's nuclear capabilities.

Closing the Hormuz Strait (which handles one-fifth of global oil consumption) would be a major red line indicating conflict escalation. However, we believe this is unlikely, as the ceasefire not only reduces this threat but such an action would severely damage Iran's own economy. Therefore, we believe buying the dip on geopolitical events remains a viable market strategy, consistent with our latest monthly outlook.

What About Tariffs?

Despite the approaching July 9 suspension of reciprocal tariffs (August 12 for China), little significant progress has been made on trade agreements—though a rare earth transportation agreement with China was reached and a proposal submitted to the EU. However, both traditional and crypto markets have largely ignored potential economic risks, partly because these have not been reflected in economic data.

Federal Reserve Chair Powell testified this week before the House Financial Services Committee and Senate Banking Committee, stating that inflation could still be affected by tariffs later this summer. (Notably, President Trump subsequently announced he could appoint Powell's successor as early as September or October.)

But remember, commodities only represent about 20-25% of the core CPI basket, and it's unclear whether businesses will fully pass on tariff costs to consumers. Additionally, service prices have been declining since mid-2024 and are more sensitive to long-term developments like AI. In fact, we believe tariffs are more likely to be deflationary due to their net impact on total demand. In our view, this will continue to drive the Fed to cut rates in the second half of this year. All of this might explain the market's complacency about tariffs, which we believe could persist until the upcoming deadline. Ultimately, we do not see trade barriers as a significant risk to our constructive Q3 2025 outlook.

Regulatory Updates

The GENIUS Act (Guiding and Establishing National Innovation for Stablecoins) passed the Senate 68-30 and is now under review in the House. House Majority Whip Tom Emmer (R-Indiana) is trying to merge the bill with the CLARITY Act (House Market Structure Act), but this process might cause delays due to the latter's complexity. Notably, President Trump has called on the House to pass the GENIUS Act "without delay and without additions". Additionally, Senate Banking Committee Chair Senator Tim Scott (R-South Carolina) indicated a crypto market structure bill could be completed by September 30.

Furthermore, on June 23, Senator Adam Schiff (D-California) introduced the COIN Act (Limiting Officers' Income and Non-Disclosure), aimed at restricting senior executive branch officials and their immediate family members from issuing, sponsoring, or endorsing digital assets.

Meanwhile, the Federal Reserve announced this week that it will no longer include reputational risk as a component of its bank supervision and examination program. This appears to be a continuation of deregulation under the current administration's "Operation Chokepoint 2.0". Given the subjectivity of "reputational risk", previous guidelines had systematically excluded the crypto industry from banking.

Polymarket: A New Crypto Unicorn?

This week, decentralized prediction market platform Polymarket sought a valuation of around $1 billion, led by Founders Fund, becoming the latest unicorn in the crypto space.

Just a day later, regulated competitor Kalshi announced $185 million in funding at a $2 billion valuation.

These deals collectively indicate that venture capital this week focused on distribution moats (consumer-facing applications) rather than liquidity moats (token chains and DEXs), with real-time event markets leading the way.

Driving the valuation are its strong usage metrics. Despite regulatory barriers preventing US users from trading, Polymarket's total trading volume has exceeded $14 billion, with about $1 billion in May alone. The platform averages 20,000-30,000 traders daily, surpassing many mid-cap DEXs and demonstrating its ability to attract non-crypto native audiences.

With a new content partnership with X (formerly Twitter), positioning prediction markets as viral social content rather than pure financial instruments, its momentum is expected to accelerate further.

Stablecoins—Especially USDC—Are Its Hidden Beneficiaries

Polymarket trades are settled in USDC on Polygon, with these stablecoin flows reflected in on-chain metrics. For instance, in November 2024, when headline news events drove market attention, monthly trading volume spiked to $2.5 billion, triggering a surge in USDC transfers and cross-chain bridge activity. Unlike lending protocols locking substantial Total Value Locked (TVL), prediction markets have faster fund circulation, with high-frequency settlements driving significant on-chain payment activity.

Coinbase Exchange and CES Insights

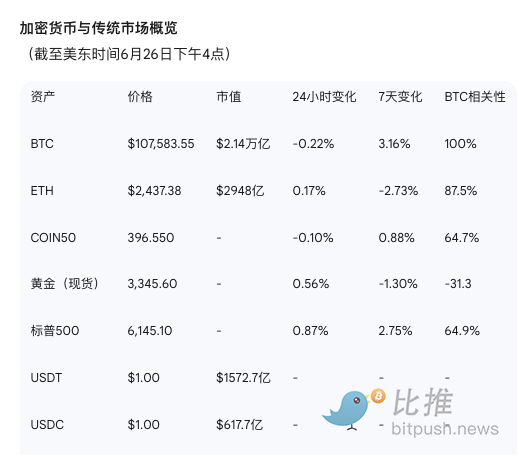

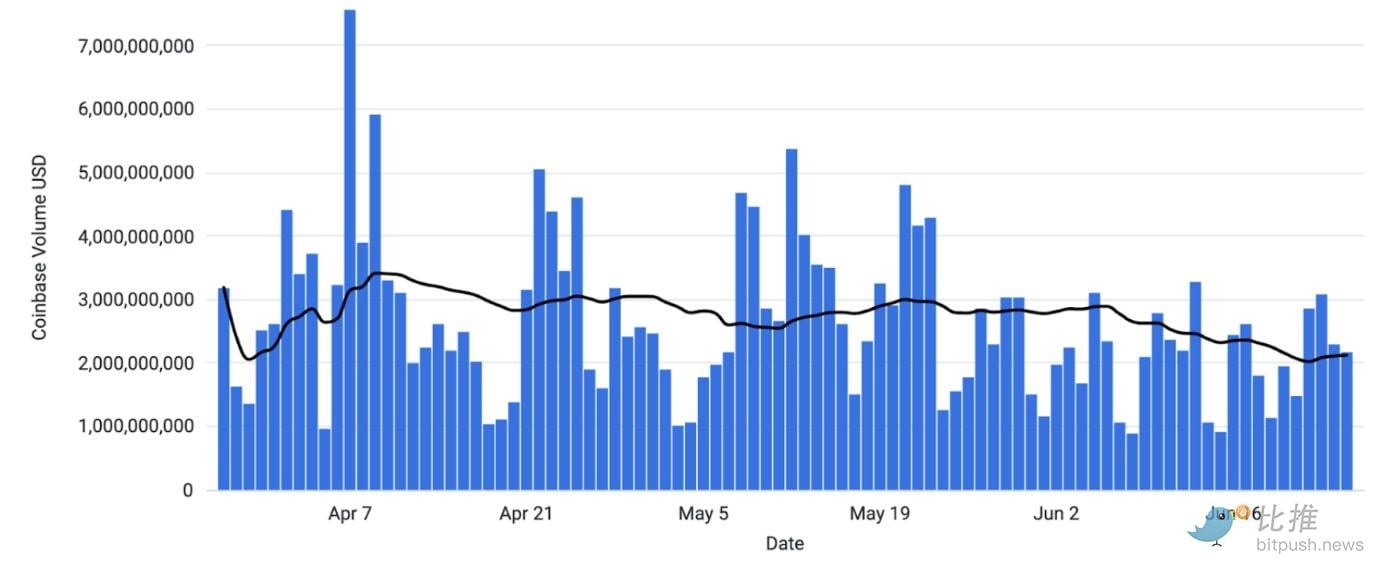

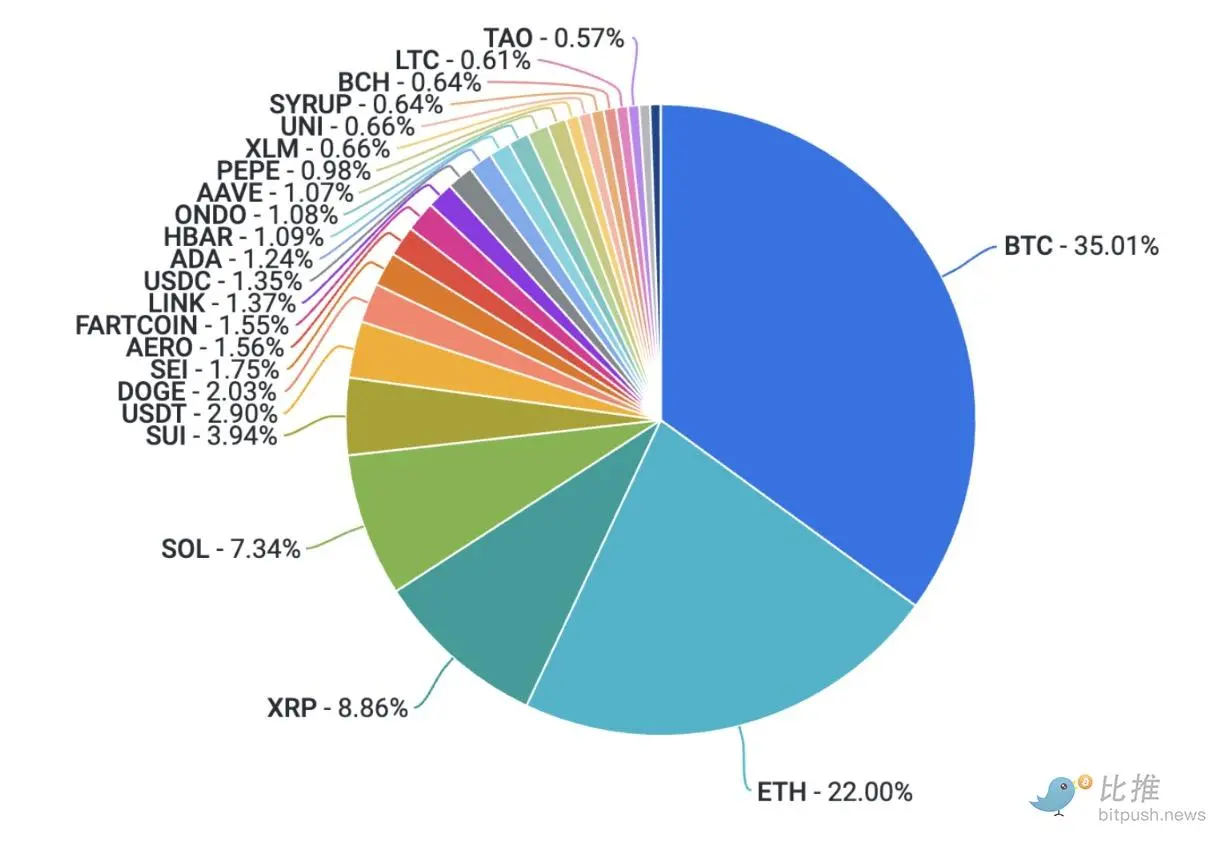

This week, Bitcoin maintained the $100,000 level in the crypto market, with the broader market in a consolidation phase.

In the housing market, US housing mortgage regulators issued an order requiring Fannie Mae and Freddie Mac to consider crypto holdings as assets when assessing housing loan risks. We also see continued inflows into spot BTC and ETH ETFs, with BlackRock submitting the ninth application for a spot SOL ETF to date.

All of these factors, along with ongoing tensions in the Middle East and comments from Fed Chair Powell, have kept traders in a constructive mood. Perpetual contract funding rates are in the low single digits, and positions appear relatively neutral, potentially leaving room for further upside.