Written by: Sanqing

Preface

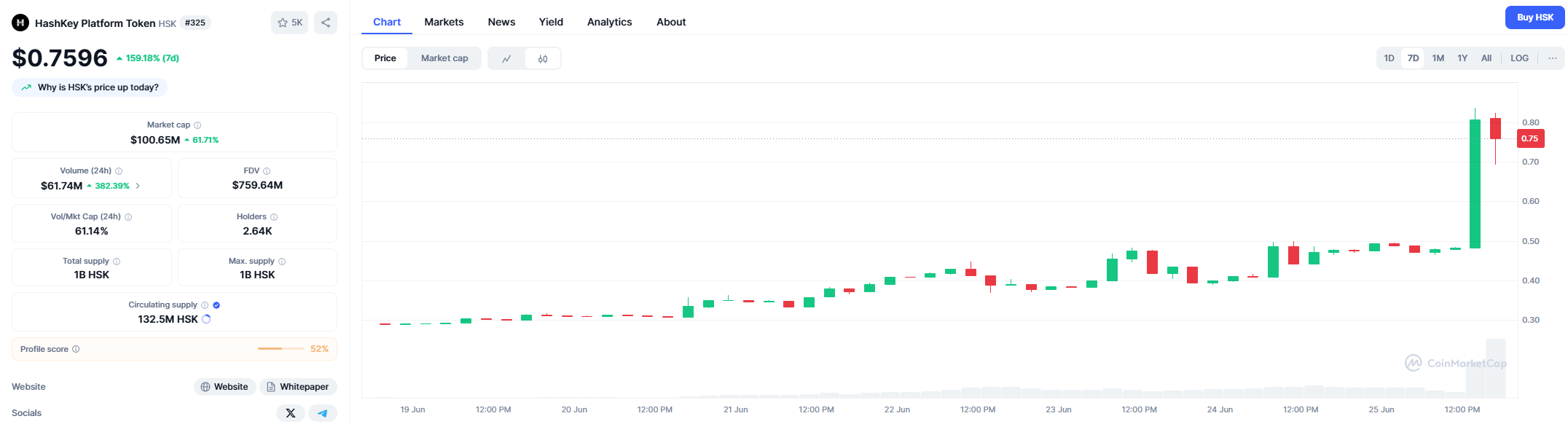

On June 25th, the Hong Kong stock market and crypto market rarely moved simultaneously: CICC International (01788.HK) surged in the afternoon, closing up nearly 200%; HashKey Exchange's platform token HSK soared over 70% on the same day. This was not a coincidence.

A single "Virtual Asset Service Qualification Upgrade" announcement triggered the market's re-evaluation of "compliance dividends" and pushed traditional brokers and compliant crypto platforms to the market focus.

I. Event Overview

In the early trading session, the Hong Kong stock brokerage sector quickly strengthened, with CICC International opening high at 1.25 HKD and continuing to rise, reaching a peak of 2.5 HKD intraday, and closing at 3.66 HKD with a 198% daily gain, creating a historical high in trading volume. Other Chinese brokers like Shenwan Hongyuan Hong Kong and Hongye Futures also simultaneously strengthened, with A-share brokerage stocks following with increased volume in the afternoon.

Correspondingly, HSK in the crypto market surged from $0.48 to $0.89 within hours, with a short-term increase of over 85% and dramatically expanded trading volume.

This "stock-token resonance" is rare and may reflect the market's synchronized mapping of regulatory signal implementation across two seemingly disconnected asset categories.

II. Policy Background: "Licensed Compliance" Enters Realization Period

The core trigger for this market movement was a notice issued by CICC International on the evening of June 24th: its wholly-owned subsidiary received approval from the Hong Kong SFC, adding virtual asset trading, investment advice, and product distribution functions to its existing securities trading license, officially entering the licensed virtual asset operation category.

Previously, Hong Kong launched the Virtual Asset Service Provider (VASP) system in 2023, requiring platforms to hold Type 1 (securities trading) and Type 7 (automated trading services) licenses and pass strict reviews before opening retail services.

By 2025, the SFC further introduced the "A-S-P-I-Re" regulatory framework (Access, Safeguards, Products, Infrastructure, Relationships), clarifying the systematic safeguards, product access, and infrastructure collaboration network required for compliant virtual asset operations.

This approval for CICC International to expand its license means that Chinese financial institutions have first established a complete channel connecting traditional brokers and compliant crypto trading. This signal provides dual expectations for the Hong Kong stock market and compliant platforms, also signifying the concrete landing of compliance traffic.

III. Platform Profile: HashKey's "Compliance Closed Loop" Ecosystem

As one of the first platforms licensed by the SFC, HashKey Exchange holds Type 1 and Type 7 licenses and has been offering HKD retail trading (BTC, ETH, USDT) since 2023. Its parent group, HashKey Group, has extensive layouts in Hong Kong, Singapore, Japan, and other locations, establishing a closed-loop ecosystem centered on "trading - asset management - compliant custody - on-chain infrastructure".

HashKey's current main business segments include:

HashKey Exchange: Local compliant trading platform in Hong Kong, offering HKD trading pairs;

HashKey Global: Trading platform for global users;

HashKey OTC Global: Large-scale over-the-counter matching for institutions;

HashKey Capital: Crypto asset management company managing over $10 billion in assets;

HashKey Tokenisation: Providing compliant tokenization solutions for RWA and traditional assets;

HashKey Chain: Self-developed zkEVM Layer2 chain, with HSK as the native token;

HashKey AI / Cloud / Brokerage: Expanding infrastructure and smart contract model deployment.

IV. HSK's Value Logic: Scarcity Reassessment Driven by Compliance

HSK is the native token of the HashKey ecosystem, covering platform fee deductions, VIP rights, node governance, on-chain gas fees, and priority allocation for new projects. Unlike most platform tokens, HSK had no ICO and no private placement financing, with distribution entirely dependent on platform incentives.

Its deflationary model is promised to be executed by HashKey Group: 20% of net profits annually will be used to repurchase and burn HSK, constructing a positive feedback between "platform growth and token value".

This price surge is not pure speculation, but a synchronized reassessment of the following mechanisms:

Enhanced user growth expectations: With licensed brokers driving traffic, HashKey's retail activity may significantly increase;

Profit model implementation: Compliant exchanges have real income, and repurchase plans have a basis for realization;

Regulatory "unique token" scarcity: Currently, only HSK operates a token model under the SFC framework, possessing a policy moat.

In other words, compliance drives not just incremental users, but a systemic elevation of platform token valuation.

Conclusion

When traditional financial institutions and crypto ecosystems establish controllable connections within the institutional framework, "compliance" is no longer a boundary suppressing imagination, but an amplifier of value.

On June 25th, what we saw was not a chance catalyst of an announcement, but a phased response of an entire system entering deep practical waters.

Compliance is not the end of the wind, but the runway for value takeoff.