As the news of the U.S. raid on Iranian nuclear facilities gradually spreads, the crypto market has once again experienced a violent downturn, with BTC dropping below $100,000 and ETH falling below $2,300, potentially signaling the beginning of a bear market for short sellers.

In recent days, both individual traders and institutions shorting the market have been almost entirely in a profitable state, with many traders feeling triumphant and claiming they've "turned the tables".

Currently, the market is oscillating between panic-driven geopolitical conflict-induced drops and minor rebounds. Odaily will explore the potential duration and key influencing factors of this "short seller's bull market" in this article for readers' reference. Note: This article is merely a perspective sharing and does not constitute investment advice.

Short Sellers' Bull Market VS Oscillation Trap: Can You Make Money Just by Shorting?

With the increasingly tense Iran-Israel situation, BTC, once considered a safe-haven asset, has now become part of the global economic ecosystem. "Iran-Israel conflict, wallet pays the bill" has become a self-deprecating joke among crypto communities. In such a market environment, the short-selling group is the small group making substantial profits.

"Short Seller King": Shorting 16 Altcoins, Floating Profit of Nearly $10 Million

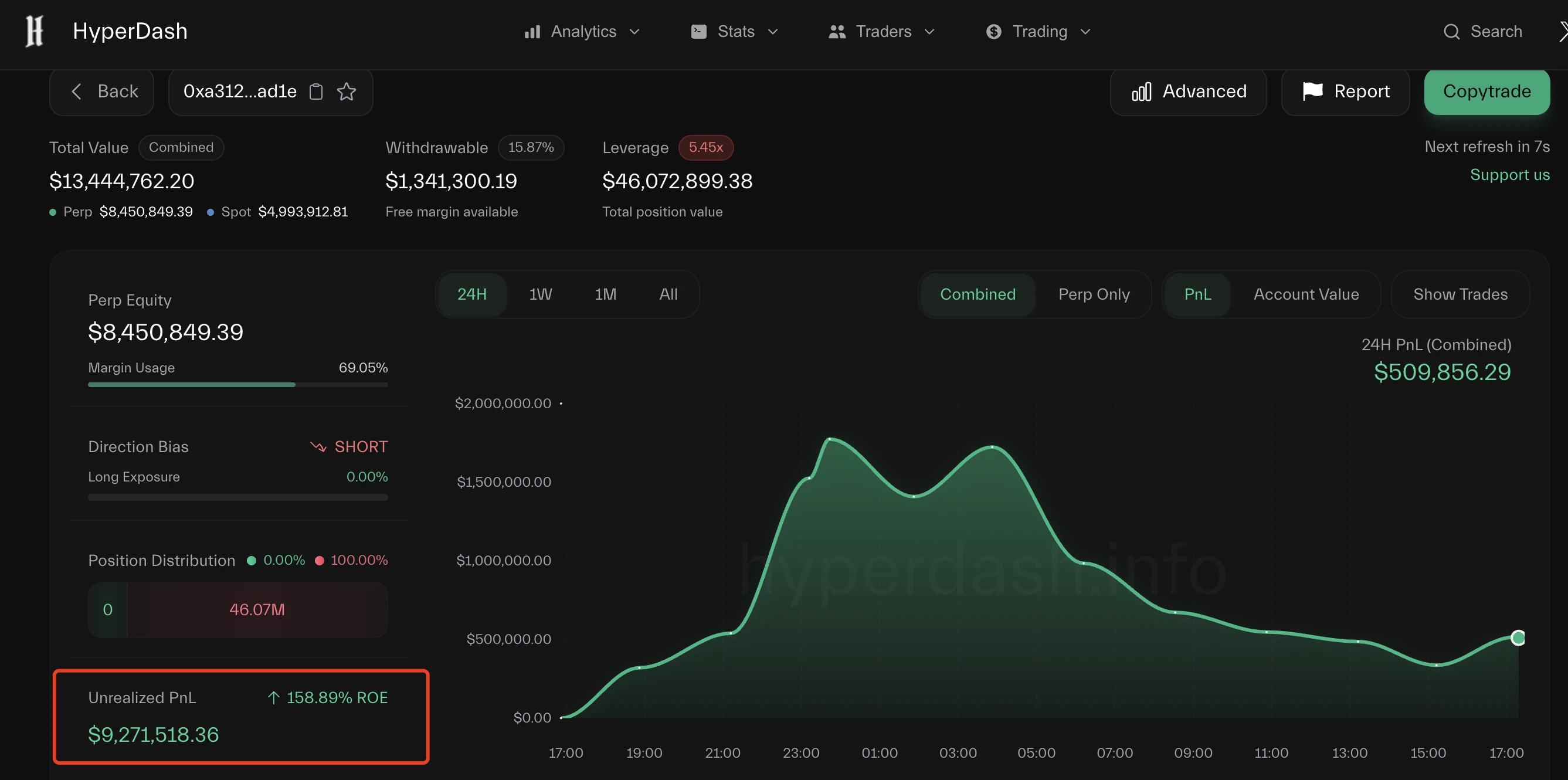

On June 20th, a "Short Seller King" on Hyperliquid who shorted 16 Altcoins reported a cumulative profit of $9.68 million, significantly higher than last week's $3.56 million. At that time, 15 out of 16 positions were in floating profit, with the only floating loss on HYPE narrowed to $1.92 million. The overall position value was approximately $53.3 million.

It's worth noting that this whale had partially closed positions for ETH, PEPE, INIT, XRP, and other assets on June 17th, locking in some profits.

https://hyperdash.info/zh-CN/trader/0xa312114b5795dff9b8db50474dd57701aa78ad1e

Currently, this address has withdrawn $1.34 million in funds, with floating profits still reaching $9.27 million. Notably, the only token causing a loss is HYPE, currently with a floating loss of around $1.7 million.

And this "Short Seller King" is not the only one.

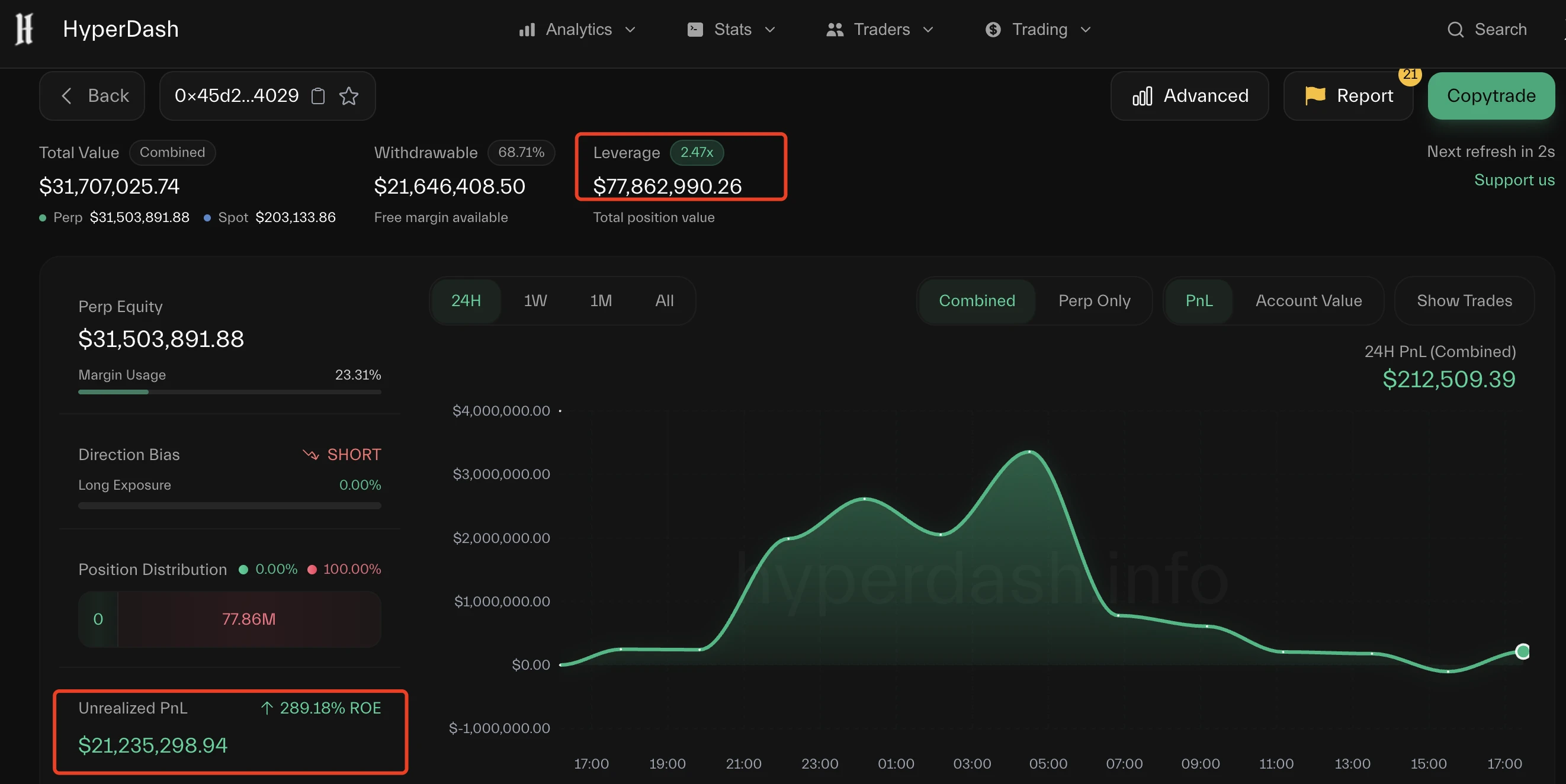

"Short Seller Whale/Institution": Shorting 58 Tokens, Floating Profit Exceeding $20 Million

Starting June 16th, a certain whale/institution began their "short selling journey" - shorting 58 tokens on Hyperliquid, including BTC, ETH, SOL, XRP, PEPE, FARTCOIN, DOGE, AAVE, HYPE, etc. Currently, this address has a floating profit of $21.34 million, with a position size of $77.79 million. Only two out of 58 short positions are in floating loss - HYPE (floating loss of about $4.28 million) and AAVE (floating loss of about $16,000). ETH performs the best, with a floating profit of $4.438 million.

https://hyperdash.info/zh-CN/trader/0x45d26f28196d226497130c4bac709d808fed4029

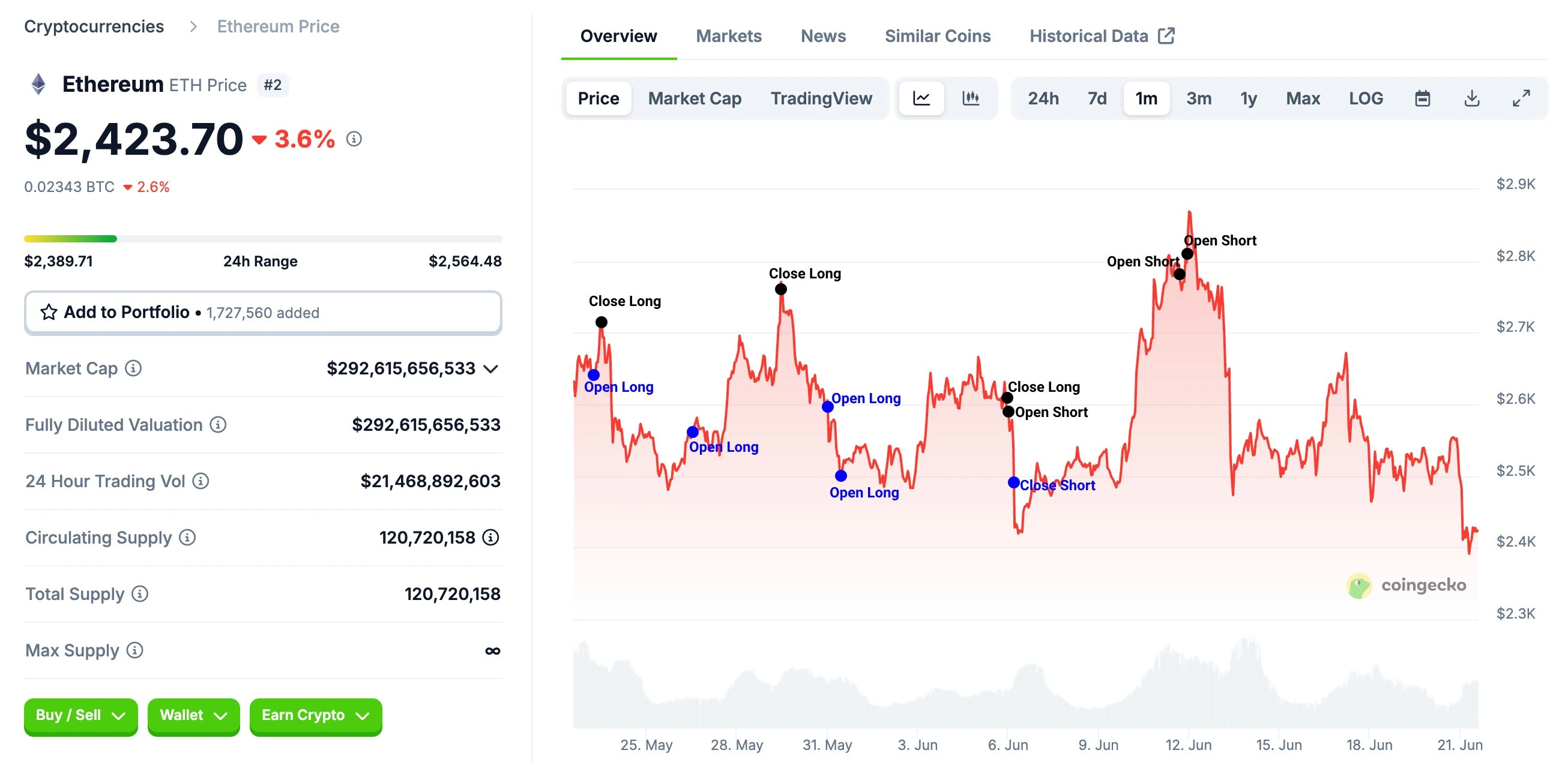

ETH Smart Money: Shorting at the Top, Floating Profit Exceeding $20 Million

Beyond the "mindless short sellers", this short-selling wave also includes "ETH smart money players".

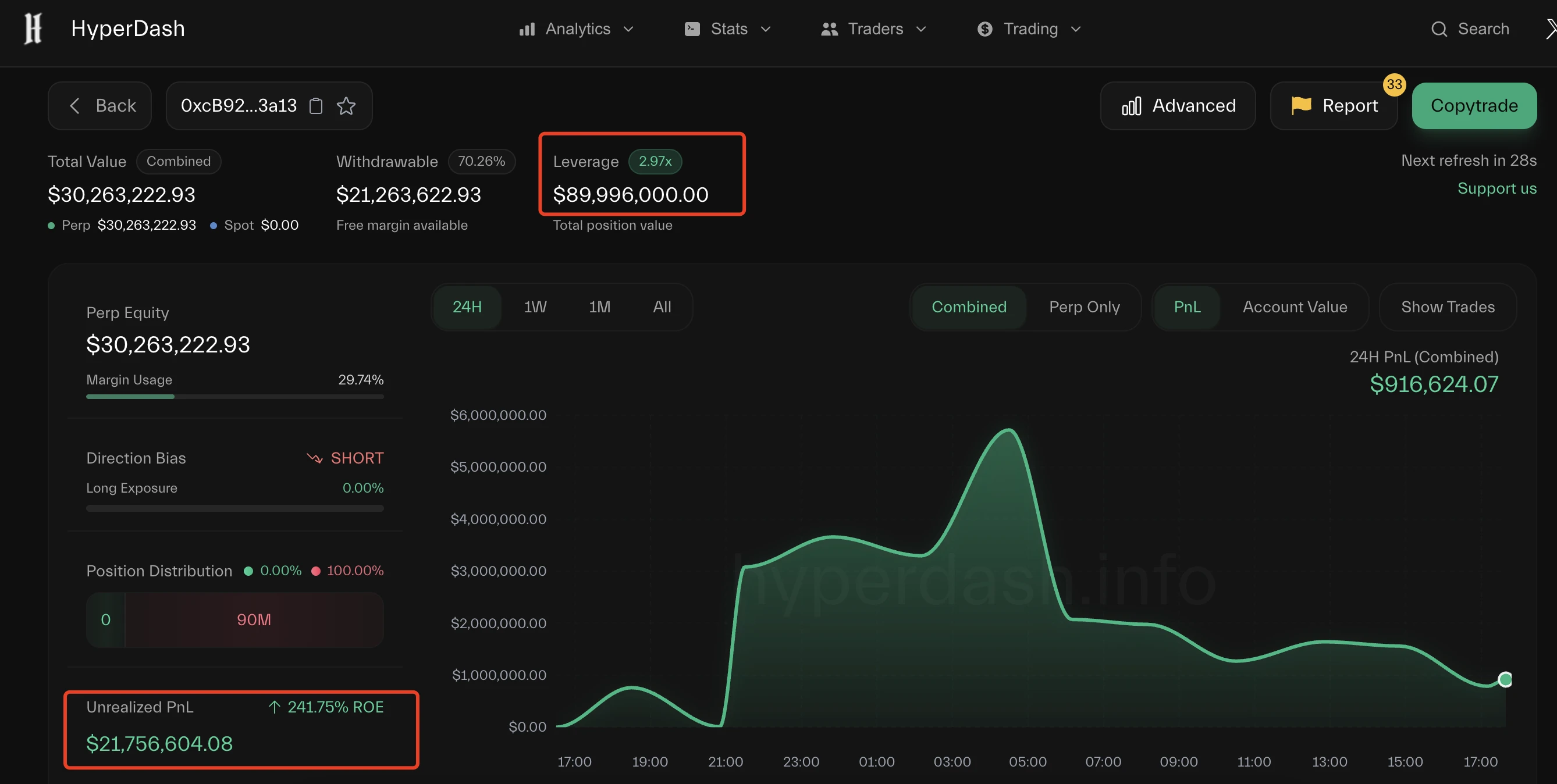

According to LookonChain's monitoring, a certain bottom-long ETH smart money player's operations over the past month have been almost flawless, consistently closing positions before significant ETH drops and shorting at the top. They previously earned $20 million and currently have a cumulative floating profit exceeding $21.75 million, with a position value of around $90 million.

https://hyperdash.info/trader/0xcB92C5988b1D4f145a7B481690051F03EaD23a13

[The translation continues in the same manner for the rest of the text, maintaining the specific translations for technical terms as specified in the initial instructions.]Trump Escalates Localized Conflict, US Teeters on the Brink of War

For Trump, there is no doubt that he is a complete troublemaker in the current Iran-Israel conflict.

On June 20, the White House's stance on the Iran issue was: US President Trump will decide within two weeks whether to take military action against Iran.

Just 2 days later, Trump boastfully stated that the US military had completed strikes on Iran's Fordow, Natanz, and Isfahan nuclear facilities, with Fordow as the primary target and full payload deployment.

Such fluctuating political attitudes and swift military strikes have further escalated the tension in the Middle East Iran-Israel situation. The latest news indicates that Iran plans to close the Hormuz Strait, a critical oil transportation chokepoint, which has been approved by the Iranian parliament but still awaits final decision from the highest security authority.

Moreover, Trump even shouted the slogan "MIGA" (Make Iran Great Again), suggesting that Iranian authorities should consider regime change.

As a businessman, Trump's psychological pressure for launching a war is far less than politicians like Biden, and the severe consequences may require the crypto market and the entire global economic system to pay the price.

Conclusion: Short-term Market Recovery Depends on US Attitude, Currently in a Pessimistic State

Overall, the crypto market's "Altcoin G" had long been brewing, and the Iran-Israel conflict and the US's direct intervention are undoubtedly catalysts for this outcome. Short-term market recovery still primarily depends on subsequent US statements and follow-up actions, especially Trump's remarks and moves.

Trader Eugene Ng Ah Sio previously wrote that he has opened long positions on Bitcoin and some Altcoins, believing that "US bombing operations, coupled with the closure of the Hormuz Strait" are consecutive blows to early longs, sufficient for a washout, and now is the time to "buy the dip".

However, whether Trump can repeat his April strategy of "initiating a trade war with tariffs and then releasing positive market-saving statements" remains uncertain.

Perhaps, for most people, limited shorting is a more cost-effective choice than blind longing.