As tensions in the Middle East escalate, Bitcoin (BTC) was temporarily pushed below $100,000 before recovering. The market remains uneasy with news that Iran is pursuing a blockade of the Hormuz Strait in retaliation for the US attack on its nuclear facilities.

According to CoinMarketCap, a global virtual asset market tracking site, BTC was traded at $100,998.37 as of 8 am on the 23rd. This is a 0.8% decline from the previous day. After the US attack on Iranian nuclear facilities, it briefly fell below the $100,000 mark but managed to recover.

Related Articles

- Virtual Assets Weak Amid Middle East Tension... Bitcoin at $104,000 [Decenter Market View]

- Virtual Assets Remain Flat After US Federal Reserve Rate Freeze [Decenter Market View]

- Virtual Assets Plummet on US Middle East Intervention Speculation... Bitcoin Down 3% [Decenter Market View]

- Virtual Assets Rise on Middle East Conflict Easing Expectations... Bitcoin Up 2% [Decenter Market View]

Major altcoins saw even larger declines. Ethereum (ETH) recorded $2,235.29, down 2.36%. XRP traded at $2.013, a 2.01% decrease. Solana (SOL) dropped 1.63% to $132.11.

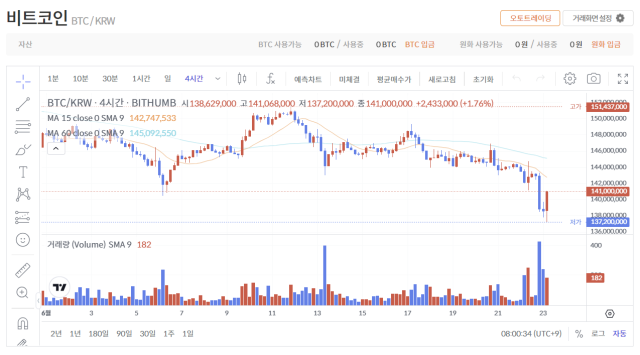

At the domestic exchange Bithumb, BTC recorded 141,001,000 won, down 0.81% from the previous day. ETH fell 2.35% to 3,122,000 won, and XRP dropped 1.71% to 2,823 won.

Virtual asset investment sentiment also deteriorated. Alternative.me's Fear and Greed Index fell 7 points to 49 points, returning to a "fear" state for the first time in two months. The lower the index is towards 0, the more contracted the investment sentiment, while closer to 100 indicates market overheating.

Geopolitical risks have increased as Iran warns of blocking the Hormuz Strait in response to the US attack on its nuclear facilities. The Iranian parliament has submitted a resolution to the government for blocking the strait. The actual blockade will be decided by the National Security Council (NSC).

The Hormuz Strait is a key strategic route through which about 20% of global oil trade passes. JP Morgan warned, "If Iran actually blocks the strait, it would be the 'worst-case scenario' of an Israel-Iran war" and that "oil prices could surge to $120-130 per barrel in such a case".

- Reporter Kim Jung-woo

< Copyright ⓒ Decenter, reproduction and redistribution prohibited >