Dogecoin (DOGE) is currently mirroring its historic consolidation patterns from 2016-17 and 2020-21, periods that preceded staggering rallies of 5,000% and 21,000%, respectively. Despite a recent 30% price drop and macro headwinds, DOGE has shown resilience by holding steady around the $0.31 mark, suggesting potential accumulation by investors. Open Interest has significantly declined to $1.74 billion since February, aligning with the price weakness, yet DOGE maintains its position in the top-10 cryptocurrencies by market cap. This consolidation phase could be setting the stage for another monumental rally, drawing parallels to its past performance. As of June 2025, the crypto community is closely watching DOGE for signs of a breakout, reminiscent of its previous bull runs.

Dogecoin Mirrors Historic Patterns Amid 30% Decline

Dogecoin's recent 30% drop belies a familiar structural setup. The memecoin is replicating its 2016-17 and 2020-21 consolidation phases—periods that preceded 5,000% and 21,000% rallies respectively. Despite current macro headwinds, DOGE's resilience at $0.31 suggests accumulation may be underway.

Open Interest has halved to $1.74 billion since February, coinciding with price weakness. Yet the asset retains its top-10 market cap position after a 287% annual gain. Retail speculation is simmering beneath the surface, with technicals hinting at a potential breakout blueprint.

Dogecoin (DOGE) Price Forecast: Analyst Predicts Rally to $4 Amid Bearish Streak

Dogecoin (DOGE), currently trading at $0.16, has faced a 25% decline over the past month, leaving analysts searching for signs of a rebound. Pseudonymous crypto analyst Cantonese Cat argues that DOGE's six-month consolidation phase is a precursor to a breakout, with a potential target of $4.13 by the end of the current cycle. The analyst cites Fibonacci retracement levels, suggesting key resistance points at $1.60, $2.26, and $4.13 on Binance data—adjusted slightly to $1.50, $2.27, and $3.94 across composite exchange feeds.

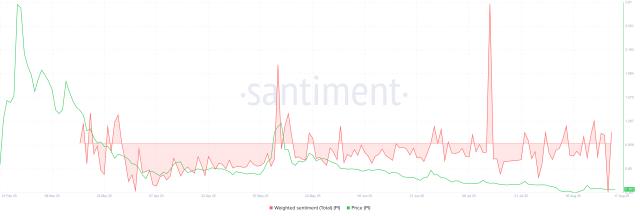

Market fatigue, Cantonese Cat notes, is typical of bull-market retracements: 'A lot of people are getting bitter about Doge … that’s exactly how higher highs and higher low type situations are supposed to get you all frustrated.' The meme coin’s prolonged stagnation since last autumn’s spike aligns with historical patterns of accumulation before upward moves.

Other analysts echo bullish sentiment. Javon Marks highlights DOGE’s resilience, though his full commentary was truncated in the source material. The broader crypto community watches for volume surges to confirm whether DOGE can reclaim its momentum and test these ambitious targets.

Dogecoin Drops 8% but Shows V-Shaped Recovery in Boost for Bulls

Dogecoin staged a sharp intraday reversal after plunging to multi-week lows, with buyers aggressively defending the $0.151 support level. The meme cryptocurrency briefly collapsed 8% amid broad crypto market weakness before rebounding to $0.157, forming what technical traders recognize as a potential bottoming pattern.

Trading volumes surged to 828 million DOGE during the sell-off—the highest hourly tally in over a week—before stabilizing. The recovery comes despite persistent macroeconomic headwinds, including hawkish central bank rhetoric and geopolitical tensions that have weighed on risk assets.

On-chain data reveals accumulation activity during the dip, suggesting institutional players may be building positions. Analysts now watch whether DOGE can consolidate above $0.157, with failure to hold this level risking retests of the day's lows.