Circle's listing has been criticized by famous investors. Particularly because early employees missed out on approximately $3 billion in unrealized profits.

Billionaire venture capitalist Chamath Palihapitiya mentioned that Circle insiders sold 14.4 million shares at an initial public offering price of $31 per share, securing around $446 million. However, with the current stock price trading above $240, the same shares would now be worth approximately $3.45 billion.

Circle IPO, Leaving Trillions for Early Employees

This difference represents a gap of about $3 billion, and Palihapitiya explained this as an expensive mistake due to choosing the traditional IPO route.

He mentioned that acquirers purchased insider stocks and redistributed them to selected customers. This left limited upside potential for original shareholders.

In his view, employees essentially handed billions in value to external investors who have essentially played no role in Circle's success.

"In this case, it was a $3 billion gift from Circle's employees and investors to people who have nothing to do with their journey," Palihapitiya said.

Palihapitiya argued that the situation could have been different if Circle had chosen a SPAC merger or direct listing.

These alternative routes often provide insiders with more control over price, timing, and disclosure, allowing them to retain more value during public transition.

He added that SPAC and direct listings more clearly disclose valuation dynamics and can be structured to benefit both sellers and buyers.

"To be clear, this value transfer mechanism does not occur through direct listing or SPAC. The benefits of SPAC and DL are very clearly disclosed upfront. This can be negotiated and minimized to benefit both selling and buying shareholders," he added.

Circle had previously planned to go public through a SPAC merger with Concord Acquisition Corporation but canceled the deal in 2022. Subsequently, it pursued a traditional IPO. While successful, it appears to have left early stakeholders with regrets.

CRCL Surges... Increasing Stablecoin Confidence

Despite the controversy, Circle's performance in the public market has been remarkable.

Trading under the CRCL ticker, the stock has surged over 675% since its $31 debut, reaching a peak of $248 per share on June 20th. This sets the company's market capitalization at around $58 billion, indicating investor confidence in the company's future.

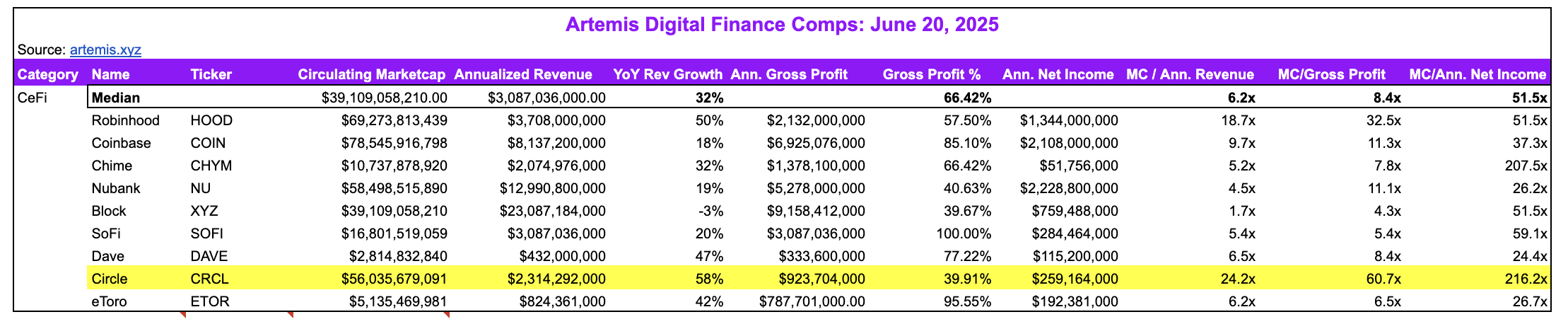

Artemis blockchain analytics company CEO John Ma noted that Circle has a much higher valuation multiple despite reporting higher net income than Coinbase and Robinhood.

"Circle is now trading at 24.2x Q1'25 revenue run rate, 60.7x Q1'25 gross profit run rate, and 216x Q1'25 net income run rate," Ma pointed out.

According to him, this premium seems to reflect investors' belief in Circle's future growth and potential regulatory advantages.

A key factor in that optimism is the recently passed GENIUS Act in the Senate. This bipartisan bill is designed to provide stablecoin clarity in the US market. Supported by President Donald Trump, the bill still requires House approval and final signing.

If passed, it could strengthen Circle's regulatory foundation and market dominance in the stablecoin sector, potentially justifying its surging stock price.