On June 20th, the key on-chain indicator tracking ETH's long-term holders (LTH) behavior closed at an all-time high. This indicates that selling pressure from this group is increasing.

This occurs at a point where market momentum has significantly slowed down. As demand for ETH weakens and investors largely remain on the sidelines amid continued market downturn, the downward trend is growing.

Ethereum Liveliness Reaches Peak

According to glassnode, ETH's liveliness reached an all-time high of 0.69 during Friday's trading session. This indicator tracks the movement of long-term held/dormant tokens. It is measured by the ratio of coin days destroyed to total coin days accumulated.

When this indicator declines, it signals that the asset's LTHs are moving assets away from exchanges, which is considered an accumulation signal. Conversely, when it rises, as with ETH, LTHs are moving coins to exchanges to sell.

ETH's liveliness surging to 0.69 suggests that LTHs are increasingly liquidating their positions as uncertainty grows. This reflects a lack of confidence in the coin's short-term price recovery.

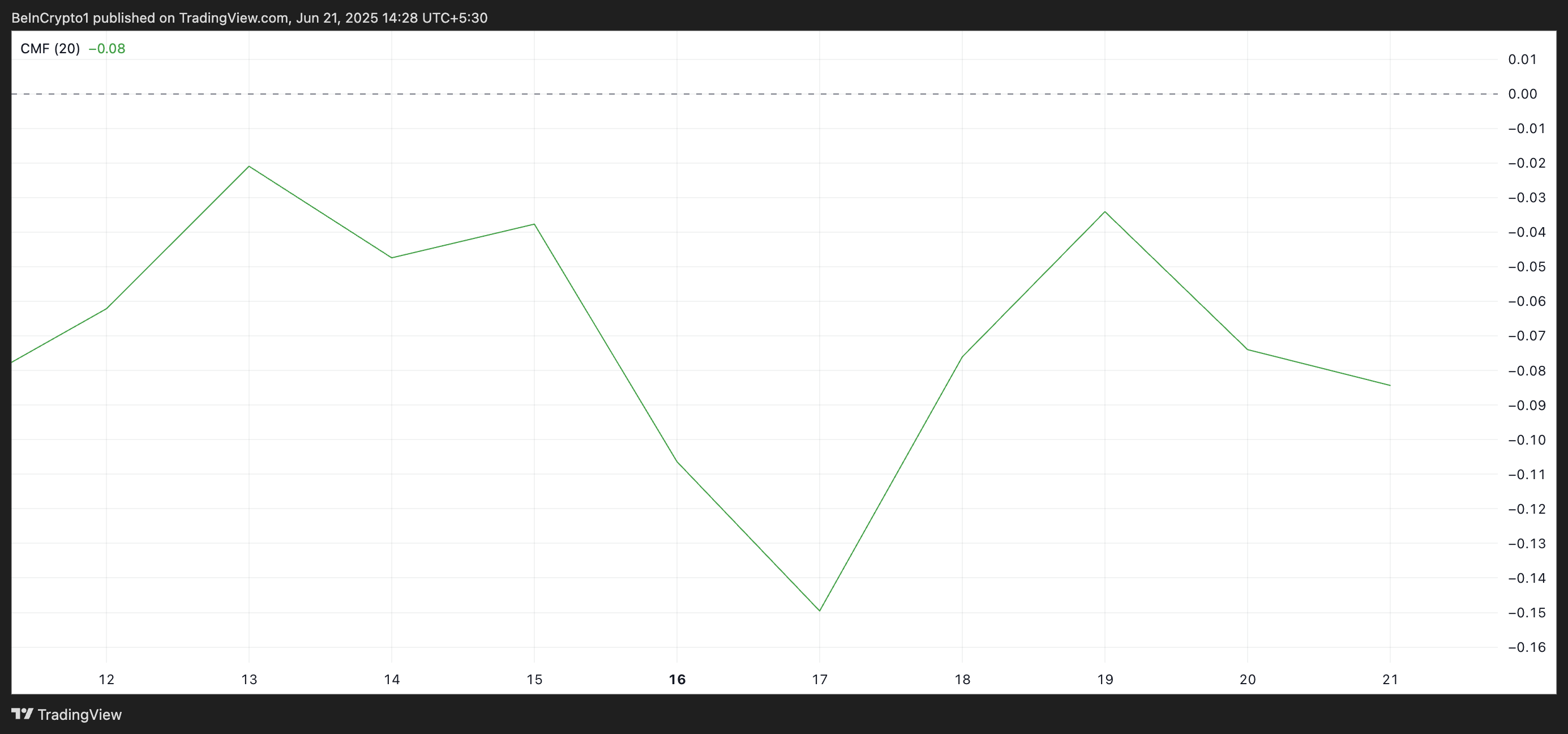

Further confirmation of this downward trend can be found in ETH's daily chart. The coin's Chaikin Money Flow (CMF) is negative and showing a downward trend. At the time of writing, ETH's CMF is -0.08, indicating a decrease in capital inflow.

The CMF indicator measures the flow of funds into an asset. When its value is negative, it indicates low buying interest and confirms a shift from accumulation to distribution.

ETH Watches May's Lowest Level

The continued selling by ETH's long-term holders combined with the overall market's decreased demand for the coin could lead to a deeper correction.

At the time of reporting, the major altcoin is trading at $2,429. If selling continues among ETH's seasoned holders, the coin could drop to $2,185. If this price level is not maintained, the coin could fall further to $2,027, which was last reached in May.

Conversely, a revival of new demand for the altcoin would invalidate this bearish outlook. In that case, the price could reverse its downward trend and rise to $2,745.