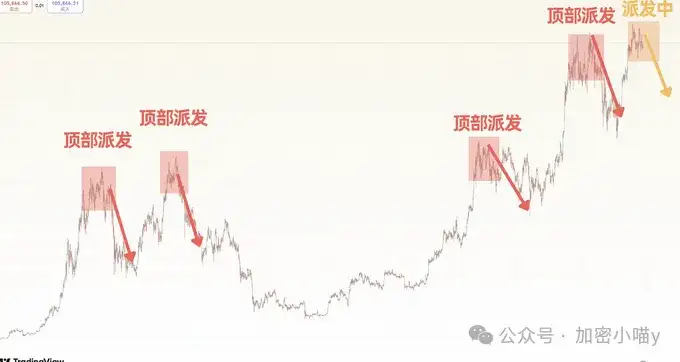

Bitcoin is currently in a typical "Double Top + top distribution" stage, similar to past cycles, where the top oscillation usually lasts 1-2 months before entering a phase of selling, turnover, and low-price accumulation. It has been a month since BTC's consolidation, and the harvesting stage may be about to begin.

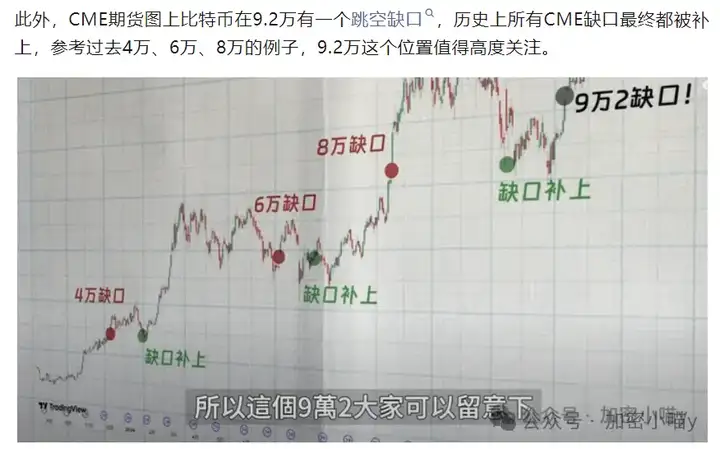

Bitcoin falls from high levels, structural adjustment not yet complete After rising to $112,000, Bitcoin formed a clear Double Top structure and entered a correction channel. The key support below is in the $100,000 to $102,000 range, and if breached, it may trigger a structural crash.

The 4-hour chart shows that prices have repeatedly stopped falling near $102,300, but the rebound is weak, still within a bear flag or descending channel, suggesting a high possibility of continued downward trend. Unless the rebound is accompanied by significant volume, there will still be heavy pressure above $106,000.

On the 1-hour chart, prices are oscillating between $102,300 and $106,500, with weakening momentum and strong market wait-and-see sentiment. Short-term focus is on potential buying opportunities at $102,500-$103,000, but if the hourly line breaks below $103,000, bears may again take control.

Overall, Bitcoin is weak in the short term and still needs to guard against downside risks. Operations should be cautious with light positions, waiting for more clear signals.

Ethereum oscillates for 40 days, bulls and bears at a stalemate, short-term trading opportunities still exist

Ethereum continues to oscillate within a range. Although it dropped 4.5% yesterday, this is the third time it has touched the lower support. Despite the long consolidation period, it does not necessarily mean a decline, as it has previously broken through the previous range high, and the pullback has not created a new low, indicating that bears do not have an advantage.

This structure is relatively friendly for short-term trading: lightly long near support, consider short at resistance zones, with stop-loss, there is still room for operation. Currently, Ethereum is approaching daily support, and short positions should be cautious. From the 4-hour view, after a sharp drop and volume contraction, although a bullish engulfing pattern stopped the decline and rebounded, the upward momentum is limited, with poor volume-price coordination, and bulls still appear weak. Overall, it is not advisable to short here, and going long requires waiting for more clear right-side signals. Weekend will be mainly oscillating, maintain patience and flexibility.

SOL drops to 135, will it drop further? Don't panic, the opportunity is just beginning

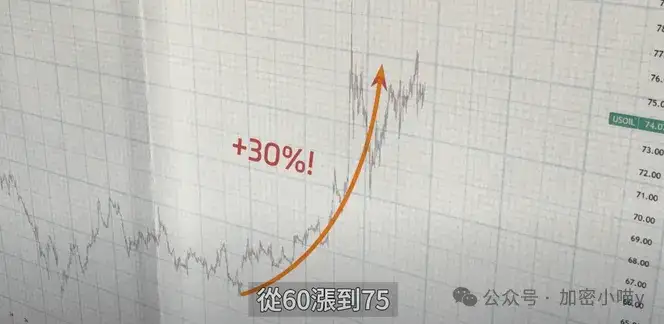

SOL dropped from 188 to 135 in just a few days, a decline of nearly 30%. Pepe, Sui, and other popular altcoins are close to being halved. However, Bitcoin remains stable at $100,000, indicating there is still significant room for correction. We have long warned that a small bear market is approaching, with altcoins adjusting first. This month's aggressive shorting is to wait for Bitcoin to enter extreme fear, when buying the dips will be a true "money-picking moment".

Don't forget, SOL will welcome a spot ETF in October, and opportunities are for the patient. Last month's top selling, this month's shorting, next month's buying the dips - get the rhythm right, and returns will naturally follow. Are you ready?

A major correction is imminent, and the real opportunity is coming soon

In the next few weeks, the market is likely to see a deep correction. The next CPI may not be containable - oil prices have risen 30% this month and rose over 40% in April. This is enough to push CPI up by 0.3%, and is not an exaggeration. Additionally, ongoing tariff pressures are a heavy blow to corporate profits and market sentiment.

US stocks are under pressure, and the crypto market cannot escape unscathed. Institutions have already started positioning short positions. European asset management giant Abraxas has heavily shorted BTC, ETH, SOL, and SUI, with positions reaching $500 million. The whale Spoofy has cleared out $3 billion in Bitcoin in recent weeks, with no signs of repurchasing. The main forces' escape signals are obvious, and there is still downside space in the market.

Doge may usher in a new wave of speculation, opportunities are quietly brewing

According to the Financial Times, Musk will launch trading functionality on X (formerly Twitter), allowing 10 billion users to directly buy stocks and cryptocurrencies, a message confirmed by X's CEO. As a Doge fan, Musk has repeatedly supported the dog coin, from Tesla merchandise to changing his avatar to Doge.

With this trading feature launch, Doge is likely to be prominently featured: such as being in the center of the trading page or even directly used as the platform's mascot. Whether he actually does this is unimportant; what matters is that market expectations and speculation have been ignited. Compared to other coins with no heat, Doge has a natural speculative advantage in the second half of the year. In the crypto world, speculation is the logic, and expectation is value.

From a technical perspective, $0.16 provides initial support, and more critically, the $0.14-$0.15 range is the previous bottom. If the price falls to this point, even without good news, a technical rebound is likely. Pay close attention and wait patiently for the opportunity.

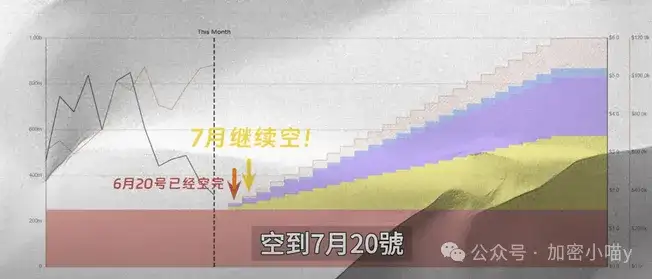

For short-term operations, shorting coins with continuous unlocking pressure is more suitable and has a higher win rate.

For example, ZRO, which has been unlocking 22% of circulating supply every 20th since June. We successfully shorted one round on June 20th, with the next round on July 20th.

I plan to position short positions at high levels in early July for a simple reason: ZRO will have continuous large-scale unlocking in the coming year, with supply exceeding demand, no one willing to take over, and heavy selling pressure, making it an "ideal shorting target". More critically, the project team itself is selling, with the founder just transferring $4 million to Binance in the early morning, likely to continue selling.

Besides ZRO, we have also shorted ZK, TRUMP, and other unlocking coins, and even positioned a short on BTC near $106,500, which has now dropped to $102,400, far exceeding expectations. Remember, opportunities are always for the prepared.

That's it for the article! If you're feeling lost in the crypto world, consider joining our community to layout and harvest with us! Scan QR code or add WeChat: 3847185042 or V: Mixm5688