In the past 24 hours, the cryptocurrency market experienced a liquidation wave of over $486 million, with $200 million in liquidations occurring within just one hour of Bitcoin's sharp decline. This sell-off was primarily driven by significant price drops in Bitcoin and Ethereum, which fell by approximately 5.65% and 6.61% respectively, with Bitcoin briefly falling below $103,000.

VX: TZ7971

This liquidation wave occurred during US stock market hours, triggered by the US plan to withdraw tariff benefits from some chip manufacturers and demand they halt production lines. Bitcoin quickly dropped from $106,000 to $104,000, and with the continued uncertainty in the Middle East and market expectations of potential US intervention, Bitcoin's price further declined to a low of $102,000.

As prices plummeted, the market widely saw a rush to exit leveraged positions.

Currently, Bitcoin has stabilized around $104,000, but Ethereum has fallen below $2,500. At this stage, the market lacks positive news, and the overall cryptocurrency market sentiment is gradually becoming pessimistic. The Bitcoin fear index has fallen below 50, indicating a neutral but slightly panicked investor sentiment.

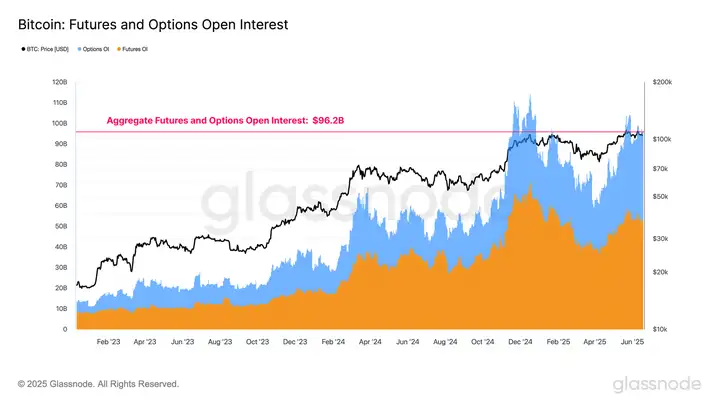

The Bitcoin derivatives market holds $96.2 billion in open interest (OI), which can potentially influence price trends when BTC trading prices approach historical highs (ATH). Although Bitcoin's open interest has dropped from its peak of $114 billion, it remains far below 2022 levels.

The launch of the US spot Bitcoin ETF in January 2024 accelerated this trend. In 2023, OI volatility was relatively mild, but after the ETF launch, 30-day changes became more volatile, reflecting the market's increasing leverage-driven nature.

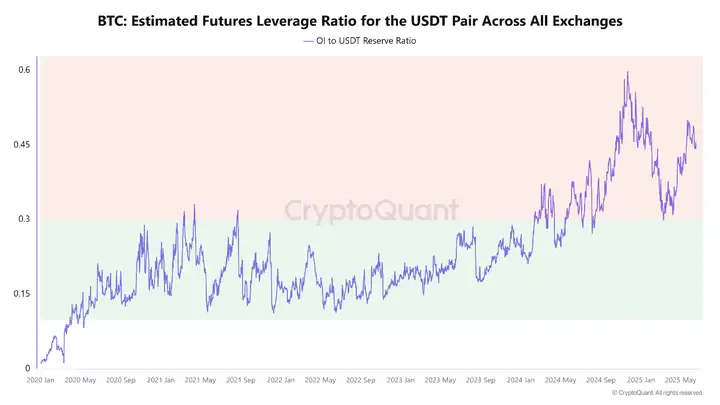

The fair market leverage ratio is currently at 10.2%, near the highest 10.8% since 2018, indicating increased speculative activity that may continue to drive price trends as Bitcoin hovers near historical highs.

This could amplify Bitcoin's price potential, pushing it to quickly break through the critical $111,800 resistance level and increase liquidity, as Binance futures data shows most traders' participation is thriving.

As shown, in May 2025, Binance reached a notable milestone with futures trading volume reaching $1.7 trillion, setting the highest monthly trading volume for 2025. This activity surge marks a strong wave of speculation and interaction that significantly contributed to Bitcoin's price rise in the early second quarter.

However, this leverage is also cautionary. The risk of large-scale liquidations remains high and could lead to significant price drops, similar to the crypto margin position volatility crash in 2021.

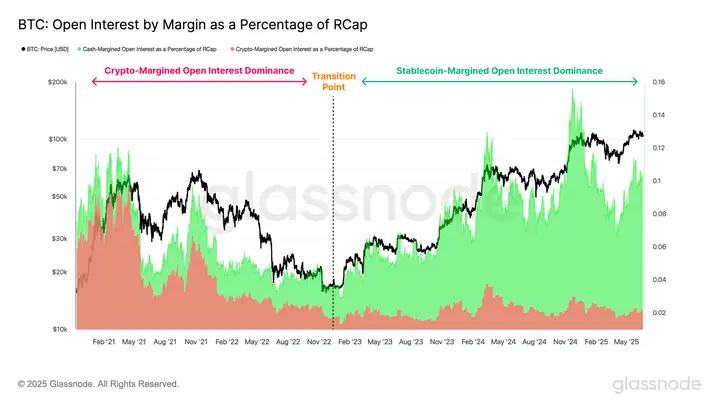

The market is showing signs of maturity. Since the FTX collapse in 2022, stablecoin margin collateral has exceeded crypto margin positions, now dominating open positions. This shift reduces collateral volatility and provides a buffer against market shocks.

BTC / USDT Futures Leverage Reflects Volatility

Data shows that the BTC/USDT futures leverage to OI ratio is gradually increasing, approaching the peak since early 2025. This confirms the earlier concerns about a high-leverage market, with Bitcoin consolidating above $100,000 for over a month.

Despite Binance's continuous increase in short positions, the funding rates typically show a relatively balanced long and short ratio. In the $100,000 to $110,000 range, most traders tend to short. This increases the possibility of price reversal. It's likely that some large investors are quietly accumulating funds in this area.

In the long term, as Bitcoin has maintained key support areas for weeks, the bullish outlook remains intact. Institutional investors remain steadfast. Within the 30 days up to June 18, US spot Bitcoin ETFs attracted over $5.14 billion in net inflows. Companies like Strategy, Metaplanet, H100 Group, and The Blockchain Group also accumulated significant BTC during this period. According to technical price patterns, the $135,000 price target remains "possible".