In the past 24 hours, approximately $400 million worth of leverage positions were liquidated in the cryptocurrency market.

According to the current aggregated data, Ethereum had the largest liquidation at $182.47 million, followed by Bitcoin at $129.15 million.

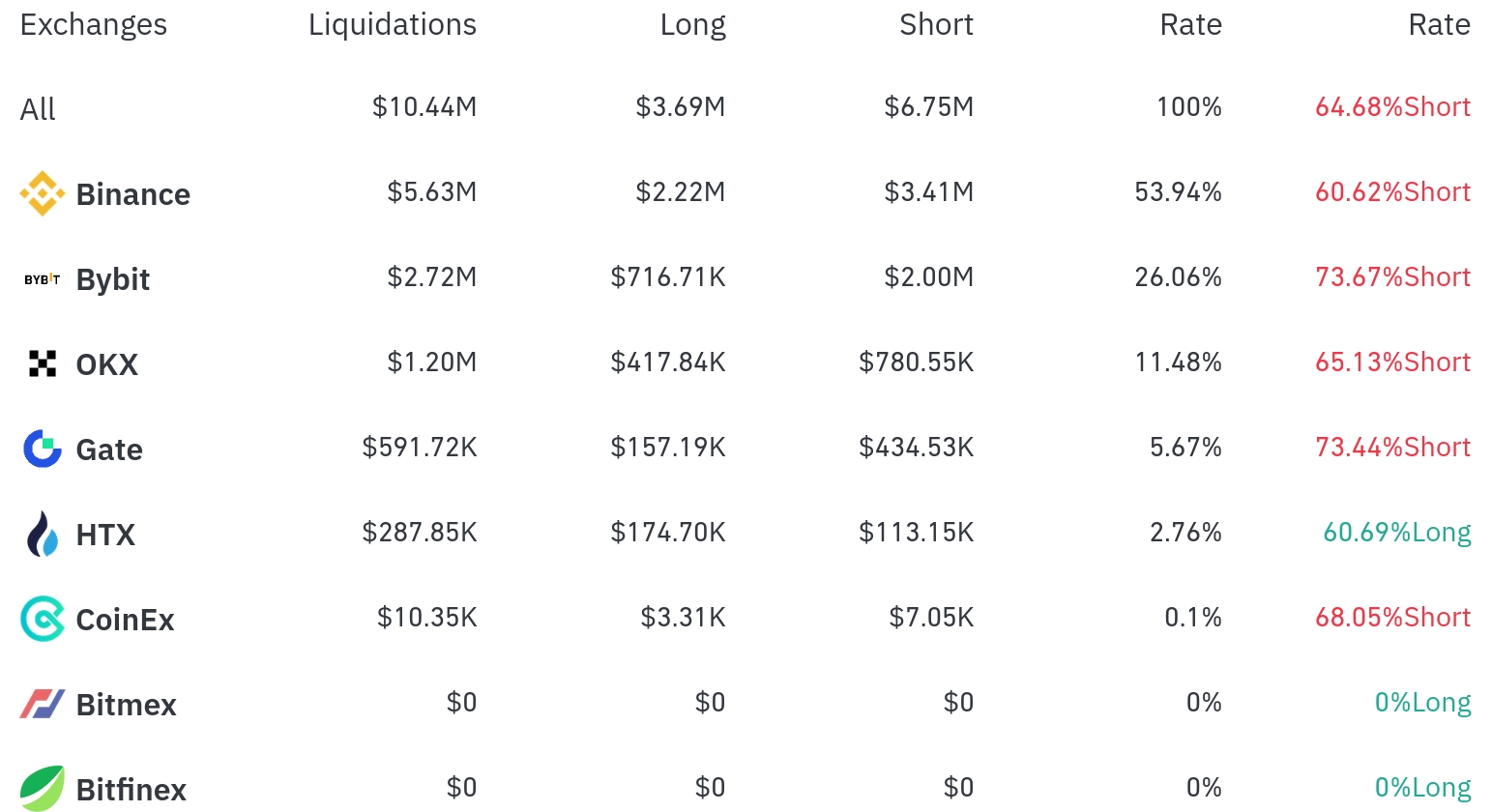

Over the past 4 hours, Binance had the most position liquidations, with a total of $5.63 million (53.94% of the total) liquidated. Notably, short positions accounted for $3.41 million, representing 60.62%, which is higher than long positions.

Bybit was the second-highest exchange with liquidations, with $2.72 million (26.06%) of positions liquidated, of which short positions dominated at $2 million (73.67%).

OKX saw approximately $1.2 million (11.48%) in liquidations, with short positions also accounting for a higher percentage at 65.13%.

Interestingly, HTX differed from other exchanges, with long position liquidations at 60.69%.

By coin, Bitcoin (BTC) and Ethereum (ETH) recorded the largest liquidation volumes. Bitcoin had approximately $129.15 million in positions liquidated over 24 hours, with $289,560 in long positions and $665,990 in short positions liquidated over 4 hours.

Ethereum (ETH) saw about $182.47 million in positions liquidated over 24 hours, with $208,730 in long positions and $1.19 million in short positions liquidated over 4 hours. Ethereum notably occupied the largest share of total liquidations.

Solana (SOL) had approximately $33.37 million liquidated over 24 hours, and Doge also saw significant liquidations of $9.98 million.

Notably, the FARTCO Token experienced a sharp price drop of -8.15% over 24 hours, resulting in about $6.88 million in liquidations. Additionally, the 1000PEI Token saw substantial liquidations of around $280,000 over 4 hours.

Uniswap (UNI) recorded a price drop of -5.36% over 24 hours, with approximately $2.2 million in liquidations.

A notable aspect of this liquidation data is that most exchanges showed higher short position liquidation rates compared to long positions. This suggests that traders who took short positions have incurred losses as the market recently showed an upward trend.

In the cryptocurrency market, 'liquidation' refers to the forced closure of a leverage position when a trader fails to meet margin requirements. This data reveals the divergent perspectives of investors regarding market direction.

Real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>