Last night, I saw a news article about Wyoming choosing a public chain for its upcoming stablecoin WYST through an open scoring process. Ultimately, 11 chains made it to the candidate list, with Aptos and Solana tying at 32 points, Sei following closely at 30 points, while Ethereum and various Layer 2 solutions scored 26 points or lower, which might differ significantly from the daily perceived ecosystem activity and token prices. I was curious about how this scoring was done, so I studied it with GPT.

1/ First, kudos to the US state government's build in public approach. The Wyoming Stablecoin Committee, established in March 2023 under the Stable Token Act, has a public Notion document containing project introduction, meeting calendars and records, scoring criteria results and memos, Q&A, contact information, and links to their YouTube channel, X account, Warpcast account, and Github account, which is more serious and transparent than many current projects.

Those interested can directly observe:

https://stabletoken.notion.site/

2/In Q4 2024, the committee initially selected 28 public chains, first screening out 14 through four yes-or-no criteria: permissionless access, supply transparency, on-chain analysis, and freezing capability. Then, they scored using 9 indicators (3 points each), including network stability, active users, TVL, stablecoin market cap, TPS, transaction fees, transaction finality time, block time, and Wyoming registration. Finally, they added 5 additional advantages (2 points each: privacy, interoperability, smart contract/programmability, use cases, partners) and subtracted 6 potential risks (2 points each: legal entity violations, team violations, security vulnerability history, poor network availability, lack of bug bounty, lack of code maintenance).

They ultimately recommended 5 Layer 1 mainchains: Solana (32 points), Avalanche (26 points), Ethereum (26 points), Stellar (24 points), Sui (26 points) and 4 qualifying Layer 2 chains: Arbitrum (26 points), Base (25 points), Optimism (19 points), Polygon (26 points) as "candidate blockchains".

3/Aptos and SEI were actually newly included in the selection this Q1. The committee updated the selection criteria this quarter, adding "vendor support" to the yes-or-no standards, meaning "the blockchain must have committee partner support for development, audit, and infrastructure deployment, which can be undertaken by a foundation with approval".

They updated another condition: "The chain must be comprehensively indexed and supported by on-chain analysis platforms cooperating with the committee (such as Chainalysis, TRM Labs)".

They also added two items to the additional advantages scoring:

- Emerging Market Trends: Whether it carries projects in emerging tracks like AI, DePIN, virtual reality, game assets

- Foundation Support: Whether the foundation can support technical development, WYST liquidity, or market promotion

In this scoring, Aptos and SEI scored 32 and 30 points respectively, thus being newly added to the candidate chains.

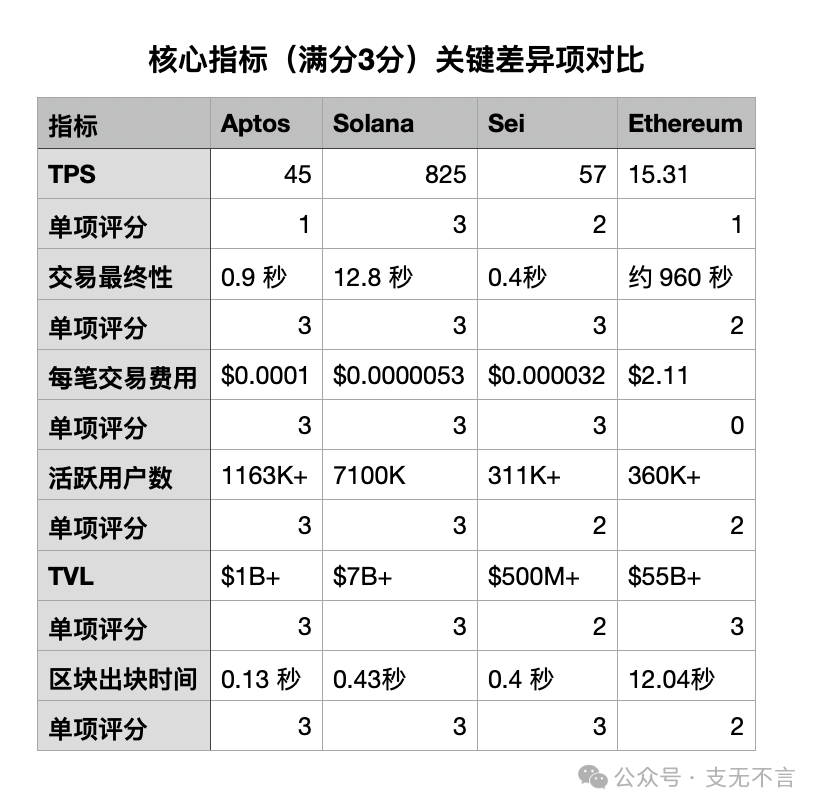

4/I created a comparative chart of key differences around core indicators. Please note that some data is from late 2024 and not the latest, as the new round did not re-score the previously selected 9 public chains.

Ethereum's TVL is cliff-like leading, but it suffers in TPS, transaction finality duration, per-transaction fees, and block time. Here you can also see that Layer 2 distribution has caused Ethereum's active user count to be only at the same level as SEI, significantly behind Aptos and Solana.

But how did Aptos manage to tie with Solana for the highest score? I found that on one hand, Aptos is indeed very balanced, with strong compliance, speed, low cost, and relatively stable network. On the other hand, it's because the second round of scoring added two additional advantage points that Solana did not re-participate in. If these two points were removed, Solana would actually still have the highest score.

5/Ethereum enthusiasts should note that although Ethereum always claims to be the best choice for real asset on-chain, at the government technical selection level, factors like permissionless network are merely a threshold. Network stability in core indicators only occupies one item; lacking technical barriers and network availability are risk deduction items. Solana, which has experienced downtime, was deducted 1 point each, but this had little overall impact. There was no scoring for decentralization degree; the state government is more concerned with the ability to freeze and whether an entity exists in Wyoming, with most core indicators focusing on performance, cost, and scale.

Of course, this state-level stablecoin issuance has always adhered to the principle of "multi-chain support, technological neutrality". They will continue updating rules, collecting feedback, and welcome chains not yet in the list to apply, so all entered and even unenlisted chains theoretically have a chance.

6/Besides public chain selection, Wyoming's state-level stablecoin project is also worth noting. As the first US state planning to issue a stablecoin, WYST originally planned to launch by July 4th, but in the late May meeting, this timeline was postponed to Q3 2025, with a new proposed date of August 20th. Subsequent work involves public opinion collection on reserve fund management rules, final approval, establishing a dedicated ledger/accounting chart, setting up trust accounts and liquidity fund accounts with third-party custodians, and connecting with licensed service providers including centralized exchanges, payment platforms, digital wallets, and market makers for WYST purchase and resale.

Finally, the stablecoin's reserve fund will be managed by Franklin Templeton, with Chainalysis handling on-chain analysis, integrating with LayerZero and Fireblocks, completing decentralized verification network and official website, deploying WYST contract to mainnet before August 20th, and making an official announcement at the Wyoming Blockchain Conference.

Besides Wyoming, Nebraska has passed its "Financial Innovation Act", authorizing an entity named Telcoin to issue a state-supported stablecoin tentatively called eUSD. A US federal overseas territory, Tinian Island in the Northern Mariana Islands, attempted to issue a USD stablecoin called Marianas US Dollar (MUSD), which was initially vetoed by the governor in April but overturned by the senate in May.

This scenario of various US states and companies eagerly preparing to issue their own stablecoins easily reminds one of the Free Banking Era from 1837 to 1866, when states, cities, private banks, railway and construction companies, stores, restaurants, churches, and individuals issued approximately 8,000 different currencies by 1860, diverse and lacking unified standards. The accompanying image is a $1 private currency from the New Jersey Delaware Bridge Company between 1836 and 1841.

7/Recent discussions about RMB stablecoins have been extensive, with many large companies eager to try. After the question of whether to have one, the next question might be which chain to use. Whether to launch a dedicated chain, use a company's alliance chain like Ant Chain or JD Chain, access common international public chains, or use domestic public chains like Hashkey Chain or Conflux - this is a new question for governments and enterprises in China, the US, and worldwide. Wyoming's scoring and disclosure system might not be perfect, but it sets a precedent for future efforts. We will likely see more interesting governance developments ahead.