XRP coils tighter than a spring-loaded trap—what's next for the embattled crypto?

Brace for impact or breakout as Ripple's token faces its make-or-break moment.

When technicals scream 'now or never,' even diamond hands get sweaty. Meanwhile, Wall Street still can't decide if crypto's the future or just a very expensive spreadsheet.

XRP Price Prediction: Analyst Declares ‘Only Two Paths Remain’ as XRP Tightens to Breaking Point

Posting on X, analyst CasiTrades wrote that XRP’s “consolidation has finally reached its apex and something big is coming next.”

Unfortunately, she suggested that a big dive is more or less as likely as a breakout, so traders may need to tread very carefully in deciding whether to buy or sell.

![]() The market is officially out of time!

The market is officially out of time!![]()

After months of tightening, the #XRP consolidation has finally reached its apex and something big is coming next. There are only two paths from here: either the explosive breakout we've been waiting for begins now, or we see one final… pic.twitter.com/xGRyaevRxX

![]()

The main point of her analysis was that, if XRP struggles to break through $2.25 for much longer, it could slide to lower levels, to $2.00 or “even $1.55.”

However, she may have invalidated her analysis to some degree by suggesting, a reply to her own post, that to “be clear, I do think we’ll get that drop to support today or tomorrow.”

This did not happen, with the xrp price hanging around the same $2.15 level it had on the day (Wednesday) she made these predictions.

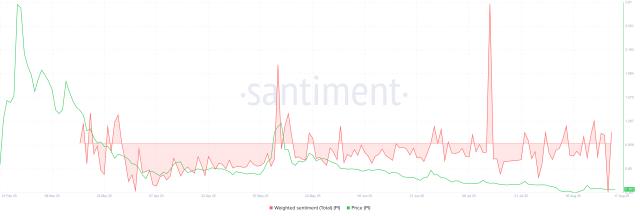

If we look at XRP’s chart today, we see that the coin’s resistance (red) and support (green) are indeed converging to a point where a big MOVE may arrive.

As for the other indicators, they suggest that the altcoin remains in an oversold position, which WOULD imply a strong rebound.

Its RSI (purple) has been below 50 for much of the time since February, while its moving average convergence divergence (MACD) is also in an oversold space.

So given that XRP remains one of the strongest coins in the market in terms of fundamentals, it should pick up again strongly soon, assuming that the Israel-Iran conflict doesn’t escalate further.

With listed firms buying up XRP, with XRP ETFs on the way, and with Ripple expanding its business, the XRP price could easily reach $2.50 by the end of July and $3 by September.

Bitcoin Hyper Gains Momentum with $1.4 Million Presale: Next 100x Coin?

XRP continues to be a very strong altcoin, but traders should always consider diversifying into newer tokens, allocating a small percentage of their portfolios to coins that may show strong volatility.

This should include presale tokens, which can often rally big when they list for the first time, especially if they’ve had successful raises.

And one sale gaining steam right now belongs to Bitcoin Hyper (HYPER), an Ethereum- and Solana-based tokensed that has raised just over $1.4 million in its ICO.

Bitcoin Hyper is quickly gaining momentum because of its exciting plans to launch a layer-two network for Bitcoin, providing the latter with a big boost in speed and scalability.

It will make use of zero-knowledge proofs to provide greater efficiency and security, while it will also harness ethereum and Solana virtual machines to achieve its greater throughput.

On top of this, it’s planning to provide a platform for DEXes and DeFi applications, so that a thriving DeFi ecosystem can build on top of the bitcoin base layer.

Its native token HYPER will be necessary to pay for transactions, meaning that demand for the token will grow in step with the platform’s growth.

Holders will also be able to stake it for a passive income, with investors able to buy it now by going to the Bitcoin Hyper website.

It’s currently selling for $0.01195, although this will rise again later today.