Author: The Beauty of Bayes

On June 13, the entire payment sector of the U.S. stock market, including Visa and MasterCard, which have the deepest business model barriers, saw a huge drop in share prices. Why could the "stablecoin expectation" instantly penetrate the payment sector?

On June 11, the U.S. Senate passed the GENIUS Act by a 68-30 majority, making the national stablecoin license "almost certain" for the first time, greatly eliminating regulatory uncertainty and sharply reducing the threshold for issuing coins;

On June 12, Shopify and Coinbase announced a pilot USDC settlement on the Base chain. The first batch of merchants went online on the same day, indicating that small and medium-sized merchants can also bypass the card organizations and directly use the US dollars on the chain to receive payments;

On June 13, WSJ revealed that Walmart and Amazon are evaluating issuing their own stablecoins; multiple media outlets followed up on the same day.

For Visa and MasterCard, the giants' defection means their "fee moat" has been directly threatened for the first time, so panic sentiment triggered institutional selling and stock prices fluctuated sharply during trading.

Judging from the reflection of the entire payment industry chain, the decline is not the "market beta" but the "business model delta".

Visa, transaction assessment fee + interchange share ≈ 55% of total revenue;

Mastercard, with a similar business structure to V, but with higher leverage;

PayPal (leading the decline in the S&P payment sector), with a Branded Checkout fee of 2.9%+, is most threatened by substitution;

Shopify, Merchant Solutions (including Shopify Payments) ≈ 2/3 gross profit;

Compared to the S&P 500's -1.1% correction on the same day, payment stocks fell 2-6 times the index.

So, which yield curve did the “stablecoin shock wave” hit?

Why is it said that this is the first time that the 200 bp fee rate moat is truly threatened?

As soon as the news of Amazon and Walmart issuing stablecoins came out on Friday, the entire payment sector plunged. The scale + bargaining power is large enough. Amazon-Walmart-Shopify together account for >40% of the US online GMV. If they collectively guide users to exchange for "their own coins", they can overcome the cold start difficulty at one time. Unlike the "encrypted payment" of the year, this time the on-chain cost-performance curve is comparable to that of the card network (Base chain TPS 1,200+, single transaction <$0.01 Gas).

① The core is still the rate difference: 2.5% (traditional card payment mode) → 0.2% (stable currency payment mode)

The average total cost of US card merchants is ≈2.1-2.7% (card swiping fee + assessment fee). For on-chain stablecoins settled in USDC/L2, the comprehensive Gas + On/Off-Ramp cost can be reduced to < 0.25%. The merchant retention rate has increased by an order of magnitude, and they immediately have bargaining chips.

② The return on capital occupation is inverted

Stablecoin issuers must hold T-Bills at a 1:1 ratio, and all or part of the face value income can be transferred to merchants/users. However, there is no interest sharing in the daily "T+1/2" settlement of traditional card clearing → the income structure is doubly affected (rate compression + loss of liquidity income).

③ Barriers shift sideways. The global acceptance network and risk rules of card organizations are the "multilateral network effect" accumulated over decades. However, on-chain contracts + international clearing and settlement replace the "physical terminal network" with the "public chain consensus layer" and "offshore US dollar reserves", and network externalities migrate rapidly. The addition of Walmart/Amazon solves the "cold start" problem at one time.

Company-level sensitivity analysis?

Visa/Mastercard, every 1 bp fee rate change ≈ EPS 3-4%;

As for PayPal, its transaction profit margin is already under pressure; if stablecoins accelerate the replacement of Braintree (low-cost gateway), Branded Checkout's gross profit will be diluted;

Shopify’s Merchant Solutions take-rate (2.42%) includes card fees; if it moves to the chain, Shop Pay’s commission will need to be repriced;

For short-term hedging, Visa and MasterCard are testing their own Tokenized Deposit & Visa-USDC settlement, but the scale is still <0.1% TPV;

PayPal has issued PYUSD, and can take advantage of this opportunity to switch to being the "issuer" to make a profit, but it will have to sacrifice its high-profit business.

As for Shopify, the company has transformed into a "multi-channel payment platform", which can transfer the fee rate and retain the volume, but the GMV burden has increased;

Long-term moat level

Visa and Wanshidake still face tough challenges in terms of fraud risk control, brand trust, and acceptance interfaces in more than 200 countries. Their moats are still the deepest in the payment stack.

PayPal’s 430 million active accounts and BNPL/wallet ecosystem still have a lock-in effect, but the company also needs to undergo a profound transformation;

Shopify's SaaS binding + OMS/logistics ecosystem, payment is just the entrance, and profits can be transferred to SaaS ARPU by guarding the front end.

Scenario simulation: What does 10% traffic outflow mean?

Assumptions: In 2026, the online retail sales in the US will be $1.2 T, the stablecoin penetration rate will be 10%, and the fee rate difference will be 200 bp.

Visa + Mastercard: Potential reduction in annual revenue ≈ $1.2 T × 10% × 200 bp × 55% split ≈ $1.3 B → EPS ≈ –6%.

PayPal: If 15% of Branded TPV is transferred out, operating profit may decline by 8-10%.

Shopify: Assuming only 20% GMV migration and a 40 bp drop in take-rate torque, gross margin compression is ≈150 bp.

But what is more important is the impact of the low fees of stablecoins on the fees of the entire payment system. Even if it replaces 10%, the fee pressure faced by the total fee basket that this payment stack can share will be significantly increased.

Let’s analyze the merchant payment stack in the United States.

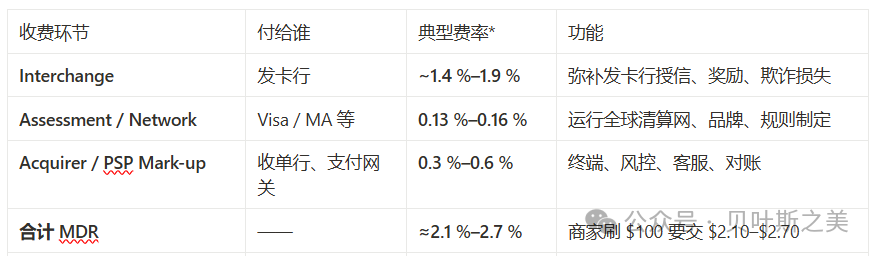

The average total fee for most merchants in the United States and Canada is between 2.0% and 3.2%; the example in this article is 2.34% (1.80% + 0.14% + 0.40%). Let’s analyze the jump from “2.5% → 0.2%” bit by bit - which charging links have been reduced to a fraction by the on-chain stablecoin.

1. Traditional credit card payment path: 2%–3% “three-level profit sharing”

Interchange = the “cake” of the issuing bank (covering credit, points, and fraud risks).

Assessment / Network & Processing fee = Visa and Mastercard’s “cake”, with a fee rate of about 0.13%–0.15% (domestic benchmark), plus a processing fee of a few cents per transaction.

Card organizations "set but do not differentiate" interchange fees, and only charge acquiring banks through independent network fee items, which are then passed on to merchants, which constitute the core revenue in Visa/Mastercard's annual reports.

2. Stablecoin path: reduce the “water withdrawal per level” to one decimal place

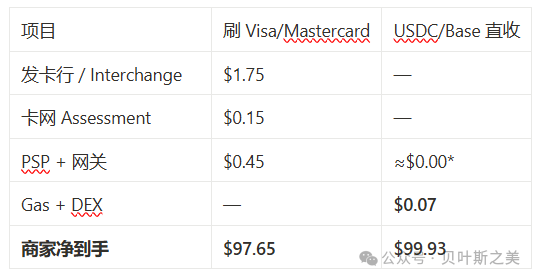

Scenario assumption: A Shopify merchant receives an order of $100, and the customer uses USDC (Base chain). The merchant is willing to keep the USDC and not redeem it immediately back to the bank account.

If merchants insist on redeeming fiat currency, they can use Coinbase Commerce's "1% off-ramp" - the overall cost is ~1.07%, which is still significantly lower than 2%+. However, long-tail merchants often retain USDC to pay suppliers and advertising fees, and directly skip the "withdrawal" step.

Why is it so cheap < 0.25%?

First, Interchange was cut off as a whole, there is no issuing bank and no credit risk → the largest part of 1.5%+ is directly reduced to zero.

Secondly, the network cost is extremely compressed, and the public chain consensus fee (Gas) is priced at a fixed rate of a few cents; at a price of $100-$1,000, it is almost negligible.

Then, the acquiring/gateway link is commoditized, Coinbase, Circle, and Stripe compete to grab volume with "zero to zero-tenths of a fee", and the bargaining power of merchants increases sharply, and the aggregated payment platform faces the greatest pressure;

There is also reverse subsidy: Shopify announced a 1% USDC cashback to consumers, which essentially uses "interest + marketing budget" to offset the residual fee and then lock the traffic back to its own ecosystem.

3. A comparison bill ($100 transaction)

In the Shopify pilot, the acquiring fee is subsidized by the platform to 0; if the Coinbase Commerce channel is used, it is changed to $1.00.

4. What other “hidden income” has also been poached?

Therefore, 2.5% → 0.2% is not just a slogan, but rather the result of turning the three-tier commissions of Interchange, Network, and Acquirer into “Gas + DEX + Ultra-thin Gateway”, with the order of magnitude reduced to two decimal places.

The "defection of giants" such as Shopify/Amazon has allowed zero-fee/negative-fee solutions to have considerable GMV for the first time, and the market has therefore repriced the fee moats of payment giants.

The current impact on Visa and Mastercard is limited. The "Platform Take Rate" calculated based on Visa's latest full fiscal year (FY 2024, ending September 2024) public financial report data - that is, net operating income ÷ payment amount:

Visa net operating income $35.9 B, payment amount $13.2 T, 35.9 ÷ 13 200 ≈ 0.00272

≈ 0.27% (≈ 27 bp), if “payment + cash withdrawal total” is used, the total amount in the same period is $16 T

35.9 ÷ 16 000 ≈ 0.00224 ≈ 0.22 % (≈ 22 bp)

Payment Volume is the benchmark Visa often uses for pricing, excluding ATM cash withdrawals; therefore, 0.27% is the Take Rate more commonly cited in the industry. If ATM/cash withdrawals are also included, the denominator becomes larger and diluted to about 0.22%. The Take Rate already includes all of Visa's operating income (service fees, data processing fees, cross-border fees, etc.), but does not include Interchange received by the issuing bank - the latter is not Visa's income.

Further breakdown of FY 2024 revenue: service fees of $16.1 B → corresponding to Payments Volume of approximately 12 bp, data processing fees of $17.7 B, cross-border fees of $12.7 B, etc. are mainly calculated based on the number of transactions/cross-border weights and cannot be simply converted by payment volume.

Therefore, according to Visa's FY 2024 annual report, the most commonly used "Net Income Take Rate" is about 0.27% (27 bp); if the cash withdrawal amount is included, it is about 0.22%, which is not much different from the domestic payment channel charges. The normal rate for domestic WeChat Pay and Ali Pay is 0.6%; service providers can reduce it to 0.38%/0.2% (promotions, small and micro businesses), so the core of the United States is that the Interchange rate is much higher than that in China.

The next two lines to watch are:

The speed of merchant penetration after the bill passes - 10% GMV penetration is enough to erode Visa/MA EPS 5%+;

Can the card network re-pipeline the on-chain settlement? If the 0.1%-0.2% clearing fee can be recovered, the stock price may return to the mean.

Once the fee moat is thinned, the denominator of the valuation model changes - this is the fundamental reason why payment stocks were dumped by institutions last week.

Which “high-frequency signals” should we focus on next?

The Senate’s final vote will be on June 17 & the House of Representatives’ schedule will be in July (the pace of legislative implementation).

Amazon/Walmart white paper or patent application (to determine whether it is a genuine coin issuance vs. a bargaining chip).

Shopify-USDC TPV KPI: If the monthly turnover exceeds $1 B, the feasibility of the merchant side will be verified.

The actual fee rate of Visa/MA stablecoin clearing network: Can “on-chain settlement” be incorporated into its own channel?

The reserve scale of Circle, Tether, etc.: If the half-year growth rate of T-Bill holdings is >25%, it means that capital outflow has indeed occurred.

Therefore, the collective adjustment of payments is not "hype news", but the premise of the valuation model has been rewritten. Concerns have arisen. The entire traditional payment chain and rates in the United States will face shocks. The follow-up will depend on the development trend of the entire stablecoin. The short-term impact will be limited.

Stablecoin legislation + retail terminal implementation have brought the "threat ten years later" to the valuation window of 24-36 months, and the market has used stock prices to re-evaluate the "net rate curve" first.

Payment giants are not sitting still: Network-as-a-Service, custody settlement layer, and Tokenized Deposit may all build new guardrails, but this will take time and capital.

In the short term, the decline reflects the "most pessimistic rate compression-EPS sensitivity" scenario. If the legislative terms are eventually tightened or the card organizations successfully re-pipeline the on-chain payments, there is room for Beta-mean-reversion in the stock price.

In the medium and long term, investors need to use the second-order derivative (changes in gross profit structure) rather than the first-order derivative (revenue growth) to measure whether the moat of payment companies is actually narrowing.

Stablecoin = parallel clearing network with “zero fees + interest return”. When the strongest buyers (Walmart/Amazon) and the most inclusive sellers (Shopify merchants) embrace it at the same time, the traditional one-size-fits-all 200bp fee myth will be difficult to maintain - the stock price gave a warning before the revenue.

The full text is over.