This week, the financial market is once again facing dual pressures: on the one hand, the situation in the Middle East is heating up, and on the other hand, the US Federal Reserve's ambiguous attitude towards interest rate policy. US stocks have fallen in this storm, and the cryptocurrency market has shown divergent trends. Although some mainstream currencies have suffered heavy losses, the price of Bitcoin has remained above $100,000. The following will help you understand the latest developments in traditional finance and cryptocurrency at once.

Table of Contents

ToggleUS stocks fell for three consecutive days: Fed's wavering attitude + tensions in the Middle East

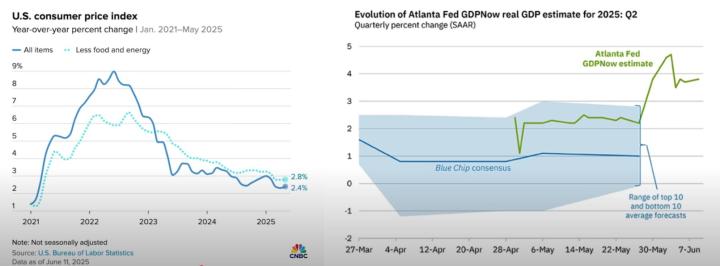

On Friday, the three major US indices showed divergent performances. The S&P 500 fell 0.22% to close at 5,967.84 points, closing in the red for the third consecutive trading day; the tech-heavy Nasdaq index fell even more, down 0.51% to 19,447.41 points; the Dow Jones Industrial Average rose slightly by 0.08% to close at 42,206.82 points.

The market originally still had expectations for the Fed to cut interest rates. Christopher Waller, a member of the US Federal Reserve Board, said in an interview: "We are likely to cut interest rates as early as July." However, Federal Reserve Chairman Jerome Powell emphasized earlier that he would continue to observe data, indicating that a rate cut is still not a foregone conclusion, exacerbating market confusion.

Trump criticizes Powell harshly, whether the United States will intervene in the situation in Iran becomes a new variable

President Trump once again publicly criticized Powell for hindering economic recovery, saying that his delay in cutting interest rates has caused the United States to lose "hundreds of billions of dollars." At the same time, Trump is also considering whether to launch a direct military strike against Iran, and the White House is expected to make a decision within two weeks.

Israeli Prime Minister Benjamin Netanyahu has ordered a targeted attack on Iran, targeting "strategic and government targets", and geopolitical risks are rapidly rising. Investors' risk aversion has increased, becoming another straw that broke the camel's back.

Technology and semiconductor stocks under pressure; Nvidia and TSMC both fall

Technology stocks have been hit hard this week, especially the chip industry. According to a report by The Wall Street Journal, the US government may revoke export exemptions for some semiconductor manufacturers, which has caused market concerns. Nvidia's stock price fell by more than 1%, while TSMC fell by nearly 2%. VanEck Semiconductor ETF (code: SMH) also fell by nearly 1%, reflecting the overall pressure on chip stocks.

Cryptocurrency volatility: Bitcoin remains strong, while Solana and Dogecoin plummet

Despite the sluggish performance of the stock market, the cryptocurrency market showed a divergence between bulls and bears. According to the latest data, Bitcoin (BTC) was quoted as high as $103,366.76, with a 24-hour drop of only 1.05%, indicating that its safe-haven properties were recognized. In contrast, Ethereum (ETH) fell 3.98% to $2,418.55.

Several main observation indicators are as follows:

Solana (SOL) plummeted 4.01%, and its decline in the past 30 days was as high as 19.54%. The current price is $140.43.

Dogecoin (DOGE) was even worse, with a single-day drop of 4.06%. The cumulative drop in 30 days exceeded 32%, falling to $0.1631.

Despite a daily drop of 7.90%, Hyperliquid (HYPE) still rose by 16.69% in the past 30 days, showing that emerging currencies are volatile but still hot.

| Rank | Name | Symbol | Price | 24h % | 7d % | 30d % |

|---|---|---|---|---|---|---|

| 1 | Bitcoin | BTC | $103,366.76 | -1.05% | -2.07% | -6.08% |

| 2 | Ethereum | ETH | $2,418.55 | -3.98% | -5.50% | -6.79% |

| 4 | XRP | XRP | $2.12 | -1.73% | -0.58% | -11.67% |

| 5 | BNB | BNB | $643.17 | -0.13% | -1.56% | -4.98% |

| 6 | Solana | SOL | $140.43 | -4.01% | -4.60% | -19.54% |

| 8 | TRON | TRX | $0.2727 | -0.56% | +0.94% | +1.41% |

| 9 | Dogecoin | DOGE | $0.1631 | -4.06% | -8.42% | -32.66% |

| 10 | Cardano | ADA | $0.5828 | -2.90% | -8.51% | -24.94% |

| 11 | Hyperliquid | HYPE | $33.54 | -7.90% | -19.94% | +16.69% |

| 12 | Bitcoin Cash | BCH | $469.75 | -5.37% | +5.90% | +13.33% |

Investors in a dilemma: Wait-and-see sentiment shrouds risk markets

According to Sam Stovall, chief investment strategist at CFRA Research, “Who wants to hold stocks over the weekend when the global situation is so uncertain?” He noted that the S&P 500 is only about 3% away from its 52-week high, but more challenges are needed to “open this rusty door.”

He added that if geopolitics can cool down a bit, market sentiment may rebound quickly. But as things stand, both the U.S. stock market and the crypto market are still at the cusp of a highly sensitive storm.

Risk Warning

Cryptocurrency investment carries a high degree of risk. Its price may fluctuate drastically and you may lose all your capital. Please assess the risk carefully.

Scale AI, once an AI training data supplier for well-known technology companies such as OpenAI, Google and Meta, recently announced the "complete termination" of cooperation with Scale AI after Meta spent $14.3 billion to acquire nearly 49% of Scale AI's shares and poached founder Alexandr Wang to join its own AI super-intelligence team. It is rumored that Google is also considering breaking off relations.

Table of Contents

ToggleMeta invested 14.3 billion RMB in Scale AI and poached the founder to join its team

According to reports , Meta previously announced that it would invest $14.3 billion in Scale AI and acquire a 49% stake, while inviting founder Alexandr Wang to join Meta's newly established "Superintelligence" department.

The goal of this department is to develop more powerful AI software that is still in the conceptual stage. It is reported that more Scale AI employees will also switch to Meta in the future.

OpenAI is highly alert to Meta's actions, and it is rumored that Google is also preparing to break off relations

Scale's original clients include well-known technology companies such as Google, Meta and OpenAI, but Meta's large investment has attracted attention from the outside world. Some people are worried that Meta may use this to gain access to the research and development dynamics of its competitors in the future.

It is understood that Google also plans to terminate its cooperation with Scale AI and has not yet responded to the public.

OpenAI says it doesn’t matter for the sake of the overall situation

Shortly after Meta and Scale AI announced their partnership, OpenAI CFO Sarah Friar said at the VivaTech conference in Paris:

“We don’t want the entire AI ecosystem to come to a halt because of a merger or acquisition.”

But a few days later, OpenAI announced that it would gradually terminate its cooperation with Scale AI and officially cut ties.

The cooperation has been terminated as the demand has exceeded the capabilities of Scale AI.

OpenAI stated that the termination of cooperation with Scale AI was not simply due to Meta's investment, but that the two parties had entered the process of terminating cooperation in the past 6 to 12 months.

The reason is that the AI models trained by OpenAI are becoming more and more complex, and are beginning to move towards AI agent systems that "have human reasoning capabilities" and "autonomously perform tasks", so more professional and customized data are needed to support them, which is beyond the capabilities of Scale AI.

Founded in 2016, Scale AI initially relied on a large number of people to help annotate images and text to support early AI training. In recent years, Scale AI has also been continuously upgraded, hiring annotators with highly educated backgrounds such as doctors and nurses to assist in the development process of more advanced models. Even so, Scale AI's services are still not enough to meet the development needs of the next generation of AI models.

OpenAI turns to emerging data provider Mercor

Currently, OpenAI has turned to other data suppliers, such as Mercor, a startup team that focuses on using AI to help technology companies recruit talent and has transformed itself into a data expert matching platform to help AI companies find suitable field experts to promote the development of the next generation of AI models.

Risk Warning

Cryptocurrency investment carries a high degree of risk. Its price may fluctuate drastically and you may lose all your capital. Please assess the risk carefully.