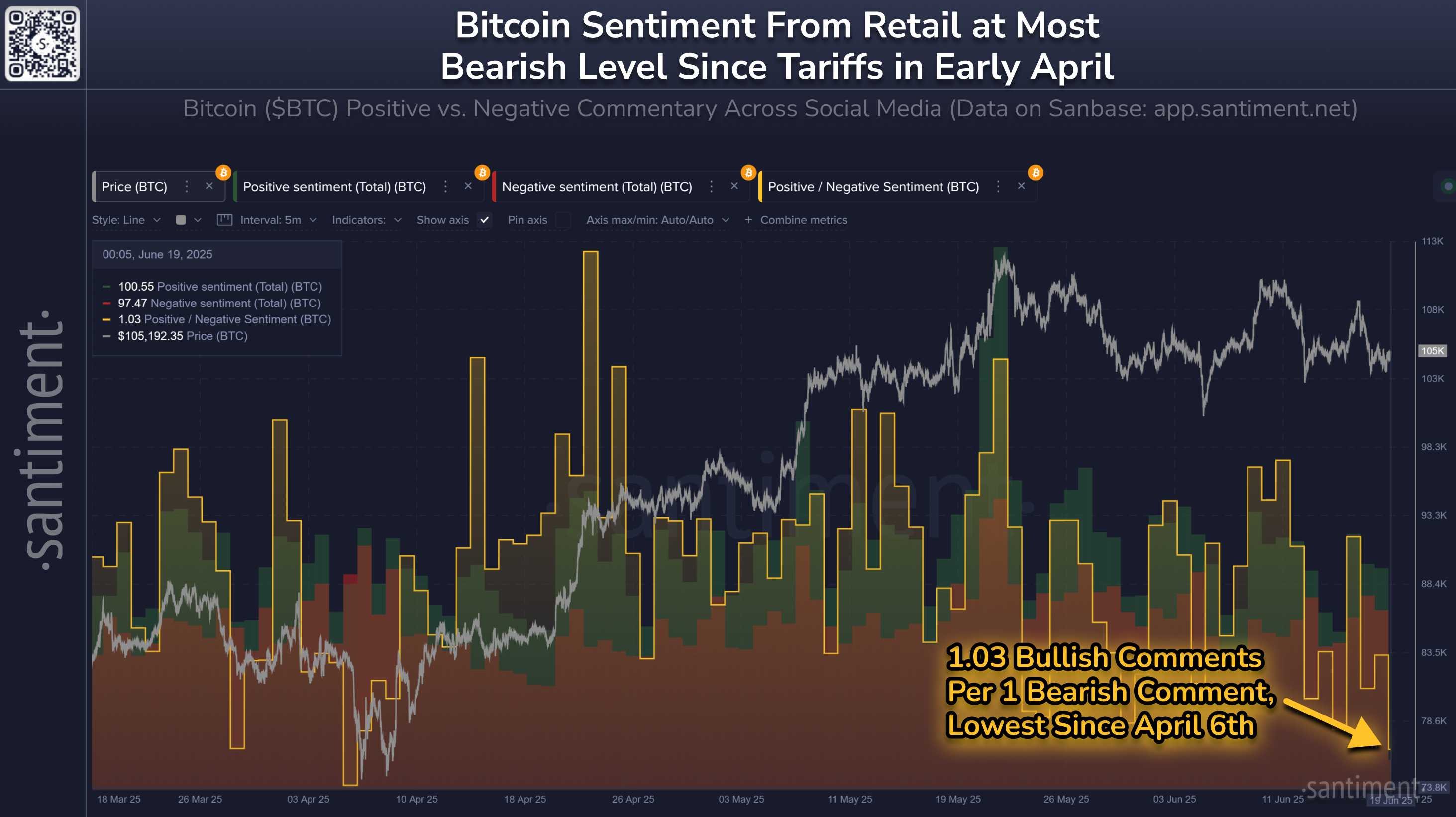

According to the latest data, the bullish sentiment of individual investors in the cryptocurrency market plummeted in June 2025, reaching its lowest point since early April.

This decline occurred amid economic and geopolitical pressures. However, experts believe this could be a positive signal for an upcoming market rebound.

Could Weak Sentiment Be a Bullish Signal?

According to data from Santiment, a cryptocurrency market behavior analysis platform, the ratio of bullish to bearish comments on social media dropped to 1.03 bullish comments per bearish comment.

This is at its lowest level since April, similar to when fears about tariff-related policies hit the market.

Santiment's report indicates that retail investors are losing patience, and bearish sentiment is growing within the cryptocurrency community. This trend commonly occurs during quiet market periods when investor confidence is under pressure.

However, Santiment analyst Brian Q believes this could actually signal a market recovery based on past behavior.

"This is typically a bullish signal. Historically, markets move in the opposite direction of retail investor expectations. The optimal buying period during the early April fears of other traders is a prime example." – Brian Q, Santiment Analyst

Additionally, SuperVerse founder ElliottRade explained that the current cryptocurrency market is experiencing a rare "asymmetric" phase.

He noted that many people in the cryptocurrency space are completely exhausted. They have stopped trading and even stopped watching the market. His YouTube channel subscribers have dropped to 2019 levels, reflecting widespread indifference.

"Socially, we are at the depths of a bearish market in many ways.

Nevertheless: Bitcoin has crossed $100,000. Stablecoins have just been legalized. DeFi is next. Institutions are in FOMO.

This is one of the most surprising and asymmetric moments in cryptocurrency history." – ElliottRade, SuperVerse Founder

This contrast is striking. While the community seems to be at the "bottom" of a bearish market, the market's fundamental elements show strong growth potential.

Sharing Brian Q's perspective, ElliottRade continues to encourage those still in the game to maintain their commitment and not give up.

2025 Market, Retail Investors Alienated

A recent report from glassnode, an on-chain cryptocurrency data analysis platform, provides deeper insights into the current market situation. Despite Bitcoin's price approaching an all-time high, on-chain transaction volume has nearly halved.

Interestingly, while transaction numbers have decreased, the average value per transaction remains high at around $36,200, suggesting that institutions or high-net-worth individuals are dominating on-chain activity.

"Transactions exceeding $100,000 showed a clear structural increase, occupying 66% of network volume in November 2022 and rising to 89% today. This trend reinforces that high-value participants are becoming increasingly dominant within on-chain activity." – glassnode Report

The minimal trace of retail investors on-chain is also due to macroeconomic events currently driving the market. For instance, the escalating tension between Israel and Iran — including recent retaliatory attacks — triggered concerns about geopolitical instability, affecting investor sentiment.

Additionally, changes in the U.S. Federal Reserve's interest rate policy exacerbated investor anxiety. The Fed delayed rate cuts amid rising global tensions. Another factor was Google's involvement in a massive password leak of 16 billion, which further deepened fear and uncertainty among investors.

As risks increase, individual investors have more reasons to hesitate before injecting capital into the market.