Written by: Oliver, Mars Finance

On June 19, 2025, when Ethereum's soul figure Vitalik Buterin replaced the original oil barrel icon representing "digital oil" with a cartoon "bull" on social media, it was not a casual doodle. This seemingly small move was more like a carefully planned value declaration, a profound reshaping of Ethereum's bull market logic. It suggests that today, with the spot ETF rolling out the red carpet for Wall Street, Ethereum's story is transcending the somewhat outdated "digital world fuel" metaphor, evolving into a more grand, solid, and complex value paradigm.

Buterin reposted and "edited" a discourse about Ethereum's three core values - "digital oil", "value storage", and "global reserve asset". These three concepts have long been a familiar melody in the community, but when they are juxtaposed by the founder in a completely new visual language, their internal tension and synergy emerge with unprecedented clarity. This "bull" is no longer a symbol of a single narrative, but an economic behemoth forged by the combined strength of three pillars. This article aims to deconstruct this emerging new paradigm and explore the profound and subtle changes in Ethereum's value foundation as it moves towards becoming a mainstream asset.

From "Digital Oil" to "Economic Heart": Value Reassessment in the Layer 2 Era

Ethereum's narrative as "digital oil" is its earliest and most successful value positioning. This metaphor intuitively explains ETH's fundamental purpose: serving as fuel (gas) for running the world's largest smart contract platform. Every transfer, every DeFi interaction, every Non-Fungible Token minting requires ETH consumption. This indispensable utility built a solid demand base for ETH. In the past, network congestion and high gas fees were even seen as a manifestation of network prosperity, directly linked to ETH's value capture.

However, entering 2025, this classic narrative is facing a profound challenge triggered by Ethereum's own success. The Dencun upgrade in March 2024, especially the implementation of EIP-4844 (Proto-Danksharding), completely changed the game. By providing a dedicated and cheap data publication channel (Blobs) for Layer 2 networks, Ethereum successfully "outsourced" a large number of transaction activities to scaling solutions like Arbitrum and Optimism. This was undoubtedly a huge technical victory, realizing the grand blueprint of enabling ordinary users to participate in the digital economy at extremely low costs. But it also brought a sharp economic paradox: when most economic activities migrate to cheap Layer 2, mainnet (L1) congestion drops dramatically, directly leading to gas fee plummeting and ETH burning reduction.

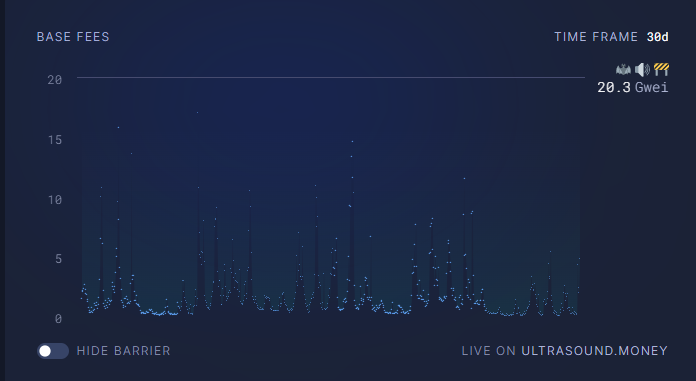

According to data on dune analytics, since the Dencun upgrade, Ethereum L1's average gas price has long been in single-digit Gwei, which was unimaginable in the past few years. Reduced fees mean that the amount of ETH burned through the EIP-1559 mechanism has also shrunk. This directly impacts the core logic of the "digital oil" narrative - the positive correlation between network usage and value capture (deflation). If the "oil" consumption is structurally decreasing, how should we assess its value?

This is precisely the key to the value paradigm shift. The new cognitive framework believes that ETH's value is no longer merely expressed as fuel "consumed" on L1, but elevated to the "economic heart" that guarantees the entire modular ecosystem's security. Ethereum L1 is transforming from a congested "world computer" to a highly secure "global settlement and security layer". Its core task is to provide ultimate transaction finality and data availability guarantees for hundreds of Layer 2s. Layer 2s process massive transactions and then submit compressed "proofs" back to L1 for final confirmation.

In this new model, ETH's value capture mechanism becomes more indirect but potentially more solid. Its value no longer primarily comes from transaction friction but from its "rent" as a security provider. Although the fees paid to L1 by individual Layer 2s have decreased, with the emergence of thousands of Layer 2s in the future, the total "rent" will still be considerable. More importantly, the entire ecosystem's security completely depends on the total ETH staked on L1. A modular ecosystem with trillions of dollars in economic activity must be protected by a security layer of similar or even higher magnitude. Therefore, ETH's demand shifts from "transactional demand" to "security demand". It is no longer gasoline but the concrete foundation supporting the entire interstate highway network (all Layer 2s), with its value positively correlated to the total economic flow of the highway network (TVL and activities of all Layer 2s). This transformation liberates ETH's value from short-term fee fluctuations, anchoring it to the longer-term, macro growth of the entire ecosystem.

The Rise of "Internet Bonds": When "Ultrasound" Falls Silent

If the "digital oil" narrative is undergoing a profound self-evolution, the "value storage" story has been almost completely rewritten. Once, "Ultrasound Money" was the community's proudest slogan. With "The Merge" significantly reducing new issuance and EIP-1559 continuously burning fees, ETH once entered a net deflationary state, praised as an asset more "sound" than Bitcoin.

However, the Layer 2 paradox mentioned earlier has also cast a shadow on this beautiful deflation myth. The reduction of L1 fees has significantly weakened the burning mechanism. Data shows that since the Dencun upgrade, ETH has returned to a slight inflationary state during multiple periods. This makes the "Ultrasound Money" slogan somewhat awkward and forces the market to seek a more resilient value support.

Thus, the "Internet Bond" narrative emerged and quickly became a more attractive story in the eyes of institutional investors. The core of this concept is that through the Proof of Stake (PoS) mechanism, anyone holding ETH can participate in network validation by Staking and thus obtain stable returns denominated in ETH. As of mid-2025, Ethereum's staking annual percentage rate (APR) remains stable around 3%-4%. This yield is not created out of thin air; it comes from transaction fees paid by users (tip portion) and ETH rewards from protocol issuance, a reasonable compensation for validators maintaining network security.

This intrinsic yield, denominated in the protocol's native asset, makes ETH a productive capital asset. It is no longer just a static commodity waiting to appreciate but a yield-generating asset that can continuously produce "cash flow" (albeit in ETH terms). For traditional financial investors accustomed to stock dividends and bond interest, this is an easily understandable and highly attractive model. VanEck analysts have explicitly stated that ETH's staking yield can be viewed as the "risk-free rate" in the digital world, with the yield of all DeFi protocols built on Ethereum being priced based on this.

The narrative of "Internet Bonds" has become more powerful due to the boom in Liquid Staking Tokens (LSTs). LSTs like Lido's stETH and Rocket Pool's rETH allow ordinary users to earn staking rewards while maintaining the liquidity of their assets. These LSTs are then deeply integrated into every corner of DeFi, serving as collateral and trading pairs, creating the so-called "LSTfi" ecosystem. This forms a powerful value flywheel: ETH is massively staked due to its interest-bearing properties, thereby enhancing network security and decentralization; the resulting LSTs, in turn, become the cornerstone of the DeFi world, further increasing demand for ETH as the underlying asset.

This narrative shift is crucial. It transforms ETH's value proposition from a speculative story dependent on network congestion and scarcity expectations to an investment story based on actual economic activity and predictable returns. Even as the "ultrasound money" deflationary halo fades, as long as the Ethereum ecosystem continues to thrive, its yield characteristics as "Internet Bonds" will remain. This provides a solid value foundation for ETH and leaves enormous room for future ETF products—a spot ETF that can directly distribute staking rewards to investors would undoubtedly be a nuclear weapon to ignite the next wave of institutional demand.

"Trust Anchor": The Ultimate Settlement Layer of the Digital Economy

Regardless of how the "oil" metaphor evolves or how attractive the "bond" yields are, Ethereum's third and most robust value pillar lies in its status as the "trust anchor" of the global digital economy. This role as a "global reserve asset" is built on decentralization, security, and unparalleled network effects, making it the most trustworthy underlying settlement layer in the digital world.

First, in the DeFi world that has reached hundreds of billions of dollars, ETH is undisputedly the king of collateral. In core lending protocols like Aave and MakerDAO, ETH and its LST derivatives dominate the total collateral. A Galaxy Research report points out that the market trusts ETH because of its deep liquidity, relatively low volatility (compared to other crypto assets), and time-tested security. Users confidently lend out billions of stablecoins because they believe in the ETH collateral behind them. This status as a "DeFi central bank reserve" creates massive, persistent, and sticky demand for ETH.

Secondly, Ethereum is the center of the global stablecoin ecosystem. Although chains like TRON have a place in USDT issuance, the vast majority of innovative and core stablecoins, such as USDC and Dai, ultimately settle their value on Ethereum. Ethereum carries over hundreds of billions of dollars in stablecoin market cap, which constitutes the lifeblood of the digital economy, with ETH serving as the vascular system ensuring the safe flow of this lifeblood.

More profoundly, traditional financial giants are voting with their feet. When BlackRock chooses to launch its first tokenized money market fund BUIDL on Ethereum, it is not valuing Ethereum's transaction speed or cost. On the contrary, it is choosing Ethereum's "diamond-like" trust and security. ConsenSys CEO Joseph Lubin once said that Ethereum provides trust "strong enough to withstand nation-state-level adversaries". This "Lindy effect" developed over more than a decade—the longer something exists, the more likely it is to continue existing—is a moat that no emerging public chain can replicate in the short term. As the wave of Real World Asset (RWA) tokenization rises, Ethereum's position as the ultimate settlement layer of global value will become increasingly unshakable, and its value as a reserve asset will be continuously reinforced.

Conclusion: Forging the "Bull" Together, Not Alone

Now, looking back at the "bull" Vitalik released, it no longer merely represents the expectation of a bull market, but is a subtle summary of Ethereum's value sources. This bull is driven by three forces:

It has the strong pulse of an "economic heart": As the security foundation of the entire modular ecosystem, its value grows in sync with the total scale of an expanding digital economy. It possesses the stable returns of "Internet Bonds": Intrinsic staking yields provide it with a solid value base and clear valuation model, attracting long-term capital seeking stable returns. It bears the immense weight of a "trust anchor": As the ultimate collateral of DeFi and the settlement layer of global value, it has distilled the market's most precious consensus and trust.

These three pillars are not isolated but interdependent and mutually reinforcing. The powerful "trust anchor" status attracts the prosperity of DeFi and RWA, driving the growth of the "economic heart"; meanwhile, the interest-bearing ability as "Internet Bonds" incentivizes massive capital to be staked, providing an impregnable security guarantee for the entire system.

Ethereum's bull market argument has bid farewell to the era that could be simply summarized by a single word (like "deflationary"). It has become more mature, more diverse, and more resilient. It no longer depends on a single narrative but has constructed a value matrix with internal logical coherence that can withstand external shocks. For institutional investors accustomed to analyzing complex systems, this grand narrative full of internal tension and synergy may have just begun to reveal its true charm. The bull V God put on heralds precisely such an era's arrival.