Source: The GENIUS Stablecoin Play

Compiled & Translated by: Lenaxin, ChainCatcher

On August 15, 1971, President Nixon introduced a series of economic policies: canceling the dollar's gold standard, freezing wages and prices, and imposing a 10% import tariff. "I have instructed the Secretary of the Treasury to take necessary measures to protect the dollar from speculative attacks." This declaration, which changed the global monetary system, was later known as the "Nixon Shock" and was more criticized than praised at the time.

This week, the U.S. Senate passed the GENIUS Stablecoin Act with an overwhelming vote of 68 to 30, marking a key step towards a comprehensive digital dollar regulatory framework. Unlike Nixon's hasty abandonment of the gold standard, this legislation builds a prudent monetary infrastructure for the digital age. According to Citigroup's forecast, the current $250 billion stablecoin market could surge to $3.7 trillion by 2030 in a bull market scenario.

The bill is still pending House vote and presidential signature. This in-depth report will analyze:

How will this bill reshape the financial system?

Why is Tether facing a survival crisis?

Is the U.S. truly approaching a watershed moment in its monetary system?

Digital Dollar Blueprint

The GENIUS Act clearly defines boundaries in the digital currency domain. Unlike past fragmented crypto regulations, this bill establishes clear standards:

Its core requirements are concise: stablecoin issuers must maintain a 1:1 reserve of dollars, short-term Treasury bills within 93 days, or equivalent liquid assets, and must undergo mandatory monthly public audits. Interest-bearing stablecoins are explicitly prohibited.

Only three types of entities can issue payment stablecoins: subsidiaries of insured banks, federally qualified non-bank issuers approved by the Comptroller of the Currency, or state-qualified issuers meeting federal standards. Foreign issuers are given a three-year transition period, after which non-compliant entities will be completely excluded from the U.S. market.

By defining stablecoins as "digital currencies" rather than special crypto assets, with monthly reserve disclosures, criminal liability for false statements, and Bank Secrecy Act compliance, the bill transforms them from unregulated experiments into legitimate financial infrastructure. This move establishes the legal status of digital dollars while systematically clearing out non-compliant participants.

Intensified Competition

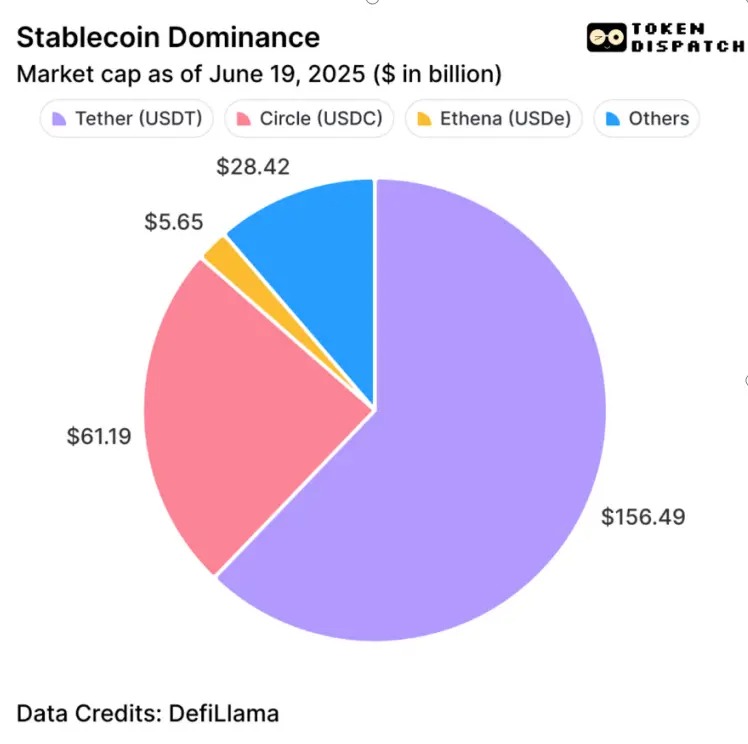

For Tether, the world's largest stablecoin issuer, the GENIUS Act is like a precisely worded three-year countdown ultimatum. Currently holding 62% market share with USDT, the issuer may face the most severe impact—precisely illustrating the market law of "the tallest tree catches the most wind".

Tether's current reserve structure does not meet the bill's requirements. Its website shows only 81.5% of USDT is backed by cash and short-term deposits, falling short of the 1:1 high-liquidity asset standard. Its Italian audit firm BDO also does not meet U.S. PCAOB qualifications and needs to rebuild its audit system.

While its CEO promises a compliant product, Tether's business model of relying on high-yield investments directly conflicts with the bill's prohibitions. During the three-year transition period, USDT will lose institutional support from banks, payment providers, and corporate finance, continuously reducing its application scenarios.

As the USDC issuer, Circle's stock price surged 35% after the bill's passage, with market value reaching 5 times its issue price. Its U.S. domestic advantages, compliant reserves, and banking network capture regulatory dividends, with Shopify's recent USDC payment integration further demonstrating its expansion momentum.

Balancing Safety and Innovation

The most controversial provision of the GENIUS Act is the comprehensive ban on interest-bearing stablecoins, reflecting Congress's profound lessons from crypto leverage collapse events. Its core concept is that payment tools should not have investment attributes. When stablecoins generate returns, they become closer to bank deposits or securities, and traditional banking systems manage such systemic risks through deposit insurance and capital adequacy mechanisms.

This will directly impact decentralized finance (DeFi) protocols relying on interest-bearing stablecoins. The bill explicitly excludes "securities issued by investment companies" and "deposits" from regulation, meaning users seeking returns can only turn to tokenized bank deposits or regulated investment products.

Controversy follows. While users bear the opportunity cost of holding non-interest-bearing assets, stablecoin issuers can still generate returns through interest-bearing tools. This trade-off brings institutional confidence far exceeding potential DeFi revenue loss: monthly reserve transparency, mandatory anti-money laundering compliance, and transaction monitoring are transforming stablecoins from crypto edge experiments to regular financial infrastructure.

Now, large banks can view compliant stablecoins as true cash equivalents, corporate finance departments can confidently hold them, and payment service providers can systematically integrate based on their bank-standard characteristics. This institutional recognition may reshape the entire financial ecosystem.

Large-Scale Application Infrastructure

The GENIUS Act builds a regulatory foundation for stablecoins to integrate into mainstream finance through two pillars: custodial protection and compliance clarity.

The custody framework requires qualified custodians to segregate customer assets, prohibit fund mixing, and ensure bankruptcy settlement priority, extending traditional financial protections to the digital asset domain.

For retail users, the bill preserves self-custody rights while requiring service providers to meet bank-level standards, ensuring regulated stablecoin wallets enjoy protections equivalent to bank accounts.

For enterprise applications, cross-border settlements can be reduced to minute-level, supply chain payments can achieve programmable transfers, and fund management can break through holiday restrictions. Individual users can also enjoy rapid cross-border transfers without high transaction fees.

The bill also mandates interoperability standard assessments to ensure stablecoin cross-platform circulation and avoid regulatory fragmentation hindering innovation.

Implementation Challenges

Despite bipartisan support, the GENIUS Act faces multiple implementation challenges:

1. Compliance costs will reshape the market landscape. The bill's requirements for monthly audits, complex reserve management, and continuous regulatory reporting effectively create a high compliance barrier. Large issuers can easily adapt due to scale advantages, while small and medium stablecoin companies might be forced out by dramatically increased operational costs.

2. Cross-border friction may hinder global application. European companies using USD-anchored stablecoins might face "currency conversion" and "foreign exchange risk" issues. Heiko Nix, Siemens' global cash management and payment head, told Bloomberg this is why the company chose tokenized bank deposits.

3. Return rate prohibition might force innovation outflow. If other jurisdictions allow interest-bearing stablecoins, the U.S. might maintain financial stability but lose technological leadership. DeFi protocols dependent on interest-bearing stablecoins will face cliff-like impacts if they cannot find compliant alternatives.

4. State and federal regulatory coordination adds new variables. The bill allows issuers with market caps under $10 billion to choose state-level regulatory systems but must prove their standards are "substantially similar" to federal requirements. State regulators must proactively submit compliance proof, with the Treasury Secretary having the power to reject certification, forcing reluctant issuers into the federal regulatory framework.

Token Dispatch Observation

With Republicans controlling the House 220-212, the bill's passage is almost certain, but implementation will test America's art of balancing innovation and regulation. This act might reshape the monetary sovereignty landscape of the digital era, just as the 1971 "Nixon Shock" controversially ended the gold standard. The GENIUS Act may now open a new digital dollar era. Its core mechanism is to mandate all compliant stablecoins reserve in dollars/U.S. Treasury bonds, directly converting global stablecoin demand into dependence on the U.S. dollar system.

The bill creates a unique "substantially similar" reciprocity clause: Compliant entities are allowed to enter the US market, while those who refuse are isolated. Ironically, this technology, originally designed to circumvent centralized regulation, has become a tool to reinforce US dollar hegemony. Crypto fundamentalists will have to face this institutional irony.

Traditional financial institutions view this as a turning point for digital assets to integrate into mainstream finance, and Circle's 35% stock price surge confirms the capital's choice: A clear regulatory framework is far more attractive than a wildly growing market. When technological idealism encounters real-world regulation, the market has already cast its vote of confidence with real money.