Author: Eren, Four Pillars; Translation: Jinse Finance xiaozou

Abstract:

In the past, banks relied on physical documents and suffered mass bankruptcies due to inefficient intermediary structures. Today’s financial system continues this complexity and operates under an indirect ownership model. As tokenized assets and stablecoins become the new core of global finance, banks are facing a moment of transformation.

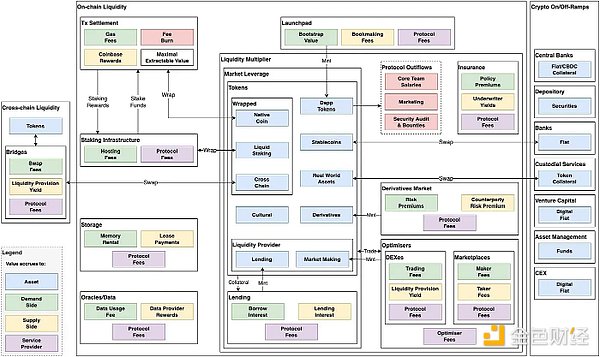

Spark's vision is to solve the inefficiencies of traditional banking and the scalability limitations of existing DeFi money markets, and to position itself as the most advanced on-chain yield engine. To achieve this vision, Spark operates the Spark Liquidity Layer (SLL), an automated asset allocation system, and SparkLend, a low-cost, highly liquid lending market.

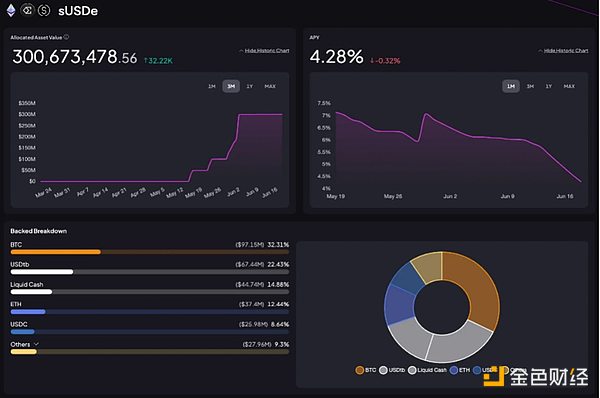

Spark Liquidity Layer (SLL) serves as an on-chain asset management engine, monitoring liquidity conditions, DeFi protocol yields and reserve levels in real time, and performing automatic rebalancing. Currently, Spark strategically allocates capital between DeFi protocols (Morpho, Aave, Ethena) and real-world assets (RWA, such as BUIDL, Superstate), manages over $4.1 billion in assets, and has accumulated over $190 million in revenue.

SparkLend operates a fixed-rate lending market funded by Sky, which achieves high capital efficiency by using sUSDS as collateral. Under this structure, SparkLend's total locked value (TVL) has exceeded $3.4 billion.

Spark’s strategy may not be groundbreaking, but through low-cost fundraising and sophisticated capital deployment, it has created a structural advantage that is difficult to replicate. As demonstrated by sUSDS’s stable yield payments, its ability to consistently provide high returns helps to establish a favorable environment for attracting large-scale capital.

1. You can save and borrow, but it is not a bank

The banking industry is once again facing a structural turning point. To understand this moment, it is necessary to review the history of banking. Banks were born during the rise of commercial capitalism. In the 17th century, goldsmiths in England kept their customers' gold and issued deposit certificates. These certificates began to circulate as currency and eventually became collateral for credit creation, laying the foundation for the modern banking system. With the establishment of the central bank system, financial institutions became the core infrastructure for asset custody, credit issuance, and payment settlement. The Industrial Revolution led to the separation of commercial banks from investment banks. By the end of the 20th century, the functions of banks had extended from physical outlets to digital banks and global financial networks.

Despite the changes in form, the core function of banks has remained unchanged: to maximize capital efficiency by acting as an intermediary to store excess capital and redistribute it to areas of demand. However, the means and tools used to achieve this have continued to evolve with the prevailing technology and financial environment.

Today, as tokenized assets and stablecoins reshape the financial landscape, is it time for banks themselves to change?

"Yes, you can save and borrow on Spark. But it is not a bank." - Spark

The Spark protocol introduced in this article presents an on-chain capital allocator optimized for the ever-changing DeFi financial landscape. In subsequent chapters, we will analyze Spark's operating mechanism in depth and explore how it differentiates from the traditional banking model in terms of capital efficiency.

2. Banks are a relic of the last century

2.1 Historical Review: Paper Bill Crisis

In the 1960s, Wall Street was booming. Low interest rates, attractive dividend returns, and increased institutional participation led to a four-fold increase in trading volume between 1960 and 1968. However, by 1969, even as the bull market continued, many brokerages were on the verge of collapse. The reason was surprisingly simple: the paper infrastructure was overwhelmed.

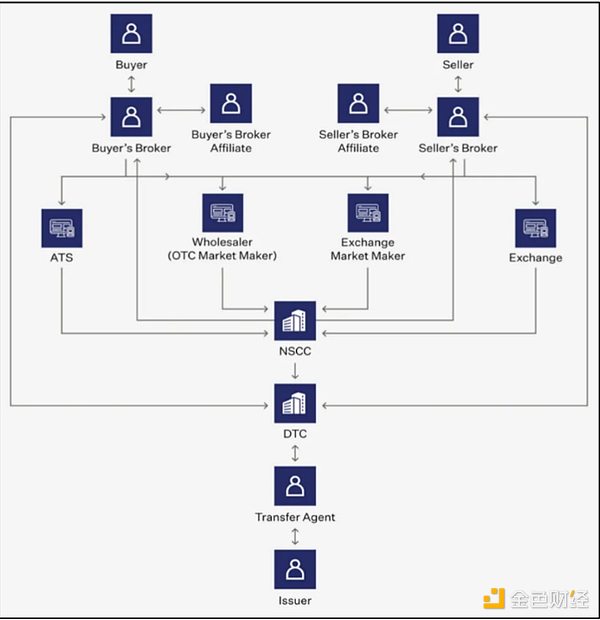

Before the advent of modern clearing systems, stock ownership was accomplished through the delivery of physical paper certificates. The seller handed the certificate to the broker, who passed it on to the buyer's broker, who then passed it on to the issuing company's transfer agent. The agent would register the change in the shareholder register, cancel the old certificate, and issue a new one. This multi-step process could involve as many as 68 separate operations and take about four business days.

As trading volume soared, the clearing process was completely paralyzed. As a result, billions of dollars of transactions could not be settled, millions of certificates were lost, and dividends were not paid. Many brokerages fell into a serious liquidity crisis: some misappropriated customer assets to fulfill their obligations, while others repurchased shares on the open market to fill the gap. These operations were tacitly allowed in the bull market, but when the market turned bearish in the late 1960s, the sharp drop in commission income made it impossible for institutions to bear the accumulated debt pressure. This "paper bill crisis" became the most serious financial infrastructure failure since the Great Depression, and eventually gave rise to today's mainstream indirect holding model.

2.2 Current situation: Structural problems of the indirect holding model

After the paper bill crisis, the capital market abandoned physical certificates and turned to an indirect holding model. In this system, the legal ownership of securities no longer belongs to individual investors, but is held by brokers or custodians. Changes in ownership are no longer achieved by modifying the name of the physical certificate, but rely on bookkeeping updates in the internal ledgers of intermediaries.

Although this system improves transaction efficiency, it also solidifies structural complexity and intermediary control.

First, the clearing process is no longer straightforward. Transactions that could have been completed directly between buyers and sellers now require the participation of multiple parties, including brokers, dealers, market makers, exchanges, clearing houses, and central depositories. Each party performs a single function and is separated or overlapped with each other, which increases friction costs. What's worse, these intermediaries extract fees, spreads, and data rentals at multiple links in the transaction chain.

Secondly, the indirect model concentrates the transaction data flow and control rights in the hands of at least a few intermediaries, resulting in information asymmetry and opacity. Since investors are not legal holders, they often cannot view their positions or execution paths in real time. Intermediaries commercialize data through information blocking or paid services.

Under this framework, intermediaries are no longer just service providers, but have become economic stakeholders embedded in the transaction structure itself. In the final financial system, the complex structure of intermediation and value capture have pushed up transaction costs, and overall efficiency has decreased instead of increased.

3. Spark in-depth analysis: DeFi’s active capital allocator

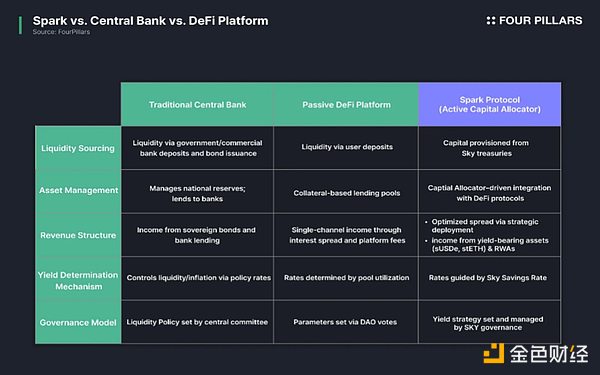

Spark was created to address the systemic inefficiencies and opacity of traditional banking. However, the idea of breaking through the limitations of the traditional financial system through DeFi is not new. Since the early stages of DeFi development, countless protocols have always pursued common goals such as peer-to-peer transactions, automated clearing, and transparent data access.

However, existing money market models have structural limitations. They mainly act as intermediaries between borrowers and lenders, but fail to integrate financial hub functions such as yield policy, capital allocator management, and risk diversification into a unified system. This makes it difficult to build a coordinated flow between returns and borrowing costs, and it is impossible to improve the return on capital. For users, it often means that it is difficult to obtain predictable and sustainable returns.

Spark differentiates itself by building a unified financial architecture centered around an on-chain capital allocator, designed to improve both capital efficiency and system stability. Spark obtains low-cost funding from Sky and strategically allocates it to mainstream protocols such as Morpho, Aave, Ethena, BUIDL, and SparkLend. These assets are managed autonomously through off-chain monitoring software, which assesses yield, risk, and efficiency in real time. The resulting income is compounded and distributed to sUSDS holders - an interest-bearing stablecoin minted using USDS, USDC, or DAI through Spark Savings.

This architecture enables Spark to break through the passive role of the traditional currency market and become an active capital allocator across the DeFi ecosystem. This will bring stronger liquidity, attract institutional funds and achieve economies of scale. As of the second quarter of 2025, Spark's total locked value (TVL) has exceeded US$7.5 billion.

Subsequent chapters will explore the relationship between Sky and Spark, and deeply analyze SparkLend and Spark Liquidity Layer (SLL) - the two core engines that drive the Spark on-chain financial stack.

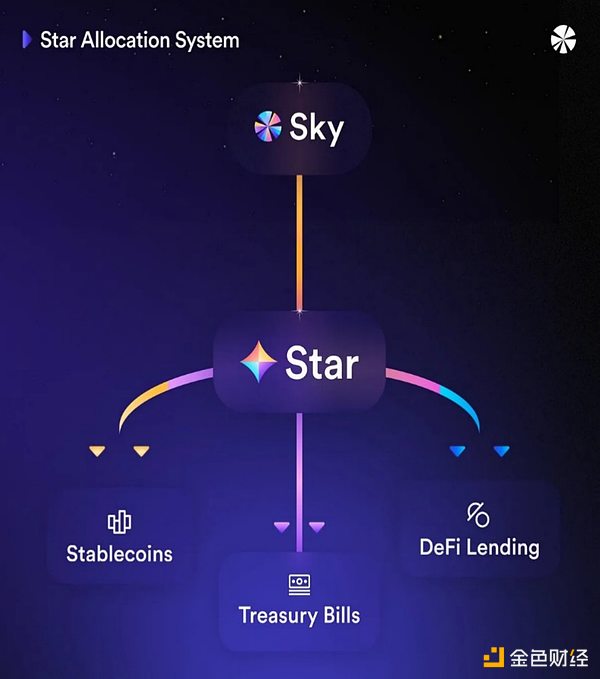

3.1 The First Venus

Spark plays the role of Star in the Sky (formerly MakerDAO) ecosystem and is put into operation as the first Star, an autonomous unit in Sky's vast Star ecosystem. Sky is a decentralized, reserve-backed protocol that has issued USDS (formerly DAI) and managed interest rate policy since 2017. As an important part of Sky's asset allocation diversification and income generation strategy, Sky launched the "Star Project", and Spark, as the first Star, is responsible for deploying funds to on-chain and off-chain assets (including RWA) to generate returns.

Although Spark operates independently, its capital structure and strategic direction are still deeply tied to Sky. For example, the initial funds supporting Spark's lending market and capital allocation engine come directly from Sky. Therefore, Spark's borrowing rate, fee structure, and revenue flow are essentially linked to Sky's reserves. To understand Spark's architecture, we must first analyze the operating mechanisms of SSR and USDS.

3.1.1 SSR and Spark Savings System

Sky Savings Rate (SSR) is a base deposit rate set by Sky governance, representing the annualized rate of return on USDS deposits. Unlike the variable interest rates commonly seen in the DeFi space, which fluctuate based on liquidity conditions, SSR is determined through governance voting.

Specifically, Sky's risk management team will propose SSR adjustment plans based on market conditions and protocol revenue. These proposals are approved by on-chain voting after community review. This mechanism gives Sky the ability to flexibly adjust interest rate policies based on the macroeconomic environment (rather than short-term liquidity pressure).

SSR is funded by Sky protocol revenue, which is generated by RWA investments (such as US Treasuries) and DeFi deployments through Spark. This clearly shows the linkage between Sky and Spark: Spark is not only a yield enhancement engine in the DeFi ecosystem, but also a key source of income supporting Sky SSR. In fact, Sky currently earns more than $400 million in revenue from reserves each year, of which 25% comes from SparkLend and SLL, and the rest comes from RWA strategies such as vaults.

SSR is the source of income, and the Spark Savings system acts as the front-end interface for users. Users can deposit USDS or USDC and receive sUSDS/sUSDC in return. These interest-bearing assets will automatically compound according to the SSR. This means that the value of sUSDS continues to grow in real time, reflecting the accumulated income. Currently, the total deposit amount of the Spark Savings System has exceeded 3.1 billion US dollars.

SSR is the source of income, and the Spark Savings system acts as the front-end interface for users. Users can deposit USDS or USDC and receive sUSDS/sUSDC in return. These interest-bearing assets will automatically compound according to the SSR. This means that the value of sUSDS continues to grow in real time, reflecting the accumulated income. Currently, the total deposit amount of the Spark Savings System has exceeded 3.1 billion US dollars.

3.1.2 USDS and Spark PSM: Multi-chain anchored stable exchange system

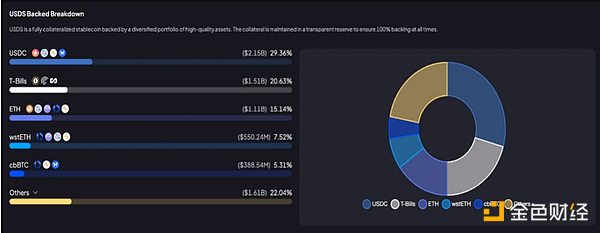

As mentioned earlier, USDS is a stablecoin issued by Sky. Spark forms a deep connection with USDS by expanding its application scenarios: it serves as a conversion gateway for converting USDS into interest-bearing stablecoin sUSDS, and also acts as a configuration layer for deploying USDS to the lending market and on-chain assets. This process not only generates income, but also helps to consolidate the anchor stability of USDS.

Spark also plays a key role in maintaining USDS price stability through the Pegged Stability Module ( PSM ). This module supports instant zero-slippage exchange of USDS, sUSDS and USDC between multiple chains such as Ethereum, Base and Arbitrum. For example, when a user redeems sUSDS for USDC, PSM will use the fund pool reserves to complete a 1:1 exchange in the background, ensuring that users have instant access to USDC liquidity.

By supporting large-scale redemptions and seamless cross-chain asset transfers, Spark PSM effectively alleviates the slippage problem and liquidity fragmentation between networks, which is crucial to maintaining the price balance of stablecoins during volatile periods or high redemption demand.

The following is the detailed operation mechanism of Spark PSM:

Reserve configuration: Large-scale USDC reserves from Sky are injected into PSM contracts deployed on supporting chains such as Base and Arbitrum.

sUSDS redeems USDC: When a user redeems USDC with sUSDS, PSM destroys sUSDS and releases an equivalent amount of USDC from the reserve. The exchange rate is calculated based on the accumulated earnings of SSR determined by the Sky cross-chain savings rate oracle (for example, 1 sUSDS = 1.05 USDC).

USDC mints sUSDS: When users deposit USDC, PSM mints new USDS at a fixed ratio of 1:1.

All exchanges are executed at a $1 anchor price, completely eliminating slippage and minimizing market volatility risks. Spark currently maintains over $100 million in USDC/USDS liquidity on the Base chain through PSM. Relying on Sky's $1.3 billion USDC reserves, Spark plans to expand the multi-chain redemption infrastructure to more networks to support seamless capital flows and ensure USDS anchor stability, while helping SLL achieve scale expansion of cross-chain liquidity configuration.

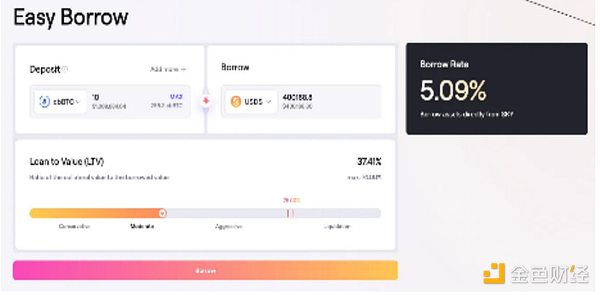

3.2 SparkLend: Lending Protocol

SparkLend is a lending protocol built on the Aave v3 fork, which is specifically optimized for large-scale borrowing needs by deeply integrating the Spark Liquidity Layer (SLL) with the Sky ecosystem. Relying on the low-cost USDS liquidity provided by Sky, the protocol aims to provide highly competitive borrowing rates.

Like other overcollateralized lending protocols, SparkLend allows users to deposit assets to earn returns, or provide collateral to borrow assets. The borrowing interest rate of each asset is adjusted algorithmically based on the utilization rate of funds: the interest rate increases when the borrowing demand increases, and the interest rate decreases when the demand decreases. This inertia-based interest rate model achieves an autonomous balance of the liquidity of the fund pool. (Special note: USDS adopts a fixed interest rate mechanism, and its interest rate is directly linked to SSR, which will be detailed below.)

Although SparkLend is similar in structure to other DeFi lending markets, it has unique advantages through deep integration with Sky and customized collateral settings:

First, SparkLend strictly limits the types of collateral assets it supports to enhance stability and reduce volatility risk. For example, SparkLend on the Ethereum mainnet only supports highly liquid assets such as ETH, stETH, WBTC, USDC, USDS, and sUSDS. Each asset is subject to the conservative loan-to-value ratio (LTV) and borrowing limit set by Spark's risk parameters. By streamlining the range of collateral assets, SparkLend effectively reduces the risk of chain liquidations or collateral failure during volatile market conditions, and strengthens the overall stability of the protocol.

Secondly, SparkLend adopts a customized interest rate model directly linked to SSR for the USDS market. Unlike most borrowing costs that fluctuate with short-term liquidity, the protocol provides USDS borrowing at a fixed SSR rate set by Sky governance. This ensures that users get predictable and continuously low-cost USDS borrowing services.

Third, SparkLend directly receives liquidity injections from Sky's vault. In practice, this means that SparkLend's USDS pool continues to receive a supply of newly minted USDS from Sky. These funds can be dynamically withdrawn or resupplied based on protocol requirements. More notably, when a user deposits USDS into SparkLend, the system automatically converts it into sUSDS, allowing users to obtain dual returns of lending income and SSR rewards at the same time.

By deeply integrating Sky's architectural advantages, SparkLend has created a highly predictable and capital-efficient lending market. The adoption of a fixed-rate mechanism based on SSR in the USDS market effectively reduces uncertainty and supports long-term funding planning. More importantly, since sUSDS continues to generate income when used as collateral, users can maximize capital efficiency without sacrificing returns.

By deeply integrating Sky's architectural advantages, SparkLend has created a highly predictable and capital-efficient lending market. The adoption of a fixed-rate mechanism based on SSR in the USDS market effectively reduces uncertainty and supports long-term funding planning. More importantly, since sUSDS continues to generate income when used as collateral, users can maximize capital efficiency without sacrificing returns.

As of the second quarter of 2025, SparkLend's total locked value (TVL) has exceeded $3.4 billion, and the Treasury holds approximately $1.8 billion in assets. It is worth noting that SLL, Spark's core capital allocation engine, has generated cumulative revenue of more than $190 million, of which SparkLend contributed 62% (approximately $120 million), becoming the largest single source of revenue in the Spark ecosystem.

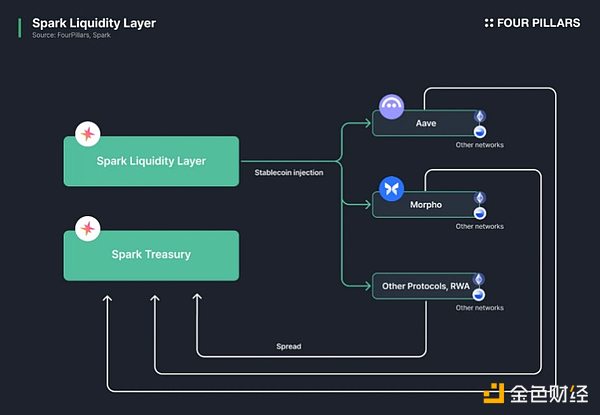

3.3 SLL (Spark Liquidity Layer): On-chain Capital Allocator

3.3.1 SLL operation mechanism

SLL is the core system that defines Spark as a "DeFi active capital allocator". As Spark's on-chain capital allocation engine, it obtains low-cost liquidity from Sky and deploys it to multiple chains and multiple DeFi protocols. The income generated by these deployments will flow back to the Sky treasury, which means that SLL is both a source of funds for USDS and sUSDS income and the economic foundation to support SSR payments.

SLL is the core system that defines Spark as a "DeFi active capital allocator". As Spark's on-chain capital allocation engine, it obtains low-cost liquidity from Sky and deploys it to multiple chains and multiple DeFi protocols. The income generated by these deployments will flow back to the Sky treasury, which means that SLL is both a source of funds for USDS and sUSDS income and the economic foundation to support SSR payments.

The functionality of SLL is not limited to capital allocation. It is integrated with off-chain monitoring software to continuously monitor cross-chain liquidity conditions, the performance of external DeFi protocols, and Sky's reserve levels. Based on these indicators, SLL automatically rebalances liquidity in real time. For example, if a surge in deposits from PSM on the Base chain results in insufficient USDC balance, the system will bridge additional USDC from the Ethereum mainnet via CCTP; if there is idle USDC on the Layer2 network, part of the funds will be withdrawn and reallocated to the mainnet.

SLL operates through three core components:

Sky Vault: This vault serves as a credit facility, allowing stars including Spark to mint USDS with Sky's collateral. Currently, more than $4.5 billion worth of USDS (formerly DAI) has been issued through the Spark Vault. These funds, obtained at low cost, are then used by SLL for strategic capital allocation across DeFi.

SkyLink: A native cross-chain bridge developed by Sky that supports the transfer of USDS and sUSDS between connected networks. This allows SLL to quickly and securely automate cross-chain fund transfers without relying on intermediaries. For transfers of external stablecoins such as USDC, SLL uses Circle's Cross-Chain Transfer Protocol (CCTP) to ensure efficient liquidity routing.

Spark PSM: As mentioned earlier, Spark's anchor stability module supports instant zero-slippage swaps between USDS, sUSDS, and USDC on each chain. During the rebalancing process, it helps SLL perform asset conversions without price deviations, maintain anchor stability, and minimize liquidity loss.

Spark uses this infrastructure to deploy billions of dollars across various DeFi protocols and asset types. All deployments are completely transparent, and users can view real-time information such as asset allocation, SparkLend total locked value, and protocol-level returns through the Spark data center.

Spark uses this infrastructure to deploy billions of dollars across various DeFi protocols and asset types. All deployments are completely transparent, and users can view real-time information such as asset allocation, SparkLend total locked value, and protocol-level returns through the Spark data center.

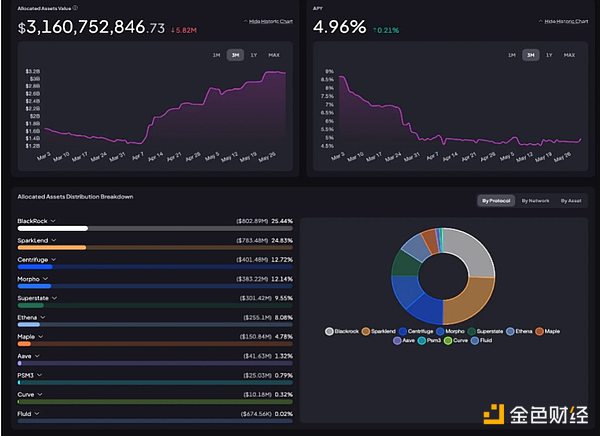

The latest data shows that the total amount of DeFi strategy allocation currently exceeds US$3.1 billion. Among them, BlackRock (through BUIDL) holds US$800 million and SparkLend holds US$900 million, ranking the top two allocation directions. Spark injects liquidity into BUIDL to obtain government bond endorsement income, while generating additional income through deposit interest on its self-operated lending platform SparkLend.

SLL's revenue sources are highly diversified: it does not rely on a single channel, and can organically combine the stable income of real assets with the native high-yield strategy of DeFi. In the RWA field, Spark provides liquidity for tokenized treasury products such as Superstate, Centrifuge, and Maple. These positions generate reliable income based on US government bonds; in the DeFi field, it cooperates with protocols such as Ethena, Morpho, and Aave to pursue higher potential returns by holding direct exposure to synthetic interest-bearing assets such as sUSDe, and complex strategy deployment through Morpho's vault.

This multi-pronged strategy has enabled SLL to generate more than $190 million in cumulative revenue. SparkLend contributed about 62% of this, proving that Spark has built an internal revenue engine that does not rely on external protocols. Morpho Vault became the second largest contributor with a 29% revenue share, which verifies that Spark is effectively fulfilling the function of the "DeFi Central Bank". The following will explore how Spark integrates with a wider range of protocols and expands its role in the ecosystem.

4. How does SLL leverage the DeFi ecosystem?

4.1 Integrate Aave protocol lending market

Through SLL, Spark provides USDS liquidity to Aave's Lido market, enabling users to borrow and lend using assets such as WETH and wstETH as collateral. In the process, Spark plays the role of a liquidity provider and earns loan income. Currently, about $20 million worth of ETH assets are deployed in the Aave market, generating a cumulative income of $400,000.

One of the core advantages of SLL integration is its ability to stabilize the lending rates of stablecoins between the Aave Core, Prime, and Base markets. When lending rates in a particular market rise, SLL will dynamically rebalance liquidity to narrow the interest rate differential. This mechanism not only improves the predictability and stability of interest rates within the Aave ecosystem, but also enables Spark to obtain sustainable returns through active liquidity provision.

4.2 Integrate the Morpho protocol lending market

Spark uses the Morpho protocol to maximize liquidity supply benefits. Liquidity is directly injected into the MetaMorpho vault to build a diversified lending market. Currently, about $400 million USDC and $500 million DAI have been deposited in the vault managed by Spark.

Most of the USDC liquidity is allocated to the cbBTC/USDC market, where users can borrow USDC with cbBTC (Coinbase wrapped BTC) as collateral. Through this market, Spark earns revenue from its deployed USDC, generating approximately $1.5 million in revenue in the past year.

Most of the USDC liquidity is allocated to the cbBTC/USDC market, where users can borrow USDC with cbBTC (Coinbase wrapped BTC) as collateral. Through this market, Spark earns revenue from its deployed USDC, generating approximately $1.5 million in revenue in the past year.

DAI liquidity is deployed on Morpho's lending platform Morpho Blue, working together with Pendle-based PT-USDS and other Ethena assets. With this configuration, users can borrow DAI with USDe or sUSDe as collateral. Since Ethena provides returns to USDe through Delta hedging strategies and RWA returns, this pairing can create a diversified income strategy for DAI. Spark earns lending income by supporting these high-yield collateral pools, and the related positions have generated a total of approximately US$50 million in revenue.

In Morpho Blue's Ethena integrated market, Spark accepts Pendle's principal tokens (PT-sUSDe and PT-USDe) as collateral and provides DAI liquidity accordingly. This lending structure is established by Spark allocating DAI to Pendle positions through Sky funds (as described in this governance post), allowing users to borrow DAI with PT-sUSDe as collateral and obtain fixed-income collateral for capital efficient lending.

This strategy allows users to earn sUSDe staking income, obtain enhanced fixed income through PT, and unlock additional liquidity for leverage operations. For Spark, this approach improves capital allocation flexibility and optimizes protocol-level returns.

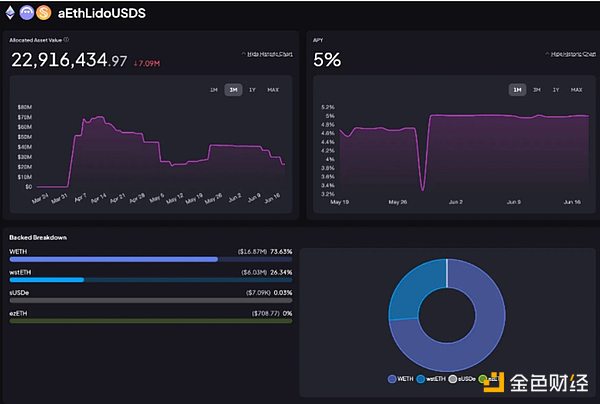

4.3 Directly hold Ethena assets

Spark is expanding its direct holdings of Ethena's USDe and sUSDe through SLL. The protocol plans to allocate up to $1.1 billion to this strategy and currently holds approximately $300 million of USDe and sUSDe directly in the capital allocator. These high-yield assets achieved an average annualized return of 18% in 2024 and will work together with existing holdings such as USDC, USDS, and sUSDS to increase SLL's overall returns.

Unlike indirect exposure through lending markets such as Morpho, this strategy enables Spark to directly obtain Ethena's revenue distribution without the involvement of intermediaries. This allows Spark to significantly reduce external dependencies while maximizing potential returns. To date, the strategy has generated approximately $1.5 million in cumulative returns.

5. How does Spark build a moat?

As described above, Spark has built a unified financial hub through SparkLend and SLL, solving the limitations of traditional banks and traditional DeFi currency markets. But where does Spark's competitive moat for sustainable expansion come from? The answer lies in its deep integration with Sky, the competitive advantages of interest-bearing stablecoins, and the operational efficiency achieved through SLL.

5.1 Low-cost funding based on SSR

Spark's core advantage comes from Sky's huge capital base and the low-cost funding structure it provides. As of now, Sky holds approximately $11 billion in collateral assets, corresponding to $8.3 billion in USDS liabilities, and maintains an excess collateral ratio of approximately 131%. This means that there are $2.7 billion in excess collateral assets, which not only consolidates the financial robustness of the Sky ecosystem, but also provides a capital operation foundation for stars such as Spark.

These low-cost funds from Sky are efficiently allocated to SparkLend and SLL. SparkLend provides a stable fixed interest rate through SSR, laying the foundation for long-term user retention; while SLL enables Spark to operate the allocator with extremely high capital efficiency and almost no reliance on external liquidity.

Part of the income generated through yield differentials and interest-bearing asset exposure flows back to Sky's SSR module as a financial pillar, and the other part is retained as protocol income. This structure allows Spark to keep funding costs at a minimum while maintaining a stable income base, which has fundamental advantages over traditional DeFi protocols in terms of sustainability and asset efficiency.

5.2 The positive cycle of sUSDS and SparkLend

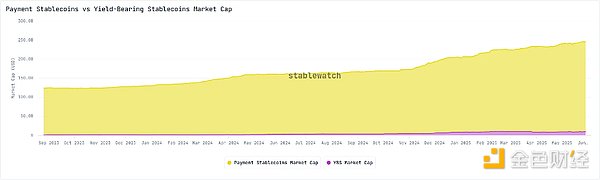

Interest-bearing stablecoins have become an effective tool to improve the capital efficiency of the stablecoin market. Since the end of 2023, the market has grown rapidly, reaching a size of approximately US$10 billion as of the second quarter of 2025, and its market value has nearly tripled in the past year.

In this rapidly growing field, Sky's sUSDS has shown strong competitiveness in revenue distribution. According to Stablewatch data, sUSDS has distributed more than $82 million in revenue to date, second only to Ethena's sUSDe in the cumulative payment revenue ranking.

The key factor behind this performance is Sky's competitive interest rate. The annualized yield offered by sUSDS is usually maintained in the range of 5% to 8%, which is comparable to the average yield of sUSDe of 6% during the same period. This attractive interest rate continues to drive the demand for sUSDS deposits, thereby optimizing Spark's financial structure.

5.2.1 Increasing capital capacity through sUSDS demand

sUSDS is an interest-bearing token that users receive after depositing USDS into SSR. As the demand for sUSDS grows, more USDS are deposited into SSR, which leads to the expansion of Sky's Treasury assets and the increase in SDS issuance. With the expansion of the Treasury, Sky can provide Spark with more low-cost funds, further enhancing Spark's lending capabilities based on SSR. This foundation enables SparkLend to offer borrowing rates below market levels, consolidating its competitive interest rate advantage.

5.2.2 Expanding SparkLend Demand through sUSDS Collateralization

SparkLend accepts sUSDS as collateral, allowing users to continue to earn SSR income while maintaining asset liquidity. This dual advantage of income and liquidity forms a strong incentive to use SparkLend.

When SparkLend incentivizes users to borrow against sUSDS, and sUSDS is put to use through SparkLend, a mutually reinforcing closed loop is formed. The increase in user-collateralized sUSDS pushes up the total locked value of SparkLend, which in turn expands the protocol's lending capacity, enabling SparkLend to issue more loans and generate more revenue.

Ultimately, the feedback mechanism formed between sUSDS and Spark has established a virtuous cycle: more sUSDS deposits expand Spark's treasury assets, improve Spark's ability to obtain low-cost funds, and enable SparkLend to provide more competitive loan rates, improve capital utilization, and increase protocol revenue. After these returns flow back to SSR, they can provide a more attractive annualized rate of return, further stimulating the demand for sUSDS and completing the closed loop.

5.3 Balancing the high returns and low risks of DeFi and traditional finance

As the tokenization of real-world assets (RWA) and the integration of crypto assets with the traditional financial system continue to blur the boundaries between DeFi and TradFi. Spark aims to achieve the dual goals of high returns and low risks by balancing DeFi native returns with RWA basic returns.

5.3.1 DeFi native income

In the money market, Aave has become an important player; and in the interest-bearing stablecoin track, Ethena has also performed strongly. How does Spark compete? It adopts a capital allocator-driven strategy to avoid direct confrontation.

At present, DeFi is increasingly showing the characteristics of "Fat DeFi" - the protocol focuses more on improving composability. Spark follows this trend through SLL: injecting liquidity into vaults such as Morpho, directly obtaining interest-bearing assets from protocols such as Ethena, and strategically accessing Aave's deep liquidity pool and large user base. This multi-channel strategy significantly improves Spark's capital efficiency.

5.3.2 RWA Benefits

Although the open source nature of DeFi allows the code to be easily copied, the strongest moat often comes from non-programmed advantages. This is the case with Spark’s deep integration with traditional finance—other protocols may be able to copy the technical architecture, but it is difficult to copy its revenue structure.

Spark's Tokenization Grand Prix program is a clear example. The program marks an important milestone in the integration of DeFi and TradFi: Sky pledged to invest $2 billion to purchase the most competitive tokenized US short-term Treasury products, ultimately attracting proposals from 39 institutions including BlackRock, Janus Henderson, and Superstate. SLL selected BUIDL, USTB, and JTRSY.

The assets acquired by Sky are all short-term U.S. Treasury-backed products with low volatility and high liquidity, and they comply with European and American securities regulatory requirements. This builds a compliance framework for institutional funds to enter DeFi and strengthens USDS's anchor stability and liquidity defense capabilities in the long term.

Spark's core advantage lies in integrating DeFi's flexible income strategy with RWA's stability through SLL: on the one hand, it increases income by interacting with external DeFi protocols, and on the other hand, it reduces volatility by allocating real assets such as US Treasury bonds. In this process, Spark redefined the relationship between DeFi and traditional finance - viewing it as a continuous "income-stability" spectrum rather than two separate fields.

6. Spark’s future development

Spark’s development direction is very clear: it aims to become the most advanced scale-based yield engine in the DeFi field, and is clearly committed to breaking through the inefficiency and opacity of the traditional banking industry and the scale limitations of the traditional currency market.

Although Spark's strategy may not seem novel at first glance, it has achieved competitive interest rates and stable returns by reducing funding costs and accurately managing exposure to interest-bearing assets. More importantly, the combination of large-scale funds provided by SSR and the capital allocator model across DeFi/TradFi has formed a structural moat that is difficult to replicate. As capital markets continue to migrate to the chain, Spark is very likely to develop into an on-chain capital hub. This development path deserves continued attention.