Author: Thejaswini M A

Compiled by: Block unicorn

Original Title: The "Invisible Infiltration" of Stablecoins: A Financial Revolution Unnoticed by Ordinary People

Preface

Yes, stablecoins are hot right now. Circle's stock is soaring. The GENIUS Bill is advancing in Congress. But these are not the key points.

The real change is hidden in plain sight. Stripe has just acquired a crypto wallet company, Shopify has set stablecoin payment as the default option, and according to reports, Amazon and Walmart are also building their own stablecoins.

When the world's largest retailers start bypassing traditional banks to save billions of dollars in fees, this is more than just the popularization of cryptocurrency.

This means that the entire payment system is being disrupted by companies we already trust. There are four clear signs that cryptocurrency is becoming commercialized.

1/ The Importance of Privy Exceeds Your Imagination

Stripe's acquisition of Privy is more than just another ordinary transaction in the crypto field.

Why? Because they bought the last piece of the digital payment empire.

Earlier this year: Stripe acquired Bridge (stablecoin infrastructure) for $1.1 billion.

Bridge is the infrastructure that allows stablecoins to serve enterprises like ordinary currency. Their API can seamlessly convert between USD and stablecoins, so enterprises can make instant global payments without dealing with crypto wallets or complex blockchain technology. Bridge can be considered a bridge between traditional banking and the new digital dollar economy.

This week: Stripe acquired Privy (crypto wallet integration).

Privy can connect wallets to interfaces familiar to users (such as email addresses) without users having to deal with complex private keys or seed phrases. For Stripe's vast user base, this means accessing crypto payments without learning crypto technology.

What did I see? A complete crypto payment system from wallet to settlement.

This acquisition shows that Stripe is committed to making stablecoin payments as convenient as traditional card processing. Companies already using Stripe (processing over $1 trillion annually) can now offer crypto payments without building new infrastructure or requiring customers to download wallet apps.

This is important because Stripe provides payment processing services for millions of businesses worldwide.

Stripe's coverage is shocking: According to a Chargeflow report, 1.4 million active websites and 90% of adults have used Stripe for transactions. On Black Friday alone, the company processed over 465 million transactions.

When they integrate stablecoin support, it's not just one company adopting cryptocurrency, but driving crypto adoption across the entire ecosystem.

Privy supports over 1,000 development teams with 75 million accounts. Stripe is essentially betting that crypto payments will become as ubiquitous as credit cards.

2/ When E-commerce is Disrupted by Its Own Platform

Shopify just announced a move that might terrify traditional payment processors. USDC payment is being rolled out to millions of merchants, with stablecoin payment becoming the "default option" unless sellers opt out.

What happens next?

Collaboration with Coinbase and deployment on Base will create a complete payment system handling everything from wallet creation to settlement. Customers can pay with USDC and get 1% cashback, while merchants enjoy faster settlement and lower fees compared to traditional credit cards.

What does this prove?

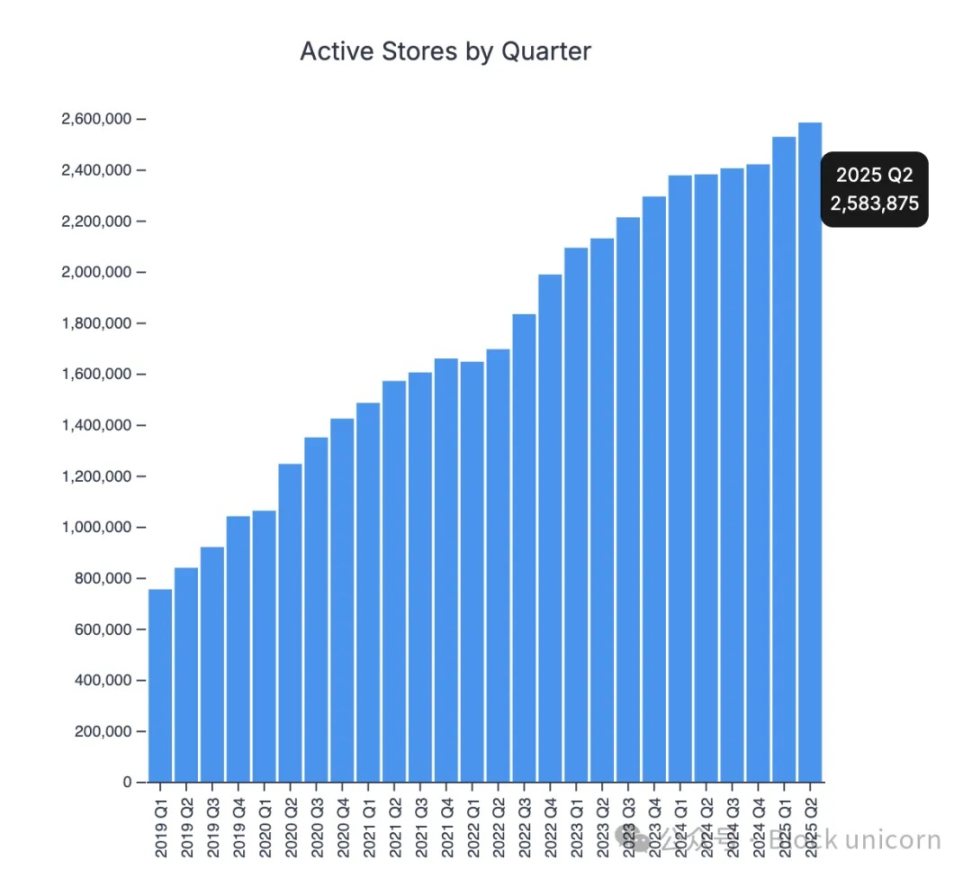

Shopify supports millions of online stores worldwide - 2.6 million merchants across over 150 countries, from individual entrepreneurs to Fortune 500 companies.

Image source: storeleads.app

When they make a simple tap, allowing all merchants to accept USDC payments and receive a 1% cashback reward, I want to call it a "revolution", and I'll tell you why.

Traditional payment processing charges retailers 2% to 3% per transaction, while stablecoin payments cost only a few cents.

For a $100 purchase:

Traditional payment: $2 to $3 fee.

USDC on Base: About $0.05 fee.

Scaling this number in Shopify's ecosystem, you'll see billions of dollars in savings.

What does this mean for you as a customer: These savings won't disappear into corporate profits. Retailers can either keep the difference (enhancing competitiveness) or directly return the saved fees to consumers by lowering prices.

Shopify has already released an enticing red envelope. They offer 1% local currency cashback for payments made with USDC. So you don't pay extra for convenient payment, but are rewarded for using a cheaper payment method.

Once Shopify's merchants start saving over 90% on payment processing, other e-commerce platforms will face a dilemma: either adopt stablecoin payments or watch their merchants migrate to platforms supporting stablecoins.

3/ When Retail Giants Build Their Own Stablecoins

According to the Wall Street Journal, Amazon and Walmart are both "considering issuing their own USD-backed stablecoins". And we're talking about massive scale...

Amazon: Annual revenue of $638 billion, e-commerce sales of $447 billion.

Walmart: Annual e-commerce sales over $100 billion.

If either of these companies launches their own stablecoin payment system, they can immediately shift billions of cash flow away from bank partners.

What does this mean for customers?

Faster checkout - instant settlement instead of T+2 processing.

Lower prices - retailers can pass on savings from eliminated fees.

Seamless international purchases - no transaction fees or delays.

Once Amazon or Walmart customers experience buying a product for $98 instead of $100 without payment processing markup, they'll expect all other retailers to offer the same. Suddenly, every business needs to integrate stablecoins, or risk losing customers to competitors who can offer the same products at 2% to 3% lower prices.

The network effect becomes unstoppable: customers demand cost savings, retailers need to reduce costs to remain competitive, and traditional payment processors watch their business model die.

4/ The Ultimate Irony: The Banks Themselves

According to a May Wall Street Journal report, the largest financial institutions, including JPMorgan Chase, Bank of America, Citigroup, and Wells Fargo, are exploring creating a consortium-backed stablecoin. The top four US banks are collaborating to build the crypto infrastructure they have denied for years.

Now, JPMorgan Chase - whose CEO Jamie Dimon has criticized Bitcoin for years - has just applied for the trademark "JPMD", covering digital asset trading, exchange, transfer, clearing, and payment processing.

This bank, which processes $1.5 trillion annually through its private JPM Coin, is now building public crypto services.

You know why this is important. Not because the largest US banks love technology, but because they see their payment monopoly about to end and want to control this transformation.

Banks earn billions from payment processing fees. Stablecoins threaten to completely eliminate these fees (and we're clearly on that path).

Their choice? Build crypto infrastructure or become irrelevant. Yes, you can call it "surrender".