We are witnessing the early stages of payment system migration, which could reshape the global business landscape in the next 5 years.

Written by: Thejaswini M A

Compiled by: Block unicorn

Preface

Yes, stablecoins are hot right now. Circle's stock is soaring. The GENIUS Act is advancing in Congress. But these are not the key points.

The real change is hidden in plain sight. Stripe just acquired a crypto wallet company, Shopify has set stablecoin payment as the default option, and reportedly, Amazon and Walmart are building their own stablecoins.

When the world's largest retailers start bypassing traditional banks to save billions in fees, this is more than just cryptocurrency adoption.

This means the entire payment system is being disrupted by companies we already trust. There are four clear signs that cryptocurrency is becoming commercialized.

1/ Privy's significance is beyond your imagination

Stripe's acquisition of Privy is not just another ordinary transaction in the crypto realm.

Why? Because they've bought the final piece of the digital payment empire.

Earlier this year: Stripe acquired Bridge (stablecoin infrastructure) for $1.1 billion.

Bridge is the infrastructure that makes stablecoins serve businesses like ordinary currency. Their API can seamlessly convert between USD and stablecoins, allowing enterprises to make instant global payments without dealing with crypto wallets or complex blockchain technology. Bridge is a bridge between traditional banking and the new digital dollar economy.

This week: Stripe acquired Privy (crypto wallet integration).

Privy can connect wallets to user-friendly interfaces (like email addresses) without users having to deal with complex private keys or seed phrases. For Stripe's massive user base, this means accessing crypto payments without learning crypto technology.

What did I see? A complete crypto payment system from wallet to settlement.

This acquisition shows Stripe's commitment to making stablecoin payments as convenient as traditional card processing. Companies already using Stripe (processing over $1 trillion annually) can now offer crypto payments without building new infrastructure or requiring clients to download wallet apps.

This is important because Stripe provides payment processing for millions of businesses globally.

Stripe's reach is stunning: According to Chargeflow, 1.4 million active websites and 90% of adults have used Stripe for transactions. On Black Friday alone, the company processed over 465 million transactions.

When they integrate stablecoin support, it's not just one company adopting cryptocurrency, but driving crypto adoption across the entire ecosystem.

Privy supports over 1,000 development teams with 75 million accounts. Stripe is essentially betting that crypto payments will become as ubiquitous as credit cards.

(The translation continues in the same manner for the rest of the text.)

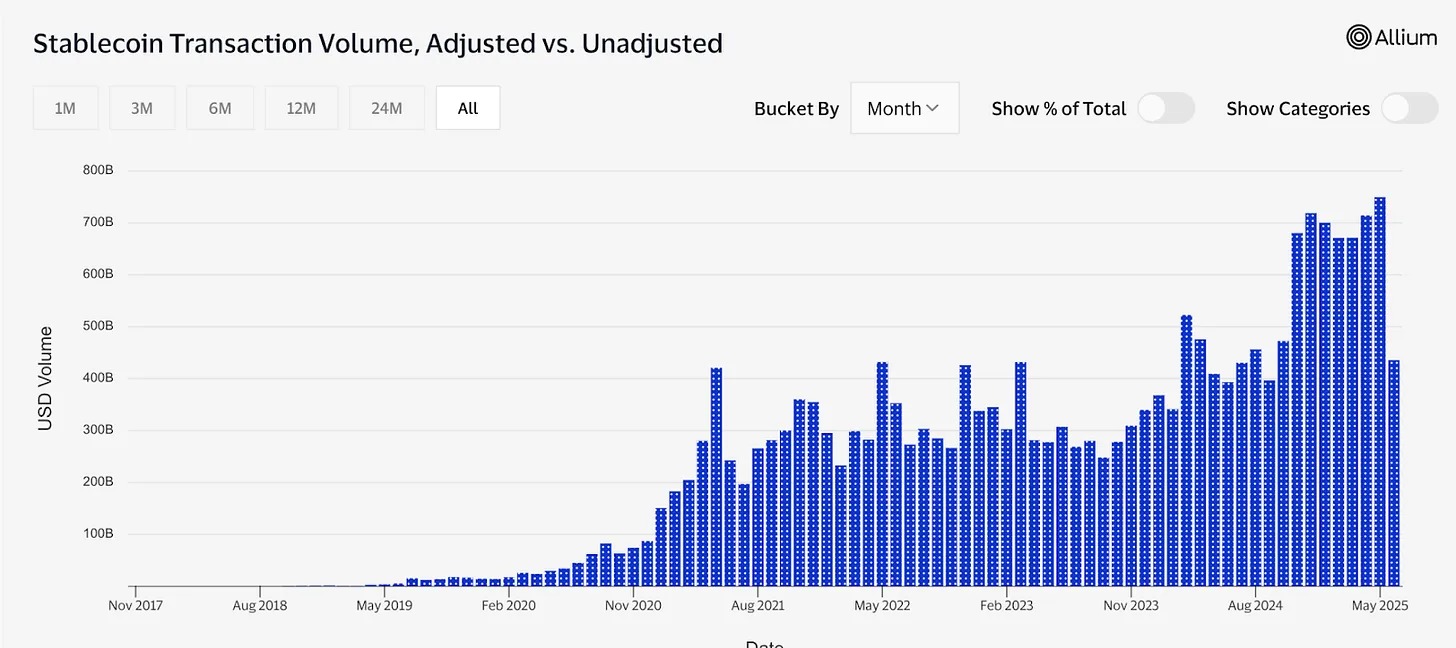

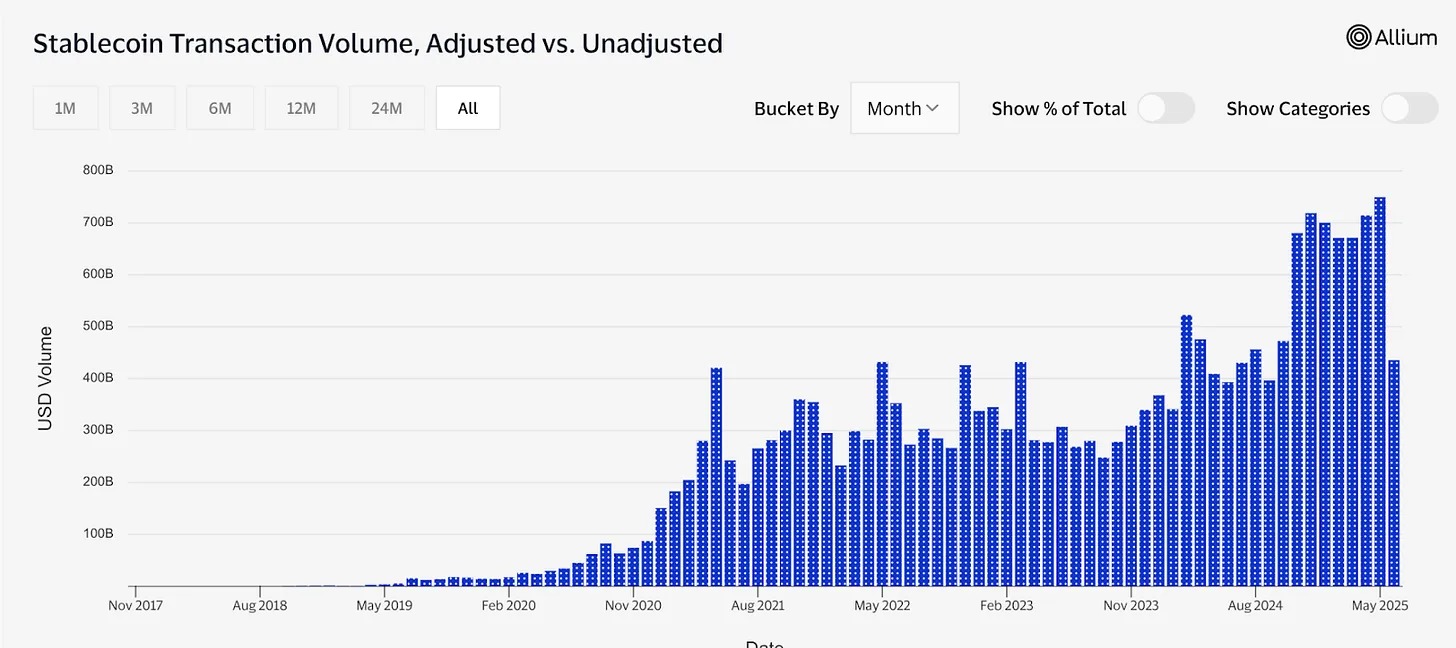

But I want to discuss the scale of reality. Stablecoin commercialization data reveals why traditional companies are starting to pay attention. In May 2025 alone, stablecoin transaction volume reached $4 trillion, with an annual cumulative total of $34 trillion.

Visa's annual transaction volume is approximately $15.7 trillion, and PayPal's is about $1.7 trillion. This demonstrates the importance and growing influence of stablecoins in the global payment field.

Image source: Visa

B2B cross-border payments using stablecoins reach $3 billion monthly, while traditional bank card payments are only $1.1 billion. The speed and cost advantages of blockchain settlement are driving enterprise adoption beyond consumer adoption.

18% of medium-sized U.S. businesses are aware of cryptocurrencies and currently use stablecoins to meet business needs, up from 8% in 2024. This adoption is for practical purposes, not speculative investment.

When Shopify (with millions of merchants), Amazon (with revenue of $638 billion), and Walmart (with e-commerce scale exceeding $100 billion) begin to drive stablecoin adoption, digital growth will quickly become astonishing.

Even if only 10% of these companies' total transactions shift to stablecoins, annual stablecoin usage would increase by over $75 billion.

Once a certain number of merchants accept stablecoins, consumers will develop a demand for them. Merchants must offer stablecoins, or they will lose business. We are witnessing the early stages of payment system migration, which could reshape the global business landscape in the next 5 years.

The craziest part? Most people won't even notice it happening. They'll just wonder why their online shopping suddenly became faster and cheaper.

Whether this represents the ultimate victory of cryptocurrency or its transformation into something entirely different remains uncertain. But all of this suggests that the true impact of cryptocurrency may come from its evolution and deep integration into existing systems, to the point where its existence becomes unremarkable.