FOMC announces maintaining the federal funds rate in the 4.25% to 4.50% range, in line with market expectations.

Although BTC price briefly dipped below $104,000 after the resolution, it quickly stabilized, returning to the $105,000 level at the time of writing, demonstrating its resilience to macroeconomic policy changes. Continued institutional investor buying is the main driver of BTC price stabilization.

VX: TZ7971

After the FOMC meeting, Powell stated at the press conference that the US economy is robust, and while inflation pressure persists, there is no urgent need to cut rates. The market reacted neutrally, with no significant bearish or bullish signals.

Powell said that the current labor market conditions are insufficient to support rate cuts, reflecting the Fed's cautious stance in continuously assessing economic trends. Powell's comments suggest that while inflation's impact may take time to fully manifest, inflation is expected to rise significantly in the coming months.

Since the last adjustment in December last year, the Fed has maintained the benchmark rate in the 4.25% to 4.5% range, adopting a wait-and-see attitude amid ongoing economic uncertainty. Recent data shows that while the labor market remains strong with low unemployment, inflation rose to 2.4% in May, higher than April's 2.3%. Powell's emphasis on the need for a comprehensive assessment of inflation aligns with the Fed's dual mandate of promoting full employment and ensuring price stability.

Additionally, the Fed predicts that inflation and unemployment will rise this year. The PCE inflation rate median is expected to reach 3% by 2025, higher than the 3.7% forecast in March. The unemployment rate forecast also shows an increase, with most officials expecting unemployment between 4.4% and 4.5% this year. Despite these predictions, the Fed still plans to cut rates twice in 2025, consistent with previous forecasts. However, these rate cuts depend on upcoming economic data.

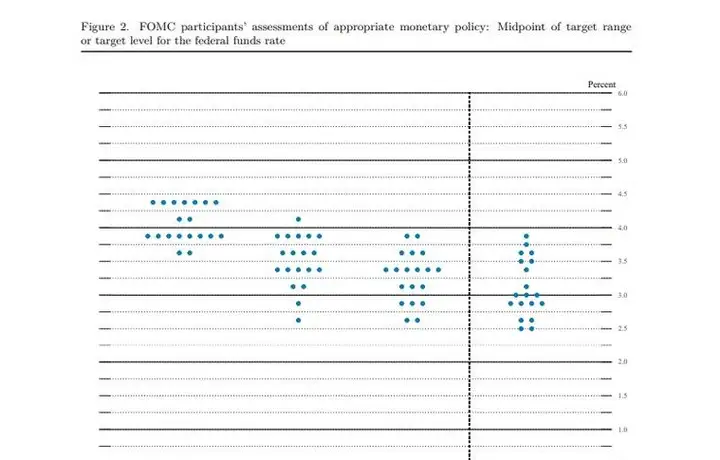

The Fed maintained rates as expected, but the dot plot changes became the market focus. While the overall expectation remains two rate cuts in 2025, the number of committee members supporting no rate cuts increased from 4 in May to 7, while those supporting two cuts decreased from 9 to 8, indicating the Fed may be gradually leaning towards no rate cuts, which is likely why US stocks and cryptocurrencies first rose and then fell.

Simultaneously, the Fed lowered the US 2025 GDP forecast to 1.4% while raising the inflation forecast to 3%, signaling that the Fed expects the US may experience "stagflation," suggesting the US economy will enter a challenging period. Powell stated in the subsequent press conference that the US economy remains strong with ideal employment data, but inflation shows no signs of decline, emphasizing that the impact of tariffs remains difficult to predict, thus maintaining the current rate level.

FOMC rate maintenance resolution brings no surprises, fully priced in by the market

According to the CME Group's FedWatch tool, the probability of no change is 99.9%, reflecting highly consistent investor expectations of Fed policy.

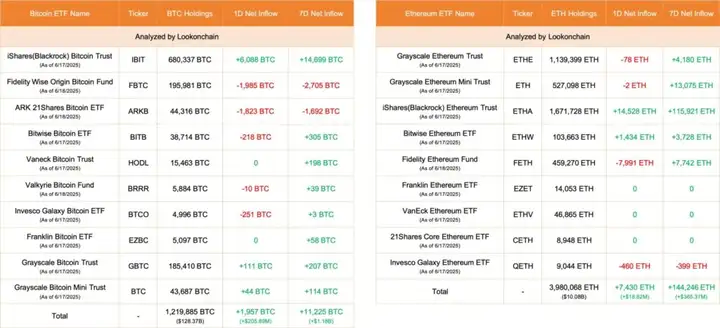

A Lookonchain report shows that before the June 18 FOMC meeting, 10 Bitcoin ETFs recorded net inflows of 1,957 BTC (approximately $205.89 million), with BlackRock's IBIT fund leading, absorbing 6,088 BTC (approximately $640.69 million), with total holdings reaching 680,337 BTC (approximately $71.59 billion).

Technical analysis shows BTC successfully breaking through the $106,200 resistance on the 4-hour chart, with RSI rising to 58 and MACD showing an initial bullish crossover, indicating strengthening short-term momentum. The 200-day moving average (around $105,300) continues to provide support. If the price stabilizes above $106,800, it may challenge the annual high of $109,800. CoinEdition notes that despite Middle Eastern geopolitical risks (such as the Nobitex exchange hack in Iran), BTC demonstrates resilience around $106,000.

The FOMC rate maintenance resolution brought no surprises and was fully priced in by the market. BTC's brief volatility stems more from trader sentiment than fundamental changes. Continued institutional investor buying, especially ETF net inflows, shows confidence in BTC's long-term prospects. The growth of the stablecoin market (reaching $251.7 billion, a 22% increase) further supports BTC demand.

Geopolitical risks have not completely subsided. Potential escalation of Middle Eastern conflicts or a shift in future Fed policy tone could create downward pressure on BTC. Close attention should be paid to ETF fund flows and geopolitical developments in the coming days, particularly the progress of the Iran-Israel conflict.

The market has already expected Powell to maintain a tough stance, which is already priced in and will not significantly impact the future market. Currently, the Middle East situation and whether the US will participate remain potential market turning points.