With the rise of yield-bearing stablecoins and DeFi protocols, Ethereum staking rewards are facing pressure. Can ETH regain its advantage in the yield competition?

Currently, Ethereum's staking annual yield has fallen below 3%, lagging behind many DeFi and RWA (Real World Assets) protocols. Yield-bearing stablecoins like sUSDe and SyrupUSDC are rapidly gaining market share, offering returns of 4% to 6.5%. Notably, the vast majority of competitive yield products are built on the Ethereum blockchain. This means their widespread adoption is still expected to drive the growth of Ethereum network value in the future. Yields are no longer just a traditional financial attribute—on-chain yields have become a core element of the crypto world, with Ethereum, as the largest proof-of-stake blockchain, at the forefront.

Ethereum Staking Yield Analysis

Ethereum's staking rewards consist of two parts: consensus rewards (issued by the protocol, with a fixed total amount that is diluted as the amount of staked ETH increases) and execution rewards (including priority fees paid by users and MEV value capture). The design adopts an inverse square root curve mechanism to ensure that as the staking amount increases, the unit yield decreases.

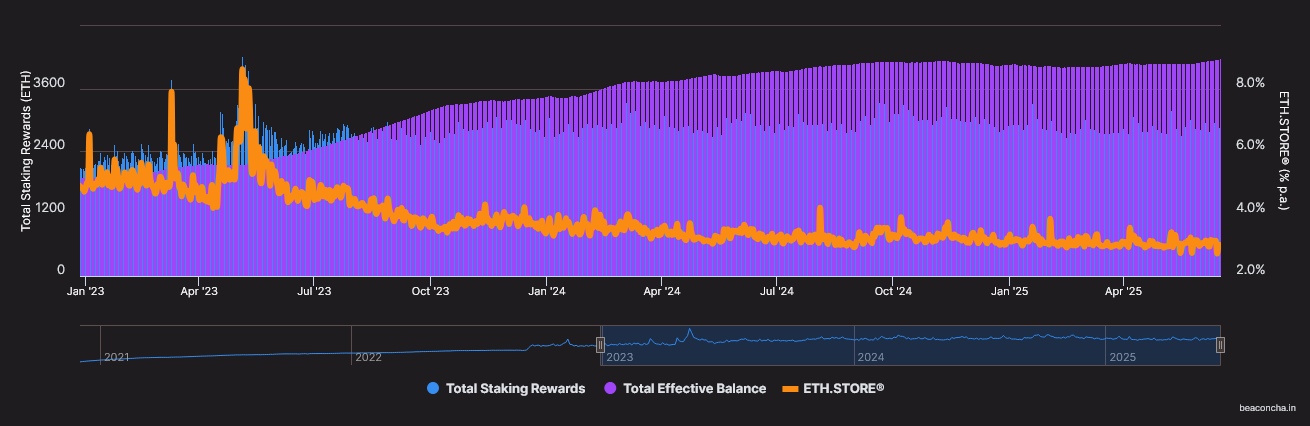

Ethereum staking reward reference rates. Source:Beaconcha.in

Ethereum staking reward reference rates. Source:Beaconcha.in

Since the "merge" was completed in September 2022, Ethereum staking rewards have continued to decline, from a peak of about 5.3% to currently below 3%. This reflects the fact that the total amount of staked ETH has exceeded 35 million, accounting for 28% of its total circulation.

However, only independent validators who operate nodes and lock up 32 ETH can receive full rewards. Most users choose liquid staking protocols (such as Lido) or exchange custody services for convenience, which charge 10%-25% in fees, further reducing users' net yields.

The Rise of Yield Stablecoins

Yield stablecoins allow users to hold USD stablecoin assets while generating passive income, typically from U.S. Treasuries or synthetic strategies. They are rapidly gaining market favor.

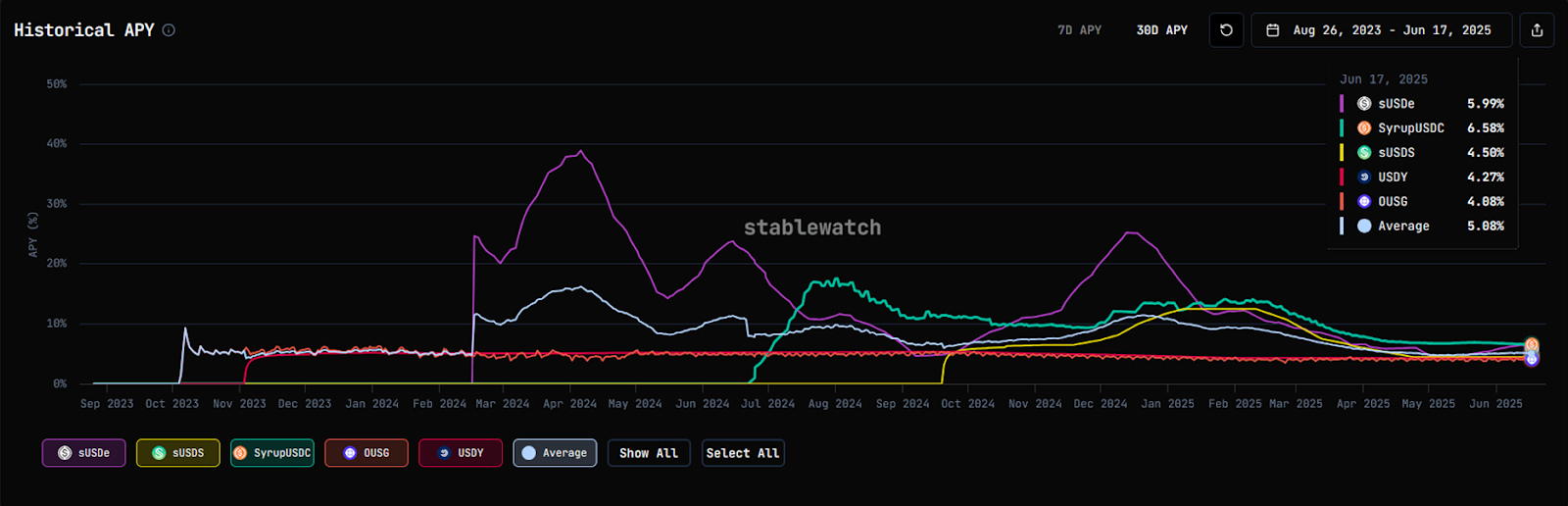

Historical annualized yields of top five yield stablecoins. Source:Stablewatch

Historical annualized yields of top five yield stablecoins. Source:Stablewatch

The top five mainstream yield stablecoins—sUSDe, sUSDS, SyrupUSDC, USDY, and OUSG—occupy over 70% of the $11.4 billion total market size, each using different strategies:

- sUSDe (Ethena): Synthetic delta-neutral strategy (ETH derivatives + staking rewards), historical returns of 10%-25%, currently around 6%, with higher risk.

- sUSDS (Reflexer/Sky): Backed by sDAI and RWA, current yield 4.5%, focusing on decentralization and low risk.

- SyrupUSDC (Maple Finance): Leveraging tokenized Treasuries and MEV strategies, current yield 6.5%.

- USDY (Ondo Finance): Anchored to short-term Treasuries, yield 4.3%, targeting low-risk institutional preferences.

- OUSG (Ondo Finance): Based on BlackRock Treasury ETF, yield ~4%, with strict KYC and high compliance.

Their key differences lie in underlying assets (synthetic/RWA), risk characteristics, and accessibility. The sector has seen a 235% surge in size over the past year, indicating strong demand for on-chain fixed income.

DeFi Lending: Ethereum-Centric

Decentralized lending platforms like Aave, Compound, and Morpho allow users to earn yields by providing assets. Interest rates are determined by algorithms based on market supply and demand, closely tied to market cycles.

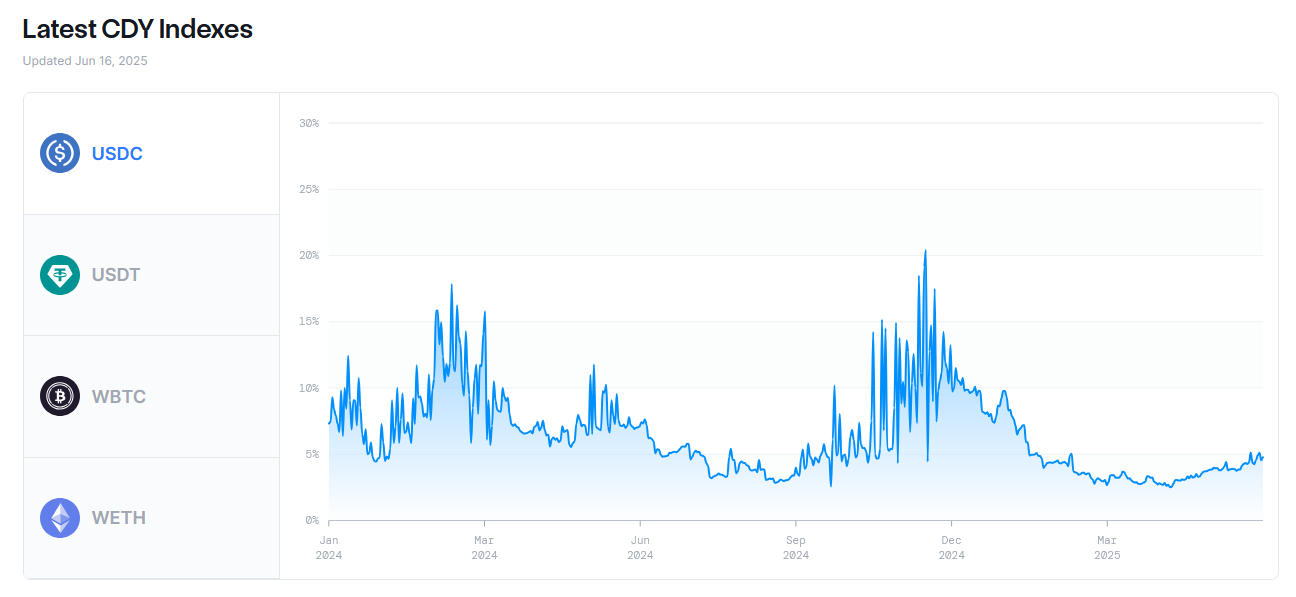

Chainlink DeFi Yield Index. Source:Chainlink

Chainlink DeFi Yield Index. Source:Chainlink

For example, the Chainlink DeFi Yield Index shows current lending yields of around 5% for USDC and 3.8% for USDT, which can significantly rise during active market periods.

Unlike traditional bank lending dominated by central bank policies, DeFi yields are market-driven, offering higher return potential but also unique risks such as smart contract vulnerabilities and oracle failures.

Core Contradiction and Ethereum's Value

A significant key point is that most of these competitive yield products (yield stablecoins, tokenized Treasuries, DeFi lending protocols) are built on the Ethereum blockchain. They rely on Ethereum's infrastructure, with some strategies directly leveraging ETH for yields.

This fact reveals a deeper logic: Ethereum remains the most trusted blockchain platform, leading in hosting DeFi and RWA assets. The prosperity of these ecosystem applications ultimately drives Ethereum network usage, increases transaction fee income, and long-term strengthens ETH's intrinsic value. From this unique perspective, Ethereum may not have lost the yield war—it is achieving another form of victory by empowering a broader, more diverse on-chain yield ecosystem. Network effects and ecosystem prosperity are the foundations of its enduring value.