Author: MD

Produced by: Bright Company

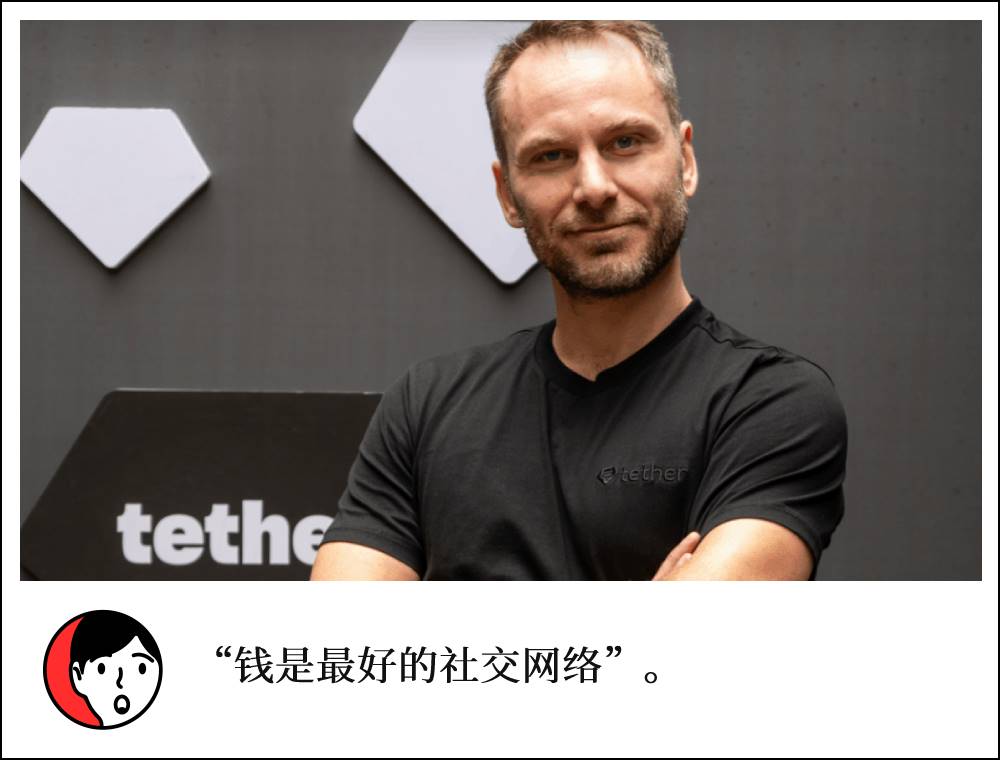

During the global Bitcoin conference in late May, Tether's CEO Paolo Ardoino was interviewed by CNBC.

In his speech at the Bitcoin conference, Paolo Ardoino said that USDT has approximately 420 million users in emerging markets and developing countries, accounting for 62% of decentralized trading volume. "More significantly, about 35% of USDT users use it as a savings account - because they live in countries like Turkey, Argentina, and Vietnam with severe currency depreciation, and they can only choose to save in US dollars, with USDT being their most realistic option."

Coingecko data on June 18 shows that USDT's total market value is approximately $155 billion, with a trading volume of about $27.7 billion in the past 24 hours, making it the world's largest stablecoin issuer; the recently listed "first stablecoin stock" Circle (CRCL.US) has a total market value of about $61.5 billion for USDC, with a trading volume of approximately $9.2 billion in the past 24 hours.

However, market analysis suggests that under the framework of the "Genius Act" (the "Guidance and Establishment of National Stablecoin Innovation Act" passed by the US Senate on June 17 and awaiting review by the US House of Representatives), Tether's compliance is lower than Circle's, which is one of the reasons why Circle went public before Tether. Paolo Ardoino also responded to questions about "offshore structure" and auditing in the interview, stating that he has had good communication with the Big Four accounting firms, but also noted that "this will be a long journey".

It's worth mentioning that Paolo Ardoino specially shared Tether's investment logic in agriculture, dairy, video platforms, and brain-computer interface technologies.

According to Tether's website, the company announced the acquisition of Latin American agricultural enterprise Adecoagro on April 30 this year, whose main business covers sugar, ethanol, dairy, and crop production in Argentina, Brazil, and Uruguay, with 210,400 hectares of farmland and multiple industrial facilities in these countries.

Regarding this, Paolo Ardoino said in the interview, "We are exploring how to demonstrate the use of stablecoins in international trade to agricultural enterprises and commodity producers (such as wheat, rice, milk, etc.). For example, Adecoagro sells products to Asia and the United States, and to make these sales more efficient, they are beginning to consider using stablecoins to complete transactions."

Tether's latest investment is the acquisition of a 31.9% stake in the Canadian gold royalty company Elemental Altus Royalties on June 12. Tether stated that this investment is to "integrate long-term stable assets like gold and Bitcoin into its ecosystem", serving both as a hedging method and part of its commitment to building a resilient digital economic infrastructure.

Below is the translated interview text (edited) by "Bright Company":

[The rest of the translation follows the same professional and accurate approach]Paolo: I love competition. But I believe that competition will mainly focus on competing with our second-largest competitor Circle, not us. The reason is that all companies announcing stablecoin plans come from traditional financial systems. The success of USDT lies in our understanding that 3 billion people in the world do not have bank accounts. These people are not bad, they are very good, just not paid attention to by banks due to poverty. To interest banks, you must contribute at least $150 in fees and commissions annually. But if you live in a country with a daily wage of $1.34 per person, or in Africa with a monthly salary of only $80, you cannot possibly give banks $150 a year. So all stablecoins created by traditional financial companies will be offered to their existing customers. While we serve 3 billion people - these 3 billion people are viewed as a "Niche Market" by the banking system. Many competitors say Tether serves the banks' "niche market", but half the world's population should not be called "niche". We built ourselves through grassroots efforts. We have established many service kiosks in Africa, and by 2030, we will have 100,000 kiosks in Africa, providing power to people in small African villages through solar panels. We already have hundreds of thousands of touchpoints in Latin America, offering stablecoin and Bitcoin education.

[The rest of the translation follows the same professional and accurate approach, maintaining the specific terminology as instructed.]Just in the past month and a half, we have started very positive dialogues with some companies from the Big Four, which will be a long process, but now it is very positive, at least we can start a dialogue. We have open discussions with them. I am confident that we will complete a full audit. I love transparency, and I am the most transparency-driven person in the company. If you look at our self-certification, it is more detailed than our competitors, disclosing all different investment categories, revealing how much gold, Bit, other assets, and government bonds we have. Last year, we conducted due diligence for over two years, and an American institution spent two years conducting the world's largest-scale due diligence, turning over every stone. At the beginning of 2024, the due diligence results will be made public, confirming the authenticity of our reserves. They conducted checks in January and May. I have also disclosed all processes and reserves to the New York Attorney General over two years as part of a settlement. We are the most scrutinized company globally. I know our company is very transparent and is setting an example for the entire industry, and I am also correcting many misunderstandings about us from the outside world.