Author: Matt Hougan, Chief Investment Officer of Bitwise; Translated by: AIMan@Jinse Finance

The world is beginning to recognize the madness of fiat currency experiments.

Legendary writer David Foster Wallace began his 2005 Kenyon College commencement speech with a parable:

Two young fish are swimming along and happen to meet an older fish swimming in the opposite direction. The older fish nods and says, "Good morning, kids. How's the water?" After swimming for a while, one of the young fish looks at the other and asks, "What is water?"

Wallace's point was that we often fail to see the most important realities, especially when these realities have completely surrounded our entire lives.

I've been thinking about those fish lately.

Like almost all financial professionals today, I have lived my entire life in a fiat-based world—where a nation's money supply is not based on the accumulation of reserves like gold or silver, but determined by the government. The United States abandoned the gold standard 54 years ago, in 1971. Assuming most people start their careers at 21, the youngest person in the financial world who remembers working in the pre-fiat era is probably 75 years old now.

When most of us were in school, the adoption of fiat currency was seen as an inevitable progress, like emerging from the mud and starting to walk upright.

People in the past thought gold was currency, and we laughed. How cute.

But people seem to be increasingly realizing that this fiat era we are experiencing might be an exception. Perhaps printing money out of thin air, as we started doing in 1971, is actually a crazy idea. Perhaps sound money needs limitations.

In other words, people are starting to look around and ask: What is fiat currency?

One group raising this question is the Financial Times in August, whose weekend "Big Read" was an in-depth article exploring how gold has become a safe haven for the world against uncertainty.

A key passage reads:

For the guardians of the global economy, gold—which has been used as a store of value since the first gold bar was made in Mesopotamia thousands of years ago—seemed destined to become irrelevant.

However, gold has made a strong comeback, not only favored by speculators and so-called "gold bugs" who distrust modern paper money, but even by the world's most conservative investors...

In an era of political fervor, as many core assumptions about the global economy are questioned, gold has once again become a cornerstone.

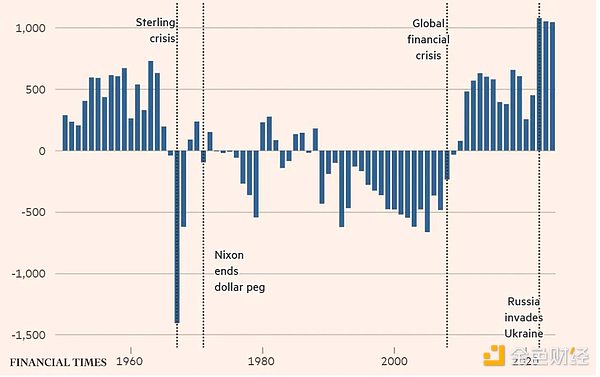

The Financial Times points out that central banks—which often bought gold before 1971—are now buying gold again in large quantities. As shown in the chart, these annual purchases began after the 2008 financial crisis and entered a hyper-growth phase after Russia's invasion of Ukraine in 2020. In other words, these purchases began when central banks started truly abusing fiat currency, and the pace of purchases accelerates once governments start seizing parts of the fiat currency.

Central Banks Are Investing Record Funds in Buying Gold

Central Bank Net Purchases/Sales (Gold Bar Tonnage)

Source: Financial Times, Data from Metals Focus, Refinitiv GFMS, and World Gold Council.

Note: The chart shows the net demand of central banks and other official institutions (including supranational entities like the IMF). It does not include the effects of swap transactions and Delta hedging.

Last year, gold surpassed the euro to become the second-largest reserve asset after the US dollar. As US debt approaches $37 trillion, and the temptation to devalue the dollar to escape difficulties grows, central bank governors realize they need to hedge risks. They want something that can:

* Be scarce

* Be global

* Be difficult for governments to manipulate

* Can be directly held with sovereign autonomy

You probably understand what I mean.

These qualities apply not just to gold.

They are increasingly looking at Bitcoin.

Bitcoin: A Weapon Against Fiat Currency Devaluation

Like governments, individual investors are beginning to recognize the dangers of printing money without consequences. Interestingly, they are mostly hedging against money printing through Bitcoin—which is widely considered a digital alternative to gold. Since its launch in January 2024, Bitcoin ETFs have attracted $45 billion in funds, compared to $34 billion for gold ETFs in the same period.

Why the difference between governments and ordinary people? The main reason is capacity: the Bitcoin market is worth $20 trillion, which is still too small for central bank officials and lacks the liquidity to support large-scale entry and exit. I suspect this will change over time—in fact, government demand for Bitcoin will only continue to grow. But for now, I believe this represents two sides of the same transaction.

However, whether we're talking about gold or Bitcoin, the fundamental point is the same: for the past forty years, we've been taught to diversify our portfolios through a mix of stocks and bonds. But no matter how you adjust—60% stocks, 40% bonds, or 70/30, whatever the ratio—you are still 100% invested in fiat currency.

People are realizing how dangerous swimming in these waters can be.