Written by: TechFlow

The once-hot crypto payment card (U card) business is now facing shrinkage.

On June 17, Christine, co-founder of Infini, posted on X, announcing the suspension of consumer-facing crypto U card services and detailing the reasons behind it:

High compliance costs, razor-thin profits, and heavy operational burden.

She candidly admitted that the B2C card business consumed 99% of the company's time and costs, yet contributed almost no revenue. This announcement marks Infini's strategic withdrawal from B2C card business, focusing instead on wealth management and B2B services.

However, 1-2 years ago, U cards were seen as a breakthrough innovation combining cryptocurrency and traditional finance.

By supporting direct consumption with stablecoins like USDT and USDC, U cards quickly attracted users in the crypto circle; at that time, ChatGPT had just emerged, and many people wanted to experience subscription services but lacked overseas bank cards, making U cards a new payment channel in this AI boom.

Withdrawal and ChatGPT - the former represents the crypto circle's desire for channel security, while the latter activated new payment scenarios.

Currently, with industry development, these two needs seemingly no longer require U cards. As more U card projects continue to fail, the difficulty of this business becomes increasingly apparent.

Not an Isolated Case

Infini's exit is not an isolated incident.

From publicly available information, we can find numerous examples of U card businesses partially or completely shutting down, with some typical cases being:

In September 2024, OneKey announced stopping new registrations and recharge functions, officially discontinuing its U card service on January 31, 2025. Although the official did not elaborate on reasons, the industry speculates it's related to upstream payment service interruption or compliance pressure;

In December 2023, Binance terminated its card services in the European Economic Area and ended cooperation in parts of Latin America and the Middle East in August 2023. This adjustment was seen as a response to increasingly strict regional regulations;

Tracing back to 2018, Visa, one of the world's largest payment networks, terminated cooperation with WaveCrest due to compliance issues. WaveCrest was an intermediary providing card issuance and payment processing for crypto payment cards, responsible for connecting U cards to the Visa network. Visa's sudden withdrawal directly prevented WaveCrest from continuing to serve its customers, including U card providers like Bitwala and Cryptopay.

These cases collectively point to a systematic challenge for U card businesses globally.

Upstream Chaos and High Costs

From an ordinary user's perspective, a U card is a very simple product - what you see is what you get, ready to use; the only considerations are rates and wear.

However, from the perspective of creating a U card, the root of the problem lies in its complex upstream and downstream logic and high cost pressures.

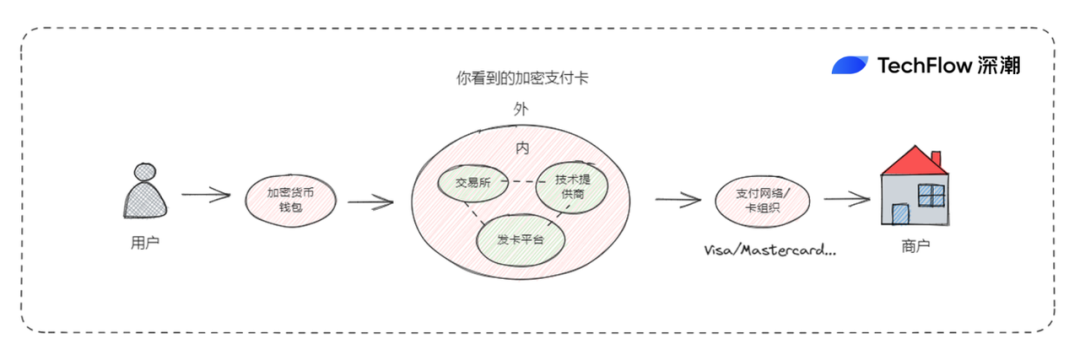

First, U card operations depend on multi-party collaboration: users top up stablecoins like USDT, card providers (like Infini) convert off-ramp to fiat, payment networks (like Visa, Mastercard) settle with card issuers and banks.

However, the upstream segment - especially payment networks and banks - is not controlled by the crypto circle. This makes U cards a "vassal" of the traditional financial system, with weak bargaining power.

But why can you see so many different branded U cards?

Exchanges are issuing cards, wallets are issuing cards, payment startups are also issuing cards... Can anyone issue a crypto payment card?

When users see a card with a crypto exchange brand and bearing a VISA logo, what's unknown is actually the collaboration model between the card issuer and technology provider.

For example, Coinbase's VISA card was previously supported by technology provider Marqeta, enabling it to issue crypto debit cards and provide users with real-time transaction authorization and fund conversion services;

Furthermore, due to the existence of "technology providers", the issuance process of crypto payment cards has become relatively simple.

Technology providers offer a kind of "card issuance as a service" capability: by providing necessary security technology, payment processing systems, and user interfaces to organizations needing card issuance, supporting crypto card issuance, currency conversion, and payments.

Card issuance demanders only need to call the technology provider's API or SaaS solution to issue and manage crypto credit/debit cards.

Simultaneously, the technology provider's "card issuance as a service" includes multiple functions such as transaction authorization, fund conversion, transaction monitoring, and risk management, helping card issuers simplify operations and improve efficiency.

In other words, the U card in your hand is actually the result of collaboration between card issuers, technology providers, banks, and payment networks.

This also means that each party in the card issuance chain wants a share of the profits. Everyone wants a piece of the pie, and the card projects and brand owners positioned relatively downstream in the entire chain can naturally obtain fewer benefits.

U card revenue primarily comes from transaction fees, but the 1-3% fees charged by payment networks, additional stablecoin conversion costs, and bank account maintenance fees quickly consume the business's profits.

Income barely covers costs, and more troublingly, fixed costs cannot be cut.

Supporting U card operations is not easy. Technical maintenance requires real-time transaction processing and security guarantee, while customer support must handle refunds and consultation needs - such as Infini's promised 10-working-day refund arrangement, which also involves personnel support and response costs.

On the user side, individuals might encounter issues in various payment scenarios, but U card business projects must handle these personalized problems; moreover, due to the long upstream chain, when technology providers or card organizations encounter issues causing service suspension/abnormalities, they often find themselves in a passive position.

Compliance Risks

Additionally, U cards face strict compliance requirements. KYC and AML are basic thresholds, and doing business in North America and Europe involves further FinCEN registration and EU MiCA regulations.

USDT itself is also an asset favored by gray industries (such as money laundering), which naturally determines that U cards need to invest more effort in risk control.

More aggressively, when U card business companies operate with a "registered overseas, staff working domestically" model, due to the crypto industry's unique domestic context, such businesses are more likely to face certain legal risks.

Recently, social media has circulated news about some U card businesses being shut down. We cannot know the authenticity and specific details of these events, but one thing is certain:

The efforts required to comply with local regulations and risks brought by other factors for U card businesses are far higher than many on-chain businesses. Sometimes it's not necessarily the card itself, but the funds involved, users, and relatively tightened public opinion environment that can cast a shadow on U card business brands and perceptions.

Laborious and unprofitable, worrying without earning money - this might be the common predicament faced by most U card project parties focusing on the payment field.

Currently, U card business might be more suitable for CEXs. CEXs are not necessarily generating profits and revenue from U cards. With sufficient profitability from trading businesses, using U cards for customer loyalty management and as a brand differentiation service is a better choice.

For instance, Bybit and Bitget currently still have corresponding U cards, and Coinbase recently stated at the State of Crypto summit that it will launch the Coinbase One Card in fall 2025, offering users up to 4% Bitcoin cashback per transaction, supported by the American Express network.

Card issuance is indeed something everyone wants to launch, but ultimately, who can succeed depends more on compliance resources and risk control capabilities. From the current situation, the U-card business is gradually moving towards oligarchy.

From Subordination to Independence

On one side, crypto businesses are hindered in traditional industries, while on the other side, traditional finance is increasingly entering crypto-related businesses.

Whether it's stablecoins, RWA, or the recently popular crypto asset reserves of US-listed companies, traditional finance is "learning" and profiting in the crypto space by leveraging existing resources and compliance.

For crypto businesses, apart from native crypto and trading-related asset chain businesses, attempts to expand outward increasingly feel constrained.

The predicament of U-card business actually reflects the awkward situation of the entire crypto industry when interacting with the traditional financial system. As a "subordinate" to traditional finance, the crypto industry has never been able to take the initiative in the payment field.

Perhaps reducing dependence on fiat currency conversion, initiating transactions directly from wallets, and settling through on-chain transactions to bypass traditional payment networks is the original form of crypto technology. However, under the premise of compliance and embracing reality, this path seems too idealistic.

Moreover, attempting to control the industrial chain due to being constrained in traditional businesses, such as acquiring banks, payment channels, and technology providers, would likely further increase business costs, especially when it's uncertain how many users would use the card.

Looking further, the contradictions reflected in the U-card business are not limited to the payment field but permeate the entire crypto industry's expansion.

When innovation and enthusiasm can only be sustained in the native crypto ecosystem, the opportunity for grassroots and independent crypto to break out remains unrealized.