On June 9, a roundtable meeting of the cryptocurrency special working group chaired by SEC Chairman Paul Atkins suggested potential favorable conditions for cryptocurrency and DeFi participants. This represents the most supportive stance of U.S. regulators towards DeFi in history, though most have not yet realized this. While no formal legislation has been passed, this is likely to be the trigger for a new DeFi revival led by the United States.

VX: TZ7971

Key Positive Signals from the SEC Roundtable

1. Financial Independence

2. Eliminating Howey Test Uncertainty: Staking, Mining, and Validators - Not Securities

3. On-Chain Product Innovation Exemption

4. Self-Custody Protection

5. Publicly Supporting Trump's Pro-Cryptocurrency Agenda

6. Encouragement of On-Chain Resilience

Directly Benefited Currencies

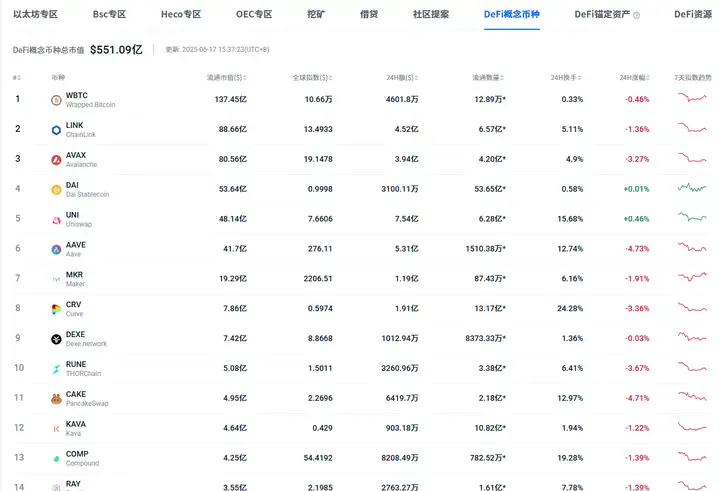

The most direct beneficiaries of regulatory clarity are protocols that form the backbone of DeFi infrastructure. These protocols typically have high Total Value Locked (TVL), mature governance structures, and clear utility functions aligned with traditional financial services.

Liquid Staking Protocols:

With staking rules clarified, protocols like Lido Finance ($LDO), Rocket Pool ($RPL), and Frax Ether ($FXS) are expected to attract institutional capital seeking compliant staking solutions. As regulatory barriers are removed, the $47 billion liquid staking market could significantly expand.

Decentralized Exchanges:

Uniswap ($UNI), Curve ($CRV), and similar protocols benefit from self-custody protection and innovation exemptions. These platforms can launch more complex financial products without regulatory delays.

Lending Protocols:

Aave ($AAVE), Compound ($COMP), and MakerDAO ($MKR) can expand their institutional-facing products with clearer regulations, especially in automated lending and synthetic asset creation.

RWA Field Leaders:

Ondo Finance, Maple Finance, and Centrifuge are poised to accelerate institutional adoption of tokenized securities, corporate credit, and structured products. Currently, the RWA field's TVL is around $8 billion and could rapidly expand with a clearer regulatory path.

How to Prepare for the Future DeFi Bull Market?

Bet on High-Reliability DeFi Protocols

Focus on protocols likely to benefit from regulatory clarity:

Staking and LST: Lido, RocketPool, etherfi, Coinbase's cbETH

Decentralized Exchanges: Uniswap, Curve, GMX, SushiSwap

Stablecoin Protocols: MakerDAO, Ethena, Frax

RWA Protocols: Ondo, Maple, Centrifuge

Accumulate Governance Tokens

Tokens of core DeFi infrastructure (especially those with high TVL and good regulatory compliance) may benefit: $UNI, $LDO, $AAVE, $RPL, $MKR, $FXS, $CRV.

Participate in On-Chain Governance

Engage in governance forums and participate in delegated voting. Regulators may prefer protocols with transparent and decentralized governance.

For retail participants, the focus should be on mature protocols with clear regulatory positioning and strong fundamentals. A conservative strategy would allocate 60% to liquid staking protocols and mainstream DEXs, 25% to lending protocols, and 15% to emerging categories with high growth potential.

Return Potential Analysis

Token Appreciation: With accelerated institutional adoption and improved protocol utility, regulatory clarity typically causes governance tokens in favorable positions to appreciate 3 to 5 times.

Yield Generation: DeFi protocols offer 4-15% annual yields through various mechanisms like staking rewards, trading fees, and lending interest. Regulatory clarity can stabilize and potentially increase these yields as institutional capital enters the market.

Innovation Access: Early participation in innovation exemption protocols could bring extremely high returns (5 to 10 times), as these projects develop new financial primitives and capture market share in emerging categories.

Compound Effect: The combination of token appreciation, yield generation, and governance participation can produce compound returns that may significantly exceed traditional investment schemes within a 12 to 24-month timeframe.

The current environment presents a rare convergence of regulatory clarity, technological advancement, and market undervaluation. Protocols and strategies that can attract institutional capital flow within the next 18 months will likely determine the next stage of DeFi growth and value creation.