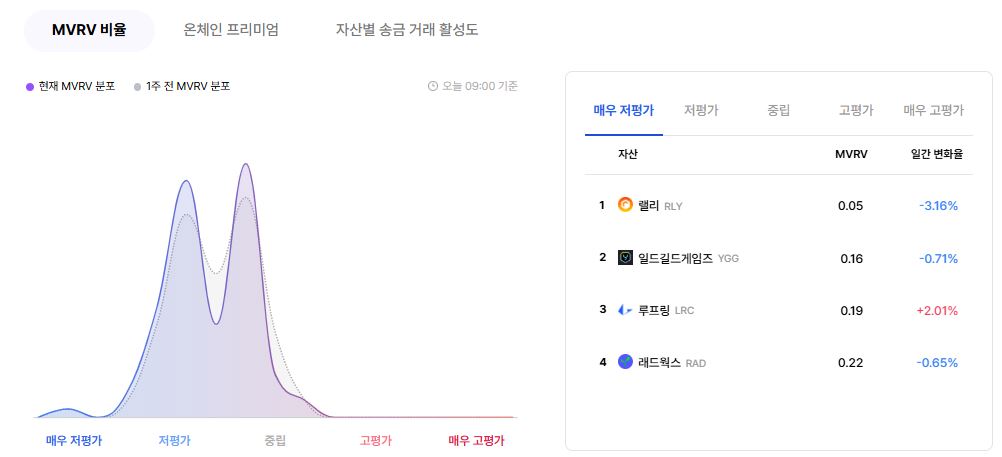

Ethereum-based on-chain indicators show that while there are still many undervalued assets, some recovery signals have been observed in premiums and transfer volumes.

According to Upbit Data Lab as of 11:20 AM on the 17th, out of 93 Ethereum-based assets listed on Upbit, 56 are in an 'undervalued' state, trading below the average purchase price. 37 were in a 'neutral' state, and there were no 'overvalued' assets.

Assets in the 'very undervalued' state based on the 'MVRV ratio' include ▲Rally (RLY, 0.05) ▲Yield Guild Games (YGG, 0.16) ▲Loopring (LRC, 0.19) ▲Radworks (RAD, 0.22).

Assets in the 'undervalued' state include ▲Strike (STRIKE, 0.23) ▲Synthetix (SNX, 0.24) ▲GitCoin (GTC, 0.25) ▲Safe (SAFE, 0.28) ▲ApeCoin (APE, 0.28).

Assets in the 'neutral' range include ▲Pendle (PENDLE, 1.50) ▲Aave (AAVE, 1.35) ▲Sky Protocol (SKY, 1.25) ▲Ethereum (ETH, 1.24) ▲Status Network Token (SNT, 1.13).

There were no overvalued or very overvalued assets. This means that despite the overall market entering a recovery trend, the proportion of assets exceeding the average purchase price remains low.

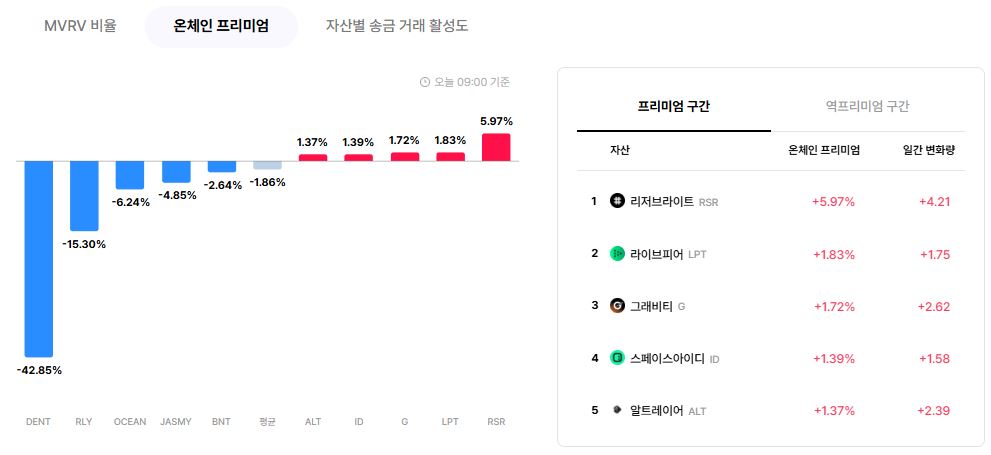

The average on-chain premium of the Ethereum network recorded -1.86%. This is a 1.58%p decrease from the previous day, indicating a continued 'reverse premium' state where the real-time trading price of Ethereum in DeFi is lower than on centralized exchanges (Upbit).

This indicator represents the difference between on-chain trading prices and Upbit prices, and a negative value suggests limited on-chain demand or relatively higher centralized exchange prices.

Assets in the on-chain premium range include ▲Reserve Rights (RSR, +5.97%) ▲Livepeer (LPT, +1.83%) ▲Gravity (G, +1.72%) ▲Space ID (ID, +1.39%) ▲Altair (ALT, +1.37%). These assets are interpreted as having on-chain trading prices higher than Upbit, signaling relatively stronger on-chain demand.

In the reverse premium range are ▲Dent (DENT, –42.85%) ▲Rally (RLY, –15.30%) ▲Ocean Protocol (OCEAN, –6.24%) ▲Jasmy (JASMY, –4.85%) ▲Bancor (BNT, –2.64%). These assets are trading lower on-chain than on Upbit, suggesting potential liquidity contraction or strong demand on Upbit.

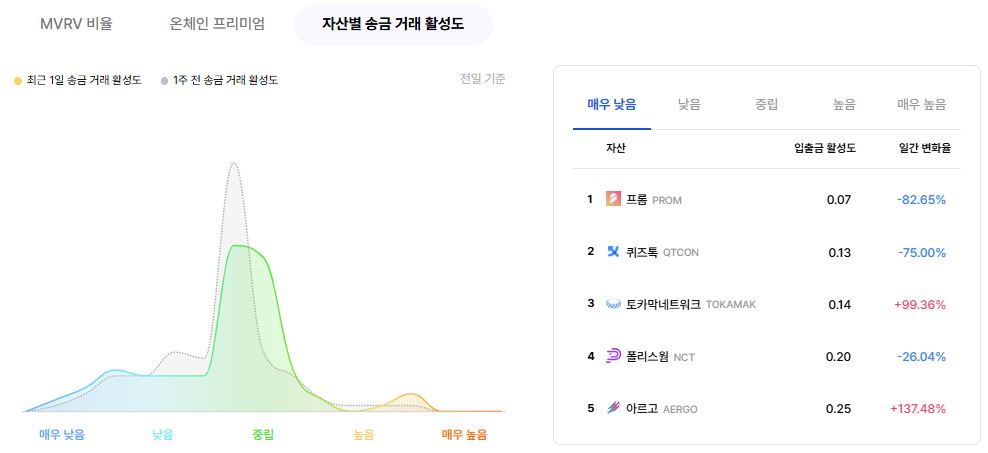

Blockchain transfer activity is generally active. 64 assets showed increased transfer activity compared to the previous day, while 34 assets decreased.

This indicator evaluates daily transfer frequency compared to the 30-day average and is used to indicate changes in on-chain demand and network utilization. Currently, transfers are active in many asset groups, interpreted as a result of short-term market recovery expectations or increased position reallocation demand.

Assets in the 'very high' activation level include ▲Altair (ALT, deposit/withdrawal activity 18.35, +3,376.13%) ▲Threshold (T, 3.26, –70.30%) ▲Big Time (BIGTIME, 2.70, +274.25%).

The 'high' range includes ▲Orbs (ORBS, 2.20, +3.96%) ▲Cartesi (CTSI, 1.74, +79.67%) ▲Cyber (CYBER, 1.60, +110.50%).

'Neutral' state assets include ▲Taiko (TAIKO, 1.46, +113.53%) ▲Bancor (BNT, 1.45, +194.21%) ▲ARPA (ARPA, 1.43, –54.73%) ▲API3 (API3, 1.39, +175.86%) ▲Sky Protocol (SKY, 1.38, +35.49%).

'Low' level assets include ▲Mask Network (MASK, 0.42, +8.50%) ▲iExec RLC (RLC, 0.45, +0.09%) ▲Civic (CVC, 0.45, –2.43%) ▲Puffer (PUFFER, 0.46, +24.57%) ▲StormX (STMX, 0.47, –6.08%).

'Very low' state assets include ▲Prom (PROM, 0.07, –82.65%) ▲Quiztok (QTCON, 0.13, –75.00%) ▲Tokamak Network (TOKAMAK, 0.14, +99.36%) ▲Plicative (NCT, 0.20, –26.04%) ▲Aergo (AERGO, 0.25, +137.48%).

The most deposited Ethereum-based assets in public exchange wallets are ▲USD Coin (USDC, 6.086 billion won) ▲Ethereum (ETH, 3.294 billion won) ▲Curve (CRV, 678 million won) ▲Uniswap (UNI, 659 million won) ▲Dent (DENT, 425 million won). This reflects deposit activities for various purposes such as expanding exchange liquidity, waiting to sell, or preparing asset exchanges.

Assets actively moved to top Ethereum holding wallet addresses include ▲Chainlink (LINK, 1.015 billion won) ▲Pepe (PEPE, 896 million won) ▲Tether (USDT, 570 million won) ▲Shiba Inu (SHIB, 84.06 million won) ▲Curve (CRV, 66.33 million won). This is interpreted as on-chain asset movement primarily for DeFi utilization or long-term holding purposes.

The most held assets in these top wallet addresses are ▲Ethereum (ETH, 110.08 trillion won), followed by ▲Tether (USDT, 13.09 trillion won) ▲USD Coin (USDC, 2.38 trillion won) ▲Shiba Inu (SHIB, 2.10 trillion won) ▲Chainlink (LINK, 1.26 trillion won). These assets simultaneously serve as key liquidity and storage means within the Ethereum network.

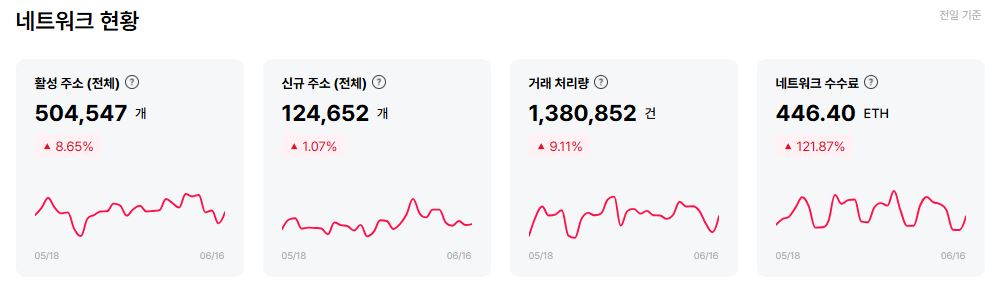

The total number of active addresses on the Ethereum blockchain was 504,547, an 8.65% increase from the previous day. This figure is calculated when a wallet or smart contract generates at least one transaction, interpreted as on-chain participation regaining vitality.

The number of newly created addresses is 124,652, an increase of 1.07% compared to the previous day. Although the address creation rate is limited, it shows that new participants are steadily entering.

The total number of transactions processed in a day is 1,380,852, an increase of 9.11% compared to the previous day. This signals a substantial increase in on-chain activity, along with the activation of dApp usage and token movement.

Meanwhile, the total fees generated on the Ethereum network are 446.40 ETH, a sharp increase of 121.87% compared to the previous day. This is analyzed to be due to a surge in network usage with an increase in fee rates or the concentration of specific high-cost transactions.