Over the past 24 hours, approximately $217 million (about 31.7 billion won) worth of leverage positions were liquidated in the cryptocurrency market.

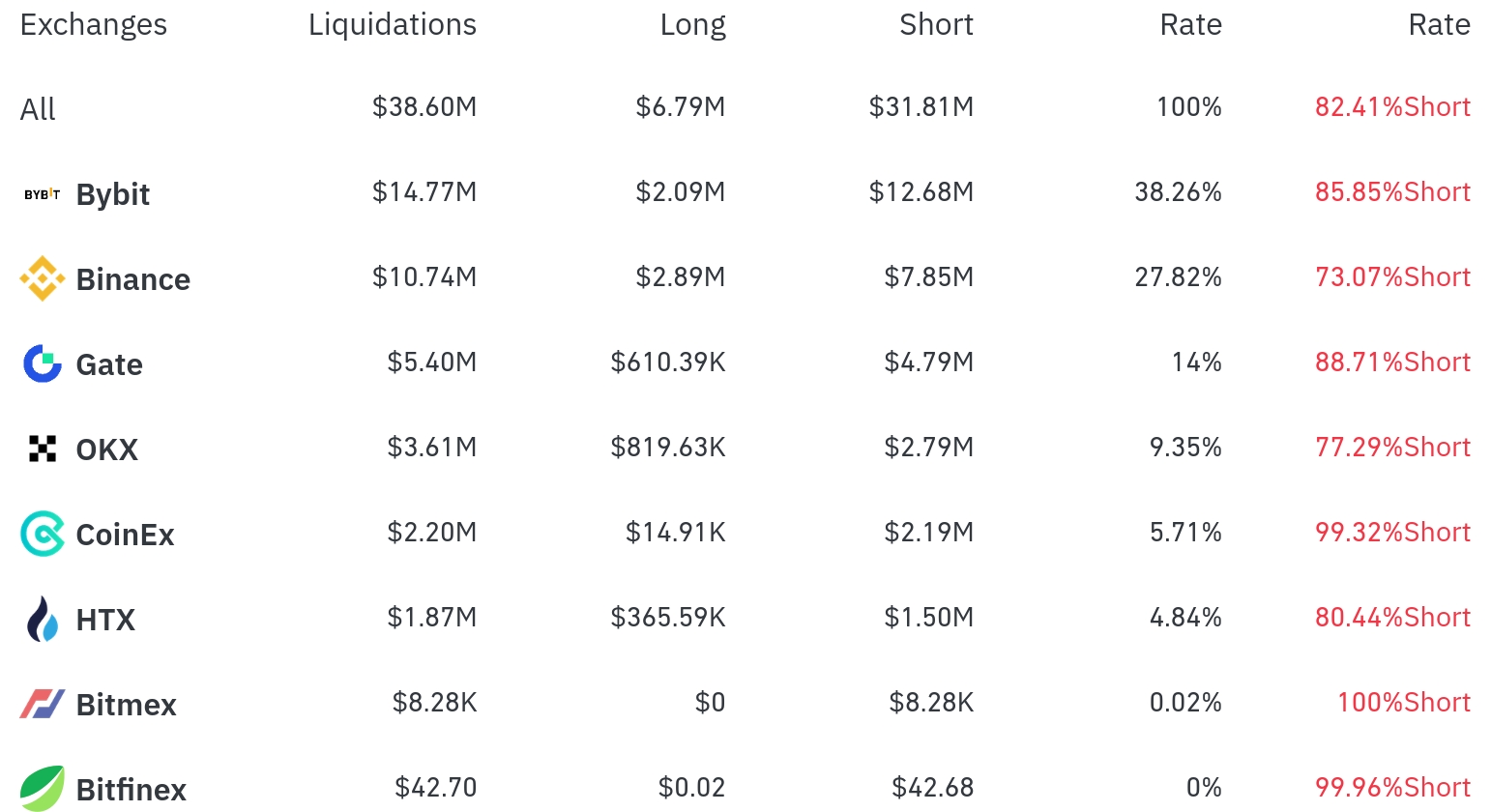

According to the currently compiled data, interestingly, Short positions were overwhelmingly liquidated in this liquidation. Looking at the liquidation data from major exchanges over 4 hours, Short position liquidations accounted for 70-90% at most exchanges.

Over the past 4 hours, Bybit had the most position liquidations, with a total of $14.77 million (38.26% of the total) liquidated. Among this, Short positions accounted for $12.68 million, or 85.85%.

Binance was the second-highest in liquidations, with $10.74 million (27.82%) of positions liquidated, of which Short positions were $7.85 million (73.07%).

Following them, Gate recorded $5.4 million (14%), and OKX recorded $3.61 million (9.35%) in liquidations. Notably, CoinEx had a 99.32% Short position liquidation rate, and while BitMEX had a small liquidation scale, all of it was Short positions.

By coin, ZKJ-related positions were the most liquidated. Approximately $103.76 million was liquidated from ZKJ positions in 24 hours.

Bitcoin (BTC) had about $42.87 million in positions liquidated over 24 hours, with a maximum of $14.49 million in Short position liquidations over 4 hours. Bitcoin's price is currently $106,766, up 1.61% over 24 hours.

Ethereum (ETH) had about $51.91 million in positions liquidated over 24 hours, with $7.5 million in Short position liquidations over 4 hours. Ethereum's price is $2,615, up 3.82% over 24 hours.

Solana (SOL) had approximately $13.95 million liquidated over 24 hours and triggered Short position liquidations with a 6.98% increase.

Doge rose 1.16% and had $1.59 million in Long positions and $1.11 million in Short positions liquidated over 4 hours.

TRUMP, a Trump-related Token, showed a relatively stable performance with a 0.94% increase, but still had about $90,000 in Long positions and $110,000 in Short positions liquidated.

Notably, FARTCO Token dropped 5.31% with approximately $3 million in positions liquidated over 24 hours, and HYPE triggered Short position liquidations with a significant 9.19% increase.

This large-scale Short position liquidation shows that traders who took short-selling positions have incurred massive losses as the recent cryptocurrency market's upward trend strengthens. Particularly, with major cryptocurrencies like Bitcoin, Ethereum, and Solana rising simultaneously, a market-wide short squeeze phenomenon appears to have occurred.

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>