Recently, the Altcoin Season Index dropped to 26, far below the "Altcoin Season" threshold of 75, indicating that the market is still in the BTC Season phase. However, historical data shows that the index often rebounds after hitting bottom, so do Altcoins still have a chance this year? How should retail investors respond?

VX: TZ7971

Decreasing Inflow of Funds in the Market: Stable Fluctuations

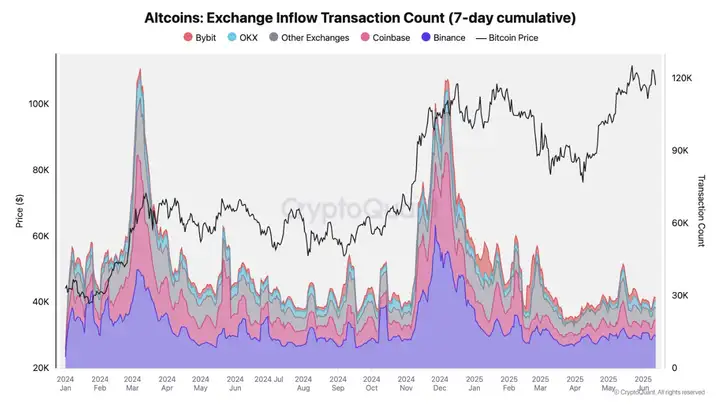

Despite the violent price fluctuations in the Altcoin market, the number of Altcoins flowing into exchanges remains surprisingly low.

At major exchanges like Binance, Coinbase, OKX, and Bybit, Altcoin deposit transaction volumes rarely exceed 30,000 transactions—far below the peak of over 100,000 transactions during the significant pullbacks in March and December 2024.

Unlike previous instances where Altcoins were massively sold before major pullbacks, current data shows a clear change in investor behavior. Instead of pushing tokens to exchanges for sale, they are choosing to transfer assets to decentralized exchanges (DEX) or convert them to stablecoins like USDC or USDT for value preservation.

Lateral movement and lack of selling pressure indicate that market sentiment is becoming more cautious—and may also suggest that the adjustment cycle will unfold differently.

However, considering only centralized exchange data may not fully reflect market conditions.

The continued low fund inflow suggests that investors are not eager to close positions. This reflects more stable market sentiment with reduced panic—possibly indicating the formation of a continuous accumulation phase.

Against the backdrop of escalating geopolitical tensions, panic is subsiding, replaced by a "cleaning" and reorganization phase. This is not a period of excessive excitement or extreme fear, but one of cautious optimism. Recent volatility and liquidation waves are helping the market restore order.

Can the Altcoin Season Index Be Reversed?

According to the Altcoin Season Index data, the index previously broke through 30 but has now fallen to 26, indicating that BTC continues to lead market pulse during recent fluctuations.

However, Altcoins are not completely eliminated. Some signs of recovery have begun to emerge, suggesting market recovery potential.

If the index breaks through 50, it will clearly indicate the start of a true Altcoin season. Currently, the balance still leans towards BTC—but in the crypto world, things can change overnight.

Will 2025 Repeat the 2021 Pattern?

Reviewing the Altcoin cycles of 2021 and 2025, a striking similarity immediately catches attention: both exhibited a "double false breakout" pattern—two consecutive price traps slightly below the 1-month moving average, followed by a strong market rebound.

In 2021, this pattern initiated months of Altcoin bull market.

In 2025, the market broke through the $180 billion support twice but showed clear rebounds afterward. The technical structure is gradually forming, but whether the breakthrough trend truly occurs depends on subsequent market movements.

However, liquidity and macro factors are not truly present in the 2025 market landscape. If the Altcoin market cap can maintain steady growth and reach the $270 billion threshold, a widespread breakout is entirely possible.

Conversely, if prices fail to hold above key moving averages, the current upward trend might be offset. Although technical signals suggest the market is prepared, actual cash flow is still needed to consolidate the upward trend.

Signs of Potential Altcoin Season

BTC Momentum Slows, Funds May Overflow: If BTC consolidates around $120,000, some profit funds might shift to Altcoins.

ETH/BTC Ratio Rebounds: ETH's recent performance outpacing BTC might drive Altcoin sentiment.

Institutional Predictions of Approaching Altcoin Season: If BTC.D has peaked, funds might move to Altcoins.

How Should Retail Investors Operate? Strategy Recommendations

Short-term (1-3 months)

Watch BTC Trend Closely: If BTC.D drops below 60%, gradually deploy in strong Altcoins (like ETH, SOL, DeFi blue-chips).

Focus on Narrative-Driven Opportunities: AI, RWA, chain games might still rotate, but require quick entry and exit.

Avoid High FDV, Low Liquidity Projects: Altcoins with high VC unlock selling pressure carry extreme risk.

Medium to Long-term (6-12 months)

Dollar-Cost Average Undervalued Blue-Chips: Like UNI, LINK, AAVE, deploy at low points.

Wait for Policy Catalysts: If US crypto regulation becomes clearer, compliant Altcoins might see opportunities.

Control Position Ratio: Prevent extreme volatility risks.

If BTC consolidates or corrects, some Altcoins might rebound, but careful selection is crucial. The market remains BTC-dominated, with a comprehensive Altcoin season possibly delayed until late 2025 or early 2026. Patiently wait for the BTC.D turning point, prioritize high-liquidity, strong narrative Altcoins, and avoid blindly chasing shit coins. Be wary of "premature Altcoin All-in" risks and maintain a flexible strategy.