In the past 24 hours, approximately $90.6 million (about 132.5 billion won) worth of leveraged positions were liquidated in the cryptocurrency market.

According to the currently compiled data, long positions accounted for $73.76 million, representing 81.4% of the total liquidations, while short positions were $16.84 million, accounting for 18.6%.

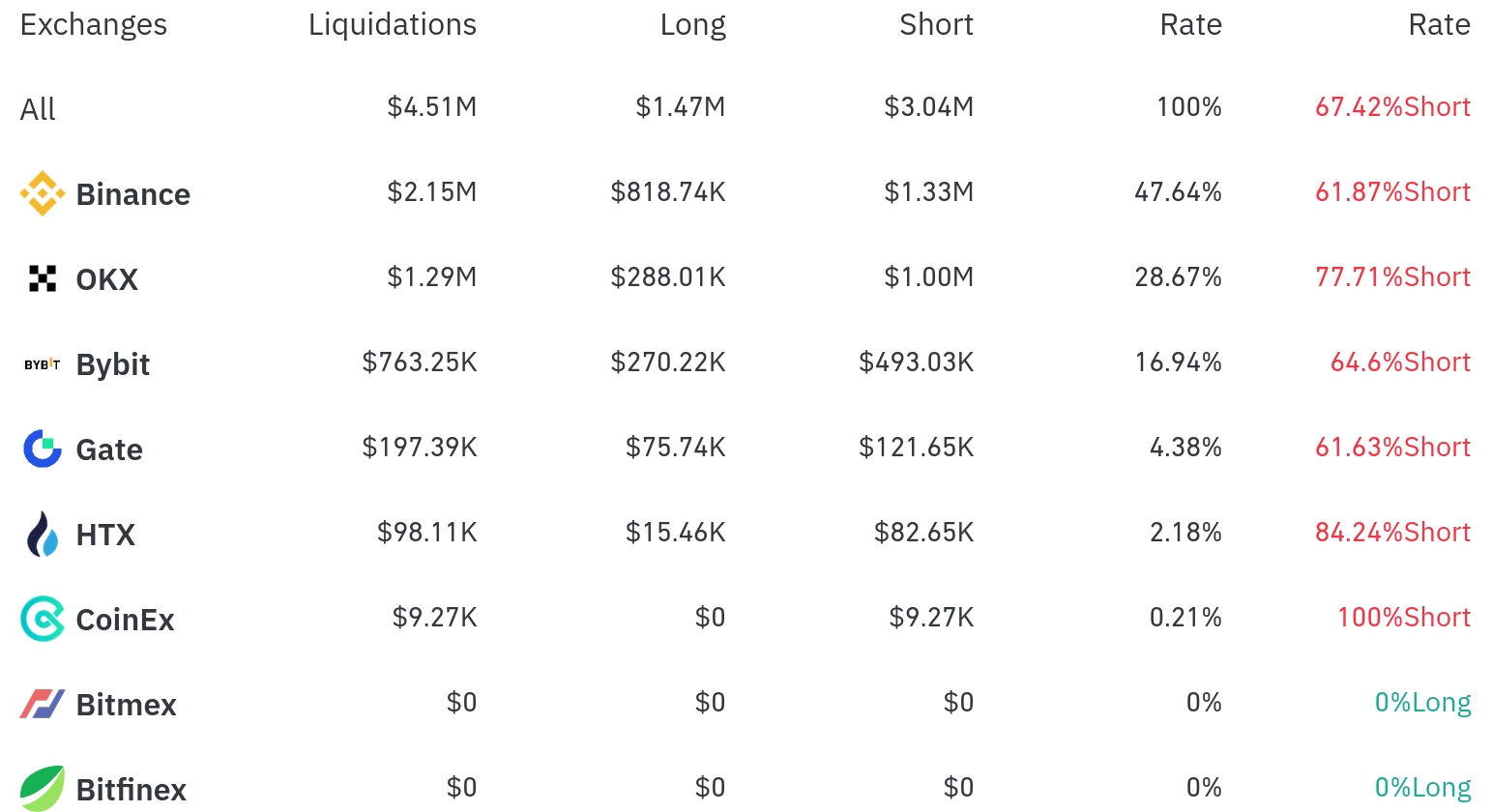

Binance experienced the most position liquidations in the past 4 hours, with a total of $2.15 million (47.64% of the total) liquidated. Notably, short position liquidations were $1.33 million, accounting for 61.87%, which was higher than long positions ($816,000).

OKX was the second-highest exchange with liquidations, with $1.29 million (28.67%) of positions liquidated, of which short positions were $1 million, representing 77.71%.

Bybit saw approximately $760,000 (16.94%) in liquidations, with short position liquidations also high at 64.6%.

Interestingly, CoinEx showed 100% short position liquidations, and most major exchanges observed a predominance of short position liquidations.

By coin, Ethereum (ETH) recorded the most liquidations. Approximately $50.54 million in Ethereum positions were liquidated in 24 hours, with $1.25 million (long $140,000, short $1.11 million) liquidated in 4 hours.

Bitcoin (BTC) had about $23.11 million in positions liquidated in 24 hours, with $87,000 liquidated in 4 hours. Notably, short position liquidations were overwhelmingly high at $85,000 during this period.

Solana (SOL) saw approximately $6.14 million liquidated in 24 hours, with about $300,000 liquidated in 4 hours, also with short position liquidations predominant.

Other notable coins include HYPE, which dropped 5.35% in price and saw about $770,000 in liquidations in 24 hours, and FARTCO, which experienced a 4.29% price drop with approximately $2.86 million in liquidations.

Meme coins PEPE and 1000PEPE also saw significant liquidations, with 1000PEPE experiencing about $2.94 million in liquidations over 24 hours.

The Trump-related token TRUMP also saw about $1.70 million in liquidations with a 1.32% price drop.

A notable aspect of this liquidation data is that most exchanges showed predominant short position liquidations, suggesting that traders who anticipated a rebound in the recent bearish market suffered losses. Market participants are advised to be cautious with leveraged trading as the current volatility may continue.

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>