Despite Israel's recent air strikes on Iran, Bitcoin (BTC) remains stable at around $106,000.

Bitcoin's short-term price trend will depend on the developments of the Iran-Israel conflict today and over the weekend. The biggest risk is that if Iran closes the Hormuz Strait, oil prices will surge and risk assets will plummet. If this happens over the weekend, 24/7 markets like cryptocurrencies will be the first to be impacted.

VX: TZ7971

However, Bitcoin's long-term prospects are less influenced by geopolitics and more related to the weakening US dollar (recently falling to a three-year low), indicating that assets with limited supply like Bitcoin have long-term growth potential.

As an emerging macro asset, Bitcoin continues to be closely watched by retail and institutional investors. However, as Bitcoin gradually develops into an independent asset class, the market remains divided on whether it possesses both risk and "safe haven" attributes.

Despite Macro and Geopolitical Instability, Large Funds Continue to Flow into Bitcoin

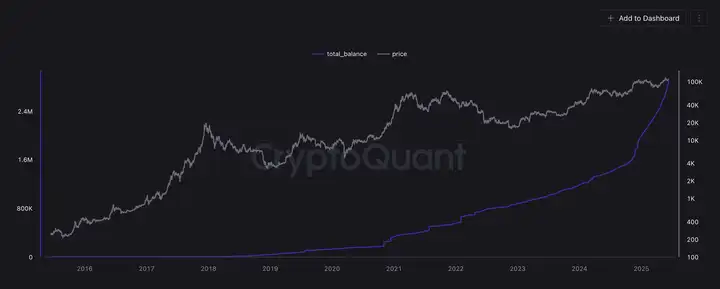

Despite macroeconomic uncertainty and escalating geopolitical tensions, long-term holders continue to accumulate BTC.

Specifically, wallets in the "accumulation address" group (defined as wallets that have never sold a satoshi and have been active in the past seven years) recorded an inflow of 30,784 BTC (equivalent to about $3.3 billion) on June 11th. This is the highest daily inflow so far in 2025.

After this surge, the total BTC held by accumulation addresses has reached 2.91 million BTC. Currently, their average price is around $64,000.

Today's fear index is 63, still in a greedy state.

The conflict is ongoing, so the current market is cautious about significant rises. Continue holding BTC, as it won't drop much.

Currently, ETH has become the focus of funds flowing against the trend. On-chain data reveals that most institutions and whales are "adding positions to protect the market". The stable upward channel is still maintained, and combined with seasonal adjustments and year-end investment strategies, multiple signals support a breakthrough rise for ETH by the end of 2025. The institutionalization trend is gradually pushing ETH into the mainstream investment market. So currently, ETH's cost-effectiveness is higher than BTC, just buy in batches at 2500-2300-2000.

The current market environment is extremely favorable for Bitcoin, and it is expected to continue rising in oscillation. Before reaching at least $140,000 to $160,000, the possibility of a deep correction of over 30% is low. The policies Trump adopted during the trade war once served as a key bottom signal for Bitcoin.

Currently, the focus should be on:

1. Reducing leverage to avoid liquidation

2. Monitoring key support levels

3. Shifting to stablecoins for hedging

4. Tracking institutional fund flows, building positions in batches to avoid one-time investment