At Bitcoin 2025, MicroStrategy co-founder Michael Saylor proposed that accumulating Bitcoin is the best way for people of all social strata and ages to achieve financial freedom. Saylor added that digital assets will soon occupy half of the world's value.

According to experts, this vision can only be realized in an ideal world. Representatives from Fedrok AG, Bitget Wallet, and Bricken explained that Bitcoin needs greater scalability, less institutional pushback, and more stability to absorb global wealth. Only when these factors align can Saylor's vision become reality.

Saylor, Bitcoin as the Ultimate Path to Wealth

Saylor recently gave a "21 Ways to Wealth" speech at Bitcoin 2025 in Las Vegas. As the strategic executive chairman and aggressive Bitcoin accumulator, he presented a comprehensive guide to building financial freedom around digital assets.

The central pillar of Saylor's vision was that individuals can add Bitcoin to their portfolio and invest in a brighter future, regardless of age and socioeconomic status.

21 Ways to Wealth pic.twitter.com/SiOVbuxmE5

— Michael Saylor (@saylor) May 31, 2025

He argued that the decentralized, programmable, and corruption-resistant characteristics of digital assets will ultimately become the dominant global currency standard, surpassing all other currencies over time.

While not explicitly mentioning the term, Saylor strongly advocated for the basic philosophy of hyperbitcoinization.

This concept suggests that as trust in traditional financial systems decreases, Bitcoin's inherent advantages will lead to a rapid and irreversible emergence as the world's primary currency.

Hyperbitcoinization: Prediction or Illusion?

Experts are divided on the feasibility of Saylor's speech. Bricken's market analyst Emmanuel Cardozo is optimistic that Bitcoin can eventually outperform its competitors. However, he acknowledges that this vision will not be immediate.

"Bitcoin's fundamental elements are clear: scarcity, decentralized nature, and increasing institutional adoption make it an excellent hedge against fiat currency devaluation. This is why Bitcoin is the fifth-largest asset in the world. As fiat currencies trend towards zero against BTC over time, there's a high likelihood it will become a global value store within 5 to 10 years." – Emmanuel Cardozo, Bricken Market Analyst

Other experts are less hopeful. They argue that hyperbitcoinization is more of an illusion than a prediction.

Bitcoin's lack of productivity compared to traditional assets like businesses, real estate, and commodities, its high volatility, and inability to generate returns or utility make this scenario unrealistic.

"Ultimately, Saylor's vision is more rooted in ideological belief than practical economics. While Bitcoin can remain a valuable alternative asset class or hedge against inflation, the concept that it will replace or dominate all other assets and currencies is impossible." – Fedrok AG CEO Philip Blazdel

Blazdel based his argument on several key factors that undermine Bitcoin's potential for dominance.

Power Struggle: Bitcoin vs. Central Control

For Bitcoin to become globally dominant, the current banking system and governments would need to relinquish their control. They will not do so without a fight, and their power grip remains solid.

"The biggest obstacle is not technology, but power. Governments are unlikely to give up control of monetary policy. A transition to a Bitcoin-based system will face structural resistance at the highest levels." – Bitget Chief Operating Officer Alvin Kan

Blazdel agreed that hyperbitcoinization is impossible without this power monopoly. Recognizing this, governments have placed multiple obstacles to hinder widespread cryptocurrency adoption.

"The vision of Bitcoin being 'valued at half of everything' requires a radical transformation of the global financial system, starting with the collapse or abandonment of fiat currencies. For Bitcoin to replace sovereign currencies, governments would need to surrender control of monetary policy, taxation, and debt issuance. This is highly unlikely. Historical and current trends show that nations strongly protect their financial authority, as evidenced by cryptocurrency bans and regulatory crackdowns in major economic countries." – Philip Blazdel

Global dominance in this context requires widespread adoption. However, Bitcoin is currently absent from most investor portfolios.

Bitcoin Adoption: Why Isn't Cryptocurrency Growth Keeping Pace?

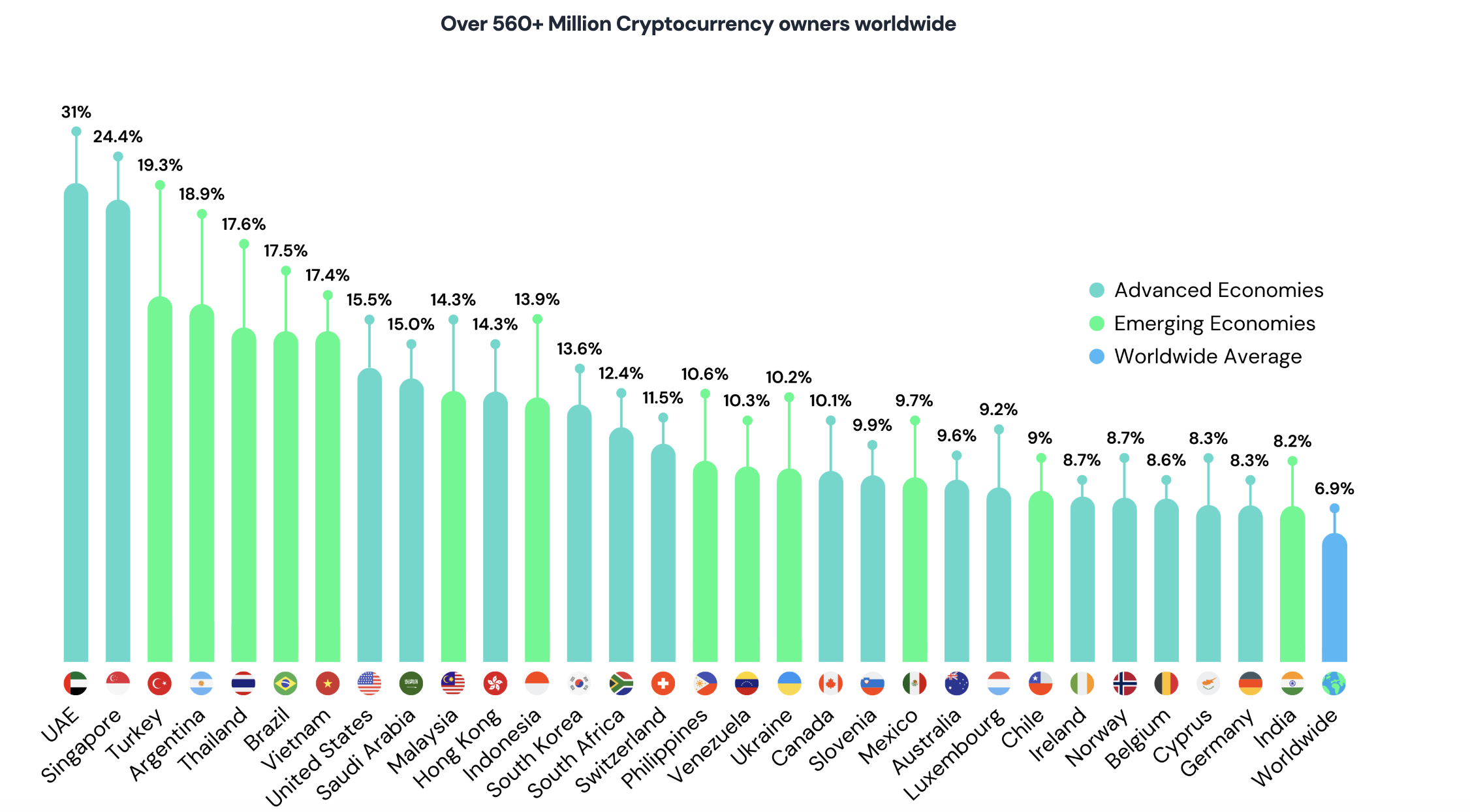

As of 2024, data from Triple-A indicates that approximately 6.9% of the global population, or over 560 million people, own cryptocurrencies. Bitcoin ownership is expected to be lower, with various reports suggesting figures between 1% and 3%.

Bitcoin's price volatility, one of its inherent characteristics, hinders the path to widespread adoption, particularly making its role as a stable medium of exchange difficult.

"Unpredictable volatility is dangerous for wealth preservation and impractical for pricing goods or services. Until greater stability is achieved, Bitcoin will remain a speculative asset rather than a reliable tool for everyday financial use." – Blazdel said to BeInCrypto.

In this regard, stablecoins are more suitable for general use cases. At the same time, common misconceptions about Bitcoin ownership hinder retail investors' adoption.

In particular, the fact that one Bitcoin is valued at over $100,000 makes investors think that only wealthy individuals can afford such assets.

"The notion that Bitcoin is too expensive often ignores the fact that it can be divided down to 0.00000001 BTC. However, perception matters. Many retail users still equate value with whole units. This psychological barrier will persist until better education is provided." – Khan explained.

These misunderstandings can cause traders to explore other cryptocurrencies, drawing attention away from Bitcoin.

'Cheaper' Altcoins and the Reason for Their Popularity

Altcoins and meme coins are more attractive to retailers due to their lower per-unit price. This stems from a lack of understanding that Bitcoin can be easily divided into smaller units or satoshis.

"This price tag typically scares the average investor. It feels 'cheaper' especially when altcoins are $1 or $100, despite being riskier investments. This perception makes people think Bitcoin is only for the rich or institutions. In fact, ordinary people are missing long-term potential due to lack of education. This is unfortunate, given that Bitcoin's fundamental is a robust investment against fiat currency depreciation over time." – Cardozo mentioned.

Regarding education, Bezel emphasized the importance of understanding and knowing how to hold Bitcoin's value.

"Managing private keys, understanding wallet options, and securing funds require technical literacy that many users lack. This steep learning curve hinders mainstream adoption and makes Bitcoin less accessible to non-professionals." – He said.

However, widespread education will yield no results without reliable infrastructure that can manage increased transaction volumes.

Scalability and Energy Footprint Concerns

Scalability is often cited as the Achilles' heel of cryptocurrencies. Most blockchains, including Bitcoin, suffer from slow transaction speeds. If the blockchain cannot handle demand from global Bitcoin adoption, the entire attempt becomes meaningless.

"Bitcoin's limited scalability is a major technical obstacle. The network processes about 7 transactions per second. This is far insufficient compared to the global financial system that requires thousands of transactions." – Bezel told BeInCrypto.

Meanwhile, Bitcoin mining consumes significant energy. High resource demand and subsequent regulatory pushback make widespread adoption even more challenging.

"Bitcoin's Proof of Work consensus mechanism consumes massive electricity comparable to a small country's energy usage. This raises critical environmental concerns and conflicts with global emphasis on ESG (Environmental, Social, Governance) standards. As institutions and governments increasingly prioritize sustainability, Bitcoin's high energy consumption could limit integration into a regulated financial ecosystem." – He added.

Ultimately, the remaining obstacles for Bitcoin to reach hyperbitcoinization are larger than its advantages.

Saylor's Bitcoin Vision: Reality?

While Saylor strongly believes in Bitcoin's ultimate ascent, its future dominance depends on its ability to overcome the many obstacles currently faced.

His strong conviction should not be dismissed, but Saylor's vision will not be realized in the short term. Therefore, investors should approach with caution.

"It depends on the individual. Bitcoin can play a role in a diversified portfolio, but it's not an asset suitable for everyone. It's more appropriate for those who understand the risks due to volatility and regulatory uncertainty." – Khan concluded.

Bitcoin is certainly securing its place in the future of finance, but current limitations suggest it remains a selective and high-conviction investment, not a standard choice for everyone.