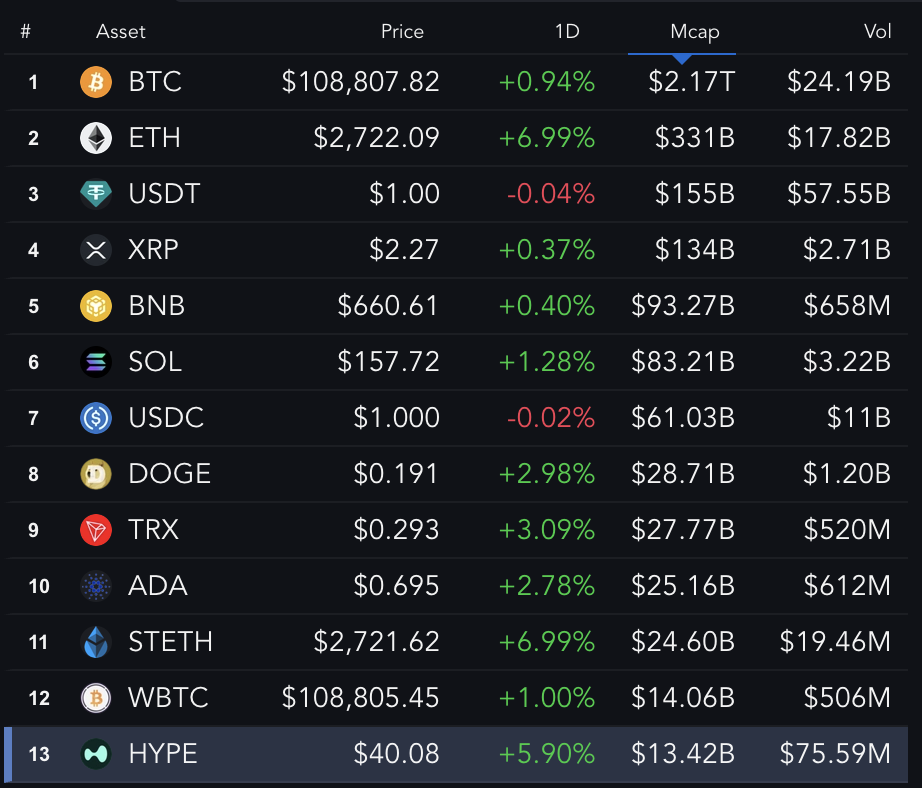

Three tokens most discussed in the market for potential Binance listing - HYPE, SPX6900, and AERO - are approaching significantly. Hyperliquid's HYPE has surpassed $40 and has become a top 10 cryptocurrency asset by market capitalization based on strong revenue and dominance in the perpetual market.

Meme coin SPX6900 has outperformed its peers, rising 111% last month and approaching its all-time high. Meanwhile, AERO is leading DeFi on Base and shows signs of a strong rebound despite recent adjustments.

Hyperliquid (HYPE)

HYPE has been recording new all-time highs over the past few weeks, currently trading above $40. Hyperliquid remains one of the most dominant forces, especially in the perpetual market.

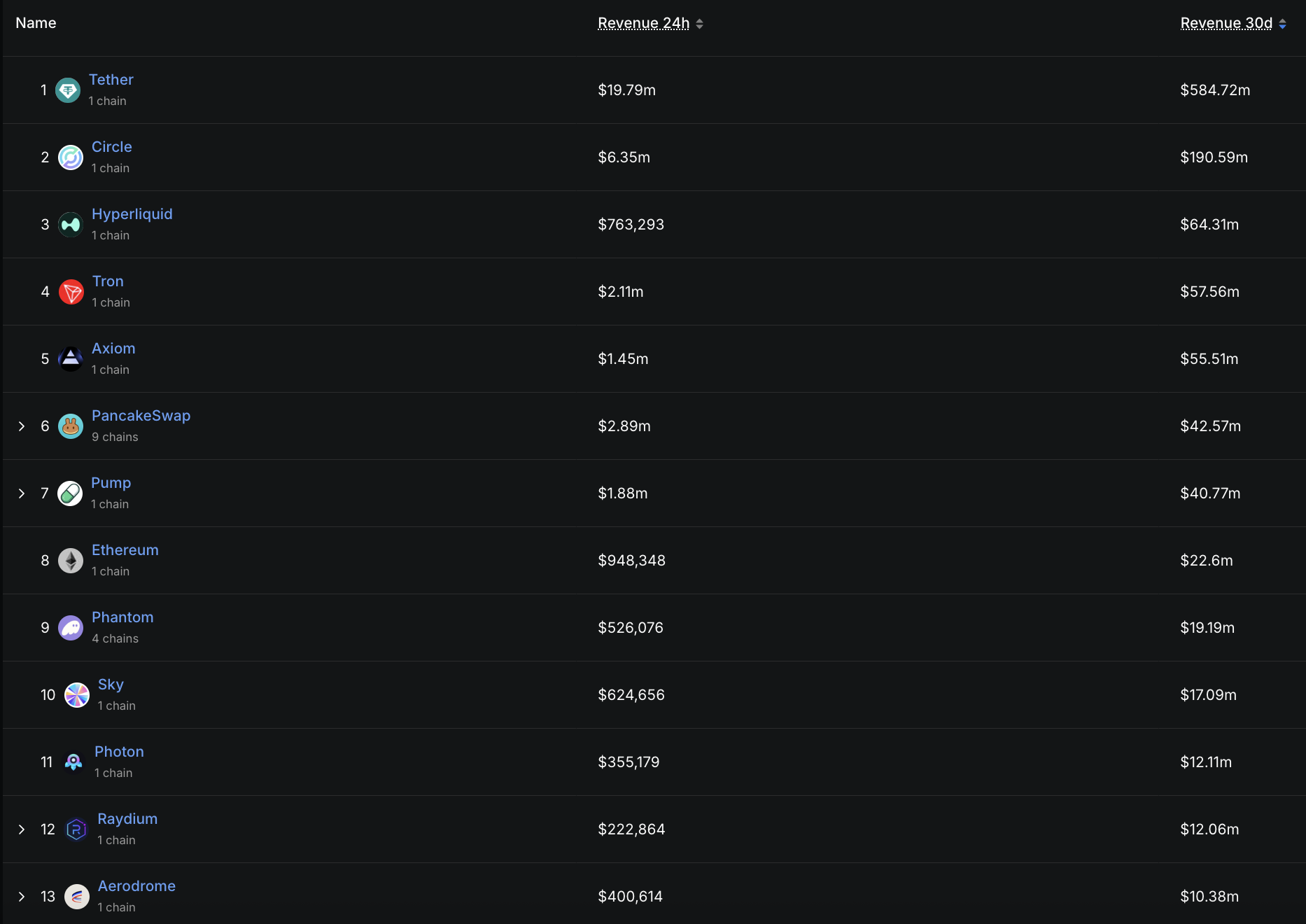

It has generated $64.3 million in revenue over the past 30 days, positioning itself just behind Tether and Circle.

This places Hyperliquid ahead of major players like TRON, Axium, Pump, and PancakeSwap, firmly establishing its position as a core revenue engine in this space.

HYPE has now established itself among the top 10 cryptocurrency assets by market capitalization - excluding stablecoins and wrapped tokens - with a valuation of $13.4 billion.

This rapid rise demonstrates its influence, and considering it is already listed on Binance US, it becomes a strong candidate for Binance listing.

By strengthening its momentum and market position, a broader Binance listing could further enhance HYPE's visibility and liquidity.

SPX6900

SPX6900 has emerged as one of the most popular meme coins in recent weeks, recording a 111% increase over the past 30 days.

It has now entered the top 10 meme coins by market capitalization, positioned just behind BONK.

Currently trading near its previous all-time high of $1.55, SPX6900 appears ready to test and potentially break through that level.

As the only meme coin in the top 10 to rise last month, it highlights its relative strength during the meme coin sector's adjustment period. This performance could increase its chances of Binance listing.

Aerodrome Finance (AERO)

AERO continues to lead as the top DEX on the Base blockchain, maintaining its dominance despite new apps like ZORA gaining attention. It remains a key driver of DeFi activity and user growth on Base.

Aerodrome generated nearly $10.4 million in revenue over the past 30 days, becoming the 13th largest protocol or chain by revenue.

With DEX trading volume on Base reaching $31.5 billion over the past 30 days, it has become the fourth-largest chain by DEX trading volume. AERO is gaining significant benefits from the ecosystem's continuous expansion, especially as content coins strive to achieve meaningful adoption.

Despite a 16.5% decline over the past 30 days, AERO showed signs of recovery, rising nearly 14% in the past 24 hours. It is currently the sixth-largest coin by market capitalization on Binance Alpha.

If this new momentum continues until May, AERO could be on track to retest $1, potentially representing a 68% increase from its current price.