Cryptocurrency market participants are carefully watching several U.S. economic indicators this week that could impact the Bitcoin (BTC) price.

While inflation data has long dominated market sentiment, labor market indicators are now emerging as a key factor for BTC's next major movement.

U.S. Economic Indicators Cryptocurrency Traders Should Focus on This Week

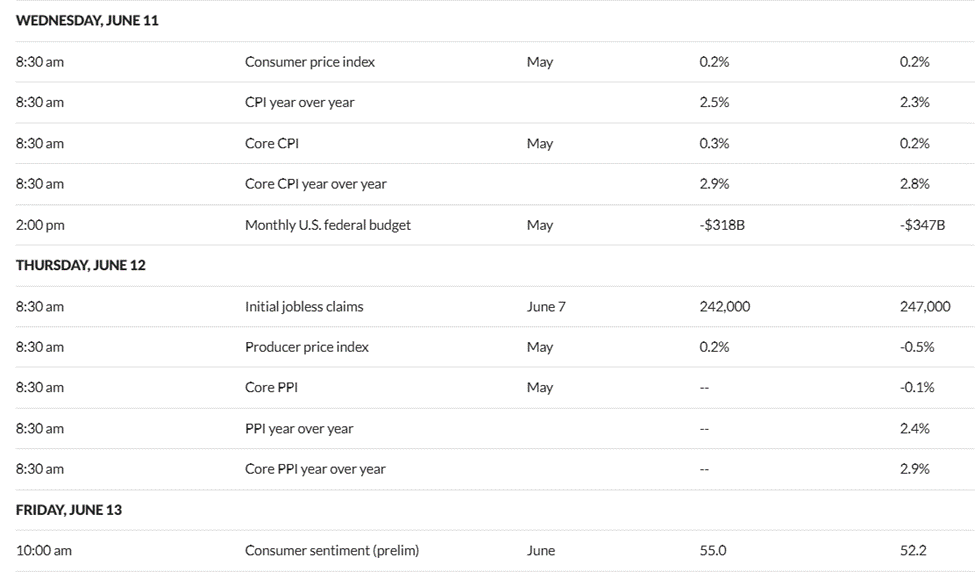

The following U.S. economic indicators can influence investor sentiment and potentially trigger Bitcoin volatility this week.

"The CPI on Wednesday and PPI on Thursday will provide a good prediction for the end-of-month PCE price. If there are no major surprises, we are likely to see a notable acceleration in this month's core figures." – Popular user on X

University of Michigan Consumer Sentiment

The University of Michigan consumer sentiment report on Friday is also an important US economic indicator that affects Bitcoin price. Economists expect it to reach 55.0 in June, which is higher than May's 52.2.

Looking back, the May consumer sentiment report showed that US consumer confidence was further deteriorating. Specifically, the consumer sentiment index dropped by 1.4 points to 52.2, which is the second-lowest in survey history, lower than during the 2008 and 1980s recessions.

The consumer sentiment index measures US consumer confidence, reflecting economic optimism or pessimism that impacts Bitcoin (BTC). It influences risk appetite and Federal Reserve policy expectations.

High sentiment (above 76.0, like 76.0 in May 2025) indicates economic strength. This can reduce the likelihood of rate cuts, strengthen the dollar, and create downward pressure on BTC price.

Conversely, low sentiment below the expected 55.0 increases expectations of Federal Reserve easing, supporting risk assets like BTC.

Major US🇺🇸 events to keep an eye this week👇

— Trader Naman (@namantrader) June 9, 2025

▪️Wednesday : CPI Inflation

▪️ Thursday : PPI Inflation

▪️ Thursday : Jobless Claims

▪️ Friday : Consumer Sentiment

▪️ Friday : Inflation Expectations

These four US economic indicators summarize consumer confidence and long-term inflation expectations, which can impact spending and overall economic growth.

According to BeInCrypto data, Bitcoin is currently trading at $105,448, which is a 0.09% decrease over the past 24 hours.