The major cryptocurrency Bitcoin has been steadily recovering after falling to its daily low of $100,424 on June 5th. While the rebound provided investors with some relief, the coin is still struggling to break through the $105,000 price level.

However, on-chain data suggests that BTC may be preparing for an upward movement due to notable liquidity concentration above the $105,000 price region.

BTC Shows Strong On-Chain Indicators…Outlook for Breaking $105,000

BTC's liquidation heatmap reveals a significant liquidity cluster around the $106,736 price area. These clusters could attract Bitcoin buyers and increase the likelihood of breaking above $105,000.

The liquidation heatmap identifies price levels with potential mass liquidation of leverage positions. These maps highlight high liquidity areas, typically distinguished by color to indicate intensity, with bright areas (yellow) representing higher liquidation possibilities.

These liquidity areas typically act as magnets for price movements, with the market moving towards them to trigger liquidations and open new positions.

Therefore, the high liquidity concentration at BTC's $106,736 price level indicates strong trader interest in buying or closing short positions at this price. This opens the door for BTC to break the $105,000 resistance and rise to the $106,000 area.

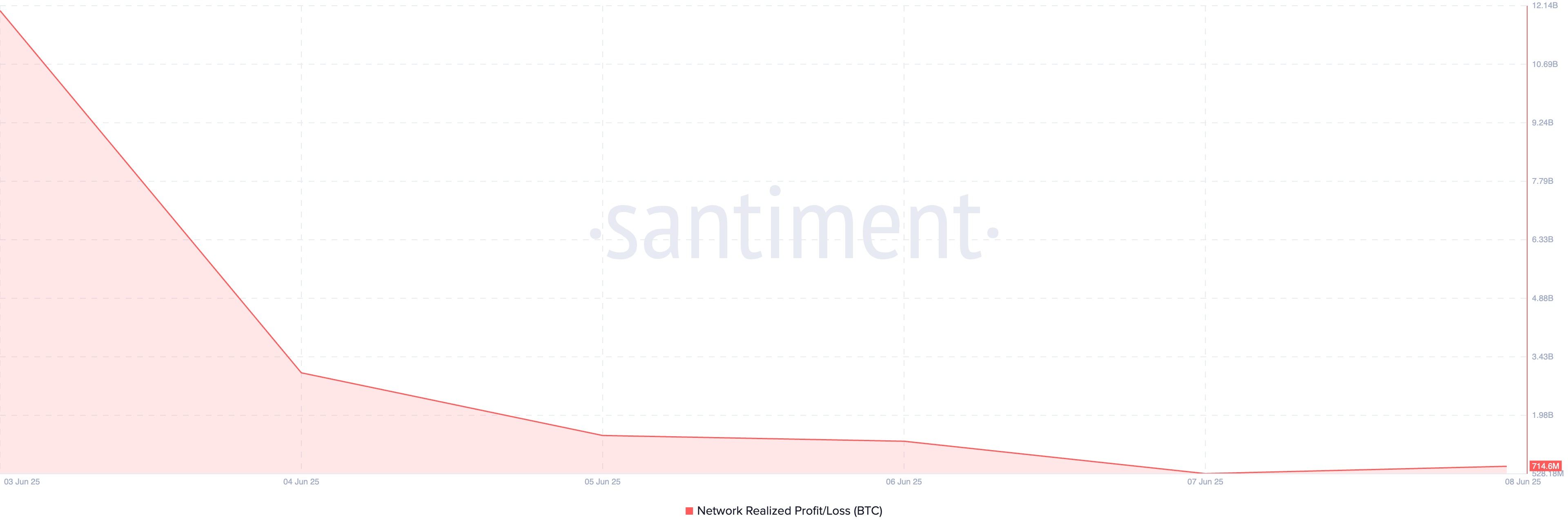

Furthermore, the decline in BTC's Network Realized Profit/Loss (NPL) supports this upward outlook. At the time of reporting, it stands at $715 million, having dropped over 90% since June 4th.

NPL measures the total profits or losses investors realize when moving coins. Historically, such a decline suppresses selling pressure and reduces traders' willingness to sell assets at a loss.

This behavior promotes longer holding periods, limits supply, and could potentially increase BTC's price in the short term.

Bitcoin's Fate: Breaking $106,000…Correction to $103,000

At the time of reporting, BTC is trading at $105,630, positioned below the resistance at $106,548. New demand entering the market could break this level and rise to the $106,736 price area where liquidity clusters exist.

Breaking this level could push BTC's price to $109,310.

However, if selling pressure intensifies, BTC could remain range-bound or potentially drop to $103,938.