Bitcoin (BTC) has concluded its recent two-week decline, with prices dropping to $100,200 before rebounding. Despite the recovery, Bitcoin remains vulnerable to price adjustments due to selling pressure from long-term holders (LTH).

The cryptocurrency market continues to be highly volatile, and Bitcoin's next price movement will depend on various factors.

Bitcoin Sales Raise Concerns

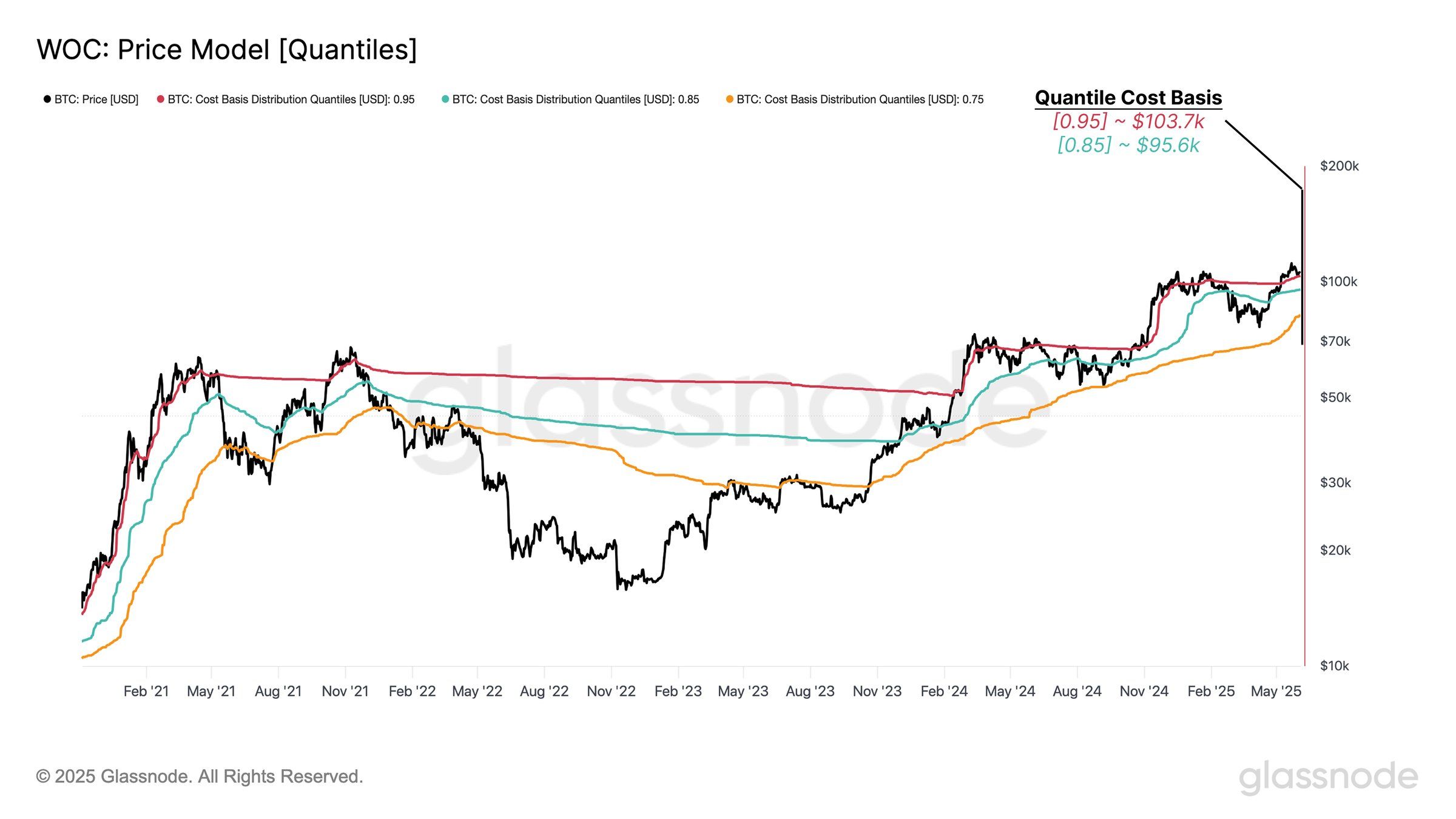

Bitcoin's cost basis distribution emphasizes important support levels in the short term. A 0.95 SSD (Saleable Supply Distribution) indicates that 95% of circulating Bitcoin supply was purchased at or below $103,700.

This suggests that only 5% of Bitcoin was acquired above this level, indicating $103,700 as a strong support zone.

Additionally, another important support level exists at $95,600, corresponding to the 0.85 SSD. This level indicates that 85% of circulating Bitcoin was acquired at lower prices and could serve as another strong support point for Bitcoin's price.

If Bitcoin faces more selling pressure, these levels could act as robust barriers against deeper declines.

Despite LTH selling pressure, Bitcoin's macro momentum suggests a positive long-term outlook.

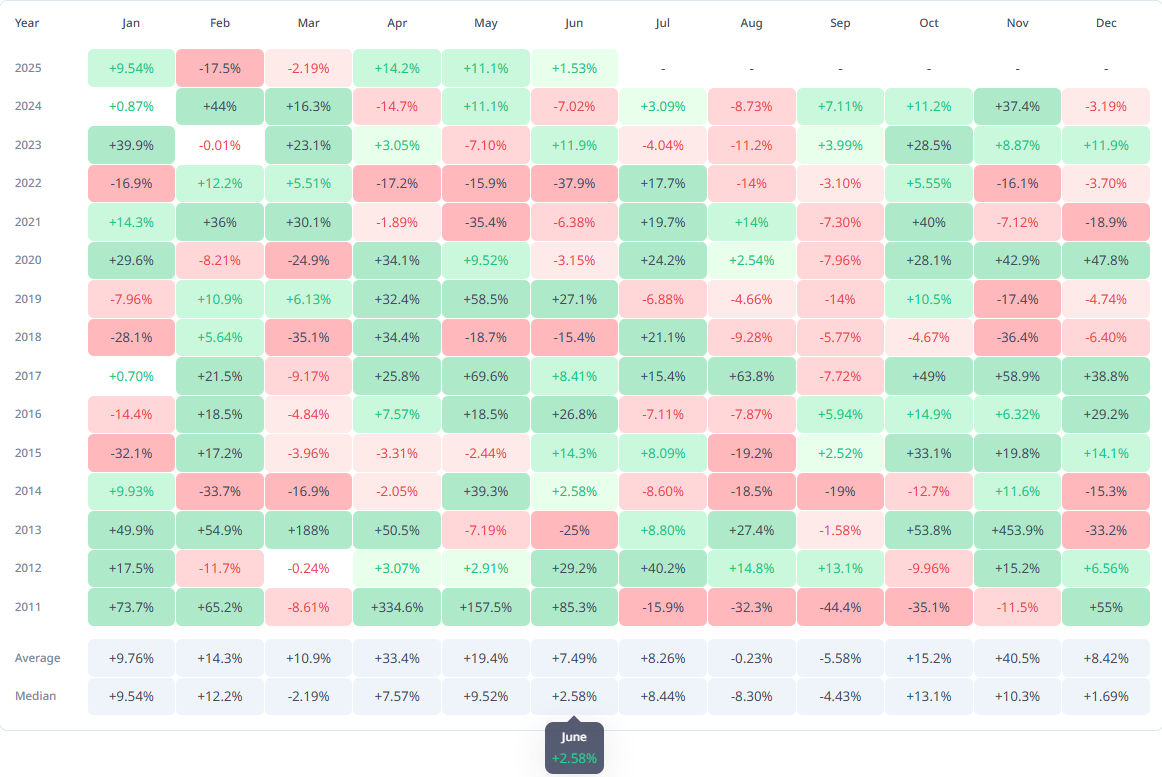

According to Bitcoin's historical monthly return data, June is generally a positive month for the asset, with a median increase of 2.58%. This indicates that while Bitcoin may experience short-term adjustments due to sales, broader market trends could support price recovery.

Historical trends suggest that Bitcoin's correction due to LTH sales is likely temporary. As Bitcoin's price shows potential for long-term growth, the market may soon shift to an upward trend, especially if broader market conditions improve.

BTC Price Has Support

Bitcoin's price has risen 4.7% over the past three days, trading at $106,263. However, the cryptocurrency remains just below the resistance level of $106,265.

Considering the current market sentiment and key support levels, Bitcoin may potentially decline in the short term.

If Bitcoin fails to maintain the $106,265 level and faces additional selling pressure, it could break through the $105,000 support and move to $103,700.

This level can provide substantial support, as confirmed by the cost basis distribution. In a more bearish scenario, Bitcoin could drop to the next support level at $102,734.

Conversely, if the broader market shifts to an upward trend and offsets LTH sales, Bitcoin could surpass the $106,265 resistance level.

Successfully breaking this level could see Bitcoin moving towards $108,000 or higher, potentially invalidating the current bearish logic and signaling potential price appreciation.