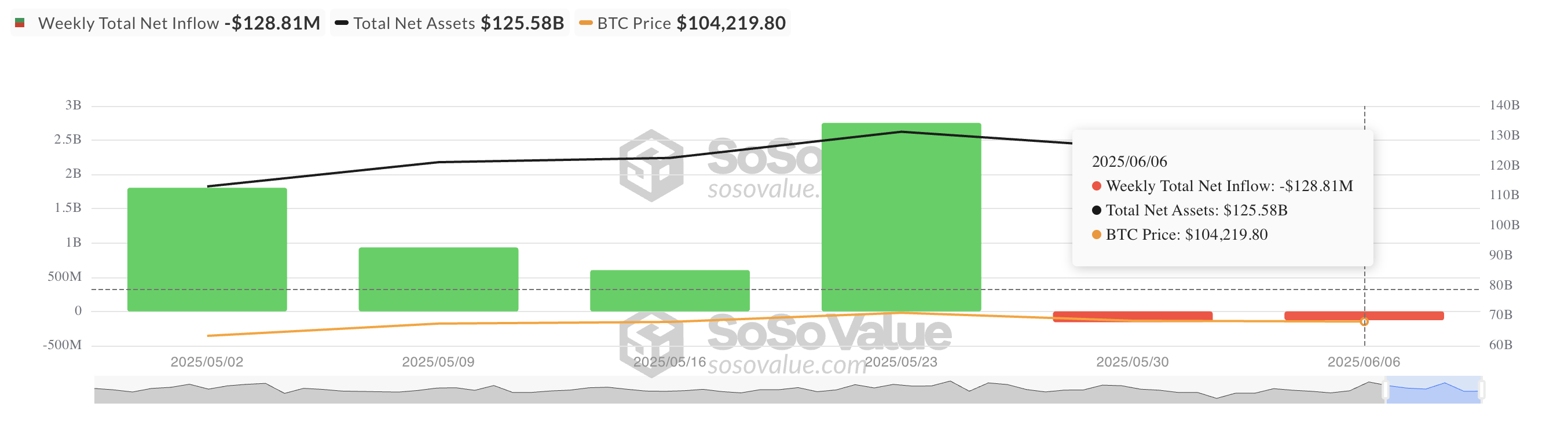

Last week, the US-listed spot Bit ETF recorded a net outflow exceeding $120 million.

This figure reflects investors' continued caution, but shows a slight improvement from the larger outflow of the previous week, suggesting a slight return of bullish sentiment.

BTC ETF Outflow Decreases…After Large Sell-off on June 5th

According to SosoValue, a net outflow of $129 million occurred from spot BTC ETF from June 2nd to June 6th. The moderation of capital outflow suggests that while some institutional investors remain cautious, others are showing increased risk appetite.

Last week, the largest single-day outflow occurred on June 5th, when BTC's price dropped to a daily low of $100,372. This decline weakened sentiment across the ETF market, with net outflows reaching $278.44 million that day.

However, the reduction in outflows on the following trading day demonstrates market resilience despite BTC's poor price performance.

Bit Futures Weak…Options Strong

Today, BTC is trading at $105,488, recording a price drop of 0.13%. The coin has resumed sideways trading, reflecting continued uncertainty in the cryptocurrency market.

Meanwhile, the funding rate for major perpetual futures markets has turned negative, indicating that more traders are expecting further short-term decline. The current rate is -0.0056%.

The funding rate is a periodic payment between perpetual futures contract traders to align contract prices with spot prices. When the funding rate is negative, demand for short positions is higher. This trend indicates that more traders are anticipating BTC's price decline, increasing downward market pressure.

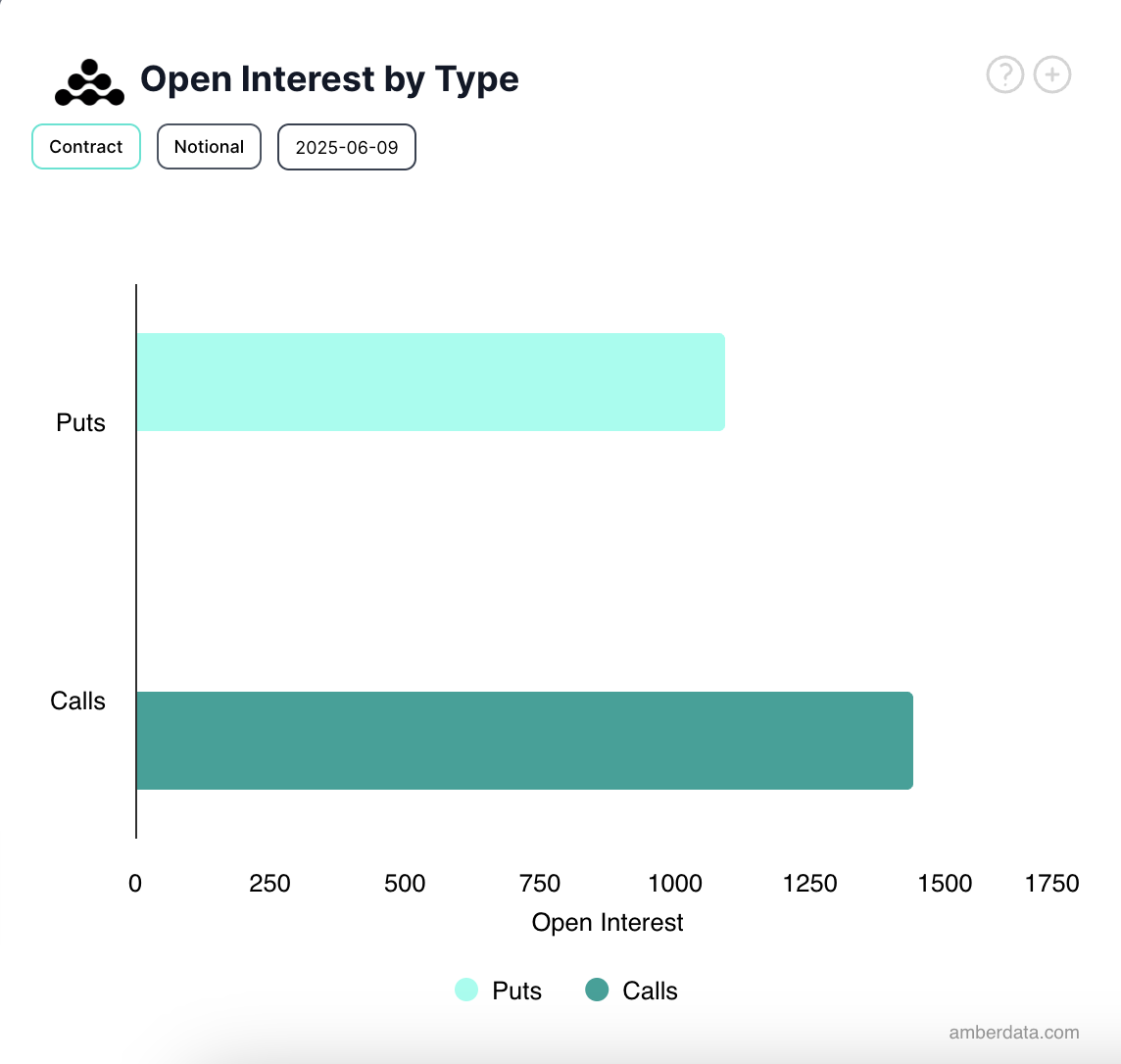

However, BTC options data provides some relief. According to data from Deribit, BTC options traders continue to show strong demand for call options. This indicates optimism among sophisticated market participants, even amid mixed short-term indicators.

Overall, while BTC ETF weekly flows remain in deficit, the slowdown in outflows and increased bullish derivatives positioning suggest that market participants may be preparing for a potential reversal.