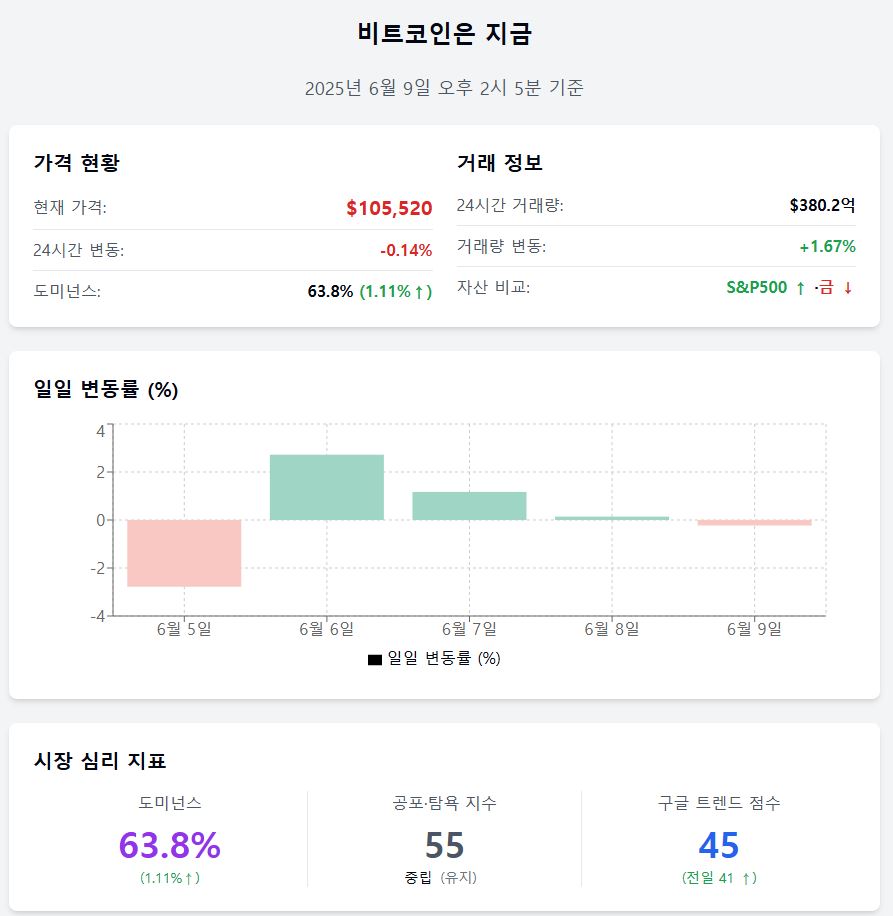

As of 2:05 PM on June 9, 2025

Bitcoin is continuing a limited range movement near the short-term resistance line while digesting selling pressure. Although the dominance has increased, some on-chain indicators such as active wallets and SSR show weakness, drawing attention to the potential short-term momentum recovery.

📈 Price Now

Price $105,519.88 (–0.14%) Bitcoin is trading at $105,519, down 0.14% from the previous day. Approaching the short-term technical upper limit and digesting selling pressure, it maintains a narrow range of sideways movement without a clear direction.

Trading Volume $38.02 Billion (+1.67%) The trading volume increased by 1.67% compared to the previous day. Some low-price buying inflows have occurred amid a wait-and-see attitude, showing a slight recovery in trading volume.

Daily Fluctuation –0.23% Bitcoin continues to show limited movement, repeating ups and downs over five days. Recent daily fluctuations are ▲June 5 –2.78% ▲June 6 +2.72% ▲June 7 +1.17% ▲June 8 +0.14% ▲June 9 –0.23%, showing a pattern of short-term adjustment and recovery rather than a clear direction.

Asset Comparison S&P500↑·Gold↓ As of June 6, the S&P 500 index rose +1.03%, while gold fell –0.43%. Bitcoin showed a similar direction to the traditional risk assets in the stock market but continues to maintain an independent price movement.

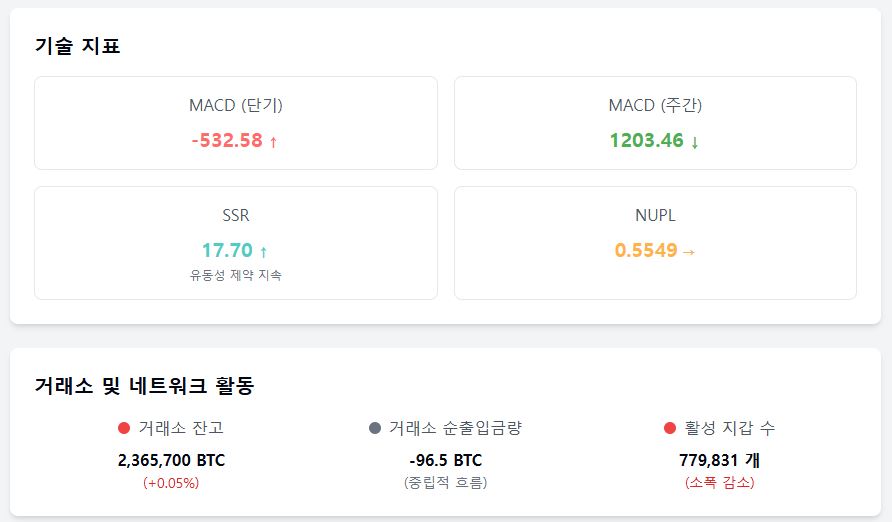

MACD –532.58 The MACD on a daily basis is –532.58, showing a short-term weak signal. However, the weekly MACD is +1203.46, maintaining a plus range and keeping the medium-term upside potential open.

❤️ Investor Sentiment Now

Dominance 63.8% (+1.11%) Bitcoin dominance increased by 1.11% from the previous day, recording 63.8%. This suggests a reinforced trend of relative fund concentration compared to major altcoins.

Fear & Greed Index 55 (Neutral) The Fear & Greed Index remains at 55, staying in the neutral zone. Although slightly lower than last week's 57, market sentiment is generally maintaining balance.

Google Trend Score 45 (+4) As of the 9th, the Google search trend score is 45, slightly up from the previous day's 41. Investor interest is somewhat recovering, with potential changes in attention depending on short-term momentum.

🧭 Market Now

SSR 17.70 (+0.23%) The Stablecoin Supply Ratio (SSR) slightly increased to 17.70. This indicates a somewhat reduced stablecoin purchasing power relative to Bitcoin, suggesting potential limitations in short-term buying momentum.

NUPL 0.5549 (Unchanged) NUPL remains at 0.5549, similar to the previous day. Many holders are still in a profit zone, with potential profit-taking pressure depending on short-term price volatility.

Exchange Balance 2,365,700 BTC (+0.05%) The amount of Bitcoin held on exchanges slightly increased. While there was a temporary deposit flow, the structural decreasing trend centered on long-term holding continues.

Exchange Net Inflow/Outflow –96.5 BTC (+0.1%) Approximately 96.5 BTC was net outflowed in a day. Both net inflows and outflows are minimal, maintaining an overall neutral flow.

Active Wallets 779,831 (–1.00%) The number of active users decreased by about 7,800 compared to the previous day. This is interpreted as the temporary wait-and-see attitude and market stagnation affecting on-chain user participation.

Get news in real-time...Go to Token Post Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>