While expectations for an upward trend in the Ethereum options market are maintained, the market appears to be entering a cautious observation phase with a decrease in trading volume and an increase in put option proportion.

According to CoinGlass as of 9 AM, the total outstanding Ethereum options are $7.42 billion, a decrease of about 0.93% from the previous day ($7.49 billion).

Over the past 24 hours, Ethereum options outstanding were recorded as ▲$5.39 billion on Deribit ▲$236.37 million on CME ▲$980.23 million on OKX ▲$424.28 million on Binance ▲$390.03 million on Bybit.

The Ethereum options contract with the most outstanding interest is the $3,200 call option (June 27) traded on Deribit, with 71,973 ETH accumulated.

Following that are ▲$3,000 call option (63,925 ETH, June 27) ▲$6,000 call option (58,965 ETH, December 26).

$3,400 call option (44,159 ETH, June 27)

$3,000 call option (42,812 ETH, December 26)

$2,800 call option (42,568 ETH, June 27)

$2,000 call option (37,157 ETH, December 26)

$1,800 call option (35,039 ETH, June 27)

Call option outstanding interest is 1,967,602.45 ETH (68.57%), and put options are 902,010.26 ETH (31.43%). With call option proportion exceeding 68%, expectations for an Ethereum price increase are still clearly reflected.

The most traded option contract in a day was the $2,200 put option (June 27) on Deribit, with 3,683 ETH traded.

Following that were ▲$2,800 call option (3,060 ETH, June 27) ▲$2,500 call option (2,962 ETH, June 13).

$2,525 call option (2,911.6 ETH, June 9, Bybit)

$3,400 call option (2,534 ETH, June 27, Deribit)

$2,450 call option (2,463 ETH, June 9, Deribit)

$3,200 call option (2,304 ETH, June 27, Deribit)

$2,600 call option (2,210 ETH, June 10, Deribit)

Call option trading volume is 89,658.57 ETH (58.31%), and put options are 64,105.6 ETH (41.69%), showing a predominant call option trend.

While upward expectations are maintained, the put option proportion exceeding 40% shows an increase in defensive trading in preparation for short-term downside risks. Overall, expectations for an upward attempt continue alongside a cautious market approach.

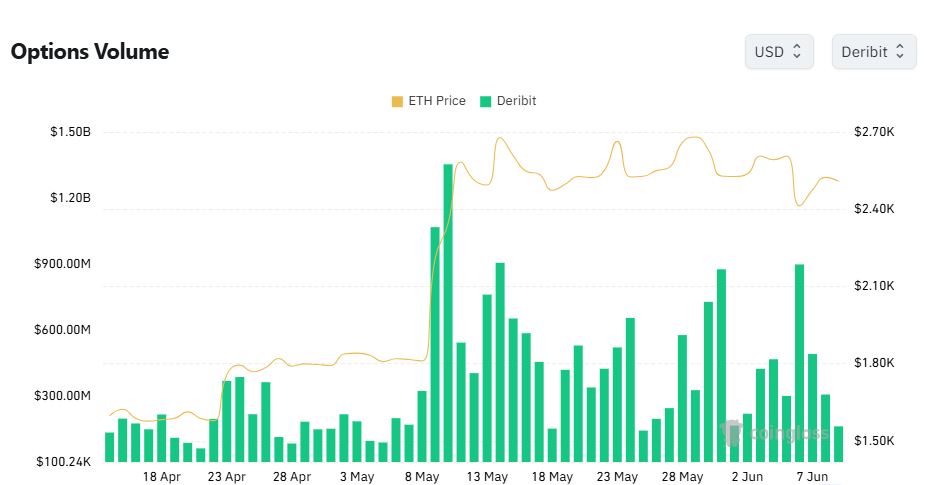

Over the past 24 hours, Ethereum options trading volume was recorded as ▲$162.24 million on Deribit ▲$6.48 million on CME ▲$91.98 million on OKX ▲$56.40 million on Binance ▲$45.04 million on Bybit. The total is approximately $451.64 million, showing a slight decrease compared to the previous day (approximately $662.06 million).

According to CoinMarketCap, Ethereum was trading at $2,504 as of 10:40 AM, a 0.47% decrease from the previous day.

[This article does not provide financial advice, and the investment results are the sole responsibility of the investor.]

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>