The price of Ethereum, a major altcoin, surged by 40% last week, which is one of the strongest weekly performances in recent months.

This rise has brought the Staked ETH coins back to an unrealized profit state for the first time since early March, which tends to reduce selling pressure among major coin holders.

Ethereum Staking Coins Recover After Market Rebound

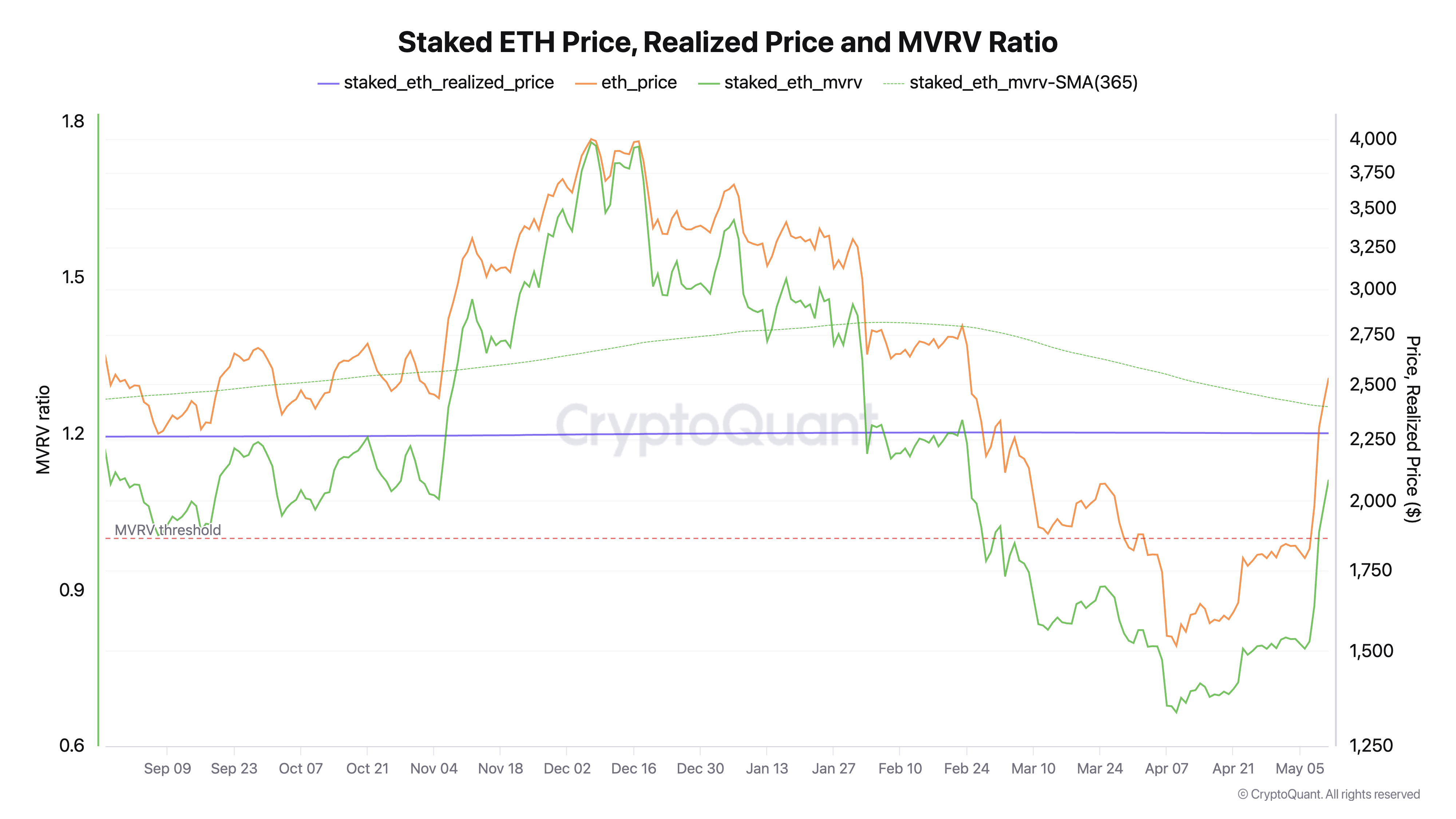

According to data from the crypto on-chain platform Crypto.com, Staked ETH coins are not included in the circulating supply and are mainly held by validators and long-term investors. They have been in an unrealized loss state since March 3, 2025. At that time, the realized price of Staked ETH was $2,279, and the market price had fallen below this level.

However, due to the broad market rally last week, ETH's value exceeded $2,279 on May 9. This indicates that Staked coins have returned to profitability, surpassing their realized cost basis.

When Stakers transition from losses to profits, this renews trust in the protocol and promotes network participation. It can also encourage more holders to maintain their Staked positions, reducing selling pressure.

Adding to the positive sentiment is the positive funding rate for ETH in the derivatives market. At the time of reporting, this is 0.001%.

This suggests that ETH futures traders are increasingly willing to pay premiums to maintain long positions. The increased demand for leverage exposure confirms the upward momentum and reflects strong market confidence.

Surge in Trading Volume Drives ETH Rally

The rising on-balance volume (OBV) on the price chart of ETH emphasizes the increasing demand for the coin. The key momentum indicator is located at 26.05 million amid strengthening trading activity.

A sharp increase in the asset's OBV indicates rising buying pressure, which can lead to continued price appreciation. If this trend continues, ETH's price could rise to $2,745.

On the other hand, if sellers regain market control, they could pull ETH's price down to $2,424. If buyers fail to defend this support level, the price decline could extend to $2,243.