Today, Bitcoin price has repeatedly risen after the US-China trade negotiation found a resolution, breaking through $105,000. This coin recorded a high of $105,705 as trading activity surged across the financial markets.

After experiencing a slight adjustment, strong upward pressure continues across BTC's spot and derivatives markets, indicating the possibility of continued price increases.

BTC Breaks Through $105,000 Amid US-China Trade Agreement

On Monday, the two economic powerhouses, the United States and China, announced a 90-day tariff reduction agreement. This sparked new optimism across global markets. As part of the agreement, the US will lower tariffs on Chinese imports from 145% to 30%, and China will reduce tariffs on US goods from 125% to 10%.

This announcement triggered a surge in trading activity in the cryptocurrency market, pushing BTC's price above the psychological $105,000 mark for the first time in weeks. Shortly after, the coin reached $105,705 before declining.

The current price has dropped to $104,397 at the time of reporting, but on-chain indicators show a strong upward trend across the market.

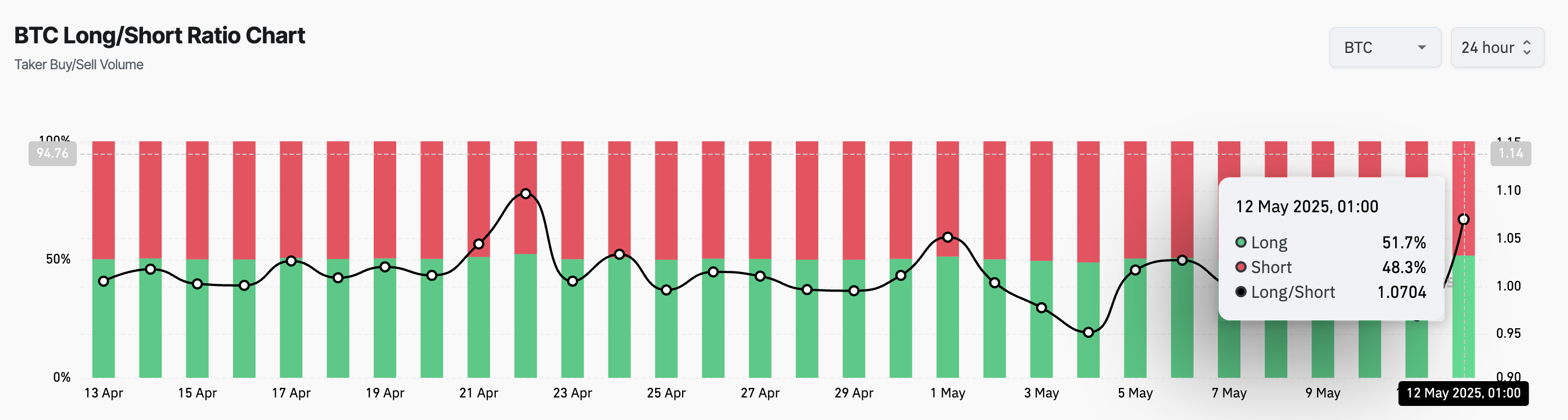

For example, the Longing/Short ratio reflects an upward bias in the futures market. At the time of reporting, this ratio is 1.07.

This ratio compares the number of Longing positions (betting on price increases) and Short positions (betting on price decreases) in the market. When the value is less than 1, traders are betting on the asset's price decline.

Conversely, when an asset's Longing/Short ratio exceeds 1, it indicates that Longing positions outnumber Short positions, suggesting traders are primarily betting on price increases.

This shows a generally upward trend among BTC's future traders, who expect continued price increases in the short term.

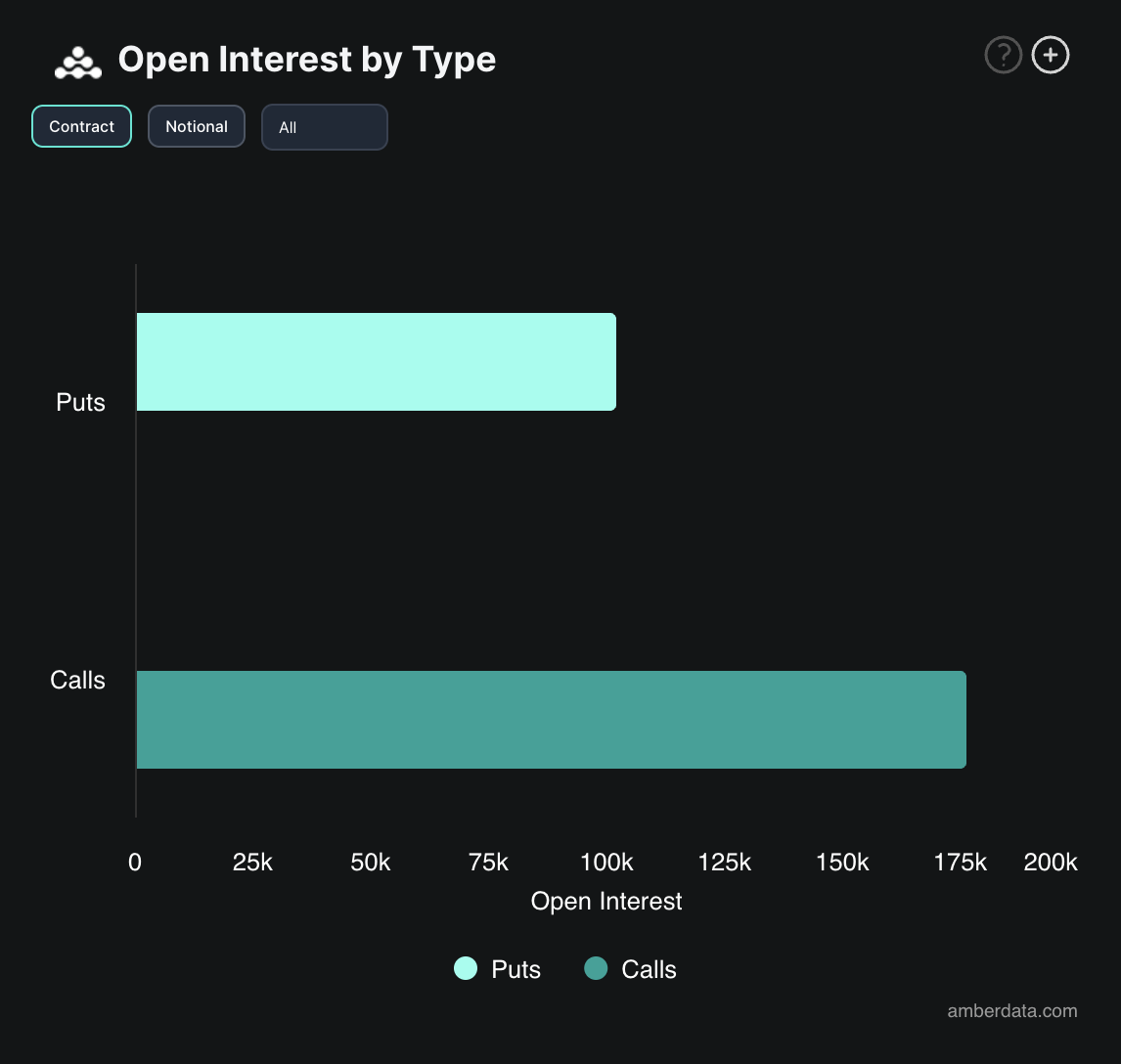

Additionally, the trend in the options market, with a surge in demand for call contracts, supports this upward outlook.

When demand for call options in the coin's options market exceeds put options, it indicates an increasing upward trend, with more traders betting on price increases.

Bitcoin Surges, Put to the Test

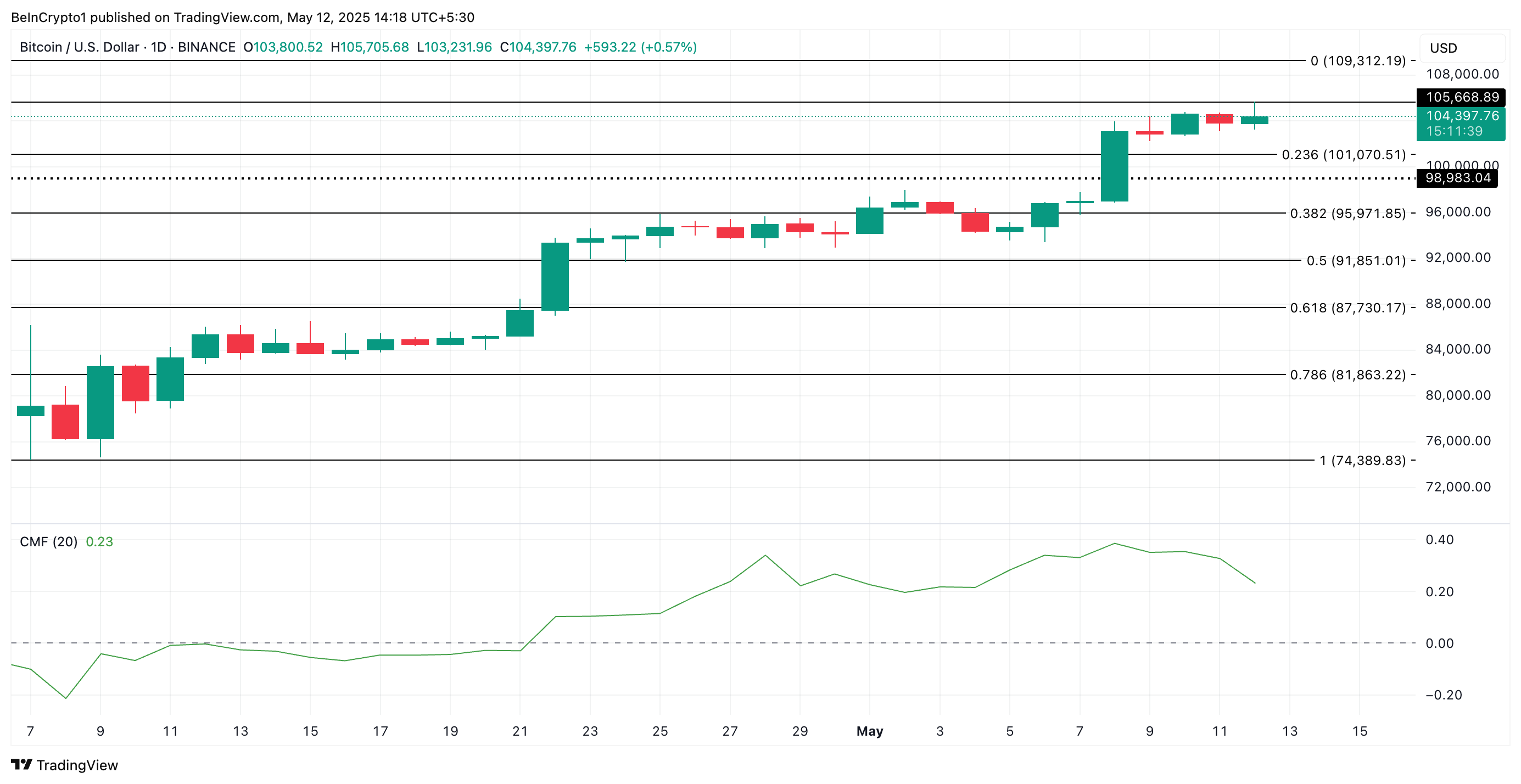

The increased derivatives activity often reflects broader expectations of price increases among BTC investors. If buying pressure continues, this coin could break through $105,000 again. If potential support at $105,668 is maintained, BTC could move towards its all-time high of $109,312.

However, BTC's Chaikin Money Flow (CMF) on the daily chart has begun to decline, forming a downward divergence with the price.

Divergence occurs when an asset's price moves in one direction, but indicators like CMF move in the opposite direction.

In this case, while BTC's price is rising, the CMF is declining, indicating a decrease in buying pressure. If this continues, BTC's price could fall to $101,070.