Author: TechFlow

Recently, L2 Mantle, which ranks fourth in TVL, released its Q2 quarterly letter to the community, highlighting two upcoming innovative products: Mantle Index Four and Mantle Banking.

One stone stirs up a thousand ripples, and the L2 competition narrative under the new cycle pattern has re-emerged.

From Base's deep involvement in the AI Agent track and the frequent hits it produced, to the game-focused Sonic mainnet launch with impressive token performance, in the L2 competition, the L2 concept has begun to be rarely mentioned alone, but has increasingly been used as a bottom-level implementation method to serve the differentiated narrative logic of the upper layer.

So, what kind of narrative logic does the market favor?

Thanks for reading TechFlow TechFlow! Subscribe for free to receive new posts and support my work.

We can also notice that whether it is using Bitcoin ETF as a starting point to bring large-scale traditional institutional funds onto the chain, or putting real-world assets on the chain to achieve more efficient circulation, the crypto market remains essentially the same, and its pursuit has always been: how to make the chips in hand more effective.

Following this essence, looking back at the development of the Mantle ecosystem in the past year, from the rapid progress of multiple core products such as mETH, cmETH, and the rebranded ƒBTC (formerly known as FBTC) in the data dimension, it is not difficult to find that this disruptor who jumped out of the traditional L2 competition early is taking "achieving higher capital efficiency" as a starting point and is moving forward towards the vision of "full-chain liquidity hub".

In the year 2025, which has already arrived, American neoliberalism represented by the $TRUMP Meme has brought unprecedented uncertainties to the crypto market, with the entry of new funds and a new round of sector rotation.

At a time when "chaos is the ladder", how will Mantle continue to improve capital efficiency, capture diversified income opportunities, and maintain its strong growth momentum while bridging the gap between crypto finance and traditional finance, and embark on the road to upgrading the brand narrative of inclusive on-chain finance with the slogan of "bringing crypto into everyday finance"?

Taking Mantle Index Four (MI4) and Mantle Banking products as examples, this article aims to explore Mantle’s past and new journey in building an on-chain financial edifice.

The core of finance lies in the financing of assets, and financing brings liquidity;

Liquidity is a reflection of the efficiency of asset financing. Therefore, in many cases, the definition of finance can be simplified to the creation and management of liquidity.

Based on this basic principle, in order to build on-chain finance and make the chips in hand more efficient, Mantle first chose to make a big fuss about the most fundamental assets.

In December 2023, Mantle officially launched the liquid staking protocol mETH, where users can obtain mETH by staking ETH and obtain an annualized rate of return that is stable at more than 6%;

In October 2024, Mantle officially launched the liquidity re-staking token cmETH, and users pledged mETH to obtain cmETH;

In August 2024, Mantle officially launched FBTC by supporting Ignition BTC. As a new type of synthetic asset, FBTC is pegged 1:1 with BTC. On February 14, 2025, Ignition FBTC announced a rebranding and officially changed its name to Function. FBTC was renamed ƒBTC as a full-chain Bitcoin income asset.

It can be seen that from LST to LRT, from ETH-Fi to BTC-Fi, Mantle has built the basic framework of its on-chain financial building by launching a variety of interest-bearing assets.

Of course, simply creating an asset will not bring liquidity, you also need to create demand for the asset. In terms of asset financing, Mantle has firmly grasped two major growth points: wider adoption and richer returns.

First, compared to other assets, Mantle's sophisticated design of assets gives it outstanding advantages:

mETH adopts the ERC-20 receipt token design that does not require permission to accumulate value, and can automatically accumulate income in the mETH token itself. This natural interest-bearing asset attribute not only makes mETH have higher capital efficiency and holding income, but also enables it to be easily adopted by applications and more deeply integrated into a richer and broader ecological scenario.

As LRT, cmETH, like mETH, also has native yield attributes and high ecological composability.

ƒBTC highlights the concept of full-chain fragmentation integration, allowing users to participate in various Bitcoin income sources such as on-chain DeFi through ƒBTC, which is anchored 1:1 to BTC, regardless of which chain their assets are on.

In addition to its own advantages, Mantle is also well aware of the truth that "better resources can create better assets". By building a complete ecosystem and creating rich circulation scenarios for interest-bearing assets, it has also achieved impressive on-chain achievements.

According to the ecology page on Mantle's official website, there are more than 230 projects in the Mantle ecosystem, covering Dex, Restaking, real world assets (RWA), games and other sectors. Among them, the DeFi sector is particularly prominent, with more than 13 lending projects in the ecosystem.

As the core interest-bearing assets of the Mantle ecosystem, mETH, cmETH, and ƒBTC have natural advantages in deep integration with the Mantle ecosystem:

mETH has currently established cooperation with 42 projects, including Eigenlayer, Symbiotic, Karak, Zircuit, INIT Capital, Pendle and other well-known projects. According to DeFi Llama data, within a week of its official launch, the TVL of mETH has exceeded 100 million US dollars, and reached a peak of 2.1 billion US dollars in 2024. The current TVL is about 1.5 billion US dollars, making it the fourth largest LSD product on Ethereum.

ƒBTC has currently established cooperation with 28 projects, including Solv, Bedrock, Pell Network, Lombard, Satlayer, Bounce Bit, Fuel, BOB and other BTCFi projects. Since its official launch in August, ƒBTC TVL has also exceeded 100 million US dollars in a short period of time, and ushered in a rapid growth at the end of October, from 270 million to 1.18 billion in November, an increase of more than 400%. The current TVL is about 1.42 billion US dollars.

At the same time, the Mantle ecosystem also has Meme and mini-games as two secret weapons for traffic. The Meme projects within the ecosystem have attracted widespread participation, and the registration volume of the idle cat-raising chain game Catizen has exceeded 20 million.

The rich ecosystem has brought about diverse usage scenarios and market demands, which are also transmitted to Mantle Network, the underlying support, helping it achieve rapid growth in 2024.

In terms of TVL: According to L2 beat data, Mantle TVL was approximately US$340 million in January 2024, and approximately US$2.06 billion on December 31, 2024, with a year-on-year increase of more than 600%. On December 9, 2024, Mantle TVL reached its peak of US$2.36 billion, an increase of more than 690% compared to the beginning of the year. Currently, Mantle TVL is stable at around US$1.9 billion.

It is particularly noteworthy that through on-chain data analysis, Mantle TVL mainly comes from DeFi products such as Dex, lending, and Restaking within the ecosystem. This In-dApps TVL not only further increases the growth value of Mantle TVL, but also largely demonstrates the active users of the Mantle ecosystem.

According to Dune data: Mantle's average daily active users exceed 45,000, and the daily active users reached a peak of 191,000 on September 11, 2024; in addition, the daily new users also reached a peak of 200,000 on September 10, 2024; the current total number of Mantle users is about 5.39 million, an increase of nearly 10 times compared to 550,000 at the beginning of 2024.

Using interest-bearing assets as a tool to expand its ecological territory, 2024 can be said to be the year when Mantle strides towards the "crypto-time liquidity hub".

As the curtain opens on 2025, how will Mantle continue to use assets as an entry point, continue to deepen its development around its on-chain financial vision, and achieve outstanding results again?

From the launch of the Mantle Index Four (MI4) product to the focus on the AI track, Mantle's answer has begun to emerge.

Before opening up new situations, it is also very important to stabilize and develop the basic advantages.

Therefore, at the beginning of 2025, Mantle also made key plans for the three major interest-bearing assets: mETH, cmETH, and ƒBTC:

On the one hand, the new revenue pool model of mETH will be launched in the first quarter of 2025. At the same time, through persistent ecological construction, it will continue to bring rich application scenarios and revenue sources to mETH/cmETH, attracting more users to participate.

On the other hand, ƒBTC will continue to deepen its presence in the field of institutional Bitcoin yield infrastructure:

We know that after completing the rebranding of Ignition FBTC → Function, ƒBTC will focus more on the three pillars of institutional-level trust and security, long-term development and sustainable growth, and full-chain and composable infrastructure, and is committed to bringing more efficient capital flows and more objective sources of income to full-chain institutions, DeFi protocols and mature DeFi participants.

Prior to this, ƒBTC received investments from a number of influential financial companies including Ant Alpha and Galaxy digital u. Adhering to the core development concept of "ƒ(BTC) = liquidity + composability + capital efficiency", in the future ƒBTC will work with institutions to create safe and reliable BTC assets, and deeply integrate with rich financial scenarios such as lending, staking, and liquidity returns.

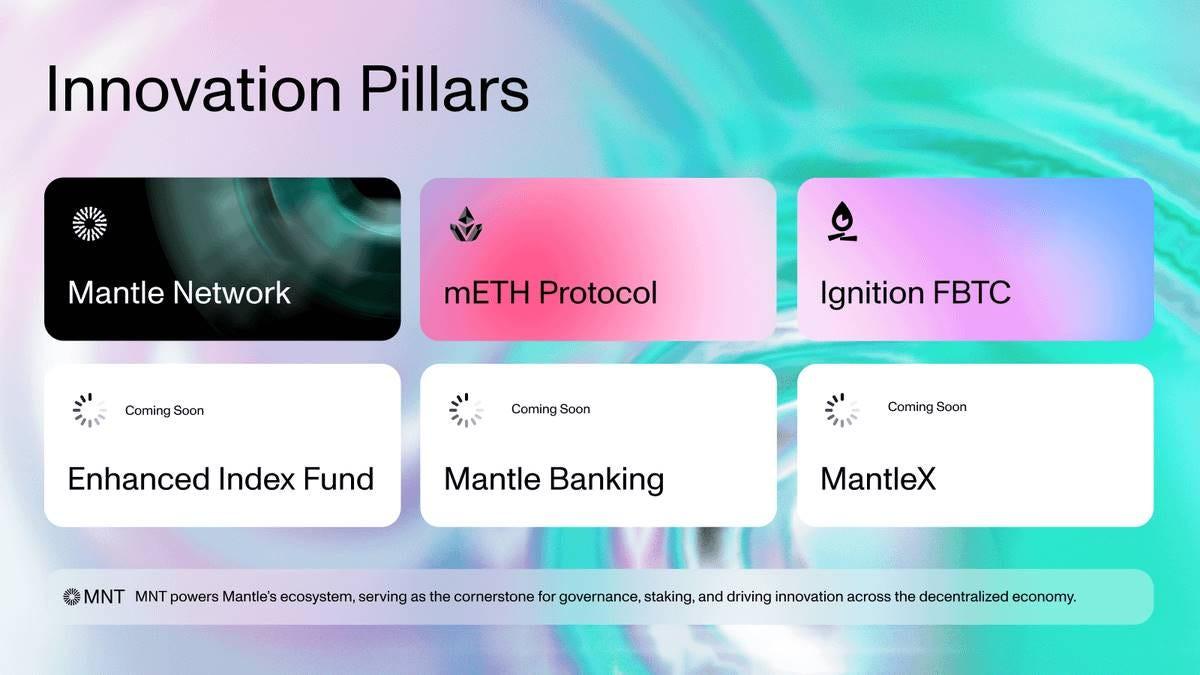

In addition to the three interest-bearing assets, the three new products just officially announced are a series of hard dishes served at the Mantle 2025 on-chain financial feast. Since then, the full picture of the six pillars of the Mantle ecosystem has been presented to the community.

With the crypto-friendly President Trump taking office, the crypto market may enter a relaxed crypto regulatory environment under the leadership of the US market. It is expected that more traditional users, funds, and institutions will flock to crypto finance. Therefore, 2025 will be the year of deep integration of Mantle on-chain finance and traditional finance, and Mantle Index Four (MI4) is a bridge built by Mantle between traditional finance and on-chain finance.

As an institutional-level compliant product, the fund caters to the huge market demand for diversified cryptocurrency exposure products, and its main audience includes both crypto users and traditional financial investors:

For crypto users, Mantle MI4 brings them institutional-level asset security and custody services;

For traditional financial users, Mantle MI4 can provide them with a convenient, intuitive and compliant way to participate in crypto finance;

More importantly, like Mantle ecosystem interest-bearing assets, Mantle MI4 has strong profitability, which undoubtedly makes the product more attractive to traditional financial users and can also attract more incremental users into the Mantle ecosystem.

In the initial stage of operation, Mantle MI4 will cover four assets: BTC, ETH, SOL and USD, and adopt a rule-based rebalancing strategy to ensure transparency and low cost. However, initiatives to promote the deep integration of the fund with more assets in the Mantle ecosystem are in the works. According to official sources, after the fund goes online, Mantle will aim to manage $1 billion in assets. With the strong credibility support of Mantle Treasury, the largest project treasury in the crypto industry, this goal has a realistic basis for rapid realization.

As a cryptocurrency bank, Mantle Banking aims to achieve a deep integration of blockchain technology and banking services, and provide payment, lending and wealth management solutions that are completely based on blockchain. It is a subdivision of the "on-chain bank" in Mantle's on-chain financial vision.

Specifically, Mantle Banking aims to help users spend, save, and invest in fiat and cryptocurrency assets in one account. By unifying the experience of fiat and cryptocurrency accounts, Mantle Banking creates a seamless and efficient user experience between TradFi and DeFi.

In the future, with the empowerment of Mantle Banking: users can deposit their fiat salary directly into Mantle Banking's integrated account, and then tokenize the deposit into stablecoins, allowing them to spend in multiple currencies globally through virtual cards at below-market rates, just like fiat currency.

Mantle Banking is committed to providing crypto services for the daily lives of a wider range of users, bridging the gap between legal currency and cryptocurrency with a DeFi-first approach. With the mission of transforming the financial architecture into a seamless, secure and user-friendly Web3, Mantle Banking will become a convenient entry point for large-scale incremental users to enter the crypto ecosystem, and an important opportunity for crypto finance to reach thousands of households.

MantleX

It is worth noting that the popularity of AI narrative remains high, and MantleX launched by Mantle also reflects its ambition in the field of AI.

As DeFAI emerges, we have seen the trend of deep integration of AI and on-chain finance: leveraging AI's advantages in data analysis, risk prediction, and automatic execution of smart contracts to bring users more efficient asset management, intelligent risk control, and personalized financial services. It can be said that the breakthrough development of AI will bring about a major breakthrough in on-chain finance.

MantleX is Mantle's important attempt in the field of AI. Its main work is divided into two aspects:

In addition, the mETH team is also conducting in-depth research on integration with DeFAI to further simplify the user experience process and obtain better benefits.

More AI support initiatives, including the Hacker House program, are also being promoted: As a large-scale AI-themed event, Hacker House aims to discover outstanding AI Agent projects and talents within the ecosystem.

In addition, with the core vision of "bringing encryption into daily finance", Mantle will also plan to launch more innovative products to attract more traditional finance and traditional funds to enter on-chain finance in various ways. Based on this, Mantle's preparations in the RWA track in 2024 may play an important role:

We know that RWA, as a track with trillion-dollar market potential for bringing real-world assets onto the chain, is not only one of the fastest growing segments in market size in 2024, but many institutions also predict that RWA will continue to develop rapidly in 2025.

In 2024, Mantle has established in-depth cooperation with Ondo Finance and Ethena, the leading projects in the RWA track. USDY and USDe have played an important role in the Mantle ecosystem. In the future, as Mantle continues to advance its strategy of integrating on-chain finance with traditional finance, this cooperation will help further integrate a wider range of TradFi funds and promote the birth of more innovative financial products and services.

If 2024 is a year of unstoppable development for Mantle, then 2025 is a year of great ambition for Mantle.

Whether it is the focus on MI4 or the AI track, they are vigorously promoting Mantle to become a value investment target. Therefore, the Mantle ecosystem core token $MNT has become an investment research topic that cannot be missed.

Due to the unique value proposition under the ingenious design, many community members who bet on the Mantle ecosystem regard $MNT as the golden shovel of the Mantle ecosystem. In terms of token utility, $MNT is not just a simple governance token, but also plays multiple roles such as gas payment and ecological incentives. It is the value hub of the entire Mantle ecosystem.

Unlike many L2s that use ETH as the Gas token, Mantle chooses to use $MNT as the Gas token.

This strategic decision makes MNT play a more core role in the ecosystem. As the scale of the ecosystem expands, when users conduct any transaction on the Mantle network, they need to use MNT to pay Gas fees, which creates a continuous and stable demand for tokens and network benefits, which not only enhances the autonomy of the ecosystem, but also provides a solid foundation for the long-term value of MNT.

Another major attraction of $MNT is its healthy token structure. All non-circulating tokens belong to the treasury and are managed by community voting. There will be no unlocking in the future.

Compared with other projects that unlock tens of millions of dollars, $MNT has no token unlocking plans in the future. According to the MC/FDV data statistics of the CoinMarketCap platform, $MNT has healthier values than many other L2 projects, and will face less market selling pressure in the future, which also provides stronger support for the continued healthy development of $MNT in the future.

In addition, Mantle Reward Station also plays an important role in encouraging long-term holding, bringing rich returns to token holders, and stimulating ecological participation:

Users can obtain MNT Power by locking MNT tokens in the Mantle Rewards Station, and can obtain more ecological rewards by allocating MNT Power to different prize pool activities. The longer the lock-up period, the more MNT Power you get, and the more lucrative the benefits. In addition, users can still participate in ecological governance by locking MNT tokens in the Mantle Rewards Station.

Currently, Mantle Rewards Station has attracted more than 36,438 users to lock in MNT tokens worth approximately US$128 million, and has cumulatively distributed token rewards worth more than US$10 million.

Most importantly, $MNT has a powerful killer weapon for its development momentum, which is Mantle Treasuary.

As the largest project treasury in the Web3 field, Mantle Treasuary has a capital scale of up to 4 billion US dollars, and it is the only project treasury with 1 billion US dollars of mainstream assets. In addition, it also holds tokens and equity including mETH, FBTC and Ethena. It is not only large in size and healthy in structure, but also has outstanding profitability. According to official data, Mantle Treasuary's profit this year has exceeded 50 million US dollars. This series of advantages provides a solid value foundation for $MNT.

More importantly, Mantle Treasuary is fully supervised by MNT holders, which further ensures that the development of the Mantle ecosystem and the flow of funds are in line with the wishes of the community, further promoting $MNT to become one of the L2 tokens with the greatest growth potential in the market.

ZK Architecture Transformation: Laying a solid foundation for "inclusive on-chain finance"

Finally, I want to talk about the technical design of Mantle.

Although many people think that the homogeneity of L2 technology is nothing to talk about, Mantle Network must have its own unique features in the underlying technology design in order to be able to support a billion-level ecological scale.

As L2, Mantle is committed to carrying forward the original intention of L2, bringing higher performance and scalability, and providing users with a high-efficiency, low-cost and smooth experience from guiding entry into the ecosystem to participating in specific interactions.

However, unlike other L2s, Mantle's core advantages can be summarized in the following three aspects:

The first is modular design : by separating the core functions of blockchain such as transaction processing, state verification and data availability into dedicated layers, it optimizes performance and reduces costs on the one hand, while also bringing greater flexibility and security on the other.

The second is the implementation of a decentralized sequencer : by introducing a "scheduler" to determine the sequencer when the next block is generated, safe and trustless block production can be further achieved, reducing the possibility of single point failure or censorship on the network and improving the decentralization of the network.

Most importantly, Mantle is also the first L2 to adopt EigenDA : As a data availability solution, EigenDA shares Ethereum's strong security foundation through the Eigenlayer re-staking mechanism. Through EigenDA, Mantle can submit only the necessary state roots to the Ethereum mainnet, and a large amount of transaction data is stored in EigenLayer, which brings high data availability, while greatly reducing fee costs and improving data processing efficiency, paving the way for on-chain finance with extremely high requirements for high throughput and low cost.

The three core technological advantages provide strong support for the rapid development of the Mantle ecosystem in 2024. In 2025, when Mantle is committed to introducing AI to promote on-chain financial innovation and guide the deep integration of on-chain finance and traditional finance, technological advancement and iteration will become even more important.

In the latest technology roadmap released by Mantle, the in-depth cooperation with Succinct has attracted much attention from the community:

With the testnet launching in Q1 2025 and planned upgrade to mainnet, Mantle Network will evolve from an optimistic rollup model to ZK validity rollups via Succinct’s SP1.

This architectural change brings more possibilities and a higher development ceiling to Mantle’s on-chain financial vision:

On the one hand, after the transformation, Mantle's chain termination time will be significantly reduced from seven days to one hour, and the interaction will be more seamless, more efficient, and lower cost (only a few cents per transaction), further realizing institutional-level asset settlement, supporting and solving capital efficiency opportunities in the entire traditional financial and blockchain industries.

On the other hand, combining the powerful functions of Succinct's SP1 zkVM with the modular functions of OP Stack also brings a higher level of security to Mantle, making Mantle more popular with traditional institutions. At the same time, more traditional users can also explore Mantle on-chain finance more easily and safely, injecting more underlying guarantees for Mantle's continued growth in 2025.

In the future, Mantle will continue to promote the implementation of multiple technology roadmaps, achieve continuous improvement in performance, cost, security, and experience through innovative technologies, and further bring prosperity to the Mantle on-chain financial ecosystem.

2025 is destined to be the year with the most uncertainty in the crypto industry, but it will also be the year with the greatest potential for explosive growth in on-chain finance.

With the fundamental change in asset control brought about by decentralized characteristics, the leap-forward improvement in capital efficiency, the innovation and flexibility of financial products, and the revolutionary changes in profit distribution, on-chain finance is often seen by traders as a more attractive option.

With the inauguration of crypto-friendly President Trump, his every move will draw the world's attention to the crypto industry: from recruiting a number of crypto talents to form a cabinet team, to the $TRUMP Meme effect introducing a large number of new people and new funds, and allowing more traditional financial institutions to see the power of crypto finance. Many people expect that in the future, under the loose crypto regulatory environment led by the United States, on-chain finance will usher in a breakthrough development.

Under the premise of such good expectations, Mantle's plans and ambitions for 2025 have become clear from the transformation from ZK architecture to MI4 products.

From the perspective of developers, the key figures in ecosystem construction, Mantle has begun to show signs of becoming a decentralized financial hub that connects the on-chain and off-chain:

In the just-concluded Mantle APAC Hackathon, more than 360 developers actively participated and submitted 170+ innovative projects. In addition, the testnet incentive program launched by Mantle in mid-2024 attracted more than 5,000 developers worldwide to participate, deployed 12,000 smart contracts, and the average daily transaction volume of the testnet exceeded 1 million.

Such a large and active developer community also makes the community have higher expectations for the Mantle ecosystem to innovate and accelerate the implementation of the on-chain financial vision. Mantle, which has already accumulated very good product reputation, on-chain performance and community voice in 2024, can it use liquidity as the main narrative line, connect interest-bearing assets, DeFi, AI and other sectors, and create a new era of on-chain finance that truly breaks through the circle?

In the new year, a new chapter of narrative is about to begin.

TechFlow is a community-driven in- TechFlow content platform dedicated to providing valuable information and thoughtful thinking.

Community:

Public account: TechFlow

Subscribe to the channel: https://t.me/TechFlowDaily

Telegram: https://t.me/TechFlowPost

Twitter: @TechFlowPost

Join the WeChat group and add assistant WeChat: blocktheworld

Donate to TechFlow to receive blessings and permanent records

ETH: 0x0E58bB9795a9D0F065e3a8Cc2aed2A63D6977d8A

BSC: 0x0E58bB9795a9D0F065e3a8Cc2aed2A63D6977d8A