The cryptocurrency market will witness Bitcoin (BTC) and Ethereum (ETH) options expiring over $2.5 billion today.

Traders are particularly paying attention as this expiration could impact the short-term trend. This can be understood through the quantity and nominal value of contracts expiring. Analyzing the put-call ratio and maximum pain point can predict traders' expectations and market direction.

Bitcoin, Ethereum Options Expiring Today

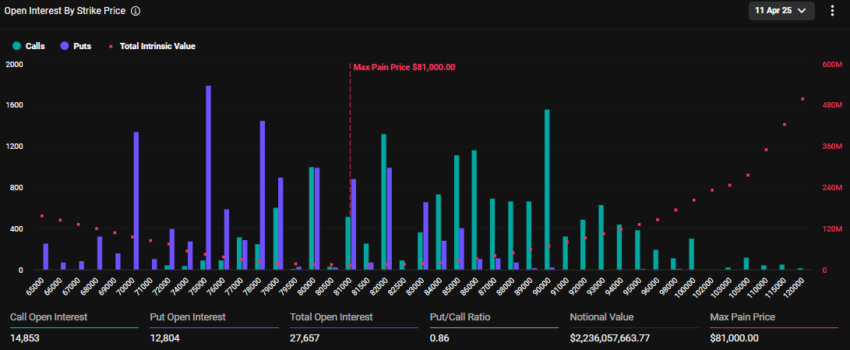

The nominal value of BTC options expiring today is $2.23 billion. According to data from cryptocurrency derivatives exchange Deribit, these 27,657 expiring Bitcoin options have a put-call ratio of 0.86. This ratio indicates that call options are more prevalent than put options.

The data also shows that the maximum pain point for these expiring options is $81,000. In cryptocurrency options trading, the maximum pain point is the price at which most contracts expire worthless. Here, the asset causes the most financial loss to the majority of holders.

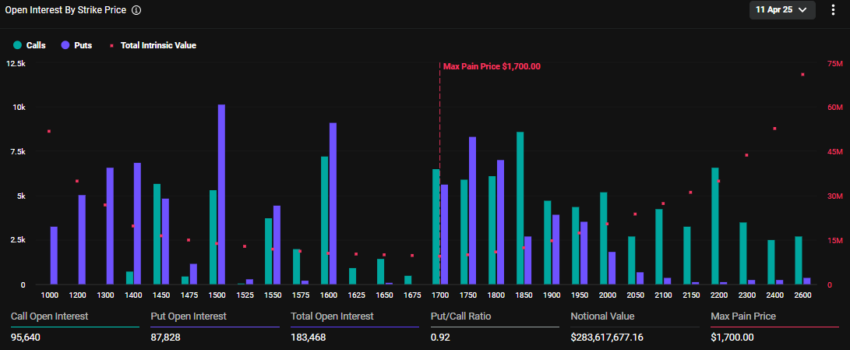

In addition to Bitcoin options, 183,468 Ethereum contracts are set to expire today. The nominal value of these expiring options is $283.6 million, with a put-call ratio of 0.92. The maximum pain point is $1,700.

Currently, the market prices of Bitcoin and Ethereum are lower than their respective maximum pain points. BTC is trading at $80,622, and ETH is positioned at $1,543.

"Given the recent market volatility and ongoing tariff developments, what impact do you think these expirations will have on price action?" Deribit asked.

Deribit is a cryptocurrency options and futures exchange. In fact, the cryptocurrency market is reeling from massive volatility due to trade war confusion caused by Trump's tariffs. Meanwhile, Cardano founder Charles Hoskinson says future tariffs will have no effect on cryptocurrencies.

He believes tariffs are already priced in and future announcements will be 'meaningless' for the cryptocurrency market.

Traders, Call Premiums Decrease Until September... Preparing for Continued Weakness

Elsewhere, Deribit analysts are noting changes in cryptocurrency options. Despite short-term declines, put demand remains. Meanwhile, call premiums are further from the curve and decreasing.

"We'll have to wait until September before calls reclaim the skew. Traders may be preparing for long-term weakness," Deribit mentioned.

This suggests traders may be preparing for long-term weakness in the cryptocurrency market. The decrease in call premiums indicates traders are less optimistic about price increases from short to medium-term.

A negative or inverted volatility skew occurs when OTM puts (lower-priced puts) have higher IV than OTM calls (higher-priced calls). This is common in stock markets when investors fear price drops.

This pattern is also appearing in the cryptocurrency options market, reflecting increasing concerns about downside risk. Analysts from Greeks.live note that BTC's IV has significantly decreased, maintaining around 50% across all expirations.

In contrast, ETH's IV remains at higher levels, with short to medium-term volatility close to 80%. Selling ETH options in the short term would be a good trade for traders.

Global economic uncertainty, including the US-China tariff war, has weakened risk appetite. The inherent volatility of cryptocurrencies could also fuel this cautious outlook.

"Market sentiment this week was more anxious. Trump's frequent tariff policy changes have made the market extremely risk-averse," analysts from Greeks.live wrote.

Analysts from Greeks.live agree with Deribit's expectation of long-term weakness. However, unlike Hoskinson, they anticipate continued market uncertainty and volatility.

For traders, this suggests the need for hedging strategies. Examples include purchasing puts or diversifying into stablecoins.

"Cryptocurrency currently lacks new capital inflow, lacks new narrative, and investor sentiment is more depressed. In this market transitioning from bull to bear, the possibility of black swan events increases significantly, and buying deep vanilla put options would be a good choice." – Analysts from Greeks.live.